Don't Miss Schedule Other Sources (OS): Key to Reporting Interest, Dividends, and More in ITR

Demystify Schedule OS in your Indian ITR! Learn how to report income from interest, dividends, family pension, winnings, and other sources. This comprehensive guide provides step-by-step instructions, tax calculation examples, and tips to ensure you file your ITR correctly and maximize deductions.

Filing your Income Tax Return (ITR) can be daunting, especially when dealing with income from various sources. In India, Schedule OS (Other Sources) is where you report income that doesn't fit into the standard categories like salary, house property, or business/profession. In this detailed guide, we'll break down Schedule OS, making it easier for you to navigate this crucial part of your tax return.

What is Schedule OS?

Schedule OS in your Indian Income Tax Return (ITR) is a crucial section where you report income earned from sources that don't fit into the typical categories like salary, house property, business, or capital gains. It's essentially a catch-all for income that doesn't have a specific schedule assigned to it.

Here's a breakdown of what Schedule OS covers:

1. Interest Income: This includes interest earned from various sources like:

- Savings bank accounts

- Fixed deposits

- Recurring deposits

- Bonds

- Other similar investments

Keep in mind that there are tax-exempt limits for certain interest income. Only the amount exceeding these limits needs to be reported in Schedule OS.

2. Dividend Income: This covers dividends you receive from:

- Shares in companies

- Mutual funds

- Equity-oriented investments

Similar to interest income, there are tax-exempt limits for dividends. You only need to report the excess in Schedule OS.

3. Family Pension: If you are receiving a family pension as a legal heir after the demise of a pensioner, it needs to be reported here.

4. Agricultural Income: While agricultural income is generally exempt from tax, if it exceeds ₹5,000 in a financial year, the excess amount becomes taxable and is reported in Schedule OS.

5. Income from Card Games, Lotteries, Crossword Puzzles, etc.: Any winnings from such activities are considered taxable income and need to be declared in Schedule OS.

6. Casual Income: This includes:

- Gifts received from non-relatives exceeding ₹50,000 in value

- Income earned from activities that you don't do regularly or as a profession

7. Any Other Income Not Covered Elsewhere: This is a broad category that covers any other income that doesn't fit into the above categories. This could include:

- Income from renting out machinery, plant, or furniture

- Royalties received

- Any other miscellaneous income

Who Needs to File Schedule OS?

You need to file Schedule OS in your Indian Income Tax Return (ITR) if you have income from any of the sources listed below:

-

Interest Income: If you've earned interest from savings accounts, fixed deposits, bonds, or similar investments that exceeds the tax-exempt limit, you must report the excess in Schedule OS.

-

Dividend Income: If your dividend income from shares or mutual funds goes beyond the tax-exempt limit, the excess needs to be disclosed in Schedule OS.

-

Family Pension: If you're receiving a pension as a legal heir of a deceased pensioner, this income must be reported in Schedule OS.

-

Agricultural Income: While agricultural income is generally exempt from tax, if it exceeds ₹5,000 in a financial year, the amount exceeding this limit becomes taxable and needs to be reported in Schedule OS.

-

Income from Card Games, Lotteries, Crossword Puzzles, etc.: Winnings from such activities are considered taxable income and must be declared in Schedule OS.

-

Casual Income: If you've received gifts from non-relatives exceeding ₹50,000 in a financial year or earned income from activities not done regularly or as a profession, this falls under casual income and needs to be reported in Schedule OS.

-

Any Other Income Not Covered Elsewhere: If you have any other income that doesn't fit into the categories mentioned above, such as income from renting out machinery, plant, or furniture, or royalties received, you need to include it in Schedule OS.

How to Fill Schedule OS

1. Gather Your Documents:

Before you start filling out Schedule OS, make sure you have all the necessary documents handy. This includes:

- Bank statements: For interest income from savings accounts, fixed deposits, etc.

- Form 16A: This form details the Tax Deducted at Source (TDS) on your interest income.

- Dividend statements: For dividends received from shares or mutual funds.

- Other relevant documents: Any other documents related to the income you're reporting in Schedule OS.

2. Choose the Correct ITR Form:

The ITR form you need to use depends on your total income and the nature of your income sources. Schedule OS is part of several ITR forms:

- ITR-2: For individuals and Hindu Undivided Families (HUFs) without income from business or profession.

- ITR-3: For individuals and HUFs with income from business or profession.

- ITR-4 (Sugam): For those opting for the presumptive taxation scheme.

If you're unsure which form to use, consult a tax professional or use an online tax filing platform that can help you determine the correct one.

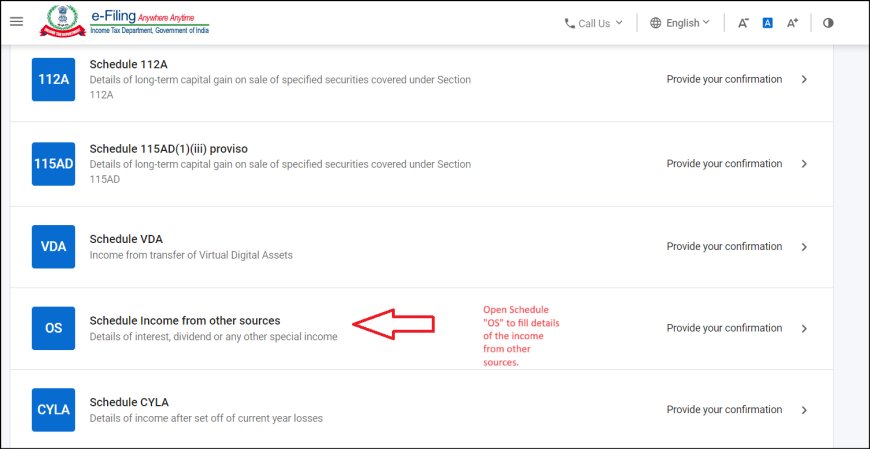

3. Navigate to Schedule OS:

Whether you're filing your ITR online or offline, find the section labeled "Schedule OS." In online filing platforms, it's usually found under the "Income" section during schedule selection. . If you're filling out a physical form, it will be a specific page.

4. Fill in the Details:

Schedule OS is divided into two parts:

a) Part A: Income Taxable at Normal Rates

This section is where you report income that will be taxed according to the regular income tax slabs and rates applicable to you. The common types of income you'll typically report in Part A include:

-

Interest / Dividend Income:

- Interest from savings bank accounts

- Interest from fixed deposits (FDs), recurring deposits (RDs)

- Interest from bonds, debentures, and other debt instruments

- Dividend from shares etc.

-

Family Pension:

- Pension received by a legal heir after the death of a pensioner.

-

Other Income Taxable at Normal Rates:

- Any other income not specifically mentioned in Part B but is taxable at normal rates.

How to fill Part A:

- For each source of income, you'll need to provide the following details:

- Nature of income: Specify the type of income (e.g., interest from savings account, interest from FD, family pension, etc.)

- Gross Amount: The total income earned from that source before any deductions.

- Deductions: Any Tax Deducted at Source (TDS) or other allowable deductions.

- Net Taxable Income: This is the amount that will be added to your total income for tax calculation. It's calculated as Gross Amount – Deductions.

b) Part B: Income Taxable at Special Rates

This section is where you report income that is taxed at specific rates, which are usually higher than the normal income tax slabs. This includes:

-

Winnings from Lotteries:

- Prizes from lotteries are subject to a flat tax rate of 30%.

-

Winnings from Crossword Puzzles:

- Income from crossword puzzles is also taxed at a flat rate of 30%.

-

Winnings from Horse Races:

- Winnings from horse races are subject to TDS (Tax Deducted at Source) at a rate of 30% if the amount exceeds ₹10,000. The remaining amount after TDS is also taxable at 30%.

How to fill Part B:

- For each source of income, provide the following:

- Nature of income: Specify the type of income (e.g., winnings from lottery, crossword puzzle, etc.)

- Gross Amount: The total amount won.

- Special Rate: Indicate the applicable special tax rate (usually 30%).

c) Part C: Income from Owning and Maintaining Racehorses

This type of income is reported under the "Income from other sources" category in Schedule OS of your ITR. It's crucial to remember that while the income falls under Schedule OS, it is subject to special provisions under Section 115BB of the Income Tax Act.

Income Types:

The income you need to report under Schedule OS includes:

- Stake Money: The prize money earned from horse races.

- Sale of Horses: Any profit gained from selling your racehorses.

- Stud Fees: Income earned from breeding your racehorses.

- Sponsorship and Advertising: Income derived from sponsorships or advertisements related to your racehorses.

Tax Treatment:

- Stake Money: This income is taxed at a flat rate of 30%, regardless of your income tax slab.

- Other Income: Income from the sale of horses, stud fees, sponsorships, etc., is taxed according to your applicable income tax slab rates.

- Deductions: You are allowed to deduct expenses incurred for maintaining and training your racehorses, veterinary care, transportation, etc. These expenses are considered business expenses and can be deducted from your income under Section 57 of the Income Tax Act.

Reporting in Schedule OS:

- In Schedule OS, under the section "Income from other sources," specify "Income from owning and maintaining racehorses."

- Report the gross income from all sources related to racehorses (stake money, sale of horses, stud fees, sponsorships, etc.).

- In the deductions column, enter any eligible expenses incurred for maintaining and training your racehorses.

- The net income will be calculated after deducting the expenses from the gross income.

5. Deductions Allowed Under Section 57:

While Section 57 doesn't offer a long list of specific deductions, it allows you to deduct reasonable expenses that you've incurred to earn income from the sources mentioned in Schedule OS. This can include the following:

-

Interest on Borrowed Capital: If you've taken a loan to invest in fixed deposits or other interest-bearing instruments, the interest you pay on that loan can be claimed as a deduction.

-

Other Expenses for Earning Income: This is a broad category and can include various expenses like:

- Bank charges: Fees paid for collecting interest, managing your investment portfolio, etc.

- Brokerage and commission: Charges paid to brokers or agents for buying or selling shares or other investments.

- Expenses for maintaining investments: Costs incurred for safeguarding investments, like locker rent for storing securities.

- Professional fees: Payments made to tax consultants, financial advisors, or other professionals for assistance in managing your investments.

-

Any Other Expenditure (Except Personal Expenses): Any other expense directly related to earning income from other sources, excluding personal expenses, can potentially be claimed as a deduction under Section 57. However, it's important to ensure that the expense is reasonable and directly linked to earning income.

6. Calculate Tax Liability:

The income reported in Schedule OS will be added to your total income from other sources. Based on this total income, your overall tax liability will be calculated as per the applicable tax slabs and rates.

Example: Filling Schedule OS for Interest Income

Scenario:

- You've earned ₹25,000 as interest from fixed deposits during the financial year.

- Your bank has deducted ₹2,500 as TDS on this interest income.

Steps to Fill Schedule OS:

-

Locate Schedule OS:

- Open your ITR form (online or offline).

- Find the section titled "Schedule OS – Income from other sources."

-

Part A – Income Taxable at Normal Rates:

- Nature of Income: Under the heading "Income from other sources," you'll find sub-headings like "Interest on Deposits." Select the appropriate sub-heading that matches your interest income source.

- Gross Income: In the column for "Gross Amount," enter ₹25,000 (your total interest income).

- Deductions: In the column for "Deductions," enter ₹2,500 (the TDS amount deducted by your bank).

-

Calculate Net Taxable Income:

- Your ITR form will automatically calculate the net taxable income from interest. In this case, it would be ₹22,500 (₹25,000 - ₹2,500).

-

Incorporating into Total Income:

- This net taxable income of ₹22,500 will be added to your total income from all other sources (salary, house property, etc.) to determine your overall taxable income.

- This total income will then be used to calculate your tax liability based on the applicable tax slabs and rates.

Additional Considerations:

- Multiple Interest Sources: If you have interest income from multiple sources (e.g., savings account, fixed deposits, bonds), report each source separately in Schedule OS.

- Form 16A: Keep your Form 16A (TDS certificate for interest) handy for reference. The TDS amount mentioned in Form 16A should match the amount you enter in Schedule OS.

- Claiming Deductions: If you incurred any expenses for earning this interest income (e.g., bank charges), you might be able to claim deductions under Section 57. However, this is subject to certain conditions and limits.

Key Points to Remember

1. Tax-Exempt Income:

-

Limit on Exemption: Certain types of income reported in Schedule OS might be exempt from tax up to a specified limit. For example, as of AY 2024-25:

- Savings bank interest is exempt up to ₹10,000 for individuals.

- Dividend income from domestic companies is exempt up to ₹5,000 for individuals.

-

Reporting is Mandatory: Even if your income falls under the tax-exempt limit, it's crucial to report it in Schedule OS. This is essential for transparency and to ensure that your ITR is accurate and complete.

-

No Tax Liability: You won't be liable to pay tax on the portion of your income that falls within the exempt limit. However, if your income exceeds the limit, the excess amount will be taxable.

2. Clubbing of Income:

-

Income of Spouse and Minor Child: In certain cases, the Income Tax Act requires the income of your spouse or minor child to be clubbed with your income for tax purposes. This usually applies to income from assets transferred without adequate consideration or where the income is considered to be earned on behalf of the individual.

-

Reporting in Schedule OS: If clubbing of income applies to you, the combined income of yourself, your spouse, and your minor child will need to be reported in Schedule OS.

3. Tax Deducted at Source (TDS):

-

Applicability: TDS is a mechanism where tax is deducted from your income at the source by the payer. This can happen for various types of income reported in Schedule OS, such as interest income or dividends.

-

Claiming Credit: The TDS deducted is not a final tax. You can claim credit for this TDS while filing your ITR. This credit will reduce your overall tax liability.

-

Form 26AS: Your Form 26AS is a consolidated statement that shows the TDS deducted from your income. It's essential to reconcile the TDS amounts mentioned in Form 26AS with the TDS details you provide in your ITR to avoid any discrepancies.

Common Mistakes to Avoid

1. Missing Income:

- Overlooking Minor Amounts: It's easy to forget about small amounts of income from various sources, such as interest from a savings account with a low balance or a small dividend payout. However, it's crucial to report all income, regardless of the amount.

- Ignoring Exempt Income: Even if your income is tax-exempt up to a certain limit (e.g., savings bank interest up to ₹10,000), you still need to report it in Schedule OS. This is essential for maintaining transparency and ensuring accurate tax records.

- Forgetting to Include All Sources: Ensure you include all income sources under Schedule OS, such as family pension, agricultural income (if exceeding the exemption limit), casual income, winnings from lotteries, and any other miscellaneous income.

2. Incorrect Classification:

- Part A vs. Part B: As discussed earlier, Schedule OS is divided into two parts: Part A for income taxable at normal rates and Part B for income taxable at special rates. It's essential to correctly classify your income under the relevant part to avoid errors in tax calculation.

- Example: Interest income should be reported in Part A, while winnings from lotteries or horse races should be reported in Part B.

3. Not Claiming Deductions:

- Section 57 Deductions: If you've incurred expenses to earn income from other sources (e.g., bank charges for collecting interest, brokerage fees for investments), you might be eligible for deductions under Section 57. Failing to claim these deductions could result in a higher tax liability than necessary.

- Keeping Records: Maintain proper records of all your expenses related to earning income under Schedule OS. This will help you easily identify and claim all eligible deductions.

Additional Mistakes to Avoid:

- Ignoring TDS: If TDS has been deducted from your income, ensure you claim credit for it in your ITR. Verify the TDS amounts in your Form 26AS with those in your ITR to avoid any discrepancies.

- Clubbing Mistakes: If clubbing of income is applicable to you (e.g., income of your spouse or minor child), ensure you correctly club the income and report it under the relevant sections of your ITR.

- Incorrect Personal Information: Double-check your personal details, such as your PAN, Aadhaar, and bank account information, to avoid any issues with tax processing or refunds.

- Filing the Wrong ITR Form: Choose the correct ITR form based on your income sources and total income. Using the wrong form can lead to your ITR being rejected.

Conclusion: Mastering Schedule OS for Accurate ITR Filing

Filing your Income Tax Return (ITR) in India can seem like a complex task, especially when dealing with income from various sources. However, understanding and accurately completing Schedule OS is crucial for reporting income from sources that don't fit into standard categories. By following this comprehensive guide, gathering the necessary documents, and paying attention to detail, you can confidently navigate through Schedule OS and ensure that your ITR is filed correctly and on time.

Remember, accurately reporting your income from other sources is not just a legal requirement; it's also essential for maintaining transparency and contributing to the nation's tax revenue. By following the guidelines outlined in this article, you can fulfill your tax obligations while also potentially reducing your tax liability by claiming eligible deductions.

If you encounter any difficulties or have doubts while filling Schedule OS, don't hesitate to seek professional help from a qualified tax consultant. Their expertise can prove invaluable in ensuring that your ITR is accurate, compliant, and filed smoothly.

By staying informed, organized, and seeking professional assistance when needed, you can master Schedule OS and confidently file your ITR, contributing to a transparent and efficient tax system in India.

Disclaimer:

The content of this article is intended to provide a general understanding of Schedule OS in the Indian Income Tax Return (ITR). While we strive to keep the information accurate and up-to-date, tax laws are subject to change, and the information provided here may not be applicable to your specific circumstances. We strongly recommend consulting with a qualified tax advisor or Chartered Accountant for personalized advice on filing your ITR and understanding your tax obligations.

What's Your Reaction?