The 70-20-10 Rule: Your Roadmap to Financial Success in India

The 70-20-10 Rule: Your Path to Financial Success in India. Learn how this simple budgeting method can help you manage your income, save for the future, and achieve your financial goals. Get expert advice, real-life case studies, and practical tips.

The 70-20-10 rule is a simple yet powerful budgeting framework that can transform how you manage your finances. Originally conceived as a learning and development model, it has found widespread applicability in personal finance. For Indians navigating the unique financial landscape of our country, this rule can be a game-changer. Let's delve into what it means, how it works, and how you can implement it to achieve your financial goals.

What is the 70-20-10 Rule?

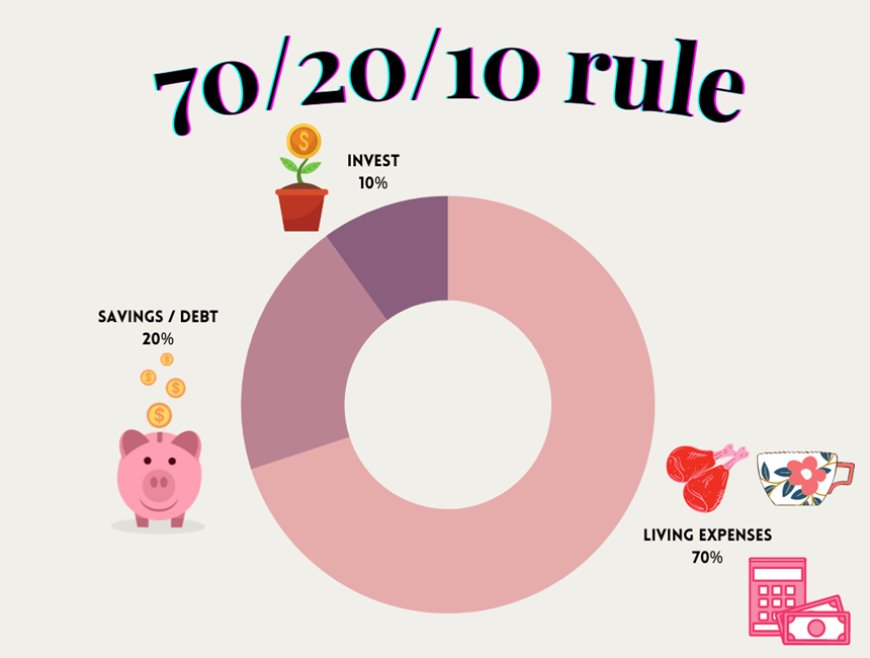

At its core, the 70-20-10 rule is a guideline for allocating your after-tax income into three distinct categories:

- 70% Needs: This covers your essential expenses – the costs of living that you simply can't do without. This includes rent or mortgage payments, groceries, utilities, transportation, debt repayments, and other recurring bills.

- 20% Savings & Investments: This portion is earmarked for building your financial future. It could involve saving for retirement, a down payment on a house, your children's education, or even a dream vacation. This is also where your investments come in – stocks, mutual funds, fixed deposits, or any other asset class you choose to grow your wealth.

- 10% Wants: This is your fun money – the amount you can spend on discretionary expenses. This could include dining out, entertainment, hobbies, shopping, or anything else that brings you joy and isn't strictly necessary.

Why the 70-20-10 Rule Works

The beauty of the 70-20-10 rule lies in its simplicity and flexibility. It provides a clear structure to manage your money without being overly restrictive. Here's why it's particularly well-suited for the Indian context:

- Balances Current Needs and Future Goals: In India, we often prioritize our immediate needs, be it family obligations or social commitments. This rule ensures you take care of those while still making consistent progress towards your long-term financial goals.

- Encourages Disciplined Saving: The 20% dedicated to savings and investments encourages a habit of regular saving, which is crucial in a country with rising inflation and a growing economy.

- Allows for Enjoyment: The 10% allocated to wants acknowledges the importance of enjoying life and indulging in occasional treats, preventing you from feeling deprived and helping you stay motivated.

Adapting the 70-20-10 Rule to Your Indian Financial Reality

While the 70-20-10 rule provides a solid foundation, you can customize it to fit your individual circumstances and aspirations:

- Higher Savings for Young Professionals: If you're in the early stages of your career, you might want to bump up the savings percentage to 30% or even 40% to accelerate wealth accumulation.

- Debt Management Focus: If you have significant debt, consider allocating a larger portion of the "wants" category towards debt repayment to become debt-free faster.

- Family Considerations: If you have a family, you might adjust the percentages based on your dependents' needs and your financial goals as a unit.

Common Challenges and How to Overcome Them: Navigating the Roadblocks to 70-20-10 Success

While the 70-20-10 rule provides a simple framework, implementing it isn't always smooth sailing. Here are some common hurdles you might encounter and practical solutions to overcome them:

Challenge 1: Irregular Income

Many Indians, especially freelancers, entrepreneurs, or those with seasonal businesses, face fluctuating income. This can make budgeting a challenge.

Solutions:

- Create an Income Buffer: During high-income months, set aside a portion of your surplus income to create a buffer for leaner months.

- Average Your Income: Calculate your average monthly income over the past 6-12 months and budget based on that figure.

- Adjust Categories: In high-income months, allocate more to savings or debt repayment. In low-income months, trim the "wants" category.

- Side Hustles: Consider exploring additional income sources to supplement your main income and create a more stable cash flow.

Challenge 2: Unexpected Expenses

Life is unpredictable, and unexpected expenses like medical bills, car repairs, or family emergencies can throw your budget off track.

Solutions:

- Emergency Fund: Prioritize building an emergency fund of 3-6 months' worth of living expenses. This can act as a safety net for unforeseen events.

- Review Insurance Coverage: Ensure you have adequate health, vehicle, and home insurance to protect yourself from financial shocks.

- Reassess Budget: If an unexpected expense arises, review your budget and adjust your allocations to accommodate the extra cost.

Challenge 3: Lifestyle Inflation

As your income increases, it's easy to fall into the trap of lifestyle inflation – spending more simply because you can. This can derail your savings goals.

Solutions:

- Mindful Spending: Be conscious of your spending habits and avoid unnecessary upgrades or impulse purchases.

- Set Spending Limits: Establish clear limits for each category of your budget and stick to them.

- Delayed Gratification: Practice delaying gratification for non-essential purchases. Give yourself a cooling-off period to evaluate if you truly need the item.

Challenge 4: Changing Priorities

Life stages and priorities evolve. What worked for you in your 20s might not be suitable in your 30s or 40s.

Solutions:

- Revisit Your Budget Regularly: At least once a year, review your budget and adjust the allocations to reflect your current goals and priorities.

-

- Seek Professional Advice: If you're facing major life changes like marriage, starting a family, or career transitions, consult a financial advisor for personalized guidance.

Case Studies: Real People, Real Results with the 70-20-10 Rule

The 70-20-10 rule isn't just a theory; it's a practical tool that has empowered countless Indians to achieve their financial dreams. Let's look at two inspiring stories:

Case Study 1: A Young Couple's Path to Homeownership

Meet Anjali and Raj, a young couple living in Bengaluru. Both working in the IT sector, they were earning a combined income of ₹1.2 lakhs per month. Initially, they struggled with managing their expenses, often finding themselves short on savings at the end of the month.

They decided to try the 70-20-10 rule:

- 70% Needs: They trimmed their lifestyle expenses, opting for home-cooked meals over frequent dining out and choosing affordable entertainment options.

- 20% Savings: They automated monthly transfers to a dedicated savings account for their down payment goal. They also invested in ELSS mutual funds for tax-saving benefits.

- 10% Wants: They set aside a smaller amount for occasional treats and weekend getaways.

Challenges: They faced unexpected medical expenses and a temporary salary cut due to the pandemic. However, their disciplined savings habit helped them weather these storms.

Result: Within three years, Anjali and Raj had saved enough for a down payment on their dream apartment. They attribute their success to the 70-20-10 rule's structure, which made saving a priority and helped them resist impulse spending.

Case Study 2: A Family's Journey to Financial Security

Meet the Sharma family – a husband, wife, and two young children living in Mumbai. The husband was the sole earner, working as a manager in a manufacturing firm. They were concerned about their financial future, especially with rising education costs and retirement looming on the horizon.

They adopted a modified 60-30-10 approach:

- 60% Needs: They diligently tracked their expenses, cutting back on non-essentials and negotiating better deals on recurring bills.

- 30% Savings & Investments: They prioritized investing in a mix of mutual funds, PPF, and NPS to build a diverse portfolio for long-term growth.

- 10% Wants: They ensured they had some room for family outings and occasional treats to maintain a healthy work-life balance.

Challenges: The family faced a job loss during an economic downturn. However, their emergency fund, built through disciplined savings, provided a crucial safety net.

Result: The Sharma family not only recovered from the setback but also continued to build their wealth. Their investments grew steadily, and they are now confident about funding their children's higher education and enjoying a comfortable retirement.

Key Takeaways:

- Discipline is Key: Both case studies highlight the importance of discipline in sticking to the chosen allocations, even when facing unexpected challenges.

- Flexibility is Important: The rule can be adapted to fit individual circumstances and goals. The Sharma family's 60-30-10 variation is a good example.

- Small Changes Add Up: Even small adjustments to spending habits can lead to significant savings over time.

-

- The Rule is a Starting Point: The 70-20-10 rule is a framework, not a rigid formula. It's a starting point that you can personalize to suit your lifestyle and aspirations.

Customizing the 70-20-10 Rule: Your Roadmap to Achieve Specific Financial Goals

The 70-20-10 rule is remarkably flexible and can be adapted to accelerate progress toward specific financial milestones. Here's how you can tweak the percentages to align with your unique aspirations:

1. Buying a Home: Supercharge Your Savings

Owning a home is a cherished dream for many Indians. To achieve this goal faster, consider shifting your focus to savings:

- 70% Needs: While still covering essentials, try to identify areas where you can cut back, such as dining out or entertainment, to free up more funds for savings.

- 30% (or more) Savings & Investments: Increase your savings allocation significantly. Explore high-yield savings accounts, recurring deposits, or short-term debt funds to maximize your returns.

- 10% (or less) Wants: Temporarily reduce your spending on discretionary items to accelerate your down payment savings.

Additional Tips:

- Consider government schemes like the Pradhan Mantri Awas Yojana (PMAY) that offer subsidies and benefits for first-time homebuyers.

- Research various home loan options and compare interest rates to find the most favorable terms.

2. Early Retirement: Turbocharge Your Investments

Dreaming of retiring early? Ramp up your investment contributions to build a substantial nest egg:

- 70% Needs: Focus on maintaining a frugal lifestyle to minimize your living expenses.

- 10% (or less) Savings: Allocate a smaller portion to basic savings and prioritize investments.

- 40% or 50% Investments: Aggressively invest in a diversified portfolio of stocks, mutual funds, or other assets that align with your risk tolerance and financial goals.

Additional Tips:

- Start early to take advantage of the power of compounding.

- Consider consulting a financial advisor to create a personalized retirement plan.

3. Starting a Business: Fuel Your Entrepreneurial Dreams

If entrepreneurship is your goal, you can adapt the 70-20-10 rule to support your venture:

- 70% Needs: Ensure your essential expenses are covered, but be prepared to make sacrifices to free up funds for your business.

- 20% Business Expenses: Allocate a portion of your income to cover initial business costs like registration, marketing, inventory, or equipment.

-

- 10% Wants (or Savings): If possible, continue saving a small amount for emergencies or future business investments. Otherwise, you can use this for personal needs.

Additional Tips:

- Thoroughly research your business idea and create a detailed business plan.

- Seek guidance from experienced entrepreneurs or mentors.

-

- Consider alternative funding options like crowdfunding or small business loans.

The 70-20-10 Rule: Beyond Financial Health, a Path to Mental Well-being

The 70-20-10 rule isn't just about numbers; it's a holistic approach to managing your finances that can significantly impact your mental and emotional well-being. Let's explore the psychological benefits this budgeting framework can bring:

1. Reduced Financial Stress and Anxiety

Money worries are a major source of stress and anxiety for many individuals and families in India. The 70-20-10 rule provides a structured plan that helps alleviate this burden. By knowing where your money is going and having a clear picture of your financial situation, you're less likely to feel overwhelmed or uncertain. This sense of control can significantly reduce financial stress and promote peace of mind.

2. Increased Confidence and Empowerment

When you actively manage your finances using a structured approach like the 70-20-10 rule, you gain a deeper understanding of your income, expenses, and savings patterns. This knowledge empowers you to make informed financial decisions. You'll feel more confident in your ability to handle financial challenges and pursue your goals.

3. A Sense of Accomplishment and Progress

The 70-20-10 rule encourages you to set financial goals and track your progress towards them. Seeing your savings grow or your debts shrink can be incredibly motivating. It creates a sense of accomplishment and reinforces positive financial behaviors. This can lead to a virtuous cycle where you become more engaged and proactive in managing your finances.

4. Improved Self-Discipline and Delayed Gratification

Sticking to the 70-20-10 allocations requires self-discipline and the ability to delay gratification. As you practice these skills, you'll find them beneficial in other areas of your life as well. You'll be more likely to resist impulse purchases, save for bigger goals, and make decisions that prioritize long-term well-being over short-term pleasure.

5. A Healthier Relationship with Money

Many people have complex and often negative emotions associated with money. The 70-20-10 rule can help you develop a healthier relationship with money. By removing the mystery and anxiety surrounding finances, you can start to view money as a tool to achieve your goals, rather than a source of stress or conflict.

6. Greater Life Satisfaction

When you're in control of your finances and making progress towards your goals, it positively impacts your overall life satisfaction. You'll feel more secure, confident, and empowered to pursue your dreams and aspirations. This, in turn, can lead to a happier and more fulfilling life.

7. Family Harmony

When everyone in the family understands and participates in the budgeting process, it can foster open communication and shared responsibility. This can reduce financial conflicts and strengthen family bonds.

Technology to the Rescue: Apps and Tools for Seamless 70-20-10 Budgeting

Managing your finances doesn't have to involve piles of receipts and spreadsheets. In today's digital age, a plethora of apps and tools can streamline the process of implementing the 70-20-10 rule, making it easier than ever to track, budget, and achieve your financial goals.

Popular Budgeting Apps in India

-

Walnut: This app automatically categorizes your expenses, tracks spending patterns, and provides insights into your financial habits. It also allows you to set bill reminders and budget goals.

-

Money Manager: With its intuitive interface, Money Manager simplifies expense tracking and budgeting. It offers features like expense reports, debt management, and even asset management.

-

ET Money: This app goes beyond budgeting to offer investment tracking, tax filing, and insurance management. It also provides personalized financial advice.

-

Expense Manager: A simple yet effective app for tracking daily expenses and categorizing them according to the 70-20-10 rule.

-

Monefy: This app focuses on simplicity, offering a quick and easy way to log expenses and view spending summaries.

India-Specific Features

Many budgeting apps cater to the Indian market by offering features like:

- UPI Integration: Directly link your UPI accounts to track transactions seamlessly.

- Local Tax Rules: Tax calculators and insights based on Indian tax laws.

- Investment Tracking: Track investments in Indian stocks, mutual funds, and other assets.

- Bill Reminders: Reminders for paying utility bills, EMIs, and other recurring payments.

- Local Currency: All transactions and calculations are in Indian Rupees.

Additional Tools

- Spreadsheets: While not as flashy as apps, spreadsheets (like Google Sheets or Microsoft Excel) can be powerful tools for creating and customizing budgets based on the 70-20-10 rule.

- Online Banking: Most banks in India offer online banking platforms with built-in budgeting tools.

- Financial Calculators: Use online calculators to estimate your future savings, retirement corpus, or loan repayments.

Tips for Using Technology

- Choose the Right Tool: Select an app or tool that aligns with your comfort level and financial needs.

- Set Up Automatic Tracking: If possible, link your bank accounts and credit cards for automatic expense tracking.

- Utilize Reminders: Set reminders for bill payments, budget reviews, and investment contributions.

-

- Review Regularly: Analyze your spending patterns and make adjustments to your budget as needed.

The 70-20-10 Rule vs. Other Budgeting Methods: Finding the Right Fit for You

The 70-20-10 rule isn't the only budgeting method out there. Let's compare it with other popular approaches and see which might suit your financial personality and goals in the Indian context:

1. The 50-30-20 Rule

This budgeting method allocates:

- 50% of income to needs (housing, food, transportation, bills)

- 30% to wants (entertainment, dining out, hobbies)

- 20% to savings and debt repayment

Pros:

- Simpler to implement than the 70-20-10 rule.

- More flexibility for discretionary spending.

Cons:

- May not prioritize savings enough for those with ambitious financial goals.

- Might not be suitable for those with high living costs or significant debt.

Who It Suits:

- Individuals with moderate incomes and manageable debt levels.

- Those who prioritize lifestyle expenses and want a simple budgeting approach.

2. Envelope Budgeting

This method involves allocating cash to specific spending categories (e.g., groceries, transportation, entertainment) in separate envelopes. Once the envelope is empty, spending in that category stops.

Pros:

- Provides a visual representation of spending limits.

- Curbs impulse spending and promotes mindful spending habits.

Cons:

- Requires more hands-on management and discipline.

- Not ideal for those who prefer digital transactions.

Who It Suits:

- Individuals who struggle with overspending in specific categories.

- Those who prefer a tangible and visual budgeting approach.

3. Zero-Based Budgeting

This method involves giving every rupee a job. At the beginning of each month, you allocate your income to various categories until your balance reaches zero.

Pros:

- Encourages meticulous tracking of every expense.

- Helps identify and eliminate unnecessary spending.

Cons:

- Time-consuming and requires frequent adjustments.

- Less flexible for unexpected expenses.

Who It Suits:

- Individuals with a strong desire for financial control.

- Those who want to optimize their spending and maximize savings.

Choosing the Right Method for You:

- Financial Goals: If you have aggressive savings goals (e.g., early retirement or buying a house), the 70-20-10 rule might be more suitable due to its emphasis on savings.

- Income Stability: If your income fluctuates, consider a more flexible method like the 50-30-20 rule or envelope budgeting.

- Personality: If you prefer a simple, structured approach, the 70-20-10 or 50-30-20 rule might be a good fit. If you enjoy hands-on control, envelope budgeting might suit you.

- Debt Level: If you have substantial debt, prioritize a method that emphasizes debt repayment, like the 70-20-10 rule or zero-based budgeting.

The Verdict

The 70-20-10 rule offers a good balance between meeting needs, saving for the future, and enjoying life's pleasures. It's a versatile framework that can be adapted to various financial situations in India. However, it's crucial to remember that the best budgeting method is the one that you can stick to consistently and that helps you achieve your financial goals. Don't be afraid to experiment and find the approach that works best for you.

An Expert's Perspective: A Conversation with Priya Sharma, Financial Advisor

To gain a deeper understanding of the 70-20-10 rule in the Indian context, we spoke with Priya Sharma, a certified financial planner with over a decade of experience advising clients in India.

Q: Priya, what's your take on the 70-20-10 rule for Indian investors?

Priya: I think it's a fantastic starting point for building healthy financial habits. It's simple, intuitive, and flexible enough to adapt to different income levels and life stages. In India, where there's a cultural emphasis on saving, this rule aligns well with our values.

Q: Are there any specific adaptations you'd recommend for Indian investors?

Priya: Absolutely. Given the rising cost of living and inflation in India, I often encourage young professionals to save more aggressively, perhaps aiming for a 80-10-10 split initially. Also, consider factoring in expenses like insurance premiums and unexpected medical costs into your 'needs' category.

Q: What are some tax-efficient investment options you'd suggest for the 'savings' portion?

Priya: India offers several tax-advantaged investment options. For long-term goals like retirement, the Public Provident Fund (PPF) and National Pension System (NPS) are excellent choices. Equity Linked Savings Schemes (ELSS) offer tax benefits along with the potential for higher returns through equity exposure.

Q: Any advice on balancing needs and wants in the Indian context?

Priya: It's crucial to strike a balance. While it's important to save for the future, it's equally important to enjoy the present. In India, we often have social obligations and family events. Don't be afraid to allocate a bit more to the 'wants' category to enjoy these occasions, but ensure it doesn't derail your long-term financial goals.

Q: What about those with irregular incomes? How can they use the 70-20-10 rule?

Priya: For freelancers or those with variable income, the key is to estimate an average monthly income. Base your budget on this average, and during higher-earning months, increase your savings or investment contributions to create a buffer for leaner times.

Q: Any final thoughts for our readers?

Priya: Remember, the 70-20-10 rule is a guideline, not a rigid law. Feel free to customize it to your unique circumstances and goals. The most important thing is to be consistent with your budgeting, track your expenses, and review your plan regularly to ensure it's aligned with your changing needs.

Key Takeaways:

- Consider adjusting the percentages based on your income, goals, and life stage.

- Prioritize tax-advantaged investments like PPF, NPS, and ELSS.

- Balance saving for the future with enjoying the present.

- If you have irregular income, base your budget on an average.

- Be consistent, track your expenses, and review your plan regularly.

Priya's insights highlight the adaptability and relevance of the 70-20-10 rule for Indian investors. It's a framework that can empower you to take charge of your finances, achieve your goals, and build a secure financial future.

Disclaimer

The information provided in this article about the 70-20-10 rule is intended for general informational and educational purposes only. It should not be considered as financial or investment advice. Individual financial situations and goals vary, and it's essential to consult with a qualified financial advisor before making any investment decisions.

The examples and case studies presented are for illustrative purposes only and may not reflect the actual experiences of all individuals. The author and publisher of this article are not responsible for any financial decisions or outcomes based on the information presented here.

What's Your Reaction?