How to File Schedule FSI & TR in ITR: The Complete Guide for Indian Taxpayers with Foreign Income

This comprehensive guide explains how to fill Schedule FSI and TR in your Indian Income Tax Return (ITR) to report foreign income accurately. It covers essential details like income types, claiming Foreign Tax Credit (FTC) and Tax Relief, common mistakes to avoid, and the importance of Form 67. Whether you're an expat, NRI, or a resident with foreign investments, this guide will help you navigate Schedule FSI with confidence.

Navigating the Indian income tax system can be a daunting task, especially when you have foreign income. Schedule FSI (Foreign Source Income) in the Income Tax Return (ITR) is where you declare this income and claim tax relief if you've paid taxes abroad. In this comprehensive guide, we'll break down the intricacies of Schedule FSI and TR, helping you understand who needs to file it, what information is required, and the step-by-step process to complete it accurately.

Understanding Schedule FSI: What is it and Why is it Important?

Schedule FSI is a designated section within your Indian Income Tax Return (ITR) where you provide comprehensive details about income you've earned from sources located outside of India. It's not just a formality – it's a critical part of your tax filing if you fit into specific residency categories:

1. Resident and Ordinarily Resident (ROR):

- This category applies to Indian citizens who have maintained a substantial connection to India. Specifically, you're considered ROR if:

- You've resided in India for at least two out of the ten years immediately preceding the relevant financial year.

- You've been physically present in India for a minimum of 730 days within the seven years leading up to the relevant financial year.

- In essence, if India is your primary home and you've spent significant time here, you likely fall under the ROR category.

2. Resident but Not Ordinarily Resident (RNOR):

- This category is slightly more nuanced. You're classified as RNOR if you meet the basic residency requirements (being in India for a certain duration), but your ties to India aren't as strong as those of ROR individuals.

- This might apply to individuals who have been working abroad for a while but still maintain some connection to India.

3. Non-Resident Indian (NRI):

- This category is the most straightforward. You're considered an NRI if you don't meet the residency requirements for either ROR or RNOR.

- Typically, this applies to Indian citizens or people of Indian origin who live and work predominantly outside of India.

Why Filing Schedule FSI is Absolutely Essential

-

Ensuring Tax Compliance: Filing Schedule FSI demonstrates your commitment to adhering to Indian tax laws. Failing to accurately report foreign income can lead to penalties and potential legal issues.

-

Claiming Foreign Tax Credit (FTC): If you've already paid taxes on your foreign income in the country where it was earned, you might be eligible to claim a tax credit in India to avoid being taxed twice on the same income. Schedule FSI is where you provide the necessary information to take advantage of this FTC benefit.

-

Transparency and Financial Integrity: Openly reporting your foreign income maintains transparency in your financial affairs. It shows tax authorities that you're proactive about complying with regulations and contributing your fair share.

When Do You Need to File Schedule FSI?

You are required to file Schedule FSI if you've earned any income that originates from sources outside of India during the financial year. This encompasses a wide range of income types, including but not limited to:

1. Salary Income:

- This refers to any income you receive from employment or services rendered in a foreign country. Whether you're working for a foreign company or an Indian company's overseas branch, this income needs to be reported on Schedule FSI.

2. Business Income:

- If you own or are a partner in a business that operates outside of India, any profits or gains generated by that business fall under this category. This includes income from sole proprietorships, partnerships, or corporations established abroad.

3. Capital Gains:

- This type of income arises from the sale of capital assets situated outside of India. Examples include:

- Selling real estate property located in a foreign country.

- Selling shares or securities of companies listed on foreign stock exchanges.

- Selling other assets like artwork, jewelry, or collectibles that are held outside of India.

4. Other Income:

- This is a broad category encompassing various types of income that don't fit neatly into the previous categories. Some examples include:

- Interest earned on bank accounts held in foreign countries.

- Dividends received from foreign companies or mutual funds.

- Rental income from properties located abroad.

- Royalties or licensing fees received from foreign entities.

- Any other form of income earned outside of India.

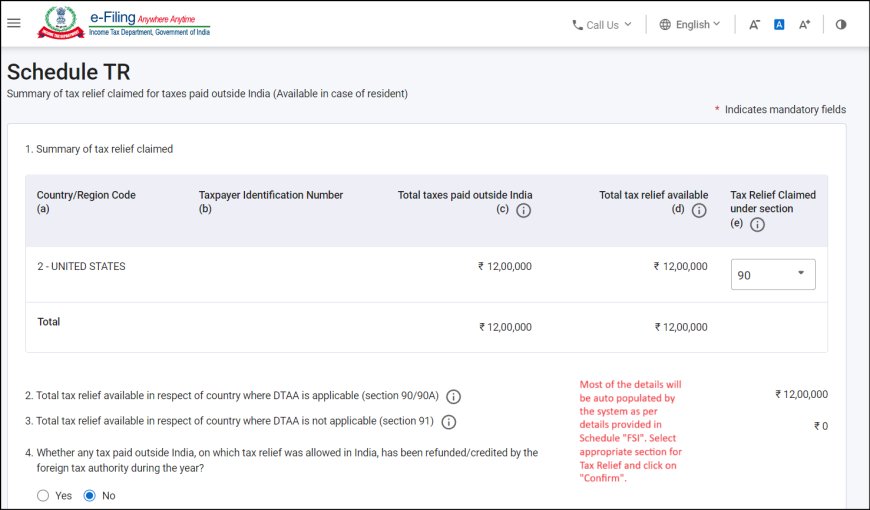

Understanding Schedule TR (Tax Relief):

Schedule TR, or Tax Relief, is a section in the Indian Income Tax Return (ITR) forms where taxpayers can claim relief from double taxation on their foreign income. It essentially provides a summary of the tax relief being claimed in India for taxes already paid in a foreign country.

Why is it Important?

Schedule TR is important because it helps taxpayers avoid being taxed twice on the same income – once in the foreign country where the income was earned and again in India, their country of residence. This double taxation can significantly increase the tax burden for individuals and businesses.

Who Needs to File Schedule TR?

You need to file Schedule TR if you meet the following criteria:

-

Indian Resident: You are an Indian resident for tax purposes (meaning you have stayed in India for 182 days or more in the financial year).

-

Foreign Income: You have earned income from a source outside India.

-

Foreign Tax Paid: You have paid taxes on that foreign income in the country where it was earned.

-

Claiming Tax Relief: You intend to claim tax relief under any of the following sections of the Income Tax Act:

- Section 90: If India has a Double Taxation Avoidance Agreement (DTAA) with the foreign country.

- Section 90A: If India has an agreement with a specified association (like SAARC) instead of a DTAA.

- Section 91: Even if India does not have a DTAA with the foreign country (unilateral relief).

Information Required for Schedule FSI & TR

To ensure you accurately complete Schedule FSI and TR and avoid any errors or omissions, you'll need to gather and prepare the following information:

1. Income Details:

- Nature of Income: Clearly specify the type of income you're reporting. This could be salary income, business income, capital gains, or other income. Be as specific as possible (e.g., "salary from employment" or "capital gains from sale of shares").

- Amount Earned in Foreign Currency: Provide the exact amount of income earned in the original foreign currency. This is essential for accurate conversion later.

- Converted Amount in Indian Rupees (INR): Convert the foreign income amount to INR using the telegraphic transfer buying rate (TTBR) prescribed by the RBI on the last day of the relevant financial year. Ensure you use the correct exchange rate to avoid discrepancies.

2. Tax Paid:

- Amount of Tax Paid in Foreign Country: State the exact amount of tax you've paid on the reported income in the foreign country. This is crucial for claiming the Foreign Tax Credit.

- Converted Amount in INR: Similar to income conversion, convert the foreign tax paid amount to INR using the prescribed TTBR.

3. Tax Identification Number (TIN):

- This is a unique number issued by the foreign tax authority to identify taxpayers. If you don't have a TIN, you might be able to use alternative identification like your Social Security Number (SSN) in the US or your passport number.

4. Country Code:

- Use the standard ISO (International Organization for Standardization) code of the country where your income originated. For instance, the country code for the USA is 840.

5. Details of Foreign Assets (If Applicable):

- If your foreign income is derived from assets held outside India, provide detailed information about these assets. This includes:

- Type of Asset: Specify whether it's real estate, shares, mutual funds, bank accounts, etc.

- Country of Location: State the country where the asset is held or registered.

- Date of Acquisition: Provide the date when you acquired the asset.

- Cost of Acquisition: Mention the original purchase price or cost basis of the asset.

6. Form 67:

- If you're claiming a Foreign Tax Credit, you must attach Form 67 to your ITR. This form is a certificate from the foreign tax authority that verifies the amount of tax you've paid on the reported income. It's essential for substantiating your FTC claim.

Step-by-Step Guide to Filling Schedule FSI & TR

1. Log into Your Income Tax Account: Access your income tax e-filing account on the Income Tax Department's official e-filing portal.

2. Select the Correct ITR Form: Choose the appropriate ITR form (ITR-2 or ITR-3) based on your income sources and residency status. Schedule FSI is relevant for residents who have foreign income.

3. Navigate to Schedule FSI: Locate the section for Schedule FSI within your chosen ITR form. It is usually found under the "Income" section during schedule selection..

4. Fill in the Required Details: Click on Schedule FSI to open it and provide accurate and complete information in all the fields. This typically includes:

- Nature of Income: Specify the type of income earned (e.g., salary, business income, interest, dividends, capital gains).

- Amount: The total amount of income earned in the foreign currency.

- Country: The name of the country where the income was earned.

- Country Code: The ISO code (two-letter alphabetic code) of the country where the income was earned.

- Tax Paid in Foreign Country: The amount of tax paid in the foreign country on that specific income.

- TIN (Tax Identification Number): Your unique Tax Identification Number in the foreign country (equivalent to PAN in India).

- Tax Payable in India: The amount of tax that would be payable on this income under normal provisions of the Indian Income Tax Act.

- DTAA (Double Taxation Avoidance Agreement) Details: If you are claiming relief under Section 90 or 90A of the Income Tax Act (based on a DTAA between India and the foreign country), provide the relevant article number of the DTAA.

- Foreign Asset Details (if applicable, to be filed in Schedule FA): If this income is related to a foreign asset you own (e.g., rental income from a property), provide details of the asset (type, location, value).

Example Scenario 1:

Mr. Rajesh, an Indian resident, received a salary of USD 50,000 from his employment in the United States during the financial year 2023-24. He also paid USD 10,000 as taxes in the US on this income. He owns no foreign assets.

How Rajesh would fill Schedule FSI:

| Field Name | Rajesh's Entry |

|---|---|

| Nature of Income | Salary |

| Amount | USD 50,000 (This will be converted to Indian Rupees using the applicable exchange rate at the time of filing) |

| Country | United States |

| Country Code | USA |

| Tax Paid in Foreign Country | USD 10,000 |

| TIN (Tax Identification Number) | Rajesh's US Social Security Number (or any other applicable tax ID in the US) |

| Tax Payable in India | This will be calculated as per the Indian Income Tax Act. Let's assume it's INR 12,00,000. |

| DTAA Details | If Rajesh is claiming a tax credit under the India-US DTAA, he would mention the relevant article here (e.g., Article 16 for salary income). If not claiming, this field can be left blank. |

| Foreign Asset Details | Not Applicable (as Rajesh does not own any foreign assets) |

Additional Notes:

- Conversion: The USD 50,000 salary will need to be converted to Indian Rupees using the Telegraphic Transfer Buying Rate (TTBR) as on 31st March 2024.

- Form 67: Rajesh needs to obtain Form 67 from the US tax authorities, certifying the USD 10,000 tax paid, and attach it to his ITR.

- Tax Credit: Rajesh can claim a tax credit for the USD 10,000 tax paid in the US to avoid double taxation. The credit will be limited to the amount of tax payable on this income in India (i.e., INR 12,00,000).

Example Scenario 2:

Ms. Priya, an Indian resident, sold shares of a US-based company during the financial year 2023-24, realizing a long-term capital gain of USD 20,000. She paid USD 3,000 as taxes in the US on this gain.

How Priya would fill Schedule FSI:

| Field Name | Priya's Entry |

|---|---|

| Nature of Income | Capital Gains |

| Amount | USD 20,000 (This will be converted to Indian Rupees using the applicable exchange rate at the time of filing) |

| Country | United States |

| Country Code | USA |

| Tax Paid in Foreign Country | USD 3,000 |

| TIN (Tax Identification Number) | Priya's US tax identification number (if applicable, else her PAN would be sufficient) |

| Tax Payable in India | This will be calculated as per the Indian Income Tax Act. Let's assume it's INR 4,50,000 (after considering indexation benefit for long-term capital gain) |

| DTAA Details | If Priya is claiming a tax credit under the India-US DTAA, she would mention the relevant article here. If not claiming, this field can be left blank. |

| Foreign Asset Details | Details of the shares sold (e.g., name of the company, number of shares, acquisition date, sale date) |

Additional Notes:

- Capital Gains Tax in India: India taxes long-term capital gains on shares at 20% with indexation benefit. Short-term gains are taxed at applicable slab rates.

- Form 67: Priya needs to obtain Form 67 from the US tax authorities, certifying the USD 3,000 tax paid, and attach it to her ITR.

- Tax Credit: Priya can claim a tax credit for the USD 3,000 tax paid in the US to avoid double taxation. The credit will be limited to the amount of tax payable on this gain in India (i.e., INR 4,50,000).

5. Claim Foreign Tax Credit (FTC)

a. Report Foreign Income in Schedule FSI: As before, report your foreign income details accurately in Schedule FSI. This includes the nature of income, amount, country, tax paid, TIN, etc.

b. Navigate to Schedule TR (Tax Relief): After filling Schedule FSI, go to Schedule TR (Tax Relief). Here, you'll find a section dedicated to FTC.

c. Fill in FTC Details: In the FTC section of Schedule TR, you'll need to provide the following details for each foreign income source (mostly auto populated from Schedule FSI):

-

- Country Name / Region code: The name and code of the country from which you earned the income.

- Income Type: Choose the appropriate income type from the dropdown menu (e.g., Salary, Business Income, Capital Gains).

- TIN (Tax Identification Number): Your unique Tax Identification Number in the foreign country (equivalent to PAN in India).

- Tax Paid in Foreign Country: The amount of tax paid in the foreign country on that specific income.

- Tax Releif available: This amount will be auto-populated based on the income offered and your tax slab.

- Tax Relief Claimed u/s 90, 90A and 91

Tax Relief under Sections 90, 90A, and 91

These sections deal with providing relief from double taxation, which means avoiding paying taxes on the same income in two countries.

Section 90:

- Applicability: This section applies when India has a Double Taxation Avoidance Agreement (DTAA) with the foreign country where you earned income.

- Relief: It allows you to claim a credit for the taxes paid in the foreign country against the taxes payable in India on the same income.

- How to Claim: Fill the relevant details in Schedule TR (Tax Relief) of your ITR form.

- Form 67: You need to file Form 67 along with your ITR, which certifies the tax paid in the foreign country.

Section 90A:

- Applicability: Similar to Section 90, but it applies when India has an agreement with a specified association (like SAARC) instead of a bilateral DTAA.

- Relief and Claim Process: The relief and claim process are the same as Section 90.

Section 91:

- Applicability: This section applies when India does not have a DTAA with the foreign country.

- Relief: You can still claim relief from double taxation, but the process is different. It is a unilateral relief provided by India and may be subject to certain conditions.

- How to Claim: You need to furnish proof of tax payment in the foreign country and follow the procedures specified by the Indian tax authorities.

Filling DTAA Details in Schedule FSI:

- When claiming relief under Section 90 or 90A, you need to specify the relevant article of the DTAA in the "DTAA Details" field in Schedule FSI of your ITR form.

- This helps the tax authorities verify your claim and apply the correct provisions of the DTAA.

Example:

If you are claiming relief under Article 12(2) of the India-US DTAA for dividend income, you would enter "Article 12(2)" in the DTAA Details field.

Key Points:

- DTAA: It is crucial to check if India has a DTAA with the country from where you earned income. This will determine which section (90, 90A, or 91) applies to your case.

- Tax Treaty: The specific provisions for tax relief vary from one DTAA to another. So, you need to refer to the relevant DTAA to understand the exact conditions and limits.

-

Attach Form 67: If claiming FTC, attach Form 67 with your ITR. This form is crucial as it certifies the amount of tax paid in the foreign country.

Additional Points to Note:

- No Separate Claim: Unlike earlier ITR forms, you don't need to explicitly "claim" FTC. Just filling in the relevant details in Schedule TR is sufficient.

- Carry Forward: If the FTC amount exceeds the tax payable in India for that year, the excess can still be carried forward for up to 8 years.

6. Double-Check and Submit: Carefully review all the information you have entered for accuracy and completeness. Any errors can lead to delays or issues with your tax return. Once you are satisfied, submit your ITR.

7. Fill Form 67: If you are claiming FTC, you need to submit Form 67. This form certifies the amount of tax paid in the foreign country.

i) Log in to the e-Filing Portal

- Visit the Income Tax Department's e-filing portal: https://www.incometax.gov.in/iec/foportal/

- Log in using your user ID (PAN) and password.

- For individuals whose PAN is not linked with Aadhaar, a popup message will appear. You'll need to link your PAN with Aadhaar to proceed.

ii) Access Form 67

- On your dashboard, click "e-File" > "Income Tax Forms" > "File Income Tax Forms."

- Search for "Form 67" or locate it in the list of forms.

- Select the relevant Assessment Year (AY) and click "Continue."

iii) Fill in Form 67

- Read the instructions carefully before you start filling the form.

- Click "Let's Get Started" to open Form 67.

- Fill in all the required details accurately. This includes:

- Part A

- Name of Country

- Source of Income

- Income from outside India

- Taxes Paid outside India (Amount & Rate)

- Tax payable on such income under normal provisions in India

- Credit claimed under Section 90/90A

-

Article No. of Double Taxation Avoidance Agreements

Note: All these details must be gathered from the foreign tax authority.

- Part B

-

- Whether any refund of foreign tax has been claimed in any prior accounting year as a result of carry backward of losses - Yes / No

- Whether credit for any foreign tax has been claimed which is under dispute - Yes / No

iv) Preview and Verify

- Click "Preview" to review all the information you've entered.

- Verify that all details are correct and accurate.

- If any corrections are needed, go back and edit the form.

v) Proceed to e-Verification

- Once you're sure all the details are correct, click "Proceed to e-Verify."

- You'll be asked to confirm if you want to e-verify the form. Click "Yes."

vi) e-Verify Form 67

- You can e-verify the form using any of the following methods:

- Aadhaar OTP

- Electronic Verification Code (EVC)

- Digital Signature Certificate (DSC)

- Choose your preferred method and follow the on-screen instructions to complete the e-verification.

vii) Submission Complete

- After successful e-verification, you'll receive a confirmation message along with a transaction ID and acknowledgment number.

- Make a note of these numbers for future reference.

Important Points to Remember:

- Form 67 must be filed before or on the due date of filing your Income Tax Return (ITR).

- You'll need supporting documents like foreign tax returns and proof of tax payment to fill Form 67.

- It is mandatory to e-verify Form 67.

Common Mistakes to Avoid When Filing Schedule FSI and TR

1. Incorrect Conversion Rates:

- The Issue: Using incorrect exchange rates can lead to miscalculations in your taxable income and tax liability. The Income Tax Department prescribes specific exchange rates (TTBR - Telegraphic Transfer Buying Rate) for each financial year.

- How to Avoid: Refer to the official notification issued by the Income Tax Department for the applicable exchange rates for the relevant financial year. Use these rates to convert your foreign income and taxes paid into Indian Rupees.

2. Missing Form 67:

- The Issue: If you are claiming Foreign Tax Credit (FTC) but fail to attach Form 67, your claim will be invalid, and you might end up paying double tax.

- How to Avoid: Ensure you obtain Form 67 from the foreign tax authority, duly filled and certified, and attach it with your ITR while filing.

3. Inaccurate Income Reporting:

- The Issue: Missing out on any foreign income or reporting incorrect amounts can lead to scrutiny from the tax department and potential penalties.

- How to Avoid: Meticulously gather all information related to your foreign income, including income from foreign assets, bank statements, and tax returns filed in the foreign country. Double-check the figures before entering them in Schedule FSI.

4. Not Claiming FTC:

- The Issue: If you are eligible for FTC but don't claim it, you end up paying taxes on the same income twice (in both countries).

- How to Avoid: If you have paid taxes on your foreign income in another country, ensure you understand the provisions of the Double Taxation Avoidance Agreement (DTAA) between India and that country. Claim FTC in Schedule TR of your ITR to avoid double taxation.

Additional Mistakes to Avoid:

- Incorrect Tax Identification Number (TIN): Double-check that you have entered the correct TIN issued by the foreign tax authority.

- Misinterpreting DTAA Provisions: If you are claiming relief under a DTAA, understand the specific provisions applicable to your income type and residency status.

- Ignoring Foreign Asset Reporting: If you own foreign assets (like property, shares, bank accounts), ensure you report them accurately in the relevant schedules of the ITR.

- Late Filing: File your ITR and Form 67 within the due dates to avoid penalties.

Conclusion

Filing Schedule FSI, which deals with reporting foreign income in your Indian tax return, can initially seem daunting due to its specific requirements and the potential implications of errors. However, armed with accurate information and careful preparation, it becomes a manageable task that ensures compliance with Indian tax laws and helps you avail of any applicable tax benefits.

Key Takeaways:

- Understanding Schedule FSI: Schedule FSI is designed for Indian residents who earn income from sources outside India. It mandates reporting details of such income, including its nature, amount, country of origin, taxes paid abroad, and any relevant foreign assets.

- Accurate Reporting: It is crucial to report all foreign income accurately, using the correct conversion rates and ensuring that no income is omitted. This not only ensures legal compliance but also helps you avoid penalties and scrutiny from the tax authorities.

- Claiming Foreign Tax Credit (FTC): If you've paid taxes on your foreign income in another country, you may be eligible to claim Foreign Tax Credit (FTC) in India. This provision allows you to offset the taxes paid abroad against your Indian tax liability, thus preventing double taxation.

- Form 67: The Key to FTC: To claim FTC, you need to file Form 67 along with your ITR. This form, obtained from the foreign tax authority, certifies the amount of tax you paid in the foreign country.

- Common Mistakes to Avoid: Some common errors include using incorrect conversion rates, failing to attach Form 67, inaccurately reporting income, and not claiming eligible FTC. Being mindful of these pitfalls can save you from unnecessary complications.

By following this comprehensive guide, understanding the requirements of Schedule FSI, and being diligent in your reporting, you can successfully navigate the process of filing your tax return with foreign income and ensure compliance with Indian tax laws. Remember, accurate and timely filing not only fulfills your legal obligations but also helps you optimize your tax liability and avail of any eligible deductions or credits.

Disclaimer:

The information provided in this article is for general informational purposes only and should not be considered as professional tax or legal advice. Tax laws and regulations are complex and subject to change. It is always recommended to consult with a qualified tax professional or advisor for specific advice tailored to your individual circumstances. The author and publisher of this article do not assume any responsibility for any errors or omissions in the content, nor any liability for any actions taken based on the information provided herein.

What's Your Reaction?