ITR-1 Filing Guide (AY 2024-25): Step-by-Step for Indian Taxpayers

Learn how to file your ITR-1 (Sahaj) for Assessment Year 2023-24 in India. This comprehensive guide covers eligibility, documents needed, deductions, common errors, and tax-saving tips, ensuring a smooth and stress-free filing experience.

Tax season is upon us, and for many Indians, the thought of filing an Income Tax Return (ITR) can be daunting. But fear not! This comprehensive guide focuses specifically on ITR-1, the simplest form designed for individuals with specific income sources. We'll walk you through the entire process, from gathering documents to e-filing your return, ensuring a smooth and stress-free experience.

Who Can File ITR-1 (Sahaj)?

ITR-1, also known as Sahaj, is the most straightforward ITR form. It's ideal for resident individuals with income from the following sources:

- Salary from employment (including allowances)

- One house property (income from rent)

- Interest income from savings accounts, fixed deposits, etc.

- Family pension

- Agricultural income up to Rs. 5,000

Who cannot file ITR-1?

The following categories of individuals are not eligible for ITR 1 return filing :

- Resident Not Ordinarily Resident (RNOR) and Non-Resident Indian (NRI) individuals

- Those with a total income exceeding ₹50 lakh

- Individuals with agricultural income surpassing ₹5,000

- Individuals with income derived from activities like lottery, racehorses, legal gambling, etc.

- Those with taxable capital gains, both short-term and long-term

- Individuals who have invested in unlisted equity shares

- Individuals with income sourced from business or profession

- Individuals serving as Directors in a company

- Individuals availing tax deduction under section 194N of the Income Tax Act

- Individuals with deferred income tax on Employee Stock Ownership Plan (ESOP) received from an eligible start-up employer

- Individuals who own and generate income from more than one house property

- Individuals who do not meet the eligibility criteria outlined for ITR-1 filing

Before You Begin: Gathering Documents

To file your ITR-1 efficiently, you'll need to have the following documents readily available:

- PAN Card: This is your unique identification number for tax purposes.

- Form 16: If you're salaried, your employer will provide this form detailing your income, deductions, and TDS (Tax Deducted at Source).

- Form 26AS: This is your Annual Information Statement (AIS) that summarizes your income from various sources like banks, post offices, mutual funds, etc. You can download it from the Income Tax Department (ITD) e-filing portal.

- Bank Account Details: Ensure you have your bank account details at hand, including account number, IFSC code, and branch name. This is crucial for receiving any tax refund.

- Investment Proofs: If you're claiming deductions under various sections like Section 80C (investments in PPF, ELSS, etc.), keep the investment proofs ready.

- Interest Certificates: These are needed for claiming deductions on interest income from various sources.

- Other Income Receipts: If you have income from other sources like rent, family pension, etc., have the relevant receipts or documents for proof.

Understanding the ITR-1 Form

The ITR-1 form consists of various sections. Here's a simplified breakdown:

- Part A: General Information: This section captures your personal details, including PAN, name, address, and contact information.

- Part B: Income Details: Here, you'll declare your income from various sources like salary, house property, interest income, etc.

- Part C: Deductions and Exemptions: This section allows you to claim deductions under various sections of the Income Tax Act, such as Section 80C for investments, Section 80D for medical insurance premiums, etc.

- Part D: Tax Payment and Verification: This section shows your total tax liability, TDS already deducted, and any tax refund due. You'll also verify your return using various methods offered by the ITD.

- Part E: Other information (Bank account details)

- Schedule IT: This section has details of advance tax and self-assessment tax payments.

- Schedule TDS: This sections has details of TDS/TCS already deducted by your employer/organizations and submitted to the income tax department.

Filing Your ITR-1 Online: A Step-by-Step Guide

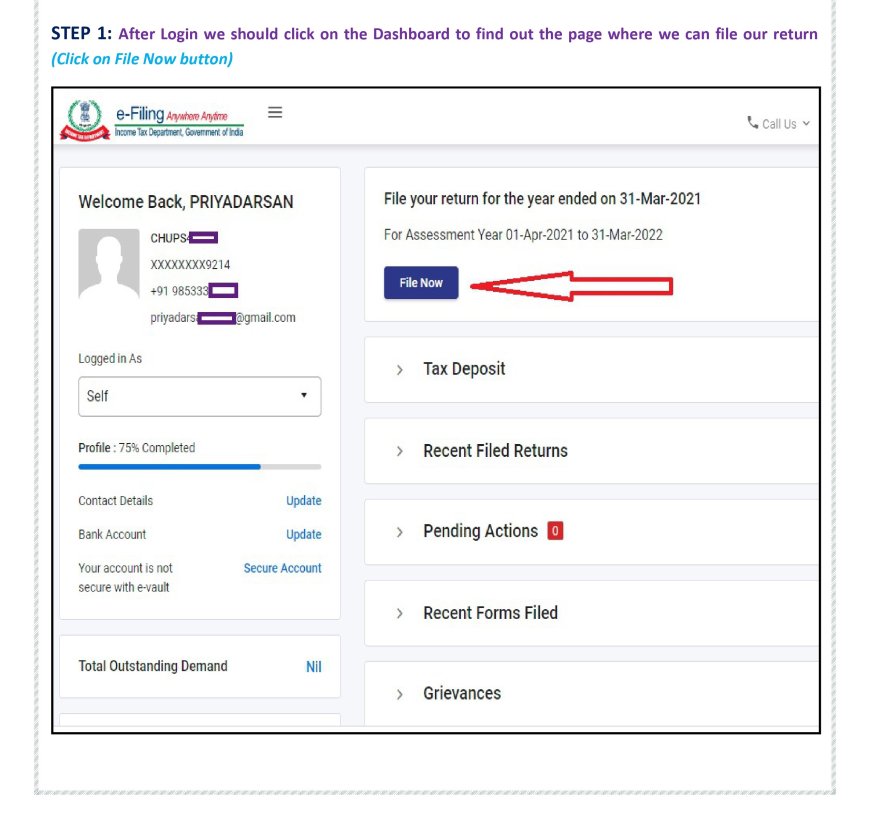

The Income Tax Department encourages e-filing ITRs for their convenience and efficiency. Here's how to file your ITR-1 online:

- Register on the Income Tax e-filing portal: Visit https://www.incometax.gov.in/iec/foportal/ and register if you haven't already. You'll need your PAN card and other basic details.

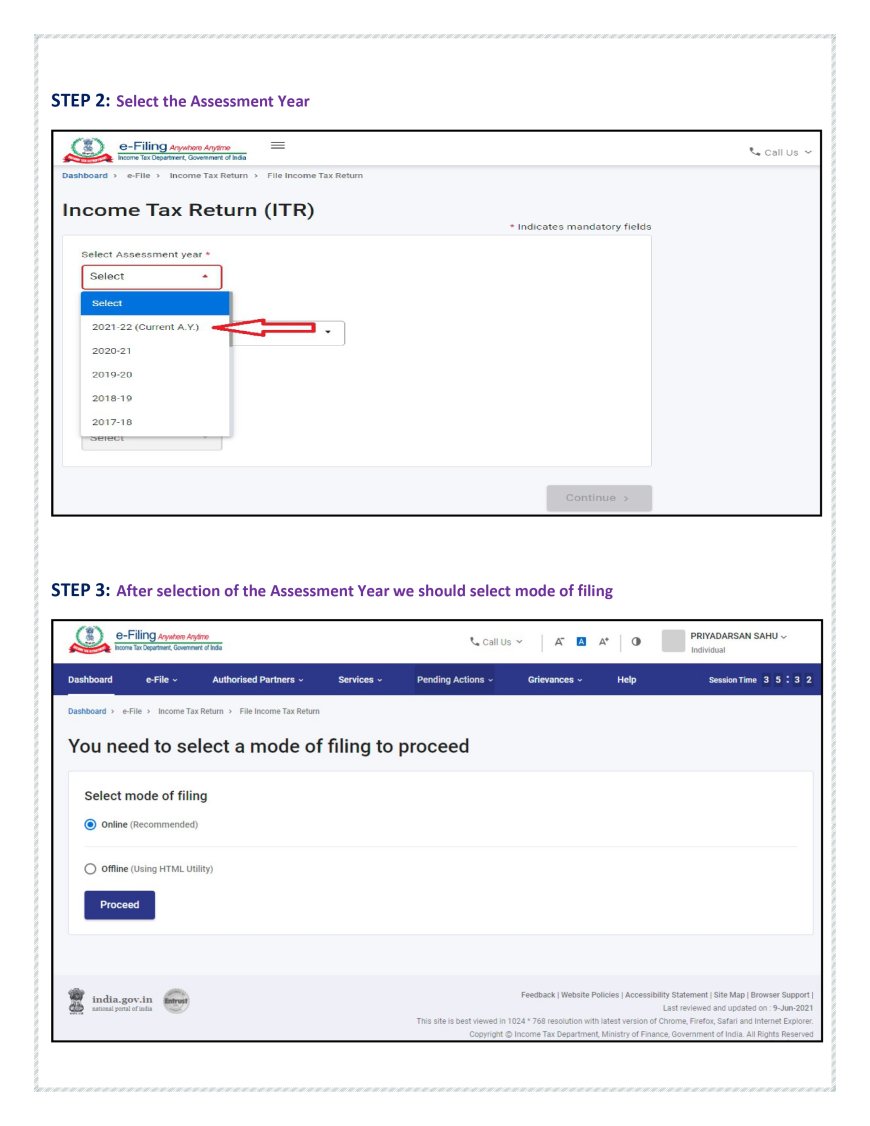

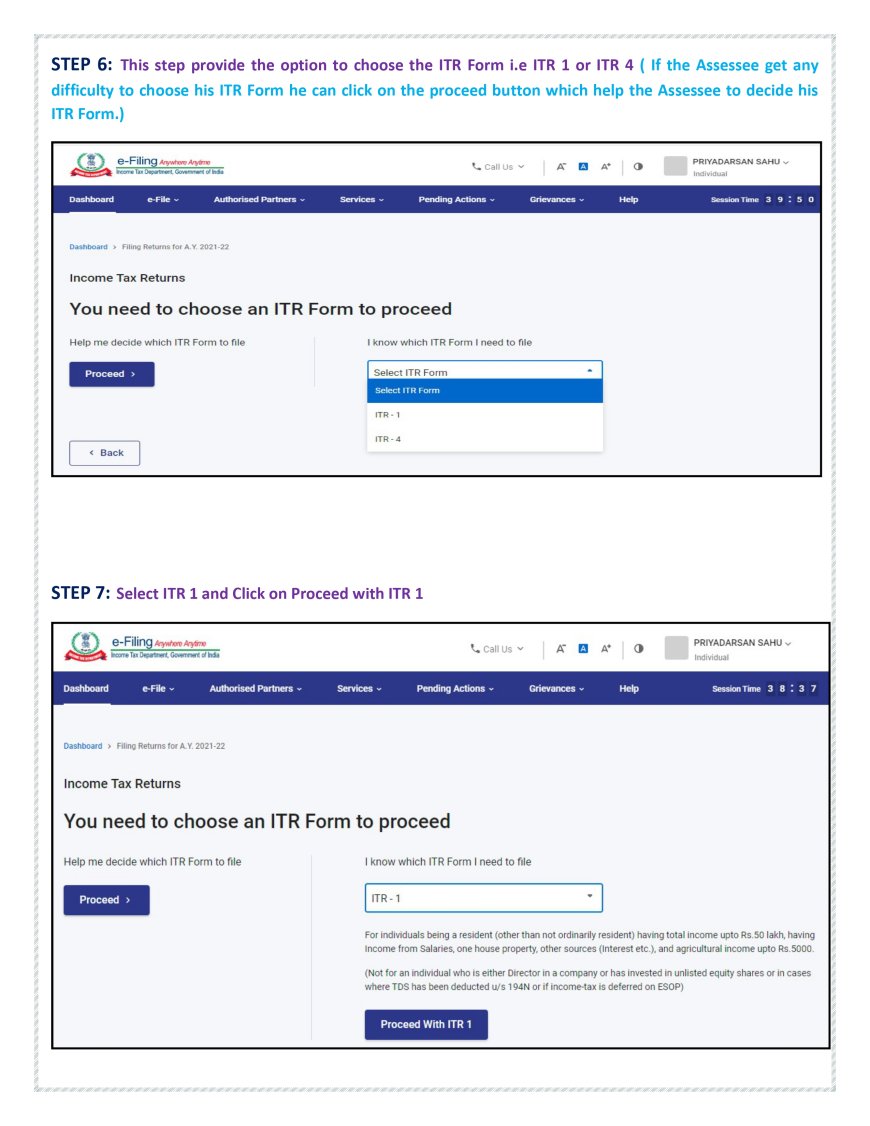

- Login and Choose ITR Form: Log in to your account and select "File Income Tax Return". Choose Assessment Year (AY) 2024-25 (for income earned in the previous financial year) and select "ITR-1" as your ITR form.

- Filing Mode: Choose "Online" as your filing mode.

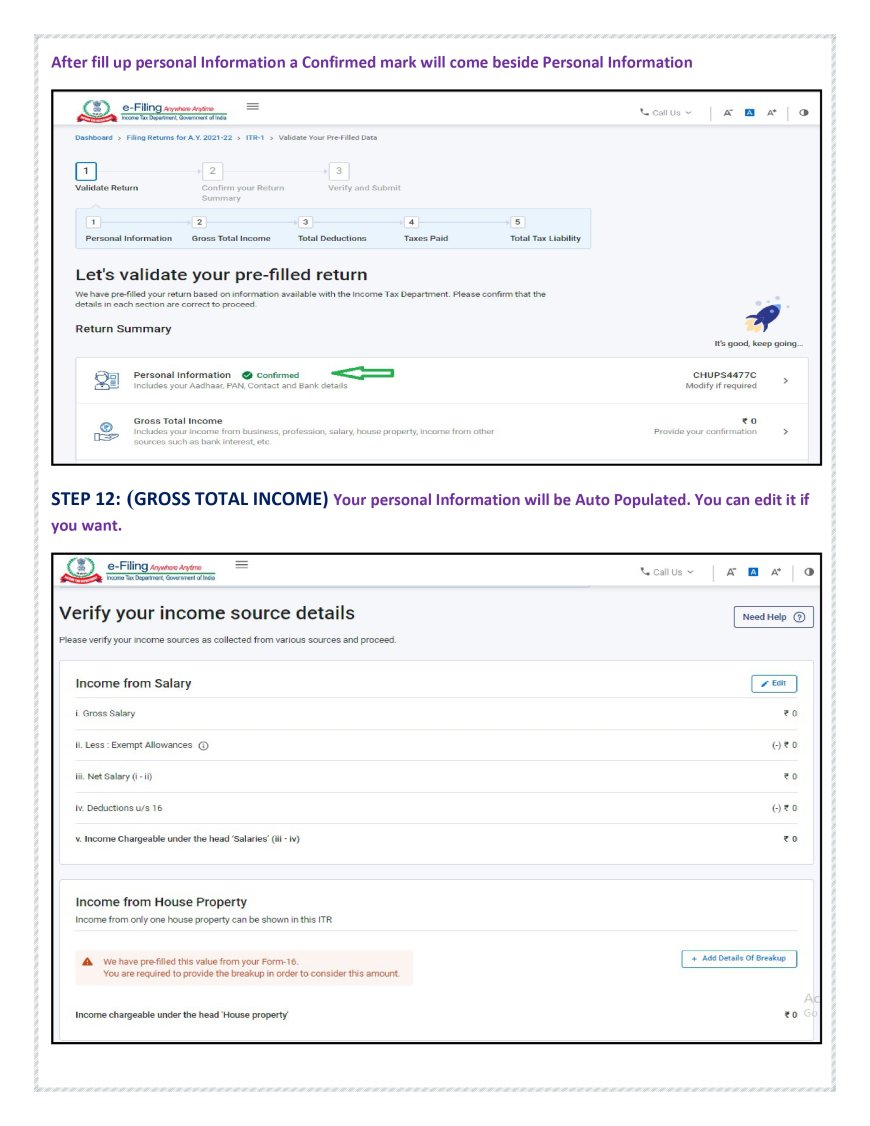

- Pre-filled Data: The ITD pre-fills your income details based on Form 16 and Form 26AS. Verify this information meticulously and edit any discrepancies.

- Part B: Income Details: Carefully review and edit income details from salary, house property (if applicable), interest income, etc.

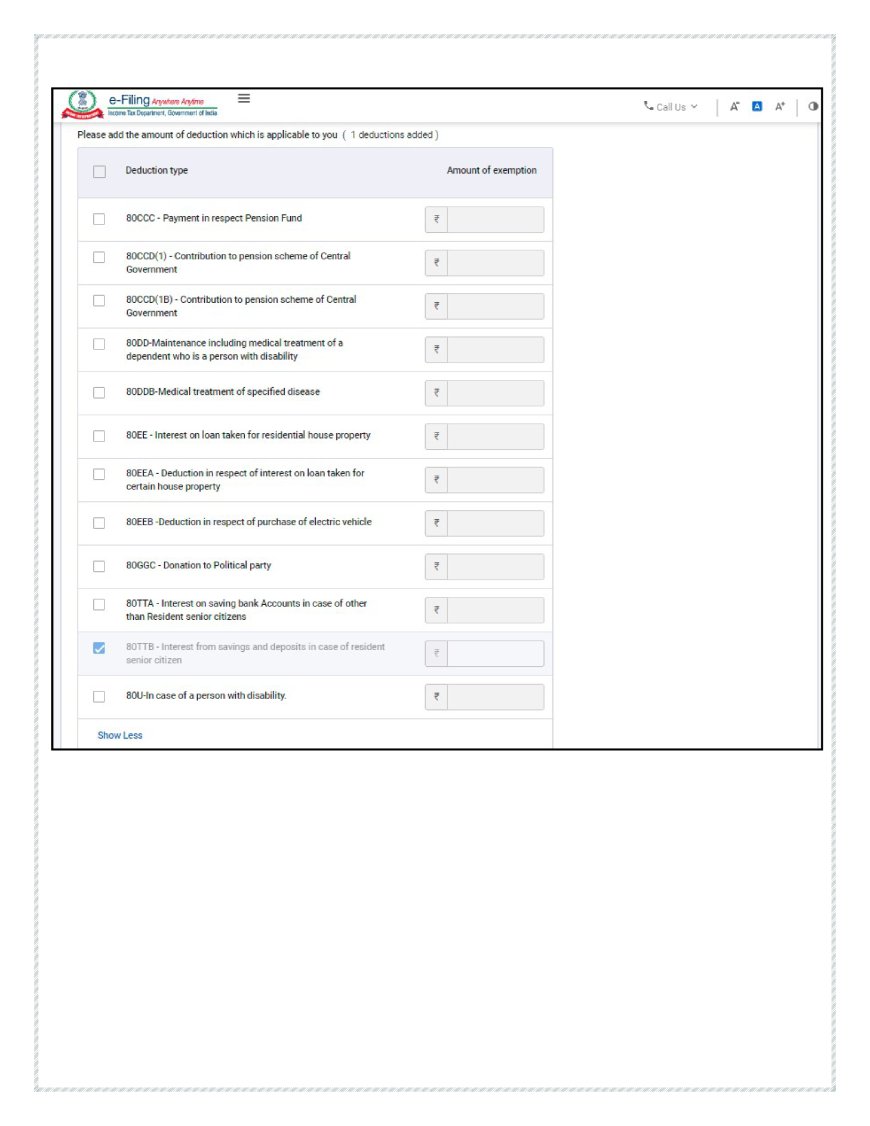

- Part C: Deductions and Exemptions: Here's where you claim deductions under various sections. Use the relevant schedules provided for specific deductions like medical insurance premiums, housing loan interest, etc. Ensure you have the necessary proofs for any deductions claimed.

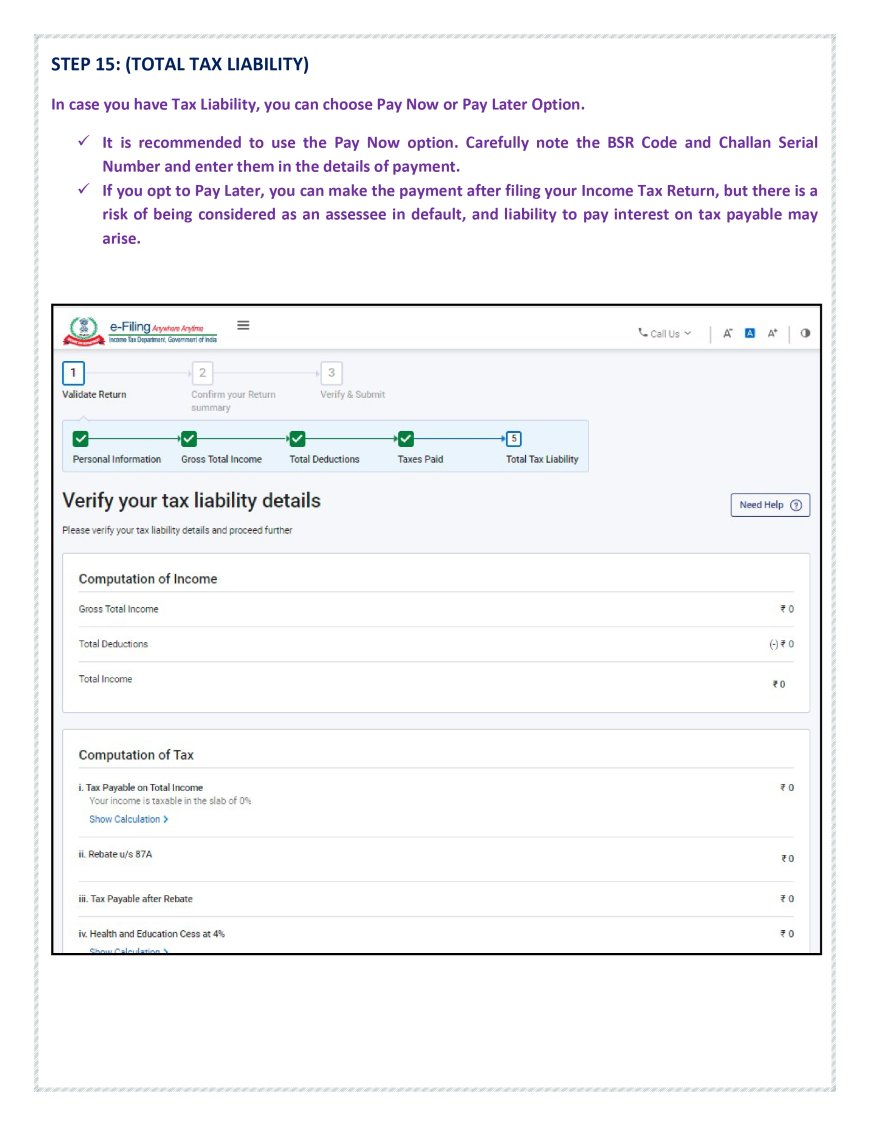

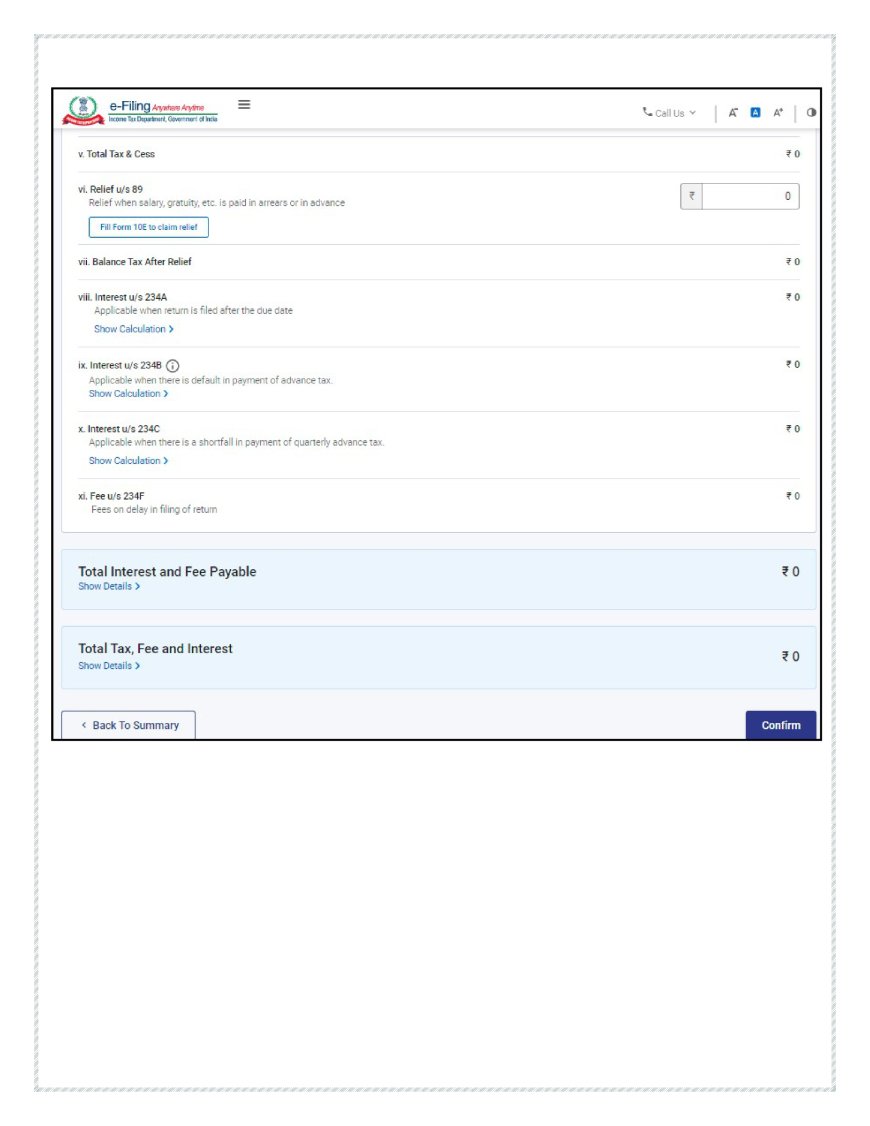

- Part D: Tax Payment and Verification: This section displays your total tax liability, tax paid through TDS, and any tax refund due.

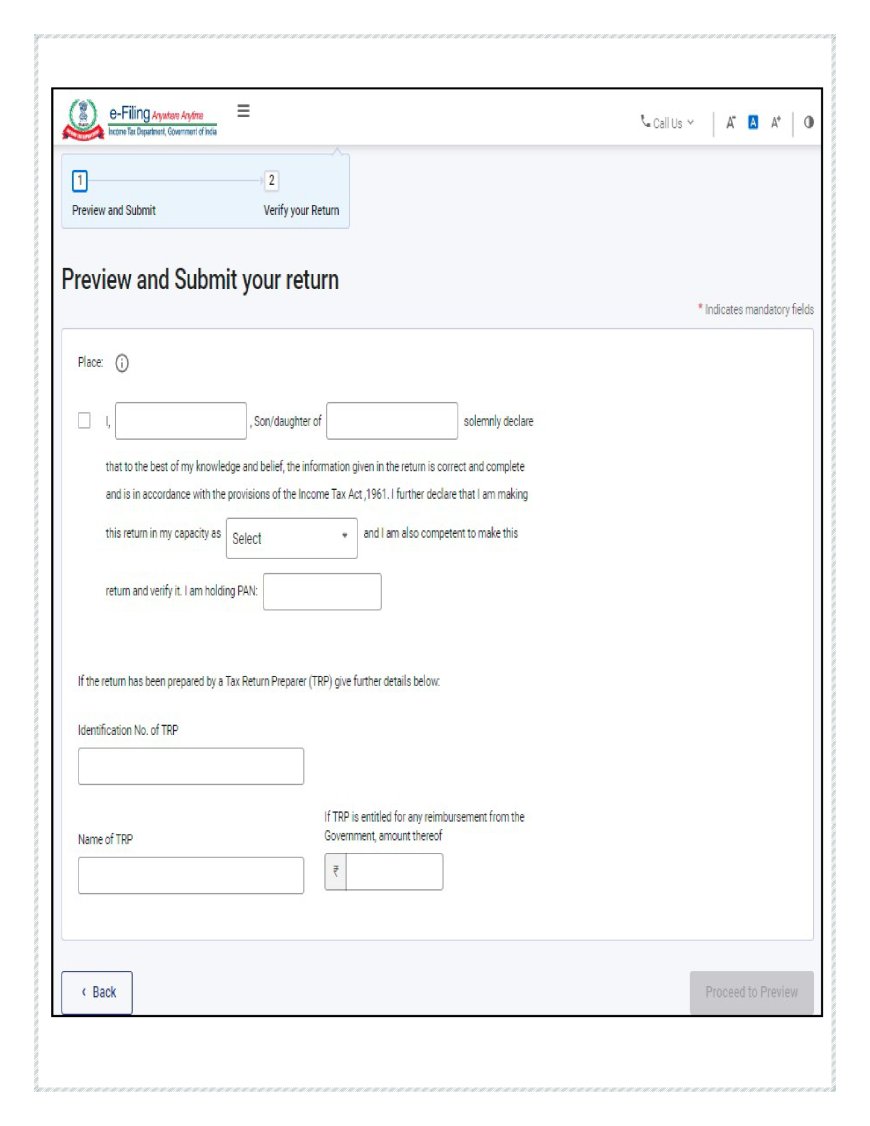

- Review and Submit: Once you've filled out all the sections, meticulously review the entire ITR for any errors.

- Verification: After reviewing, click "Proceed to Verification". You can either e-verify your return immediately or verify it later within 120 days of filing. E-verification methods include Aadhaar OTP, net banking, bank account number, Demat account number, etc.

Filing Your ITR-1 Online: Detailed Visual Guide

Detailed Breakdown of Tax Deductions Under Section 80: Maximizing Your Savings

Section 80 of the Income Tax Act, 1961, provides a wide array of deductions that can significantly reduce your taxable income and, consequently, your tax liability. Let's delve deeper into some of the most common and beneficial deductions available under this section:

1. Section 80C: Investments and Savings:

- Limit: The maximum deduction allowed under Section 80C is ₹1.5 lakhs for the financial year.

- Eligible Investments and Expenses:

- Life insurance premiums paid for self, spouse, or children

- Contributions to Employee Provident Fund (EPF)

- Public Provident Fund (PPF) investments

- National Savings Certificate (NSC) investments

- Equity Linked Savings Scheme (ELSS) investments

- Sukanya Samriddhi Yojana (SSY) investments

- National Pension System (NPS) contributions (up to ₹50,000 under 80CCD(1B))

- Tuition fees paid for children's education (up to two children)

- Repayment of principal on home loans

- Stamp duty and registration charges for a new house

- Conditions: Some investments, like ELSS, have a lock-in period, meaning you cannot withdraw the amount before a certain time frame.

2. Section 80D: Medical Insurance Premium:

- Limit:

- For individuals below 60 years: ₹25,000

- For senior citizens (60 years and above): ₹50,000

- For very senior citizens (80 years and above): ₹1 lakh

- Eligible Expenses: Health insurance premiums paid for self, spouse, children, and parents.

- Additional Deduction: An additional deduction of ₹5,000 is available for preventive health checkups.

3. Section 80E: Interest on Education Loan:

- Limit: No specific limit. The entire interest paid on the education loan is eligible for deduction.

- Eligibility:

- Loan must be taken for higher education (after passing Senior Secondary Examination or equivalent).

- Loan must be taken for yourself, spouse, children, or a student for whom you are the legal guardian.

- Conditions: Deduction can be claimed for up to 8 years or until the interest is fully repaid, whichever is earlier.

4. Section 80TTA/80TTB: Interest on Savings Account/Deposits (For Senior Citizens):

- Section 80TTA:

- Limit: ₹10,000

- Eligible Income: Interest earned on savings accounts with banks, post offices, or cooperative societies.

- Section 80TTB:

- Limit: ₹50,000

- Eligible Income: Interest earned on deposits (fixed deposits, recurring deposits, etc.) with banks, post offices, or cooperative societies.

5. Section 80G: Donations:

- Limit: Varies depending on the donation made and the organization receiving it (50%, 100%, or 100% with 10% of adjusted gross total income).

- Eligible Donations: Donations made to specific charitable organizations approved by the government.

6. Section 80DD: Medical Treatment of Disabled Dependent:

- Limit:

- ₹75,000 for dependents with 40-80% disability

- ₹1,25,000 for dependents with more than 80% disability

- Eligibility: Expenses incurred for the medical treatment (including nursing), training, and rehabilitation of a disabled dependent.

7. Section 80U: Deduction for Disabled Individuals:

- Limit:

- ₹75,000 for individuals with 40-80% disability

- ₹1,25,000 for individuals with more than 80% disability

Illustrative Case Studies: ITR-1 Filing in Real-Life Scenarios

To solidify your understanding of the ITR-1 filing process, let's explore a few case studies that demonstrate how different individuals with varying income sources can utilize this form:

Case Study 1: Salaried Individual with a Home Loan

Meet Rahul, a 35-year-old software engineer with an annual salary of ₹12 lakhs. He has an ongoing home loan for which he pays ₹2 lakhs in interest and ₹1 lakh towards principal repayment annually. He also invests ₹50,000 in ELSS mutual funds and ₹1 lakh in PPF. Let's see how his ITR-1 would look:

- Part B: Income Details:

- Salary: ₹12 lakhs

- Income from house property: Loss of ₹2 lakhs (since the property is self-occupied, the entire interest is considered a loss)

- Part C: Deductions:

- Section 80C: ₹1.5 lakhs (ELSS + PPF + home loan principal repayment)

- Section 24(b): ₹2 lakhs (interest on home loan)

- Total Taxable Income: ₹8.5 lakhs

In Rahul's case, the loss from house property reduces his taxable income significantly, resulting in lower tax liability.

Case Study 2: Individual with Rental Income

Meet Priya, a 45-year-old teacher earning ₹8 lakhs annually. She also owns a house that she rents out for ₹2 lakhs per year. She incurs expenses of ₹50,000 for maintenance and repairs. Let's analyze her ITR-1:

- Part B: Income Details:

- Salary: ₹8 lakhs

- Income from house property: ₹1.5 lakhs (Rental income - Expenses)

- Part C: Deductions:

- Standard deduction: ₹50,000 (automatically applied to salaried individuals)

- Total Taxable Income: ₹9 lakhs

Priya's rental income adds to her taxable income, but the standard deduction provides some relief.

Case Study 3: Taxpayer with Investments under Section 80C

Meet Amit, a 30-year-old marketing professional with a salary of ₹10 lakhs. He invests ₹1.5 lakhs in various eligible instruments under Section 80C, including PPF, ELSS, and life insurance premiums. Here's how his ITR-1 would look:

- Part B: Income Details:

- Salary: ₹10 lakhs

- Part C: Deductions:

- Section 80C: ₹1.5 lakhs

- Standard deduction: ₹50,000

- Total Taxable Income: ₹8 lakhs

Amit maximizes his tax savings by utilizing the full limit of Section 80C deductions, bringing his taxable income down significantly.

Recent Amendments made in the ITR-1 Form for AY 2024-25

- Individuals filing ITR 1 need to indicate their preferred tax regime in the return of income. The New Tax Regime is the default tax regime from this year, as per the amendments introduced by the Finance Act 2023 in Section 115BAC. For individuals, HUFs, AOPs, BOIs, and AJPs, the new tax regime will apply by default. However, those who prefer the old tax regime, they must explicitly choose to opt-out of Section 115BAC(6).

- For individuals with income (excluding income from a business or profession) need to specify their preferred tax regime in the income tax return filed for the relevant assessment year under Section 139(1). For individuals with income from a business or profession, the option to opt out of the new tax regime and revert to the old tax regime is available. To exercise this choice, they must submit Form No. 10-IEA on or before the due date for filing the income tax return under Section 139(1).

- An additional section, Section 80CCH, has been introduced by the Finance Act 2023. This section specifies that individuals who enroll in the Agnipath Scheme and subscribe to the Agniveer Corpus Fund on or after 01-11-2022 are entitled to a tax deduction for the entire amount deposited in the Agniveer Corpus Fund. To accommodate this change, ITR forms 1 has been updated to incorporate a new column which allows taxpayers to provide the relevant details regarding the amount eligible for deduction under Section 80CCH.

Troubleshooting Common ITR-1 Filing Issues: Your Guide to a Hassle-Free Return

While filing ITR-1 is designed to be straightforward, taxpayers often encounter some common issues. Here's how to address them and ensure a smooth filing experience:

- Mismatches in Form 26AS/AIS:

- Problem: The income details in your Form 26AS (Annual Information Statement) or AIS (Annual Information Statement) don't match the figures in your Form 16 or other income documents.

- Solution:

- Reconcile: Carefully compare your Form 16, interest certificates, and other income documents with the information in Form 26AS/AIS.

- Contact Deductors: If you identify any discrepancies, contact the relevant deductors (your employer, bank, etc.) to rectify the information.

- File Corrected TDS Return: If the error lies with the deductor, request them to file a revised TDS return with the correct information.

- Include in ITR: If the discrepancy cannot be rectified before filing, include the correct income details in your ITR and provide an explanation in the relevant schedule.

- Incorrect TDS Details:

- Problem: The TDS amount deducted by your employer or other deductors is incorrect or doesn't match the figures in Form 26AS.

- Solution:

- Contact Deductors: Reach out to the deductor and request a correction in the TDS details.

- File Corrected TDS Return: If the error is with the deductor, they need to file a revised TDS return with the correct information.

- Claim Refund: If excess TDS has been deducted, you can claim a refund while filing your ITR.

- Difficulty Claiming Deductions:

- Problem: You're unsure if you're eligible for a particular deduction or don't know how to claim it in the ITR-1 form.

- Solution:

- Refer to Instructions: Carefully read the instructions provided with the ITR-1 form and the relevant sections of the Income Tax Act.

- Consult a Tax Professional: If you're still unsure, seek guidance from a chartered accountant or tax consultant.

- Check ITD Website: The Income Tax Department website often has FAQs and guidance on claiming deductions.

- Technical Glitches on the E-filing Portal:

- Problem: You encounter technical issues like website errors, slow loading times, or difficulty saving your ITR.

- Solution:

- Clear Cache and Cookies: Try clearing your browser's cache and cookies and then try again.

- Use Different Browser: If the issue persists, try using a different web browser.

- Try Offline Utility: If the online portal is not working, you can download the offline utility from the ITD website and file your ITR offline.

- Contact Helpdesk: If you face persistent technical problems, contact the Income Tax Department's helpdesk for assistance.

- Other Issues:

- Incorrect Bank Account Details: Ensure your bank account details are accurate for a smooth refund process.

-

- Forgotten Password: If you forget your e-filing portal password, you can reset it using your registered email ID or mobile number.

Tax-Saving Tips for ITR-1 Filers: Optimize Your Returns and Minimize Your Taxes

While ITR-1 might seem like a simple form, there are still plenty of opportunities to maximize your tax savings. Here are some practical tips to help you minimize your tax liability:

- Utilize Section 80C to the Fullest:

- Invest in Tax-Saving Instruments: Explore eligible investments like ELSS mutual funds, PPF, NPS, and tax-saving fixed deposits to exhaust the ₹1.5 lakh deduction limit under Section 80C.

- Claim Deductions for Home Loan Repayment: If you have a home loan, ensure you claim deductions for both principal repayment (under Section 80C) and interest paid (under Section 24(b)).

- Tuition Fees: Don't forget to include tuition fees paid for your children's education (up to two children) while calculating your 80C deductions.

- Health is Wealth - Section 80D:

- Maximize Medical Insurance Premium Deduction: Take full advantage of the deductions available under Section 80D for medical insurance premiums paid for yourself, your spouse, children, and parents.

- Senior Citizen Parents: If your parents are senior citizens, you can claim a higher deduction for their health insurance premiums.

- Preventive Health Checkups: Remember to claim the additional deduction of ₹5,000 for preventive health checkups.

- Optimize Your Savings:

- Section 80TTA/80TTB: If you have significant savings in your bank account, consider using Section 80TTA (for everyone) or 80TTB (for senior citizens) to claim deductions on interest earned.

- Timing is Key:

- Plan Your Investments: Invest in eligible tax-saving instruments early in the financial year to maximize the benefits for the entire year.

- Home Loan Principal Repayment: If you have a home loan, try to prepay a portion of the principal before the end of the financial year to claim a higher deduction under Section 80C.

- Additional Tips:

- HRA Exemption: If you live in a rented accommodation, don't forget to claim House Rent Allowance (HRA) exemption to reduce your taxable salary.

- Standard Deduction: Salaried individuals are eligible for a standard deduction of ₹50,000. Ensure you claim this deduction while filing your ITR-1.

- Donate to Charity: If you donate to eligible charitable organizations, claim deductions under Section 80G.

Remember, tax planning is an ongoing process. It's essential to stay informed about the latest tax laws and regulations. Consult a tax professional if you have any doubts or need personalized advice to optimize your tax savings.

Conclusion

Filing your ITR-1 doesn't have to be a stressful ordeal. By understanding the eligibility criteria, gathering the necessary documents, and following the step-by-step guide outlined in this article, you can file your return with confidence and ease. Remember, accurate and timely filing is crucial for staying compliant with tax laws and avoiding any unnecessary penalties.

Important Points to Remember

- Due Date: The due date for filing ITR-1 is generally July 31st of the assessment year.

- Late Filing Fees: If you file after the due date, you might have to pay late filing fees.

- Refund Bank Account: Ensure your bank account is pre-validated on the e-filing portal to receive any tax refund quickly.

- Save Draft: Regularly save your progress as a draft while filling out the ITR-1. This prevents data loss in case of technical glitches or disruptions.

- Tax Professionals: If you're unsure about any aspect of filing ITR-1 or have complex income sources, consider seeking professional help from a chartered accountant or tax consultant.

Common Mistakes to Avoid When Filing ITR-1

- Incorrect Personal Information: Double-check your name, PAN, address, and contact details. Errors here can lead to delays in processing your return.

- Mismatching Income Details: Ensure your income details in the ITR match those mentioned in Form 16 and Form 26AS.

- Claiming Wrong Deductions: Claim only those deductions for which you have valid proof. Incorrect claims can invite scrutiny from the ITD.

- Missing Deadlines: File your ITR before the due date to avoid late filing fees and other penalties.

- Not Verifying Your Return: E-verification is essential to complete the ITR filing process. Ensure you verify your return within the stipulated time frame.

Additional Tips for a Smooth ITR-1 Filing

- Start Early: Don't wait till the last minute. Start gathering your documents and information well in advance.

- Keep Track of Deadlines: The ITD often releases important updates and deadlines on their e-filing portal and social media channels. Stay informed.

- Maintain Records: Keep a copy of your filed ITR and all supporting documents for future reference.

- Stay Updated: Tax laws and regulations can change. Stay updated with the latest information to ensure accurate filing.

FAQs on ITR-1 Filing: Your Questions Answered

Q1: Can I file ITR-1 if I have a housing loan?

A: Yes, you can file ITR-1 even if you have a housing loan, as long as you meet the other eligibility criteria. You can claim a deduction for the interest paid on your housing loan under Section 24(b) and the principal repayment under Section 80C, subject to the respective limits.

Q2: What if I forgot to report some income while filing ITR-1?

A: If you realize you've missed reporting some income after filing your ITR-1, you can file a revised return. The deadline for filing a revised return is usually before the end of the relevant assessment year or before the completion of the assessment by the tax department, whichever is earlier.

Q3: How long does it take to get a tax refund?

A: The time taken to receive your tax refund can vary. Usually, it takes anywhere between 20-45 days from the date of e-verification of your return. However, the processing time can be longer in some cases, especially during peak tax season. You can track your refund status on the Income Tax Department e-filing portal.

Q4: Can I file ITR-1 if I have income from freelance work or a business?

A: No, ITR-1 is not applicable if you have income from freelance work or business. If you have such income, you need to file ITR-3 or ITR-4, depending on your nature of business.

Q5: Is it necessary to file ITR-1 if my total income is below the taxable limit?

A: Filing ITR-1 is not mandatory if your total income falls below the taxable limit. However, it is advisable to file your return even if you don't have any tax liability as it serves as proof of income and can be helpful for various purposes like loan applications, visa processing, etc.

Q6: Can I file ITR-1 if I have income from capital gains?

A: No, ITR-1 cannot be used if you have income from capital gains (e.g., from selling shares or property). In such cases, you need to file ITR-2 or ITR-3, depending on your other income sources.

Q7: What happens if I make a mistake in my ITR-1 filing?

A: If you make a mistake in your ITR-1, you can file a revised return to correct the error. Ensure you file the revised return before the deadline to avoid any penalties.

Q8: Can I file ITR-1 if I'm a non-resident Indian (NRI)?

A: No, ITR-1 is only for resident Indians. If you're an NRI, you need to file different ITR forms based on your income sources and residency status.

Q9: Where can I get help if I face issues while filing ITR-1?

A: You can seek assistance from the Income Tax Department's helpline, consult a chartered accountant or tax professional, or refer to the help section on the e-filing portal for guidance.

Glossary of Common Tax Terms for ITR-1 Filing:

-

Assessment Year (AY): The year in which your income from the previous financial year is assessed and taxed. For example, for income earned in FY 2023-24, the assessment year would be AY 2023-24.

-

Tax Deducted at Source (TDS): A system where a certain percentage of income is deducted as tax at the time of payment. Examples include TDS on salary, interest income, or rent.

-

Deductions: Amounts allowed by the Income Tax Act that can be subtracted from your total income, reducing your taxable income. These deductions are often related to specific investments, expenses, or donations.

-

Exemptions: Certain types of income that are not subject to tax, such as agricultural income up to ₹5,000 for ITR-1 filers.

-

Gross Total Income (GTI): The total income you earn from all sources before any deductions or exemptions are applied.

-

Net Taxable Income: The income on which you are liable to pay tax after all deductions and exemptions have been considered.

-

Financial Year (FY): The 12-month period from April 1st to March 31st. For example, FY 2023-24 refers to the period from April 1, 2023, to March 31, 2024.

-

Form 16: A certificate issued by your employer that shows details of your salary, TDS deducted, and other relevant information for ITR filing.

-

Form 26AS/AIS: Your Annual Information Statement, a consolidated statement showing details of taxes deducted on your behalf (TDS), taxes paid by you, and other tax-related information.

-

Section 80C: A section of the Income Tax Act that allows deductions for various investments and expenses, up to a maximum of ₹1.5 lakhs.

-

Section 80D: A section of the Income Tax Act that provides deductions for medical insurance premiums paid for self, spouse, children, and parents.

-

E-filing: The process of filing your Income Tax Return electronically through the Income Tax Department's online portal.

-

-

Refund: An amount paid back to you by the Income Tax Department if the taxes paid by you (through TDS or advance tax) exceed your actual tax liability.

-

Disclaimer: The information provided in this article is intended for general informational purposes only and should not be considered as professional tax or financial advice. Tax laws and regulations are subject to change, and individual circumstances may vary. We strongly recommend consulting with a qualified tax advisor or chartered accountant for personalized guidance on your specific tax situation. The author and publisher of this article are not liable for any errors, omissions, or losses arising from the use of this information.

What's Your Reaction?