Confused About Schedule CYLA? Tax Loss Filing Made Easy

Learn how to file Schedule CYLA in your Indian Income Tax Return (ITR) to carry forward and set off current year's losses. This comprehensive guide covers eligibility, step-by-step instructions, common mistakes to avoid, and expert tips for maximizing tax benefits. Demystify Schedule CYLA and optimize your tax planning today!

Filing income tax returns (ITR) in India can be a complex process, especially with numerous schedules and forms to consider. One such schedule is Schedule CYLA – the Statement of Income After Set Off of Current Year's Losses. This schedule is crucial for taxpayers who have incurred losses in the current financial year, as it allows them to carry forward these losses to offset future income.

In this comprehensive guide, we will delve into the intricacies of Schedule CYLA, its purpose, applicability, and step-by-step instructions on how to file it correctly.

Understanding Schedule CYLA

Schedule CYLA, or the Statement of Income After Set Off of Current Year's Losses, is a crucial component of the Indian Income Tax Return (ITR). Its primary purpose is to address situations where a taxpayer incurs losses during a financial year. These losses could arise from various income streams, including:

- Income from House Property: This refers to losses incurred on rental properties or from interest paid on home loans. For instance, if your rental income is less than your expenses (maintenance, property tax, etc.), you incur a loss.

- Capital Gains: Losses can arise when you sell a capital asset like stocks, real estate, or mutual funds for less than what you originally paid for it.

- Business or Profession: Businesses and professionals can face losses due to various factors like economic downturns, market conditions, or unexpected expenses.

- Other Sources: Losses can also stem from other sources such as speculative activities or gambling.

How Schedule CYLA Works

-

Loss Calculation: The first step involves determining the total amount of losses incurred under each of the above-mentioned heads of income. These losses are then reported in the respective schedules of your ITR (e.g., Schedule HP for house property losses, Schedule CG for capital gains losses).

-

Adjustment of Losses: Schedule CYLA comes into play by allowing you to adjust these current year losses against your income from other sources. This adjustment is done in a specific order, prioritizing the same head of income first. For example, losses from house property would be adjusted against income from house property before being set off against other sources like salary or business income.

-

Calculation of Adjusted Total Income: After setting off the losses, the remaining income is considered your adjusted total income. This adjusted income is a critical figure because it forms the basis for further tax calculations in the ITR.

-

Carry Forward of Unabsorbed Losses: If your losses exceed your current year's income under a particular head, the unabsorbed portion can be carried forward to future years. You can then offset these carried-forward losses against income earned in subsequent years, up to a maximum of eight assessment years.

Key Advantages of Schedule CYLA

- Tax Optimization: By allowing you to carry forward losses, Schedule CYLA helps you reduce your overall tax liability over multiple years.

- Fairness: It acknowledges that losses are a part of economic activity and provides a mechanism for taxpayers to recover these losses over time.

- Financial Planning: Understanding your losses and how they can be set off against future income is crucial for sound financial planning and decision-making.

Who is Required to File Schedule CYLA in Their ITR?

Schedule CYLA is mandatory for taxpayers who have incurred losses under specific categories during the financial year. These categories include:

-

Income from House Property:

- Rental Income Loss: If your expenses (maintenance, repairs, interest on home loan, etc.) exceed the rental income you received from a property.

- Interest on Home Loan Loss: If you have paid interest on a home loan for a property that's not self-occupied or let out (e.g., under construction, vacant).

-

Capital Gains:

- Short-Term Capital Loss (STCL): Loss incurred on the sale of capital assets held for 36 months or less (12 months or less for certain assets).

- Long-Term Capital Loss (LTCL): Loss incurred on the sale of capital assets held for more than 36 months (more than 12 months for certain assets).

-

Business or Profession:

- Business Loss: If your business expenses exceed your business income.

- Professional Loss: If your professional expenses exceed your professional income.

-

Other Sources:

- Speculative Loss: Loss incurred in speculative transactions like intraday trading.

- Loss from Gambling/Betting: Loss incurred from gambling or betting activities.

- Other Specified Losses: Losses not covered under the above categories but specified in the Income Tax Act.

Important Considerations:

- No Profit, No Schedule CYLA: If you haven't made any profit under any head of income in the financial year, you don't need to file Schedule CYLA, even if you have incurred losses.

- Carry Forward: If you can't fully set off your losses against your current year's income, the unabsorbed portion can be carried forward for up to 8 assessment years.

Who is Exempt from Filing Schedule CYLA?

- Taxpayers with No Losses: If you have not incurred losses in any of the above categories, you are not required to file Schedule CYLA.

- Taxpayers Filing ITR-1 (Sahaj): This form is meant for salaried individuals with simple income sources and does not allow reporting of losses.

Detailed Steps to File Schedule CYLA Online

1. Login to the e-filing Portal:

- Visit the official Income Tax Department's e-filing website (

https://www.incometax.gov.in/iec/foportal/ - Click on "Login Here" and enter your Permanent Account Number (PAN), password, and the captcha code displayed.

- If you haven't registered yet, create an account by clicking on "Register Yourself."

2. Select the Relevant Assessment Year:

- From the dashboard, select the "e-File" option and then click on "Income Tax Return."

- Choose the appropriate Assessment Year (AY) for which you are filing the return.

- Select the correct ITR form based on your income sources and residential status.

3. Navigate to Schedule CYLA:

- Once you are in the ITR form, scroll down to the "Schedules" section.

- Click on "CYLA" to open the Schedule CYLA form.

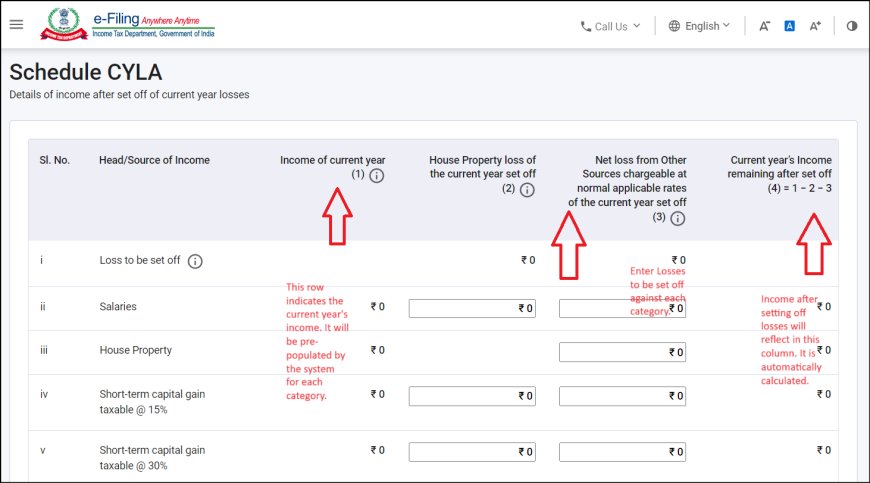

4. Fill in the Details:

- Part A - Statement of Current Year's Losses:

-

- Select the relevant heads of income under which you have incurred losses (house property, capital gains, business/profession, etc.).

- Enter the amount of loss under each head. This information is usually pre-filled from other schedules.

- Part B - Statement of Income After Set Off of Current Year's Losses:

-

- The system will automatically calculate your income under each head after setting off the losses.

- If you have any brought forward losses from previous years, enter them in the respective fields.

5. Calculate Adjusted Total Income:

- The e-filing portal will automatically calculate your adjusted total income after taking into account the current year's losses and any brought forward losses.

- This adjusted total income will be carried forward to the relevant sections of the ITR form for further tax calculation.

6. Verify and Submit:

- Double-check all the information you have entered in Schedule CYLA.

- Make sure the amounts are accurate and match the figures reported in other schedules.

- If everything is correct, click on "Save" and then "Submit" to file the schedule.

Important Points and Considerations for Schedule CYLA Filing

1. Time Limit for Carrying Forward Losses:

- The income tax laws allow you to carry forward most types of losses for up to eight assessment years immediately following the year in which the loss was incurred. For example, if you incurred a loss in FY 2023-24 (AY 2024-25), you can carry it forward and set it off against income up to FY 2031-32 (AY 2032-33).

2. Order of Set-off:

- Losses are set off in a specific order. First, they are adjusted against income under the same head in the current year. For instance, a loss from house property would be set off against any income from house property in that year.

- If there is any loss remaining after this adjustment, it can be carried forward and set off against income under any head in subsequent years. This means you have more flexibility to offset losses against different income sources in the future.

3. Carry Forward Restrictions (Specific Losses):

- Speculative Business Losses: These losses can only be set off against profits from speculative businesses. They cannot be adjusted against income from other heads.

- Specified Business Losses: These losses are incurred in businesses that have been notified by the government. Such losses can only be set off against income from specified businesses.

4. Unabsorbed Losses:

- If you cannot fully adjust your losses against your current year's income or carried forward losses from previous years, the remaining amount will be considered as unabsorbed losses.

- You can continue to carry forward these unabsorbed losses for up to eight assessment years or until they are fully set off, whichever is earlier.

Example: Filing Schedule CYLA for Loss from House Property

Assume you own a rental property and during the financial year (FY) 2023-24, you incurred a loss of ₹50,000 from this property. Your other income sources for the year include a salary of ₹8,00,000. Now, let's see how to report this loss in your ITR using Schedule CYLA.

Steps to File Schedule CYLA for House Property Loss:

-

Access Schedule CYLA:

- Log in to the e-filing portal and start filing your ITR for the relevant assessment year (AY 2024-25 in this case).

- Navigate to Schedule CYLA in your chosen ITR form.

-

Part A - Statement of Current Year's Losses:

- Under the "Head of Income" column, select "Income from House Property."

- In the "Amount of Loss" column, enter the loss amount of ₹50,000.

-

Part B - Statement of Income After Set Off of Current Year's Losses:

- Under "Head of Income," the system will automatically display "Income from House Property" and "Income from Other Sources" (assuming you only have these two income sources).

- The system will show your income from salary as ₹8,00,000 under "Income from Other Sources."

- In the "Amount of Loss Set Off" column under "Income from House Property," the system will automatically fill ₹50,000 (your loss amount).

- Since the entire loss from house property can be set off against your salary income, the "Income Remaining After Set Off" under "Income from House Property" will be zero.

- The "Income Remaining After Set Off" under "Income from Other Sources" will be ₹7,50,000 (₹8,00,000 - ₹50,000).

-

Verification and Submission:

- Review all the entered details carefully.

- Ensure the figures match the information reported in other relevant schedules (e.g., Schedule HP for house property details).

- Click "Save" and then "Submit" to file Schedule CYLA.

Important Notes:

- Carry Forward: If your loss from house property exceeded your other income, the unabsorbed portion would be carried forward to the next assessment year for adjustment against any head of income.

- Form 26AS: Cross-check the house property loss details reported in your Form 26AS (tax credit statement) with the figures you enter in Schedule CYLA. They should match.

Common Mistakes to Avoid When Filing Schedule CYLA

Being aware of these common errors can help you ensure a smooth and error-free filing process:

1. Incorrect Loss Figures:

- Double-Check Calculations: Always verify that the loss figures you enter in Schedule CYLA match the amounts reported in the respective schedules of your ITR. For example, cross-check the house property loss with the amount shown in Schedule HP.

- Include All Losses: Make sure to include all relevant losses incurred during the financial year under the applicable heads of income. Don't overlook any potential deductions or set-offs.

2. Wrong Assessment Year:

- Verify AY: Double-check that you are filing Schedule CYLA for the correct Assessment Year. The AY corresponds to the financial year in which you earned the income and incurred the losses.

- Due Dates: Remember that the deadline for filing ITR (and consequently Schedule CYLA) is typically July 31st of the assessment year.

3. Not Claiming Carry Forward Losses:

- Previous Year's Losses: If you have unabsorbed losses from previous years, make sure to include them in the "Brought Forward Losses" section of Schedule CYLA. These losses can be set off against your current year's income.

- Maximize Benefits: Not claiming carried forward losses is a missed opportunity to reduce your tax liability.

4. Ignoring Restrictions on Specific Losses:

- Speculative Losses: Remember that speculative business losses can only be set off against profits from speculative businesses. They cannot be adjusted against other income sources.

- Specified Business Losses: Similarly, losses from specified businesses can only be set off against income from specified businesses.

Conclusion: Mastering Schedule CYLA for Smart Tax Planning

Filing Schedule CYLA might seem intimidating for some taxpayers, especially those encountering losses for the first time. However, with the knowledge and guidance provided in this comprehensive guide, you can confidently navigate the process and turn your losses into potential tax savings.

Remember these key takeaways:

- Understanding is Key: Take the time to understand the purpose of Schedule CYLA and the types of losses it covers. This will help you identify whether or not you need to file it.

- Follow the Steps: Filing Schedule CYLA online is a straightforward process when you follow the step-by-step instructions and enter accurate information.

- Avoid Common Errors: Be vigilant and avoid the common mistakes mentioned earlier to ensure a smooth and error-free filing experience.

- Consult a Professional (When Needed): If you have complex losses or face any uncertainties, don't hesitate to seek assistance from a qualified tax professional. Their expertise can prove invaluable in ensuring correct and optimal tax filing.

By mastering Schedule CYLA, you unlock a powerful tool for tax optimization. Carrying forward losses can significantly reduce your tax burden in future years, giving you more control over your finances. It also ensures that you remain compliant with tax regulations, avoiding any potential penalties or legal complications.

Schedule CYLA is more than just a tax form; it's a strategic instrument for financial planning. Understanding your losses and how they can be set off against future income empowers you to make informed decisions and build a stronger financial future.

As tax laws are subject to change, it's crucial to stay updated with the latest regulations and guidelines. Consult official resources like the Income Tax Department's website or seek professional advice to ensure you are always in compliance.

With the right knowledge and approach, Schedule CYLA can become a valuable ally in your journey towards efficient tax planning and financial well-being.

Disclaimer:

The information provided in this article is for general informational and educational purposes only. It is not intended to be a substitute for professional financial or tax advice. Tax laws are subject to change, and individual circumstances may vary.

We strongly recommend that you consult with a qualified tax advisor or chartered accountant for personalized advice regarding your specific tax situation and the filing of Schedule CYLA.

The author and publisher of this article are not liable for any errors, omissions, or losses arising from the use of this information.

What's Your Reaction?