The 28/36 Rule: Your Financial Compass for Affordable Living in India

Navigate the Indian housing market with confidence! Learn how the 28/36 rule can help you determine affordable housing costs and manage your debt. Discover expert tips, case studies, and resources for financial stability.

Navigating the financial landscape of India can be tricky. With the rising costs of housing, education, and daily living, it's easy to feel overwhelmed. But what if there was a simple rule of thumb to guide your financial decisions, especially when it comes to managing your housing costs and overall debt?

Enter the 28/36 Rule. This well-established financial guideline can empower you to make informed choices about housing affordability, debt management, and long-term financial stability. Let's dive into the details of this rule and understand its significance for your financial well-being in India.

Understanding the 28/36 Rule

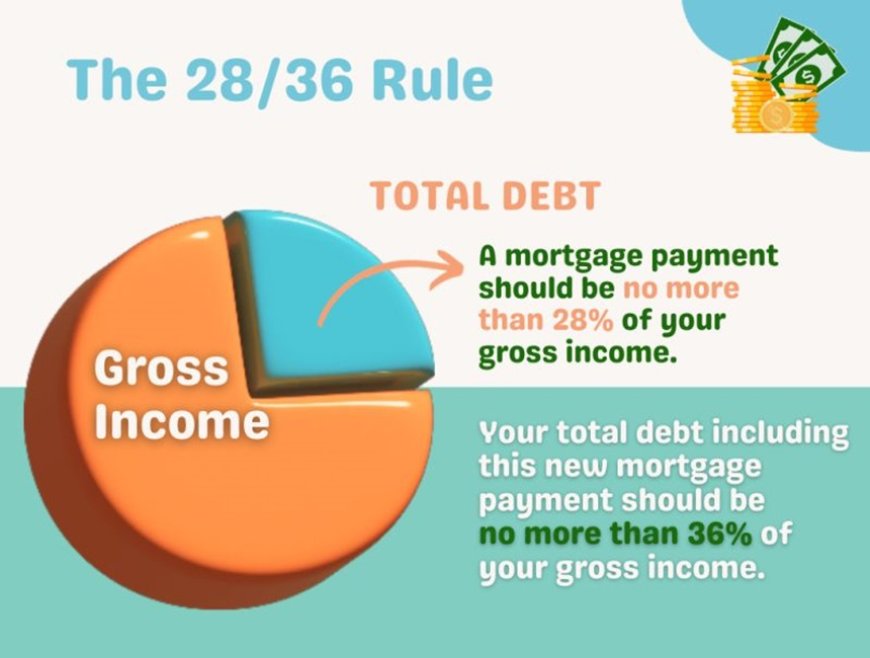

The 28/36 Rule is a widely recognized benchmark that helps you gauge the affordability of your housing costs and total debt in relation to your income. Here's the breakdown:

- 28% Rule (Housing Costs): Your total housing expenses, including rent or mortgage payments, property taxes, insurance, and maintenance costs, should ideally not exceed 28% of your gross monthly income.

- 36% Rule (Total Debt): Your total monthly debt payments, including housing costs, personal loans, car loans, credit card payments, and other debts, should not surpass 36% of your gross monthly income.

These percentages offer a safe zone to help you avoid overstretching your finances, ensuring that your essential expenses remain within a manageable limit. Let's explore the importance of each component.

The 28% Rule: Housing Affordability in the Indian Context

In the vibrant and diverse real estate market of India, housing costs can vary significantly depending on the city, location, and property type. The 28% rule provides a valuable reference point to determine whether a particular house or apartment fits your budget.

If your housing expenses exceed 28% of your gross income, you might face challenges in meeting your other financial obligations, saving for the future, or enjoying a comfortable lifestyle. However, it's important to note that this rule is a guideline, not a strict mandate. Several factors can influence the ideal percentage for housing costs in your situation, such as:

- City and Location: Housing costs are generally higher in metropolitan cities like Mumbai, Delhi, and Bengaluru compared to smaller towns or rural areas. Therefore, you may need to adjust the 28% benchmark accordingly.

- Family Size and Lifestyle: If you have a larger family or prefer a more luxurious lifestyle, you might be willing to allocate a higher percentage of your income to housing.

- Financial Goals: Your financial goals play a crucial role. If you're prioritizing saving for retirement or a down payment on a house, you might choose to keep your housing expenses lower.

The 36% Rule: Managing Your Debt Wisely

In addition to housing costs, the 36% rule focuses on your overall debt burden. Managing debt responsibly is crucial in India, where loans and credit cards have become increasingly accessible.

By keeping your total debt payments below 36% of your gross income, you create a buffer zone for unforeseen expenses, financial emergencies, and future investments. Excessive debt can lead to stress, financial instability, and even bankruptcy in extreme cases.

The 28/36 Rule vs. Indian Lending Practices: A Closer Look

While the 28/36 rule offers a globally recognized benchmark, it's important to understand that Indian banks and lenders often operate with their own set of DTI ratio thresholds. These thresholds can vary depending on several factors:

1. Lender's Risk Appetite:

- Conservative Lenders: Some banks might be more conservative and prefer borrowers with lower DTI ratios, typically below 40%. They prioritize minimizing risk and ensuring loan repayment.

- Flexible Lenders: Other lenders might be more flexible, especially for borrowers with strong credit profiles and stable income. They might approve loans with DTI ratios up to 50% or even higher in some cases.

2. Borrower's Profile:

- Income Level: Borrowers with higher incomes are often seen as lower risk and might be eligible for loans with higher DTI ratios.

- Credit Score: A good CIBIL score demonstrates responsible credit behavior, making you a more attractive borrower. A high score can sometimes offset a slightly higher DTI ratio.

- Occupation: Certain professions, such as government employees or professionals in stable industries, might be considered more secure, allowing for a higher acceptable DTI ratio.

3. Type of Loan:

- Home Loans: Lenders are generally more cautious with home loans, often requiring lower DTI ratios, usually below 40%, to mitigate the risk of default.

- Personal Loans: Personal loans are unsecured, so lenders might set a higher DTI threshold, sometimes up to 50%, as they can charge higher interest rates to compensate for the risk.

- Car Loans: Car loan DTI ratios might fall somewhere in between, depending on the lender's policies and the borrower's profile.

4. Other Factors:

- Loan Amount: Larger loan amounts might necessitate lower DTI ratios to ensure affordability and reduce the risk of default.

- Interest Rates: Higher interest rates might lead to lower DTI thresholds as lenders want to ensure borrowers can comfortably manage higher EMIs.

- Fixed Obligations to Income Ratio (FOIR): Many Indian lenders also utilize the FOIR to assess a borrower's repayment capacity. FOIR considers not only the proposed loan EMI but also existing EMIs from other loans. A lower FOIR indicates a higher capacity to take on additional debt.

Understanding Your Options

It's crucial for borrowers to be aware of these variations in DTI thresholds and research different lenders to find the best fit for their financial situation. While a lower DTI ratio is always desirable, it's not always a strict barrier. Many factors come into play, and it's possible to secure a loan even if your DTI ratio exceeds the recommended limits, depending on your overall financial health and the lender's policies.

Remember, the 28/36 rule serves as a useful guideline, but it's not the sole determining factor in loan approval. By understanding the nuances of Indian lending practices and comparing different lenders, you can make informed decisions that align with your financial goals.

Rising Inflation: A Challenge to the 28/36 Rule

Inflation, the steady increase in prices over time, can significantly impact your ability to adhere to the 28/36 rule. Here's how:

Challenges:

- Eroding Purchasing Power: As inflation rises, the value of your money decreases. This means your income might not go as far as it used to, making it harder to afford housing and other expenses within the recommended percentages.

- Fixed Salaries: If your income isn't keeping pace with inflation, your housing costs and debt payments can eat up a larger portion of your budget, leaving less for other essential needs and savings.

- Increased Borrowing Costs: Inflation often leads to higher interest rates on loans and credit cards. This can push your debt payments above the 36% limit, even if your income remains stable.

- Budgetary Pressure: Rising prices for everyday goods and services can strain your budget, leaving less room for discretionary spending and making it harder to save for the future.

Adapting to Inflation:

To maintain a healthy financial balance in the face of inflation, you'll need to be proactive and adaptable. Here are some strategies:

-

Increase Your Income: Explore opportunities to increase your income, such as seeking a promotion, taking on freelance work, or starting a side hustle. Negotiate a raise with your employer if your salary hasn't kept up with inflation.

-

Reassess Your Budget: Regularly review your budget and adjust your spending habits. Look for areas where you can cut back on discretionary expenses to free up more funds for essential needs. Consider switching to more affordable alternatives or reducing your consumption.

-

Prioritize Debt Repayment: Focus on paying down high-interest debt as quickly as possible to minimize the impact of rising interest rates. Consider refinancing existing loans to secure lower rates if possible.

-

Save Aggressively: Aim to save a larger portion of your income to combat the erosive effects of inflation. Explore investment options that offer potential for growth that outpaces inflation, such as equity mutual funds or index funds.

-

-

Negotiate Housing Costs: If you're renting, try negotiating with your landlord for a lower rent increase or explore moving to a more affordable location. If you have a mortgage, consider refinancing to a lower interest rate or making additional payments to pay it off faster.

-

Case Studies: Real-Life Examples

Case Study 1: The Young Professional Couple

Meet Priya and Rahul, both IT professionals in Bengaluru, earning a combined gross income of ₹1.5 lakhs per month. They're eager to buy their first home, but are navigating the high cost of living in a metro city.

- Challenges: Their dream home has an EMI of ₹50,000, which exceeds the 28% rule limit of ₹42,000. Additionally, they have existing car loan EMIs and credit card debt, pushing their total debt payments close to 36% of their income.

- Solutions:

- Downsize: They could explore smaller apartments or homes in less expensive areas to lower the EMI.

- Increase Down Payment: Saving a larger down payment can significantly reduce the EMI and bring it within the 28% threshold.

- Refinance Debt: Consolidating their existing debt into a lower-interest loan could free up more funds for housing.

Case Study 2: The Family with Children

Meet the Sharma family – two working parents with two school-going children. Their combined income is ₹2 lakhs per month. They recently purchased a home with an EMI of ₹60,000, but are struggling to balance this with rising education costs.

- Challenges: Their housing expenses already exceed the 28% limit, and adding education fees, personal loans, and other expenses pushes them well beyond the 36% debt limit.

- Solutions:

- Refinance Mortgage: Refinancing their mortgage at a lower interest rate could decrease their monthly payments.

- Explore Education Loans: They could consider educational loans with favorable terms to manage education costs.

- Cut Back on Discretionary Spending: Temporarily reducing non-essential spending can free up funds for necessities.

Case Study 3: The Single Person with Student Loans

Meet Anya, a recent graduate working in Delhi with a monthly income of ₹50,000. She's looking to rent an apartment but also needs to repay her student loans.

- Challenges: Her student loan EMIs already take up a significant portion of her income, leaving her limited room for housing expenses while staying within the 36% limit.

- Solutions:

- Find Affordable Housing: Look for shared accommodation or smaller apartments in less expensive areas to keep rent within a reasonable range.

- Income-Driven Repayment Plan: Explore options for student loan repayment plans that adjust monthly payments based on income to free up more cash flow for housing.

- Boost Income: Consider freelance gigs or part-time work to supplement income and expand her budget for housing.

Key Takeaways:

- The 28/36 rule is a useful guideline, but its application can vary depending on individual circumstances and financial goals.

-

- Flexibility and adaptability are key when facing challenges like high living costs, inflation, and unexpected expenses.

Practical Tips for Implementing the 28/36 Rule in India

- Track Your Income and Expenses: The first step is to meticulously track your income and expenses to get a clear picture of your financial situation. Analyze your spending patterns and identify areas where you can cut back.

- Prioritize Your Debts: If your debt exceeds the recommended limit, focus on paying off high-interest debts first, such as credit card balances or personal loans. Consider debt consolidation to simplify your payments and potentially lower interest rates.

- Create a Budget: Develop a comprehensive budget that aligns with the 28/36 rule. Allocate specific percentages of your income to housing, other debts, savings, and discretionary spending. Review and adjust your budget regularly as your income or expenses change.

- Save for a Down Payment: If you're planning to buy a house, prioritize saving for a substantial down payment. This will not only reduce your loan amount and monthly mortgage payments but also make you a more attractive borrower to lenders.

- Negotiate Rent or Mortgage Terms: Don't hesitate to negotiate with landlords or lenders to secure better rental rates or mortgage terms. A slight reduction in your monthly housing costs can make a significant difference in your overall budget.

- Explore Government Housing Schemes: The Indian government offers various housing schemes and subsidies to make housing more affordable for different income groups. Research and explore these programs to see if you qualify for any benefits.

Additional Tips for Indian Homebuyers:

- Factor in Property Taxes and Maintenance Costs: Don't just consider the base rent or mortgage payment. Factor in property taxes, society maintenance charges, and potential repair costs when assessing housing affordability.

- Consider Long-Term Financial Goals: Before committing to a housing expense, think about your long-term financial goals, such as retirement planning, children's education, and other major life events.

- Seek Professional Financial Advice: If you're unsure about how to apply the 28/36 rule to your specific situation, consult a financial advisor who can provide personalized guidance based on your income, expenses, and financial goals.

Beyond the Numbers: The Importance of Financial Well-being

While the 28/36 rule provides a valuable framework for managing housing costs and debt, it's important to remember that financial well-being encompasses more than just numbers. It's about achieving peace of mind, financial security, and the freedom to pursue your dreams.

By prioritizing financial literacy, budgeting, and responsible debt management, you can create a solid foundation for a prosperous future. The 28/36 rule serves as a compass to guide you on your financial journey, empowering you to make informed decisions that align with your values and aspirations.

Remember, the ultimate goal is to create a balanced financial life that allows you to enjoy a comfortable lifestyle, save for the future, and achieve your financial goals. The 28/36 rule is merely a tool to assist you in this endeavor. So, embrace it, adapt it to your circumstances, and embark on a path towards a financially secure and fulfilling life in India.

FAQ: Your Questions About the 28/36 Rule Answered

Q: Is the 28/36 rule applicable to everyone?

A: While the 28/36 rule is a widely recognized guideline, it's not a one-size-fits-all solution. Your ideal percentages may vary based on your city, income, family size, financial goals, and individual circumstances. It's a starting point to assess affordability, but you might need to adjust it based on your situation.

Q: What happens if I exceed the recommended limits?

A: Exceeding the 28/36 limits doesn't automatically disqualify you from getting a loan or finding a place to live. However, it could indicate that you might be overextending your finances and could face challenges meeting your financial obligations or saving for the future. It's crucial to assess your overall financial situation and make informed decisions.

Q: Do Indian lenders strictly adhere to the 28/36 rule?

A: Not always. While some Indian lenders might use it as a guideline, they often have their own debt-to-income (DTI) ratio thresholds and may consider other factors like your credit score, income stability, and Fixed Obligations to Income Ratio (FOIR) when assessing loan applications.

Q: Should I include my monthly investments in the debt calculation?

A: No, investments are not considered debt. The 36% limit applies to your total debt payments, including loan EMIs and credit card bills. Investments, like mutual funds or SIPs, are not factored into this calculation.

Q: Can I still buy a home if my housing expenses exceed 28% of my income?

A: It's possible, but it depends on various factors, including your income stability, other debts, and savings. You might need to make a larger down payment, explore housing in more affordable areas, or consider government housing schemes to make homeownership more accessible.

Q: How does rising inflation impact the 28/36 rule?

A: Inflation can erode the value of your income and make it difficult to adhere to the rule. As prices increase, your expenses might grow faster than your income, pushing your housing costs and debt payments beyond the recommended percentages. You might need to adjust your budget, prioritize debt repayment, and explore ways to increase your income to stay within the limits.

Q: Can a financial advisor help me with the 28/36 rule?

A: Absolutely! A financial advisor can assess your financial situation, provide personalized guidance on applying the rule, and help you create a budget and debt management plan that aligns with your financial goals. They can also offer valuable insights on navigating rising inflation and suggest strategies to maintain a healthy financial balance.

Additional Resources: Tools and Information to Empower Your Financial Journey

To further assist you in applying the 28/36 rule and navigating the Indian financial landscape, we've compiled a list of helpful resources:

Financial Calculators:

- 28/36 Rule Calculator: This simple online calculator helps you determine your ideal housing budget and maximum debt limits based on your income and expenses: https://www.omnicalculator.com/finance/28-36-rule

- EMI Calculator: This calculator lets you estimate your monthly installments (EMIs) for various loan types, including home loans, personal loans, and car loans: https://www.bankbazaar.com/emi-calculator.html

Government Websites:

- Pradhan Mantri Awas Yojana (PMAY): The official website for this flagship housing scheme provides detailed information on its components, eligibility criteria, and application process: https://pmay-urban.gov.in/

- Ministry of Housing and Urban Affairs (MoHUA): The MoHUA website offers a comprehensive list of other government housing schemes and subsidies available for different income groups: https://mohua.gov.in/

We hope these resources empower you to make informed financial decisions, manage your housing costs and debts effectively, and achieve your financial goals. Remember, knowledge is key to financial well-being, so don't hesitate to utilize these tools and resources to your advantage.

Disclaimer:

The information provided in this article about the 28/36 rule is intended for general informational and educational purposes only. It is not intended as a substitute forprofessional financial advice. While we strive to provide accurate and up-to-date information, financial situations can vary greatly, and the applicability of the 28/36 rule may differ based on individual circumstances.

We strongly recommend consulting with a qualified financial advisor or professional to discuss your specific financial situation, goals, and risk tolerance before making any financial decisions. The author and publisher of this article are not responsible for any financial outcomes or decisions made based on the information presented here.

What's Your Reaction?