How to File Schedule BFLA in ITR: Step-by-Step Filing Guide with Examples

Master Schedule BFLA in your Indian Income Tax Return (ITR) to unlock significant tax savings. Learn how to carry forward past business, capital, or speculative losses, and correctly file Schedule BFLA for maximum benefits.

Filing your Income Tax Return (ITR) can be a daunting task, especially when it comes to complex schedules like BFLA. In this comprehensive guide, we'll break down the intricacies of Schedule BFLA, explain why it's crucial, and walk you through the steps of filing it correctly.

What is Schedule BFLA?

Schedule BFLA, which stands for "Brought Forward Loss Adjustment," is a crucial part of the ITR for individuals and businesses who have incurred losses in previous financial years. These losses, if eligible, can be carried forward and set off against future income to reduce your tax liability. Schedule BFLA serves as a record of these brought forward losses and how they are adjusted against your current year's income.

Schedule BFLA serves two primary purposes:

-

Documentation: It meticulously records the details of your brought forward losses. This includes the types of losses (e.g., business loss, capital loss), the financial years they were incurred, and the amount of each loss that remains unabsorbed.

-

Adjustment: It facilitates the systematic set-off of these brought forward losses against your current income. The schedule guides you through the process of adjusting these losses against specific income heads, following the rules and order prescribed by the Income Tax Act.

Why is Schedule BFLA Important?

Schedule BFLA plays a pivotal role in your financial landscape, impacting your taxes and broader financial strategies in several ways:

1. Tax Optimization - Your Ticket to Lower Taxes:

- Leverage Past Losses: Schedule BFLA allows you to turn past financial setbacks into present-day tax advantages. By systematically offsetting your brought forward losses against your current income, you can substantially reduce your taxable income.

- Significant Tax Savings: This reduction in taxable income directly translates to lower tax liability, potentially saving you a substantial amount of money.

- Financial Relief: For businesses and individuals recovering from losses, this tax relief can be a lifeline, aiding in financial recovery and future growth.

2. Accurate Reporting - Your Shield Against Tax Troubles:

- Compliance with Tax Laws: Schedule BFLA ensures that you adhere to the Income Tax Act's provisions regarding the carry forward and utilization of losses. Accurate reporting avoids any potential legal complications or penalties.

- Transparency and Credibility: Properly filled Schedule BFLA enhances the credibility of your tax return, demonstrating your commitment to transparent financial reporting.

- Smooth Tax Processing: It streamlines the tax assessment process, preventing delays or inquiries due to discrepancies in your reported losses.

3. Financial Planning - Your Compass for Informed Decisions:

- Strategic Tax Management: Understanding how brought forward losses interact with your current and future income helps you make informed financial choices. You can strategize investments, expenses, and business decisions to optimize your tax position.

- Long-Term Financial Health: By effectively utilizing your brought forward losses, you not only reduce your immediate tax burden but also contribute to your long-term financial stability and growth.

- Financial Resilience: Schedule BFLA empowers you to navigate financial challenges more effectively, utilizing past losses as a tool for recovery and resilience.

Schedule BFLA: When and Why You Need to File

Filing Schedule BFLA isn't a requirement for every taxpayer. It specifically applies to individuals or businesses who meet certain criteria related to past financial losses:

Eligibility Criteria:

You are required to file Schedule BFLA if you fulfill BOTH of the following conditions:

1. Unabsorbed Losses:

- You have incurred losses in previous financial years that were not entirely offset against your income in those years. These leftover losses are known as unabsorbed losses.

- For instance, if you had a business loss of ₹1 lakh last year and your income was only ₹50,000, you could only offset ₹50,000. The remaining ₹50,000 is an unabsorbed loss.

2. Eligible Losses:

- The losses you incurred must fall under the categories specified by the Income Tax Act as eligible for carry forward. These eligible losses generally include:

- Business Loss: Loss incurred from a business or profession.

- Capital Loss: Loss resulting from the sale of capital assets like stocks, real estate, or mutual funds.

- Loss from Speculative Business: Loss arising from speculative transactions like trading in derivatives or intraday trading.

Who Doesn't Need to File Schedule BFLA?

If you do not have any unabsorbed losses from previous years or the losses you incurred are not classified as eligible losses, you are not required to file Schedule BFLA.

Types of Losses Eligible for Carry Forward

Schedule BFLA allows you to carry forward specific types of losses to offset against future income. Understanding these loss categories is crucial for accurate reporting and maximizing your tax benefits:

1. Business Loss:

- What it is: This is a loss incurred in the ordinary course of your business or profession. It can include losses due to lower sales, higher expenses, bad debts, or any other factor affecting your business profitability.

- Examples:

- A manufacturing company facing a decline in demand for its products.

- A consultant experiencing a decrease in client projects.

- A retailer dealing with inventory losses due to theft or damage.

- How it's carried forward: Business losses can be carried forward for up to 8 assessment years and can only be set off against future business income.

2. Capital Loss:

- What it is: This loss occurs when you sell a capital asset (e.g., stocks, real estate, mutual funds) for less than its purchase price.

- Types:

- Short-term Capital Loss (STCL): Arises from the sale of assets held for 36 months or less (12 months for listed securities and equity-oriented mutual funds).

- Long-term Capital Loss (LTCL): Arises from the sale of assets held for more than 36 months (12 months for listed securities and equity-oriented mutual funds).

- How it's carried forward: Both STCL and LTCL can be carried forward for up to 8 assessment years. However, LTCL can only be set off against future long-term capital gains, while STCL can be set off against both long-term and short-term capital gains.

3. Loss from Speculative Business:

- What it is: This loss is incurred from speculative transactions, which are considered riskier than regular business activities. Speculative transactions include intraday trading, trading in derivatives (futures and options), and certain commodity trading.

- Examples:

- Losses from day trading in the stock market.

- Losses from trading in futures contracts on commodities.

- Losses from options trading.

- How it's carried forward: Losses from speculative business can be carried forward for up to 4 assessment years and can only be set off against future profits from speculative business.

Time Limit for Carry Forward of Losses

While the ability to carry forward losses is a valuable tax-saving tool, it's important to understand that there are time limits for utilizing these losses. Here's a breakdown of the time limits for different types of losses:

1. Business Loss and Capital Loss:

- Time Limit: Both business losses and capital losses (both short-term and long-term) can be carried forward for a maximum of 8 assessment years following the year in which the loss was incurred.

- Example: If you incurred a business loss in the financial year (FY) 2023-24, you have until the assessment year (AY) 2032-33 to utilize that loss.

2. Loss from Speculative Business:

- Time Limit: Losses arising from speculative businesses have a shorter carry forward period of 4 assessment years following the year of the loss.

- Example: If you incurred a loss from speculative business in FY 2023-24, you have until AY 2028-29 to offset that loss against future speculative income.

Why Time Limits Matter:

- Tax Planning: Understanding these time limits is crucial for effective tax planning. It allows you to strategize when and how you utilize your brought forward losses to maximize your tax savings.

- Avoid Losing Benefits: Failing to utilize the losses within the stipulated time frame means you permanently lose the opportunity to offset them against future income.

Additional Considerations:

- Filing Deadline: To carry forward losses, you must file your Income Tax Return (ITR) on or before the due date. Filing a belated return may disqualify you from carrying forward certain losses.

- Set-off Order: Remember that losses have a specific order of adjustment, with business losses generally being offset first, followed by capital losses, and then losses from speculative business.

How to Fill Schedule BFLA: A Step-by-Step Guide

While Schedule BFLA might seem daunting, it becomes manageable with a systematic approach. Here's a detailed guide to help you navigate the process:

1. Gather Information:

- Previous ITRs: Retrieve your Income Tax Returns from previous years to identify the types and amounts of unabsorbed losses you're carrying forward.

- Form 16/16A/Other Income Proofs: Collect documents like Form 16/16A (for salaried individuals), bank statements, interest certificates, and any other relevant proofs to determine your income for the current financial year.

- Computation of Income: Calculate your income under various heads (e.g., Salary, House Property, Business/Profession, Capital Gains, Other Sources) based on the documents you've gathered.

2. Access Schedule BFLA:

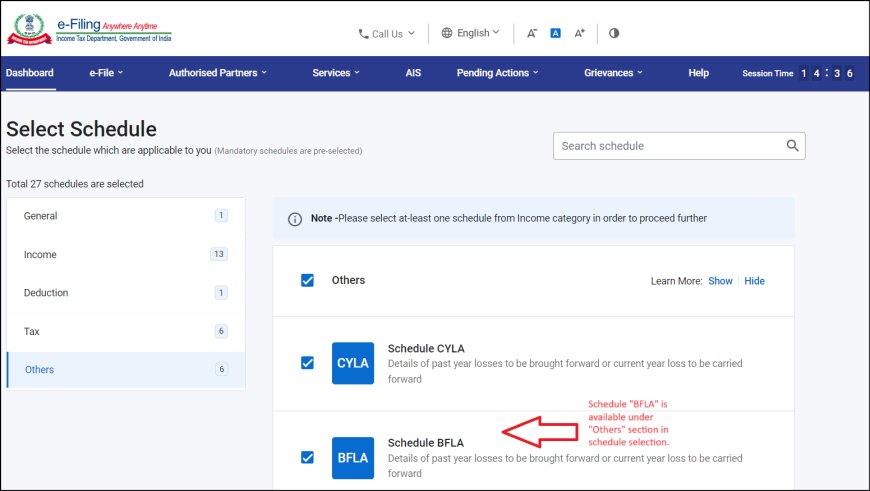

- Online ITR Filing: If you're filing your ITR online through the Income Tax e-filing portal or any other authorized platform, you'll find Schedule BFLA in the "others" section during schedule selection within the ITR form.

- Offline ITR Filing: If you're filing offline, download the applicable ITR form and locate the Schedule BFLA section.

3. Fill in the Details:

- Current Year's Income: Start by entering your current year's income under the respective income heads in the designated columns.

- Brought Forward Losses: Below each income head, you'll find columns for entering the details of your brought forward losses. Enter the amount of unabsorbed loss from each category (business, capital, speculative business) in the corresponding column.

- Loss Set-off: Based on the Income Tax Act's order of adjustment, set off your brought forward losses against the current year's income under the appropriate heads. Ensure you utilize the entire eligible loss amount in the correct order.

- Income Remaining After Set-off: The form will automatically calculate the remaining income after adjusting the losses. This is the amount that will be further considered for tax calculation.

4. Verify and Submit:

- Double-check: Thoroughly review all the information you've entered in Schedule BFLA. Ensure that the figures match those in your previous ITRs and income proofs.

- Calculations: Verify that the total of brought forward losses and adjusted losses aligns with your own calculations.

- Save/Submit: Save your progress if filing online or attach Schedule BFLA with your offline ITR form. Submit your return as per the usual process.

Important Points to Remember When Filing Schedule BFLA

While Schedule BFLA is a powerful tool for tax optimization, certain crucial points need careful consideration to ensure accurate filing and maximize its benefits:

1. Order of Adjustment:

- Follow the Law: The Income Tax Act lays down a specific order in which losses must be set off against income. Generally, the sequence is:

- Business loss

- Specified business loss (if any)

- Loss from owning and maintaining race horses (if any)

- Short-term capital loss

- Long-term capital loss

- Intra-Head and Inter-Head Set-Off: First, losses are set off within the same head of income (intra-head). If any losses remain unadjusted, they can then be set off against income under other heads (inter-head).

- Seek Guidance: If you're unsure about the correct order or have complex scenarios, consult a tax professional to avoid errors.

2. Unutilized Losses:

- Carry Forward: Any losses that cannot be fully adjusted against the current year's income can be carried forward to subsequent years within the permissible time limit.

- Maintain Records: Keep meticulous records of your unutilized losses, as you'll need these details when filing your ITRs in future years.

- Strategic Planning: Consider your future income projections and plan your tax strategies accordingly to maximize the utilization of these carried forward losses.

Schedule BFLA in Action: A Practical Illustration

Let's delve deeper into how Schedule BFLA works with a practical example:

Scenario:

Imagine you're a freelance consultant who faced a tough financial year. In the financial year (FY) 2022-23, your business incurred a loss of ₹50,000. However, in FY 2023-24, your business has picked up, and your total income from consultancy services amounts to ₹80,000. This is how you would utilize Schedule BFLA in your ITR for AY 2024-25:

Schedule BFLA (Simplified Illustration):

| Description | Amount (₹) |

|---|---|

| Business Income (Current Year) | 80,000 |

| Brought Forward Business Loss (BFBL) | 50,000 |

| Loss Set-off Against Business Income | 50,000 |

| Income Remaining After Set-off | 30,000 |

Explanation:

-

Business Income: You enter the full amount of your business income earned in the current financial year, which is ₹80,000.

-

Brought Forward Business Loss: You enter the unabsorbed business loss of ₹50,000 from the previous year.

-

Loss Set-off: Schedule BFLA automatically calculates the maximum amount of BFBL that can be adjusted against your current business income. In this case, the entire ₹50,000 BFBL can be set off.

-

Income Remaining After Set-off: After adjusting the BFBL, your taxable business income for the current year is reduced to ₹30,000 (₹80,000 - ₹50,000). This significantly lowers your tax liability.

Key Points:

- Order: The set-off is done automatically in the correct order as per the Income Tax Act.

- Tax Savings: By utilizing the BFBL, you have effectively reduced your taxable income and, consequently, your tax burden.

- Further Utilization: If your business loss had been higher (e.g., ₹90,000), you could have set off ₹80,000 in the current year and carried forward the remaining ₹10,000 to the next assessment year.

Conclusion: Schedule BFLA – Your Pathway to Tax Efficiency and Financial Empowerment

Filing Schedule BFLA correctly is a fundamental step for any taxpayer carrying forward losses from previous years. While it might appear complex at first glance, understanding the key concepts and following the step-by-step process outlined in this guide will make it a manageable and rewarding task.

By mastering Schedule BFLA, you can unlock a multitude of benefits:

- Substantial Tax Savings: Effectively utilizing your brought forward losses can significantly reduce your tax liability, freeing up valuable resources for other financial goals.

- Enhanced Compliance: Accurate reporting of losses and their adjustments ensures that you adhere to tax regulations, avoiding any potential legal complications or penalties.

- Strategic Financial Planning: Knowing how to leverage your past losses through Schedule BFLA empowers you to make informed financial decisions, optimize your tax strategies, and build a more resilient financial future.

Embrace the Opportunity:

Don't let unabsorbed losses go to waste! If you meet the eligibility criteria, Schedule BFLA presents a golden opportunity to turn past setbacks into present-day gains. Take the time to understand the process, gather your documents, and utilize this powerful tool to your advantage.

Remember:

- Order of Adjustment: Follow the prescribed order for setting off losses.

- Time Limits: Utilize your brought forward losses within the specified time frame.

- Professional Guidance: Seek expert help if you encounter complexities or need personalized advice.

Your Financial Future Starts Now:

With the knowledge and tools you've gained from this guide, you're well-equipped to navigate the intricacies of Schedule BFLA. Take charge of your tax planning, optimize your financial outcomes, and unlock a brighter financial future. Remember, every loss is an opportunity for growth, and Schedule BFLA is your key to unlocking that potential.

Disclaimer:

The information provided in this article about Schedule BFLA is intended for general informational purposes only and should not be considered as professional financial or tax advice. Tax laws and regulations are subject to change, and individual circumstances may vary.

It's highly recommended that you consult with a qualified tax professional or chartered accountant (CA) for personalized advice regarding your specific tax situation and the filing of Schedule BFLA in your ITR. The author and publisher of this article are not liable for any errors, omissions, or any actions taken based on the information provided herein.

What's Your Reaction?