Demystifying the Public Provident Fund (PPF): A Comprehensive Guide for Indian Investors

PPF: Your tax-saving, high-interest, government-backed investment for a secure future. Unveil the power of Public Provident Fund (PPF) for Indians! Explore benefits, strategies, and recent updates in this comprehensive guide. Secure your financial future with PPF.

In the labyrinth of financial instruments, the Public Provident Fund (PPF) shines as a beacon of security and long-term growth for Indian investors. Backed by the government, PPF offers a unique blend of attractive interest rates, tax benefits, and a risk-free environment. If you're seeking a reliable avenue to build your retirement nest egg or achieve other financial goals, PPF deserves your attention. Let's delve deeper into this powerful savings tool and uncover its nuances.

What is the Public Provident Fund (PPF)?

The PPF is a government-backed savings scheme introduced by the National Savings Institute of the Ministry of Finance in 1968. Its primary objective is to mobilize small savings by offering a secure investment option with reasonable returns and significant tax advantages. PPF is often considered a cornerstone of financial planning for many Indians due to its triple EEE (Exempt-Exempt-Exempt) tax status, which means that contributions, interest earned, and maturity proceeds are all tax-free.

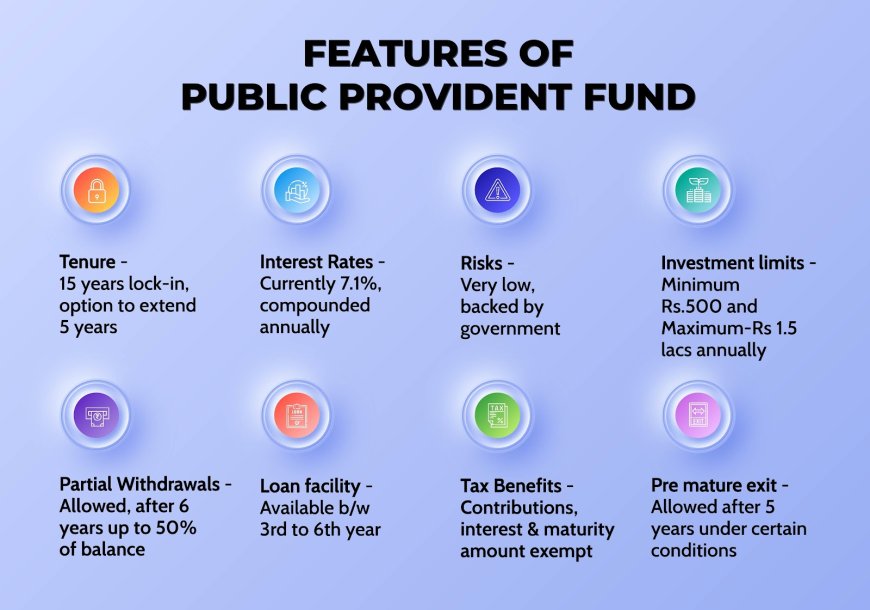

Key Features of PPF

-

Eligibility:

- Any Indian resident can open a PPF account.

- Minors can also have accounts opened on their behalf by their parents or guardians.

- NRIs are not eligible to open new PPF accounts, but they can continue existing ones opened while they were residents.

- One individual can hold only one PPF account.

-

Account Opening:

- PPF accounts can be opened at designated post offices, nationalized banks, and select private banks.

- Online account opening is also available through certain banks.

-

Tenure:

- The standard PPF account has a 15-year lock-in period.

- After maturity, the account can be extended in blocks of five years indefinitely.

-

Minimum and Maximum Contributions:

- The minimum annual contribution is ₹500.

- The maximum annual contribution is ₹1.5 lakhs.

- Contributions can be made in a lump sum or in installments throughout the year.

-

Interest Rate:

- The PPF interest rate is determined by the government quarterly and is usually higher than most fixed deposit rates.

- The interest is calculated on the lowest balance between the fifth and last day of the month and is compounded annually.

-

Loan and Partial Withdrawal Facility:

- PPF allows loans against the balance from the third to the sixth year of the account opening.

- Partial withdrawals are permitted from the seventh year onwards, subject to certain conditions.

-

Tax Benefits:

- PPF falls under the EEE category, providing tax deductions under Section 80C of the Income Tax Act.

- Up to ₹1.5 lakhs invested in PPF can be claimed for tax deductions.

PPF for Specific Financial Goals: Unleashing its Potential

1. Retirement Planning:

PPF's long-term nature and tax-free maturity make it an ideal choice for building a retirement corpus. Regular contributions throughout your working years can accumulate into a sizable amount upon retirement, ensuring financial security in your golden years.

- Example: Assume you're 30 years old and contribute the maximum ₹1.5 lakhs annually to PPF for 15 years at an average interest rate of 7.1%. At maturity, your corpus would be approximately ₹40.65 lakhs. If you continue to extend the account in 5-year blocks and maintain the same contribution, your retirement nest egg could grow substantially over time.

2. Children's Education:

PPF offers a disciplined approach to saving for your child's future education. By starting early and contributing consistently, you can accumulate funds to cover tuition fees, accommodation, and other educational expenses.

- Example: If you start investing ₹50,000 annually in a PPF account for your newborn child, assuming a 7.1% average interest rate, the corpus could grow to approximately ₹18.68 lakhs by the time they turn 18. This could significantly offset the burden of rising education costs.

3. Down Payment on a House:

PPF can be a reliable way to save for a down payment on your dream home. The partial withdrawal facility after the 7th year allows you to access funds for this purpose without disrupting your long-term investment plan.

- Example: Suppose you want to buy a house in 10 years and need a down payment of ₹20 lakhs. If you start investing ₹1 lakh annually in PPF at a 7.1% interest rate, you'll accumulate approximately ₹14.49 lakhs in 10 years. You can then use the partial withdrawal facility to access the remaining amount needed for the down payment.

Important Considerations:

- Inflation: Keep in mind that inflation erodes the purchasing power of money over time. While PPF offers a relatively safe investment, its returns may not always outpace inflation.

- Diversification: Don't put all your eggs in one basket. While PPF is a solid foundation for your financial plan, consider diversifying your investments to manage risk and potentially achieve higher returns.

-

- Start Early: The power of compounding works best when you start investing early. The sooner you begin contributing to your PPF, the more time your money has to grow.

Case Studies and Real Life Examples

Case Study 1: Priya's Retirement Nest Egg

Priya, a 28-year-old software engineer, started investing in PPF early in her career. She understood the value of disciplined savings and tax-free returns. Every year, she diligently contributed the maximum amount to her PPF account.

Over 25 years of consistent contributions and compounding interest, Priya's PPF corpus grew significantly. When she reached 55, she had accumulated a substantial nest egg that allowed her to retire early and pursue her passion for traveling. Priya's story demonstrates how PPF can be a reliable tool for securing a comfortable retirement.

Case Study 2: Ravi and Neha's Child's Education Fund

Ravi and Neha, a young couple, wanted to ensure their newborn daughter had access to the best education. They opened a PPF account in their daughter's name and started contributing regularly.

By the time their daughter turned 18, Ravi and Neha had accumulated a significant sum in the PPF account. This helped them fund her undergraduate studies abroad without any financial stress. The tax-free maturity amount was a huge advantage, allowing them to maximize their savings for their daughter's future.

Case Study 3: Asif's Dream Home

Asif, a 35-year-old entrepreneur, had always dreamt of owning his own home. He began investing in PPF early in his business journey, understanding its potential for long-term wealth creation.

Over 12 years, Asif diligently contributed to his PPF account, accumulating a sizeable amount. After the seventh year, he utilized the partial withdrawal facility to access funds for the down payment on his dream home. Asif's strategic use of PPF allowed him to realize his goal of homeownership without compromising his long-term financial security.

PPF Interest Rate Trends: A Historical Perspective

| Period | Interest Rate (%) | Key Events/Observations |

|---|---|---|

| 1968-1986 | 4.8-12% | Steady increase in rates; peak at 12% for an extended period. |

| 1986-2000 | 12% | Consistent rate at 12% for over a decade. |

| 2000-2003 | 9.5-11% | Gradual decline in rates. |

| 2003-2011 | 8% | Stable rate for 8 years. |

| 2011-2013 | 8.6-8.8% | Slight increase in rates. |

| 2013-2016 | 8.7% | Stable rate, PPF limit increased to ₹1.5 lakhs from 2014 onwards. |

| 2016-2018 | 7.6-8.1% | Fluctuating rates, generally trending downward. |

| 2018-2020 | 7.6-8.0% | Continued fluctuations, with some periods of increase. |

| 2020-2024 | 7.1% | Consistent rate at 7.1% for four years. |

Key Observations:

- Early Years: PPF interest rates were relatively high in the initial years, reaching a peak of 12% and remaining there for a significant period.

- Gradual Decline: The rates gradually declined from the late 90s, reaching a low of 7.1% in recent years.

- Recent Stability: Since 2020, the PPF interest rate has been stable at 7.1%, offering predictable returns.

What to Expect:

While historical performance can provide insights, it's important to remember that PPF rates are subject to change based on government policies and economic conditions. Here are some key takeaways:

- No Guarantee of High Returns: Although PPF offered very high rates in the past, those rates may not be replicated in the future.

- Benchmark for Comparison: PPF rates are often used as a benchmark to compare other fixed-income investments.

- Realistic Expectations: It's reasonable to expect moderate returns from PPF, typically higher than most bank fixed deposit rates.

-

- Long-Term Focus: PPF is best suited for long-term financial goals where consistent, tax-free returns are prioritized over potentially higher but riskier returns from other investments.

PPF and Inflation: Protecting Your Hard-Earned Savings

Inflation, the gradual increase in the prices of goods and services, is a silent thief that erodes the purchasing power of your money over time. When planning long-term investments like PPF, it's crucial to consider the impact of inflation on your returns.

Historical Comparison: PPF vs. Inflation

Over the years, PPF interest rates have often surpassed the average inflation rate in India. This means that, historically, PPF investments have generally been able to beat inflation and offer positive real returns. However, there have been periods where inflation has outpaced PPF returns, leading to a decrease in the real value of investments.

Current Scenario:

As of 2024, the PPF interest rate is 7.1%, while India's average inflation rate hovers around 6-7%. This suggests that the current PPF rate is likely to keep pace with or slightly exceed inflation.

Importance of Considering Inflation:

- Real Returns Matter: It's not just about the nominal return you earn, but the real return that matters. Real return is the return you earn after accounting for inflation. If your investment doesn't beat inflation, your money loses value over time.

- Long-Term Planning: Inflation's impact becomes more pronounced over long periods. When planning for goals like retirement or your child's education, it's essential to factor in inflation to ensure your savings will be sufficient to meet your needs in the future.

- Diversification: While PPF is a safe investment, it's wise to diversify your portfolio with other asset classes like equities or real estate, which have the potential for higher returns and can help you hedge against inflation.

Strategies to Combat Inflation:

- Maximize PPF Contributions: Contribute the maximum permissible amount annually to take full advantage of the tax benefits and accumulate a larger corpus.

- Invest in Other Avenues: Explore other investment options that offer potential for higher returns, such as equity mutual funds or index funds, while keeping in mind your risk tolerance.

- Regularly Review Your Portfolio: Monitor the performance of your investments and adjust your portfolio as needed to stay ahead of inflation.

Why Should You Invest in PPF?

-

Guaranteed Returns: PPF offers government-guaranteed returns, making it a safe haven for risk-averse investors.

-

Attractive Interest Rates: The interest rate on PPF is often higher than that of many other fixed-income instruments.

-

Tax Benefits: PPF's triple EEE status allows you to save on taxes at all stages of investment.

-

Long-Term Wealth Creation: The 15-year lock-in period encourages disciplined savings and helps in building a substantial corpus over time.

-

Loan and Withdrawal Flexibility: The option to take loans and make partial withdrawals provides liquidity for emergencies and other financial needs.

Expert Insights on PPF Investments

1. Amit Trivedi, Certified Financial Planner:

"PPF is like the tortoise in the race – slow and steady, but it wins in the long run. It's a must-have in every Indian's financial portfolio for its unbeatable combination of safety, tax efficiency, and guaranteed returns."

2. Radhika Gupta, MD & CEO, Edelweiss Asset Management:

"PPF is the cornerstone of a balanced portfolio. It offers stability and acts as a counterweight to volatile investments like stocks. For risk-averse investors, it's a safe haven for wealth creation."

3. Harsh Roongta, Personal Finance Expert:

"PPF is not just a savings scheme; it's a disciplined way to build wealth. The forced lock-in period encourages regular saving habits, which is crucial for achieving long-term financial goals."

4. Mrin Agarwal, Financial Educator & Founder, Finsafe India:

"PPF is a powerful tool for women and young adults. It empowers them to take control of their finances, create a safety net, and plan for their future with confidence."

5. Adhil Shetty, CEO, BankBazaar:

"The biggest mistake people make with PPF is not utilizing its full potential. Contribute the maximum amount allowed each year to maximize tax benefits and build a substantial corpus over time."

PPF vs. Other Investment Options: A Head-to-Head Comparison

| Feature | Public Provident Fund (PPF) | Fixed Deposits (FDs) | National Savings Certificates (NSCs) | Equity Linked Savings Scheme (ELSS) |

|---|---|---|---|---|

| Returns | Moderate (Govt. set) | Moderate (Fixed) | Moderate (Fixed) | High Potential (Market-linked) |

| Risk | Very Low (Govt. backed) | Low | Low | Moderate to High |

| Liquidity | Low (Partial withdrawal/loan allowed after certain years) | Moderate (Premature withdrawal with penalty) | Low (Premature encashment allowed with penalty) | Low (3-year lock-in) |

| Tax Benefits | EEE (Exempt-Exempt-Exempt) | EET (80C deduction, interest taxable) | EEE (Exempt-Exempt-Exempt) | EET (80C deduction, LTCG tax*) |

| Ideal for | Risk-averse investors seeking stable, long-term growth with tax benefits | Conservative investors seeking guaranteed returns | Investors seeking fixed income with tax benefits | Investors with higher risk appetite seeking potential for high growth and tax benefits |

-

Returns: PPF offers moderate returns, determined by the government quarterly. FDs and NSCs also offer moderate but fixed returns, while ELSS has the potential for high returns due to its equity exposure.

-

Risk: PPF is considered the safest option as it's backed by the government. FDs and NSCs are also relatively low-risk, while ELSS carries higher risk due to market fluctuations.

-

Liquidity: PPF has low liquidity due to its lock-in period and restrictions on withdrawals. FDs offer moderate liquidity but with penalties for premature withdrawals. NSCs have similar liquidity restrictions. ELSS has a 3-year lock-in period, making it illiquid during that time.

-

Tax Benefits: PPF, NSCs, and ELSS offer tax deductions under Section 80C of up to ₹1.5 lakhs. PPF and NSCs are entirely tax-free (EEE), while ELSS is subject to long-term capital gains tax (LTCG) if the gains exceed ₹1 lakh in a financial year. FD interest is taxable as per your income tax slab.

-

-

Ideal for: PPF is ideal for risk-averse investors seeking long-term growth with tax benefits. FDs are suitable for those who prioritize guaranteed returns. NSCs are similar to PPF but with a fixed tenure. ELSS is suitable for investors with higher risk tolerance and a long-term investment horizon.

-

How to Open a PPF Account?

-

Gather Documents: You'll need your KYC documents like Aadhaar card, PAN card, address proof, and passport-sized photographs.

-

Choose a Bank or Post Office: Select a financial institution that offers PPF accounts.

-

Fill the Application Form: Complete the PPF account opening form accurately.

-

Submit Documents: Submit the form along with the required documents.

-

Make the Initial Deposit: Make the initial deposit of at least ₹500 to activate your account.

Strategies to Maximize Your PPF Returns

-

Invest Early: The earlier you start investing in PPF, the longer your money will have to compound, leading to higher returns.

-

Invest Before the 5th of the Month: To earn maximum interest, deposit your contributions before the 5th of every month.

-

Max Out Contributions: Try to contribute the maximum permissible amount of ₹1.5 lakhs annually to reap the full tax benefits and maximize your savings.

-

Extend Your Account: After the initial 15 years, extend your PPF account in blocks of five years to continue enjoying its benefits.

Conclusion

The Public Provident Fund (PPF) stands as a pillar of financial security for Indian investors. With its unbeatable combination of safety, attractive returns, and tax efficiency, it's a compelling option for individuals looking to create long-term wealth and secure their financial future. Whether you're a seasoned investor or a beginner, PPF should be an integral part of your investment portfolio.

Dispelling Myths and Answering Your PPF Questions

Common Misconceptions:

1. Myth: Only salaried individuals can open a PPF account.

Fact: Any Indian resident, regardless of their employment status, can open a PPF account. This includes self-employed individuals, homemakers, and even students.

2. Myth: The interest rate on PPF is fixed for the entire 15-year tenure.

Fact: The PPF interest rate is revised quarterly by the government and can fluctuate based on prevailing economic conditions.

3. Myth: I can withdraw my entire PPF balance anytime after the 15-year lock-in period.

Fact: While you can close your PPF account after maturity, you can't withdraw the entire balance at once unless you don't extend the account. You can continue investing for further blocks of 5 years and make partial withdrawals.

4. Myth: PPF is only for senior citizens.

Fact: PPF is a versatile savings scheme suitable for individuals of all ages, from young adults starting their careers to those nearing retirement.

5. Myth: PPF is riskier than fixed deposits (FDs).

Fact: PPF is one of the safest investment options available, as it is backed by the government. FDs, while safe, are not entirely risk-free as they are dependent on the financial stability of the bank.

Frequently Asked Questions (FAQs):

1. Can I have multiple PPF accounts?

No, you can hold only one PPF account under your name.

2. Can I open a joint PPF account?

No, PPF accounts can only be opened in the name of a single individual.

3. How do I close my PPF account before maturity?

You can only close your PPF account prematurely under specific circumstances, such as the account holder's critical illness or higher education abroad.

4. What happens if I miss a contribution in a year?

You can revive your account by paying a penalty of ₹50 for each missed year along with the minimum annual contribution for those years.

5. Can I transfer my PPF account from one bank to another?

Yes, you can easily transfer your PPF account from one bank or post office to another.

6. Is the interest earned on PPF taxable?

No, both the interest earned and the maturity proceeds of PPF are completely tax-free.

7. Can I nominate someone for my PPF account?

Yes, you can nominate one or more individuals to receive the PPF balance in the event of your untimely demise.

8. Can I use my PPF balance as collateral for a loan?

Yes, you can avail of a loan against your PPF balance between the third and sixth year of account opening.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author and publisher do not guarantee the accuracy or completeness of the information and are not responsible for any actions taken based on the information presented.

What's Your Reaction?