Economic Cycles: Understanding Recessions, Booms, and How the Economy Impacts Personal Finances

This comprehensive article explores economic cycles, explaining recessions, booms, and their impact on personal finances. Understand the ebb and flow of economic cycles and how they influence your income, investments, savings, and debt. It offers practical strategies to navigate these cycles and achieve financial security.

The Indian economy, like all others, is not a static entity. It's a dynamic system characterized by periods of growth and decline, often referred to as economic cycles. Understanding these cycles, recognizing their various phases, and how they impact personal finances is crucial for everyone, regardless of their income level or financial goals.

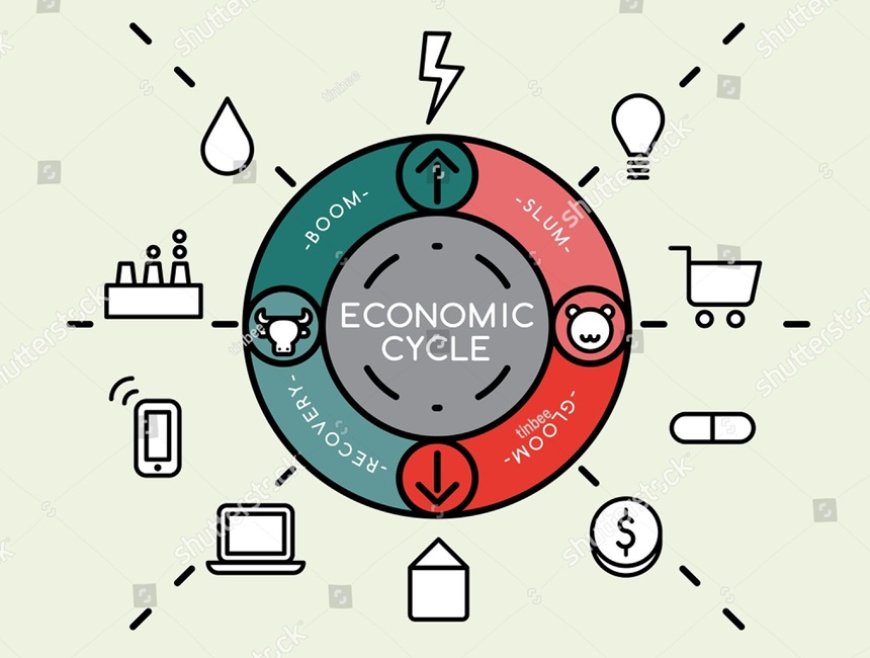

What are Economic Cycles?

Economic cycles, also known as business cycles, are recurring fluctuations in economic activity, characterized by alternating periods of expansion (growth) and contraction (decline). These cycles are a natural part of the economic landscape, and while their exact timing and intensity can be unpredictable, they generally follow a similar pattern.

The phases of an economic cycle:

- Expansion (Boom): This is the phase of prosperity and growth. The economy is humming along smoothly, with businesses thriving, unemployment low, wages rising, and consumer confidence high. The stock market is usually bullish, and people feel optimistic about the future.

- Peak: This marks the high point of the expansion phase. It's the moment when economic growth reaches its zenith and is about to change direction. While it may seem like a time of celebration, it's also a signal that the boom phase is ending, and a slowdown is on the horizon.

- Contraction (Recession): This is the downturn phase of the cycle. The economy starts to shrink, businesses struggle, unemployment rises, wages stagnate or decline, and consumer confidence drops. The stock market is typically bearish, and people are more cautious with their spending. A recession is technically defined as two consecutive quarters of negative GDP growth.

- Trough: This is the lowest point of the contraction phase. It's the moment when the economy hits rock bottom and is about to start recovering. While it can be a difficult time, it also signals that the downward spiral is ending, and things are about to start looking up.

- Recovery: This is the phase of healing and rebuilding. The economy starts to grow again, albeit slowly at first. Businesses start to hire again, unemployment starts to decline, and consumer confidence begins to improve. The stock market usually starts to rebound, and people gradually become more optimistic.

Key points to remember about economic cycles:

- They are inevitable. No economy can grow indefinitely without experiencing some downturns.

- They are unpredictable. The exact timing and intensity of each phase can vary, making it challenging to predict when the next recession or boom will occur.

- They are interconnected. Global events, government policies, and other factors can influence economic cycles.

- They impact everyone. Businesses, individuals, and governments all feel the effects of economic cycles.

How the Economy Impacts Personal Finances

The economy is not just an abstract concept discussed by economists and policymakers; it has a very real and tangible impact on our everyday lives and personal finances. The ups and downs of economic cycles can significantly influence our ability to earn, save, invest, and spend.

Boom Times

During an economic expansion or boom, the overall mood is upbeat. Businesses are flourishing, creating ample job opportunities and driving up wages. This translates to increased disposable income for individuals, allowing them to:

- Spend more: With more money in their pockets, people are more likely to indulge in discretionary spending, such as travel, dining out, and entertainment.

- Save more: Higher income also provides an opportunity to bolster savings for future goals like retirement, education, or a down payment on a house.

- Invest more: The buoyant stock market during boom times often attracts more investors, hoping to capitalize on the rising tide and grow their wealth.

Recession Blues

However, the picture changes dramatically during an economic contraction, particularly a recession. Businesses face challenges, leading to layoffs and wage freezes or cuts. The ripple effects on personal finances can be severe:

- Job insecurity and income loss: The fear of losing one's job or experiencing a pay cut looms large, creating anxiety and financial stress. For those who do lose their jobs, the sudden drop in income can make it difficult to meet basic needs.

- Reduced spending: With less money coming in, people tend to cut back on discretionary spending, impacting businesses that rely on consumer spending.

- Difficulty saving: Saving for the future becomes challenging when every rupee counts towards immediate expenses.

- Investment losses: The stock market tends to decline during recessions, potentially eroding the value of investments and retirement savings.

- Rising debt: The combination of reduced income and unexpected expenses can force people to rely on credit cards or loans, leading to increased debt burden.

The Importance of Financial Preparedness

While we cannot control the economic cycles, we can take steps to mitigate their impact on our personal finances:

- Emergency fund: Building and maintaining an emergency fund equivalent to 3-6 months of living expenses can provide a crucial safety net during tough times.

- Budgeting and expense tracking: Having a clear picture of your income and expenses helps you make informed spending decisions and identify areas where you can cut back if needed.

- Diversified investments: Spreading your investments across different asset classes can help reduce the risk of significant losses during market downturns.

- Debt management: Prioritizing paying down high-interest debt and avoiding unnecessary borrowing can help protect your financial health during economic downturns.

- Upskilling and career development: Continuously enhancing your skills and knowledge can make you more valuable in the job market, even during challenging times.

The economy is a powerful force that can influence our financial well-being. Understanding the impact of economic cycles and taking proactive steps to manage your finances can help you weather the storms and thrive in the long run. Remember, financial planning is not just about maximizing gains during boom times but also about safeguarding your financial future during economic downturns.

Impact on Specific Areas of Personal Finance

The impact of economic cycles is not uniform across all aspects of personal finance. Let's delve deeper into how specific areas are affected:

1. Employment and Income:

- Recession: During a recession, businesses often resort to cost-cutting measures, including layoffs and hiring freezes. This leads to a surge in unemployment, making it difficult for job seekers to find suitable employment. Even those who retain their jobs may face pay cuts or reduced working hours, impacting their income. The uncertainty and financial stress can be immense.

- Boom: In contrast, a booming economy is characterized by high demand for labor. Companies are actively hiring, leading to low unemployment rates and increased job security. Employees may also benefit from salary hikes and bonuses, further boosting their income. This creates a sense of financial stability and optimism.

2. Investments:

- Recession: Stock markets tend to react negatively to economic downturns. Investor confidence plummets, leading to widespread selling and a decline in stock prices. This can erode the value of investments, especially for those heavily invested in equities. It's a testing time for investors, requiring patience and a long-term perspective.

- Boom: During a boom, the stock market usually thrives. Positive economic indicators and strong corporate earnings fuel investor optimism, driving up stock prices. This can be a rewarding time for investors, with the potential for significant gains. However, it's important to exercise caution and avoid chasing speculative bubbles.

3. Savings:

- Recession: Reduced income and unexpected expenses during a recession can make saving a challenge. People may be forced to dip into their savings to cover essential costs, delaying their financial goals. It's crucial to have an emergency fund to tide over such difficult times.

- Boom: Increased income and a sense of financial security during a boom can create a conducive environment for saving. People are more likely to save a portion of their income for future needs, such as retirement or children's education.

4. Debt:

- Recession: A recession can exacerbate debt problems. Reduced income can make it difficult to keep up with loan repayments, leading to missed payments, penalties, and a damaged credit score. Rising interest rates can further increase the debt burden. It's essential to prioritize debt management and seek help if needed.

- Boom: While access to credit is easier during boom times, it's important to exercise caution. Borrowing to finance lifestyle expenses can lead to a debt trap if the economic situation changes. It's advisable to use credit responsibly and maintain a healthy debt-to-income ratio.

5. Real Estate:

- Recession: The real estate market can experience a downturn during a recession. Property prices may decline, and demand for housing may weaken. This can be an opportunity for buyers, but sellers may struggle to get their asking price.

- Boom: A booming economy often fuels a real estate boom. Increased demand for housing, coupled with low-interest rates, can drive up property prices. This can benefit existing homeowners but make it challenging for first-time buyers to enter the market.

Navigating Economic Cycles: Strategies for Personal Financial Management

Economic cycles, much like the weather, are forces beyond our control. However, just as we prepare for different seasons, we can also equip ourselves to navigate the financial fluctuations that economic cycles bring. Here's a deeper look at some key strategies:

1. Build an Emergency Fund

- Why it's crucial: An emergency fund acts as a buffer against unexpected events like job loss, medical emergencies, or major home repairs. It provides peace of mind and prevents you from resorting to high-interest debt during tough times.

- How to build it: Aim to save at least 3-6 months' worth of living expenses in a liquid and easily accessible account, such as a high-yield savings account or a fixed deposit. Start small and gradually increase your contributions as your income allows.

- When to use it: Dip into your emergency fund only for genuine emergencies, not for discretionary spending or impulse purchases. Replenish it as soon as possible after using it.

2. Diversify Your Investments

- Why it's important: Diversification spreads your investment risk across different asset classes, such as stocks, bonds, real estate, and gold. This ensures that if one asset class underperforms, others may compensate, protecting your overall portfolio.

- How to diversify: Consider your risk tolerance, investment goals, and time horizon when creating a diversified portfolio. Consult a financial advisor if needed to ensure your investments are aligned with your financial objectives.

- Rebalance regularly: Periodically review your portfolio and rebalance it to maintain your desired asset allocation. This may involve selling some assets that have performed well and buying others that have lagged to bring your portfolio back in line with your original plan.

3. Manage Your Debt

- Why it's essential: High levels of debt can be a major burden, especially during economic downturns when income may be reduced. Prioritize paying down high-interest debt, such as credit card debt, as quickly as possible.

- How to manage debt: Create a budget and track your expenses to ensure you have enough to cover your debt payments. Consider debt consolidation or balance transfer options to reduce interest costs. Avoid taking on new debt unless necessary.

- Responsible borrowing: During economic booms, it's easy to get carried away with easy access to credit. Borrow only what you can comfortably repay and avoid using credit for discretionary spending.

4. Live Below Your Means

- Why it matters: Lifestyle inflation, or the tendency to increase spending as income rises, can derail your financial goals. Living below your means allows you to save and invest more, building a secure financial future.

- How to do it: Track your expenses, create a budget, and stick to it. Differentiate between needs and wants, and prioritize saving over impulsive spending. Consider automating your savings to ensure consistency.

- Delayed gratification: Resist the urge to keep up with the Joneses. Focus on your financial goals and avoid comparing your lifestyle to others.

5. Review Your Financial Plan Regularly

- Why it's necessary: Your financial plan is not a one-time document; it needs to evolve with your life circumstances and economic conditions. Regularly review and adjust your plan to ensure it remains relevant and effective.

- How to do it: Set aside time annually or bi-annually to review your financial plan. Assess your progress towards your goals, make necessary adjustments, and seek professional advice if needed.

- Be adaptable: Economic cycles can bring unexpected challenges and opportunities. Be prepared to adapt your financial plan accordingly to stay on track.

Current Economic Scenario in India and its Impact

As of August 2024, the Indian economy finds itself in a dynamic phase marked by both promising recovery and lingering challenges.

Green Shoots of Recovery

The COVID-19 pandemic dealt a severe blow to the Indian economy, causing a sharp contraction in 2020. However, the economy has shown remarkable resilience, bouncing back with robust growth in recent quarters. Several positive indicators point towards a steady recovery:

- GDP Growth: India's GDP growth has been impressive, exceeding expectations and positioning it as one of the fastest-growing major economies globally. This growth is fueled by strong domestic demand, government spending on infrastructure, and a rebound in exports.

- Declining Unemployment: Unemployment rates, which spiked during the pandemic, have gradually declined, indicating a recovery in the job market. While certain sectors, such as hospitality and tourism, continue to face challenges, overall employment prospects are improving.

- Rising Consumer and Business Confidence: With economic activity picking up, consumer and business confidence is on the rise. This positive sentiment is reflected in increased spending and investment, further fueling the recovery.

Lingering Challenges

While the recovery is underway, several challenges persist, creating a complex economic landscape:

- Inflation: Rising inflation, particularly in food and fuel prices, is a major concern. This erodes purchasing power and impacts household budgets, especially for low-income families. The Reserve Bank of India is taking measures to curb inflation through monetary policy tightening.

- Supply Chain Disruptions: Global supply chain disruptions, exacerbated by the pandemic and geopolitical tensions, continue to impact businesses in India. This leads to shortages of essential goods, delays in deliveries, and increased costs, impacting both businesses and consumers.

- Geopolitical Tensions: The ongoing geopolitical tensions, such as the Russia-Ukraine conflict, can create uncertainty and volatility in the global economy, which can indirectly impact India. Fluctuations in oil prices, currency exchange rates, and global trade flows can affect India's economic outlook.

Impact on Personal Finances

The current economic scenario presents both opportunities and challenges for individuals:

- Opportunities: The recovering economy, with rising GDP and declining unemployment, creates a favorable environment for job seekers and those looking to switch careers. Increased business activity and consumer spending can also create opportunities for entrepreneurs and investors.

- Challenges: Rising inflation can strain household budgets, requiring careful financial planning and expense management. The uncertainty caused by supply chain disruptions and geopolitical tensions can impact businesses and investments, requiring a cautious approach.

Adapting Your Financial Strategy

Given the dynamic economic environment, it's crucial to stay informed and adapt your financial strategy accordingly. Here are some key considerations:

- Inflation-proofing your savings: Consider investments that offer protection against inflation, such as inflation-indexed bonds or gold.

- Diversifying your investments: Spread your investments across different asset classes to mitigate risks arising from market volatility and geopolitical uncertainties.

- Budgeting and expense management: Carefully track your expenses and create a budget to navigate the challenges posed by rising inflation.

- Emergency fund: Maintain an adequate emergency fund to provide a safety net in case of unexpected events, such as job loss or medical emergencies.

- Upskilling and career development: Invest in your skills and knowledge to enhance your employability and career prospects in a changing job market.

Conclusion

Economic cycles, with their inevitable fluctuations, can feel like an unpredictable rollercoaster ride for our personal finances. However, understanding their dynamics and proactively managing our money can empower us to navigate these ups and downs with confidence.

While economic cycles can be challenging, they also present opportunities for growth and learning. By staying informed, being proactive, and adopting sound financial management practices, you can not only weather economic storms but also thrive in the long run. Remember, financial security is not about having a large amount of money; it's about having peace of mind and the freedom to pursue your dreams, regardless of the economic climate.

As the Indian economy continues its recovery journey, it's an opportune time to take charge of your financial future. With prudent planning, disciplined execution, and a willingness to adapt, you can build a strong financial foundation that will support you through all economic cycles.

Financial planning is not a one-time event, but a continuous journey that requires constant attention and adaptation. It's about setting clear financial goals, creating a roadmap to achieve them, and regularly reviewing and adjusting your plan as circumstances change.

Disclaimer:

The information provided in this article is intended for general knowledge and educational purposes only and does not constitute financial, investment, or any other professional advice. The content should not be considered a substitute for personalized advice from a qualified professional who can assess your specific financial circumstances and goals.

Investing involves risks, including the potential loss of principal. Economic conditions and market trends are subject to change, and past performance is not indicative of future results. The strategies and tips mentioned here do not guarantee financial success. The effectiveness of any financial strategy is dependent on various factors, including individual circumstances and prevailing market conditions.

While we strive to provide accurate and up-to-date information, we make no representations or warranties regarding the completeness,

External links within this article are provided for convenience and do not imply endorsement or recommendation of their content.

Please remember that financial decisions should be made after careful consideration and consultation with a qualified professional.

What's Your Reaction?