Direct vs. Regular Mutual Fund Plans: Your Path to Cost-Efficient Investing

This comprehensive guide explores the difference between direct and regular mutual fund plans in India, highlighting the cost benefits of direct plans and providing tips for choosing the right plan for your investment goals.

The world of mutual funds can be complex, but one choice that significantly impacts your returns is whether to opt for a direct or regular plan. This comprehensive guide unravels the distinction between these two options and reveals how direct plans can potentially save you money and enhance your investment gains in the long run.

Understanding Mutual Fund Plans

Mutual funds have emerged as a popular investment avenue for individuals seeking to participate in the financial markets while mitigating risk through diversification. In essence, a mutual fund is a collective investment vehicle that pools money from numerous investors, channeling it into a diversified portfolio of securities such as stocks, bonds, or a combination of both. These investments are carefully managed by professionals known as fund managers, who possess the expertise to navigate the complexities of the market and strive to generate optimal returns for the investors who have entrusted them with their funds.

The beauty of mutual funds lies in their ability to provide investors with access to a wide array of assets that they might not be able to invest in individually. This diversification helps spread risk, as the performance of one security doesn't solely determine the overall outcome of the investment. Additionally, mutual funds offer the advantage of professional management, relieving investors of the burden of constantly monitoring the market and making investment decisions.

Delving Deeper: Direct vs. Regular Plans

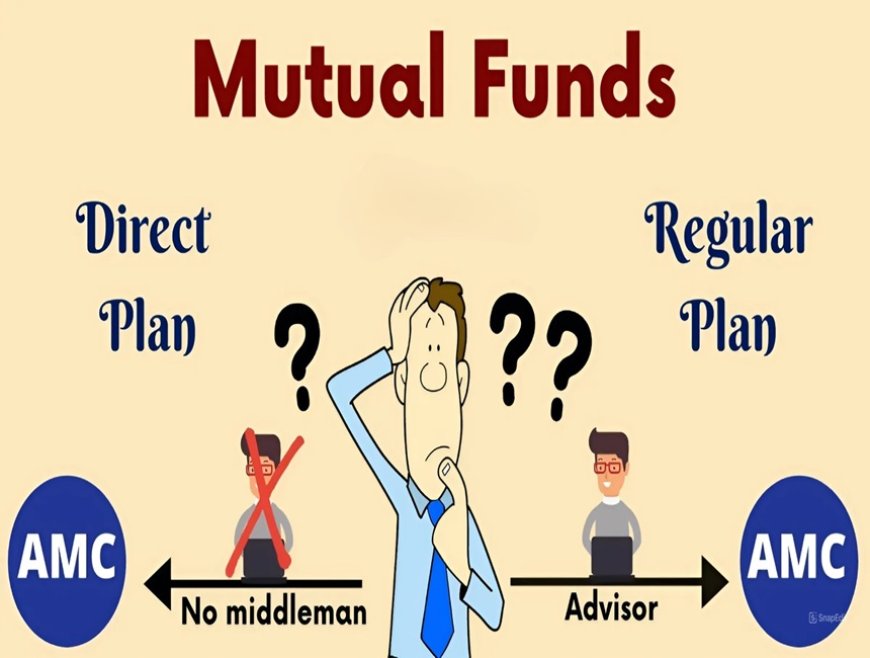

Within the realm of mutual funds, two distinct types of plans cater to different investor preferences and needs:

1. Direct Plans: The Path of Independence

Direct plans represent a direct relationship between the investor and the Asset Management Company (AMC). By investing directly with the AMC, you eliminate the need for intermediaries like brokers, distributors, or financial advisors. This streamlined approach translates into a significant benefit – lower expense ratios.

Expense ratios are essentially the fees charged by the AMC for managing the fund's operations. These fees cover various costs, including fund manager salaries, administrative expenses, marketing costs, and more. Since direct plans bypass the commissions paid to intermediaries, their expense ratios are considerably lower than those of regular plans. This cost advantage can have a substantial impact on your investment returns, particularly over longer time horizons.

2. Regular Plans: The Value of Guidance

Regular plans, in contrast to direct plans, involve the participation of intermediaries like distributors or financial advisors. These professionals offer valuable services to investors, including personalized investment advice, portfolio reviews, and ongoing support. They can guide you in selecting suitable funds based on your risk profile, financial goals, and investment horizon.

However, the expertise and convenience provided by distributors come with a cost – higher expense ratios. Regular plans incorporate commissions paid to distributors, which can range from 0.5% to 1% or more of your invested amount annually. These commissions are reflected in the higher expense ratios of regular plans, which can erode your investment returns over time.

The Cost Factor: Decoding Expense Ratios in Mutual Funds

Expense ratios play a pivotal role in determining the overall returns you earn from your mutual fund investments. They represent the annual fees levied by the Asset Management Company (AMC) to manage the fund, covering a range of operational expenses essential for the smooth functioning of the fund. Understanding the nuances of expense ratios is crucial for making informed investment decisions and maximizing your potential gains.

What Expense Ratios Cover

Expense ratios encompass various costs incurred by the AMC in managing the fund. These costs typically include:

- Fund Management Fees: These fees compensate the fund managers for their expertise in selecting securities, constructing portfolios, and actively managing the fund to achieve its investment objectives.

- Administrative Costs: These costs cover the day-to-day administrative expenses involved in running the fund, such as record-keeping, investor communication, and regulatory compliance.

- Marketing and Distribution Expenses: These costs are associated with marketing the fund to potential investors and distributing it through various channels.

- Other Operational Expenses: This category includes miscellaneous expenses like custodian fees, audit fees, and legal fees.

The Expense Ratio Differential: Direct vs. Regular Plans

The most significant difference in expense ratios arises between direct and regular plans.

Direct Plans: These plans boast lower expense ratios due to the absence of commissions paid to intermediaries. Since investors purchase direct plans directly from the AMC, there are no distribution fees involved. This cost advantage can have a substantial impact on your long-term returns, as even a seemingly small difference in expense ratios can compound over time.

Regular Plans: Regular plans come with higher expense ratios because they include commissions paid to distributors or financial advisors. These commissions are intended to compensate distributors for their role in educating investors, providing guidance, and facilitating the investment process. However, these commissions ultimately come out of your pocket and can eat into your investment returns.

Expense ratios are a crucial factor to consider when evaluating mutual funds. By opting for direct plans, you can potentially save on costs and enhance your returns over time. However, if you value professional guidance and personalized advice, regular plans might be a better fit, even with their higher expense ratios.

Illustrating the Cost Benefits of Direct Plans: A Real-World Scenario

To truly grasp the financial impact of choosing a direct plan over a regular plan, let's delve into a practical example that mirrors the investment journey of many individuals.

The Investment:

Assume you invest ₹1 lakh in a large-cap equity mutual fund. This type of fund invests primarily in well-established companies with a history of stable growth. You have a long-term investment horizon of 20 years, and you expect the fund to generate an average annual return of 12%.

The Plans:

- Direct Plan: This plan comes with an expense ratio of 1%.

- Regular Plan: This plan has a higher expense ratio of 2%.

The Difference in Returns:

Over 20 years, the difference in returns between these two plans becomes substantial due to the compounding effect:

- Direct Plan: Your initial investment of ₹1 lakh would potentially grow to an impressive ₹9.65 lakh.

- Regular Plan: In contrast, the same investment in the regular plan would accumulate to ₹6.41 lakh.

The Cost Advantage:

The difference in returns between the two plans – a staggering ₹3.24 lakh – is solely attributable to the lower expense ratio of the direct plan. This illustrates how even a seemingly small difference of 1% in expense ratio can significantly impact your wealth accumulation over time.

Why the Difference Matters:

The additional ₹3.24 lakh earned through the direct plan could be used for various purposes, such as:

- Retirement Planning: It could contribute to a more comfortable retirement lifestyle.

- Child's Education: It could fund your child's higher education expenses.

- Down Payment on a House: It could help you purchase your dream home.

Key Takeaways:

This case study underscores the importance of considering expense ratios when selecting mutual funds. While a 1% difference in expense ratio might seem trivial in the short term, its impact over a long investment horizon can be substantial.

Here are some key takeaways:

- Compounding Works Wonders: The power of compounding magnifies the benefits of lower expense ratios over time. Even a small percentage saved on fees can translate into significant gains in the long run.

- Long-Term Horizon Amplifies Benefits: The longer your investment horizon, the more pronounced the difference in returns between direct and regular plans will be.

- Choose Wisely: Carefully evaluate the expense ratios of different mutual fund plans and consider opting for direct plans if you're comfortable with independent decision-making.

By understanding the impact of expense ratios and choosing the right plan, you can make your money work harder for you and achieve your financial goals more effectively.

Navigating Your Investment Path: Direct vs. Regular Plans – A Personalized Approach

The choice between direct and regular mutual fund plans isn't a one-size-fits-all decision. It depends on your individual circumstances, preferences, and financial goals. Let's delve deeper into the key factors that can guide your decision:

1. Investor Knowledge and Confidence

Direct plans are best suited for investors who possess a solid understanding of financial markets, mutual funds, and investment strategies. If you are comfortable conducting your own research, analyzing fund performance, and making independent investment decisions, a direct plan can be a rewarding choice.

- Advantages: By opting for a direct plan, you eliminate the need for intermediaries, saving on commissions and reducing your overall expenses. This translates to potentially higher returns over time.

- Considerations: Direct plans require you to be proactive in managing your investments. You need to stay informed about market trends, monitor your portfolio regularly, and make adjustments as needed.

2. Need for Financial Advice

If you are new to investing or prefer professional guidance, a regular plan might be a better option. Financial advisors can offer valuable insights and expertise, helping you navigate the complex world of mutual funds.

- Advantages: Financial advisors can tailor investment recommendations to your specific needs, risk tolerance, and financial goals. They can also provide ongoing support, rebalance your portfolio, and keep you updated on market developments.

- Considerations: Regular plans come with higher expense ratios due to commissions paid to advisors. However, the value of professional advice might outweigh the additional cost for some investors.

3. Investment Horizon

Your investment horizon – the time frame for which you plan to stay invested – plays a significant role in your decision.

- Long-Term Investors: Direct plans are particularly advantageous for long-term investors. The compounding effect of lower expense ratios over several years or decades can significantly boost your overall returns.

- Short-Term Investors: For shorter investment horizons, the impact of expense ratios might be less noticeable. However, even in the short term, direct plans can still offer marginal cost savings.

4. Financial Goals

Your financial objectives should be a driving force behind your choice.

- Maximizing Returns: If your primary goal is to achieve the highest possible returns and minimize costs, direct plans are generally the more prudent choice.

- Seeking Guidance: If you prioritize professional guidance and personalized advice, regular plans might be more aligned with your needs.

5. Cost Sensitivity

If you are highly sensitive to costs and want to keep your expenses to a minimum, direct plans are the clear winner. However, it's important to consider whether the potential cost savings outweigh the value of professional advice for your specific situation.

Making an Informed Decision

Ultimately, the choice between direct and regular plans boils down to your individual circumstances and preferences. There is no right or wrong answer – the best option for you depends on your financial knowledge, comfort level with independent decision-making, and investment goals.

By carefully evaluating these factors and considering your own unique needs, you can make an informed decision that empowers you to achieve your financial aspirations and build a brighter future. Remember, the key is to choose the path that aligns with your individual journey and maximizes your chances of success.

Switching to Direct Plans: A Smart Move? – Weighing the Pros and Cons

If you're holding regular mutual fund plans, the allure of lower expense ratios offered by direct plans might be tempting. However, the decision to switch isn't always straightforward. Let's delve into the factors that should influence your decision:

Understanding the Switching Process

Switching from a regular plan to a direct plan essentially involves selling your existing units in the regular plan and repurchasing them in the direct plan of the same fund. This process might seem simple, but it's important to consider the potential consequences before making the leap.

Factors to Consider:

-

Exit Load: Many mutual funds impose an exit load if you redeem your units before a specified period. This fee, usually a percentage of the redeemed amount, can eat into your returns. Before switching, check the exit load applicable to your regular plan and factor it into your calculations.

-

Tax Implications: Switching from a regular to a direct plan is considered a sale and purchase transaction for tax purposes. If your investment has generated capital gains, you might be liable to pay capital gains tax. Consult a tax advisor to understand the potential tax implications and determine whether the tax liability outweighs the potential savings from lower expense ratios.

-

Time Horizon: If you have a long-term investment horizon, the benefits of switching to a direct plan can be substantial due to the compounding effect of lower fees. However, if you plan to redeem your investments in the near future, the exit load and tax implications might outweigh the potential cost savings.

-

Fund Performance: While expense ratios are crucial, they shouldn't be the sole deciding factor. Evaluate the performance of both the regular and direct plans of the fund you are considering. If the regular plan has consistently outperformed its direct counterpart, the higher expense ratio might be justified.

-

Convenience and Guidance: Switching to a direct plan requires you to take full ownership of your investments. You'll need to conduct your own research, monitor your portfolio, and make independent decisions. If you prefer the convenience of professional guidance, sticking with a regular plan might be a better option.

When Switching Makes Sense:

Switching to a direct plan can be a smart move in the following scenarios:

- Long-Term Investors: If you have a long investment horizon, the cost savings from lower expense ratios can significantly boost your overall returns.

- DIY Investors: If you are comfortable managing your investments independently and don't require professional advice, direct plans offer a more cost-effective option.

- High Exit Load Funds: If your regular plan has a high exit load, waiting until the exit load period expires before switching can help you avoid unnecessary costs.

Switching to direct plans can be a wise decision for many investors, but it's not always the best course of action. Carefully evaluate the factors mentioned above, seek professional advice if needed, and make an informed decision based on your specific situation.

Remember, the goal is to choose the path that offers the best combination of cost efficiency, convenience, and investment performance, ultimately helping you achieve your financial dreams.

Empowering Your Investments: Additional Tips for Savvy Indian Investors

Beyond understanding the fundamentals of direct vs. regular plans, savvy Indian investors can take additional steps to optimize their mutual fund investments:

1. Research Thoroughly: Your Investment Compass

Before diving into any mutual fund, embark on a comprehensive research journey. Dive deep into the fund's historical performance, scrutinizing its returns across various market conditions. Pay close attention to the expense ratio, as even seemingly minor differences can significantly impact your long-term gains. Understand the fund's investment strategy – is it focused on growth, value, or a blend of both? Research the fund manager's track record, assessing their experience, expertise, and ability to navigate market fluctuations.

Pro Tip: Explore independent research reports from reputable financial institutions. These reports offer unbiased analyses of fund performance and can help you make informed decisions.

2. Compare Direct and Regular Plans: Unearth Hidden Savings

Take advantage of online tools and resources provided by AMCs or financial websites to compare the expense ratios of direct and regular plans for the same fund. This simple comparison can reveal the potential cost savings you can achieve by opting for a direct plan.

Pro Tip: Pay attention to the "tracking error" of the direct and regular plans. This metric measures how closely the direct plan's performance mirrors that of the regular plan. A lower tracking error indicates that the direct plan closely follows the regular plan's investment strategy, ensuring you're not sacrificing performance for cost savings.

3. Review Your Portfolio Regularly: Stay on Course

Investing is not a "set it and forget it" endeavor. Regularly review your mutual fund portfolio to ensure it aligns with your evolving financial goals and risk tolerance. As your life circumstances change or market conditions shift, you might need to rebalance your portfolio to maintain the desired asset allocation.

Pro Tip: Set reminders to review your portfolio at least annually or whenever there are significant changes in your financial situation. Consider consulting a financial advisor for a comprehensive portfolio review and personalized recommendations.

4. Seek Professional Guidance: Tap into Expertise

If you feel overwhelmed by the complexities of mutual funds or lack confidence in your investment decisions, don't hesitate to seek professional guidance. A qualified financial advisor can offer valuable insights and tailor a personalized investment plan that aligns with your individual needs and aspirations.

Pro Tip: When choosing a financial advisor, look for certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). These credentials signify expertise and commitment to upholding ethical standards in financial planning.

5. Additional Considerations for Indian Investors:

- Tax Efficiency: Consider tax-saving mutual funds (ELSS) for potential tax deductions under Section 80C of the Income Tax Act.

- Invest through SIPs: Systematic Investment Plans (SIPs) allow you to invest regularly in small amounts, averaging out your purchase price and reducing risk.

- Stay Updated: Keep abreast of the latest financial news and regulatory changes that might impact your investments.

- Diversify: Don't put all your eggs in one basket. Diversify your investments across different asset classes and fund categories to manage risk effectively.

By incorporating these additional tips into your investment strategy, you can enhance your understanding of mutual funds, make informed decisions, and pave the way for a more prosperous financial future. Remember, investing is a marathon, not a sprint. With patience, discipline, and a well-informed approach, you can achieve your long-term financial goals and build a secure financial legacy.

Charting Your Course: Direct vs. Regular Plans – The Final Verdict

In the intricate world of mutual funds, the choice between direct and regular plans is a pivotal decision that can significantly impact your investment journey and long-term financial well-being.

Regular plans offer the undeniable advantage of professional guidance and personalized advice, providing a sense of security and support, particularly for novice investors or those seeking expert insights. However, this convenience comes at a cost in the form of higher expense ratios, which can erode your returns over time.

Direct plans, on the other hand, empower you to take charge of your investments, eliminating the need for intermediaries and reducing costs. By opting for direct plans, you can harness the power of compounding and potentially achieve higher returns due to lower expense ratios. This path demands greater self-reliance and financial acumen, as you'll be responsible for making your own investment decisions.

Ultimately, the "right" choice boils down to your individual circumstances, preferences, and financial goals. There's no one-size-fits-all answer.

If you're a seasoned investor with a deep understanding of financial markets and the confidence to navigate them independently, direct plans can be a lucrative option. The cost savings can translate into substantial gains over time, accelerating your journey towards financial independence.

However, if you're a new investor or value the expertise and guidance of a financial advisor, regular plans might be a better fit. The additional cost of professional advice can be justified by the peace of mind and personalized support it provides.

Regardless of your choice, remember that informed investors make empowered decisions. Thoroughly research your options, compare expense ratios, consider your risk tolerance and investment horizon, and seek professional guidance if needed. By taking these proactive steps, you can navigate the world of mutual funds with confidence and build a brighter financial future.

The journey to financial success begins with a single step – the step of making informed choices. Whether you choose the path of independence with direct plans or the guided route with regular plans, may your investment journey be filled with growth, prosperity, and the realization of your financial dreams.

Disclaimer:

The information provided in this article is for educational and informational purposes only. It is not intended as financial advice and should not be taken as a substitute for professional consultation. Before making any investment decisions, please conduct thorough research and consult with a qualified financial advisor.

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance is not indicative of future results. The information presented here is based on publicly available data and does not constitute a recommendation to buy or sell any particular mutual fund.

What's Your Reaction?