Maximizing Tax Benefits Under Different Tax Regimes: Choosing the Right Regime (Old vs. New) for Indian Taxpayers

Confused about Indian tax regimes? This guide breaks down the differences and helps you choose the best plan to save more on your taxes. Unravel the secrets of Indian tax regimes and discover the optimal strategy to maximize your tax savings. Learn how to choose between the old and new regimes for a lighter tax burden.

In the ever-evolving world of Indian taxation, navigating the intricacies of tax regimes can be a daunting task. Choosing the right regime – old vs. new – can significantly impact your final tax liability. This article delves into the intricacies of both regimes, empowering you, the Indian taxpayer, to make informed decisions and maximize your tax benefits.

Understanding the Landscape: Old vs. New Tax Regimes

The Indian Income Tax Act offers two primary tax regimes for individual taxpayers:

-

Old Tax Regime: This traditional regime allows for various deductions and exemptions under different sections of the Income Tax Act. These deductions can significantly reduce your taxable income, leading to lower tax outgo.

-

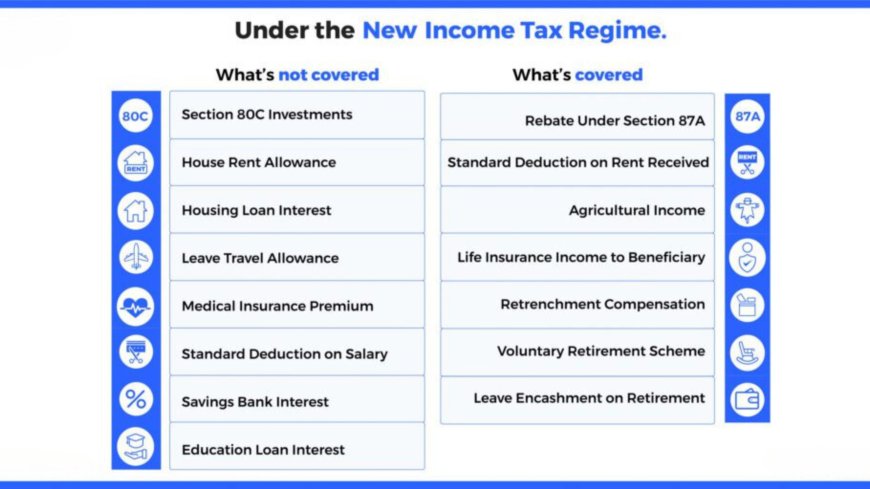

New Tax Regime: Introduced in Budget 2020, this regime boasts lower tax slabs compared to the old regime. However, it comes with a trade-off – most deductions and exemptions available under the old regime are not applicable here.

Benefits of Choosing the Right Regime

Selecting the optimal tax regime hinges on a thorough understanding of your income profile and investment habits. Here's a breakdown of the key factors to consider:

-

Income Level:

-

Old Regime: Generally, those with high income and availing significant deductions under sections like 80C, 80D, etc., benefit more from the old regime.

-

New Regime: This regime might be suitable for individuals with lower incomes (up to ₹7.5 lakhs) as they can enjoy a complete tax rebate and potentially lower tax rates on higher income slabs. Additionally, those with minimal deductions may find the new regime's simplicity appealing.

-

-

Investment Habits:

-

Old Regime: If you invest heavily in tax-saving instruments like Equity Linked Savings Schemes (ELSS), Public Provident Fund (PPF), or National Pension System (NPS), the old regime allows you to claim deductions under Section 80C, potentially leading to significant tax savings.

-

New Regime: This regime might be suitable for investors who primarily focus on non-tax-saving instruments like stocks or real estate, as deductions for these are not available under either regime.

-

-

Complexity:

-

Old Regime: The old regime involves calculating deductions and exemptions from various sections, making tax filing slightly more complex.

-

New Regime: The new regime offers a simpler tax filing process due to fewer deductions and lower tax slabs.

-

Decoding the Old Tax Regime: A Haven for Deductions?

The old regime offers a plethora of deductions and exemptions that can substantially reduce your taxable income. Here are some key sections to understand:

-

Section 80C: This section allows deductions for investments in various instruments like PPF, ELSS, National Savings Certificate (NSC), Unit Linked Insurance Plans (ULIPs) with a premium-paying term of at least 10 years, tuition fees for your children, and principal repayment of a home loan. The maximum deduction under this section is ₹1.5 lakhs.

-

Section 80D: This section provides deductions for medical insurance premiums paid for yourself, your spouse, dependent parents, and even dependent children. Additionally, deductions are available for medical expenses incurred for yourself, your spouse, and dependent parents.

-

House Rent Allowance (HRA): Salaried individuals can claim an HRA exemption if they pay rent. The exemption amount is calculated based on the city of residence, your rent paid, and your employer's contribution towards your rent.

-

Leave Travel Allowance (LTA): This exemption allows salaried individuals to claim a deduction for travel expenses incurred for themselves and their family while on leave.

The New Tax Regime: A Simpler, Streamlined Approach

The new tax regime offers a more straightforward tax filing experience with lower tax slabs. However, most deductions and exemptions available under the old regime are not applicable here.

Here's a breakdown of the key features of the new regime:

-

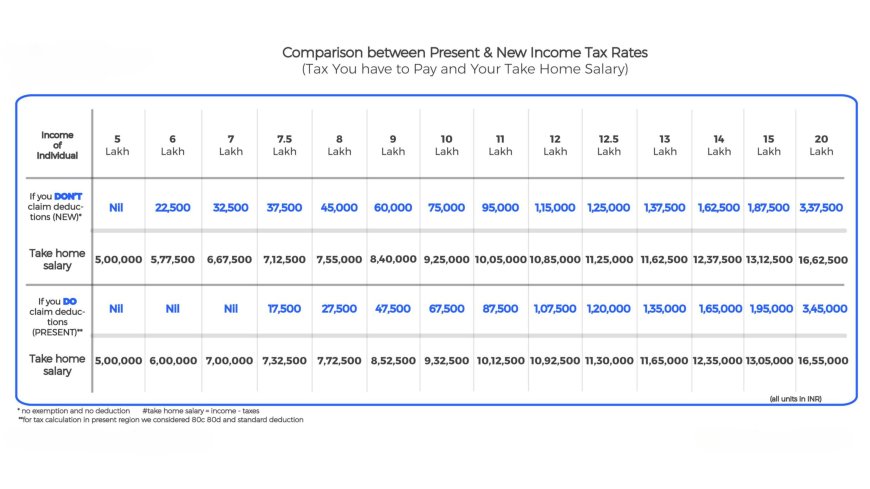

Lower Tax Slabs: The new regime boasts lower tax slabs compared to the old regime. This can translate to lower tax outgo for individuals in certain income brackets.

-

Standard Deduction: Instead of claiming deductions for various expenses like HRA and LTA, the new regime offers a standard deduction that simplifies tax filing.

-

Limited Deductions: Unlike the old regime, only a few deductions are available under the new regime, such as employer's contribution to NPS.

Choosing the Right Regime: A Step-by-Step Guide

Here's a step-by-step approach to help you decide which regime is better suited for you:

- Gather your income details: This includes your salary income, house rent allowance, interest income, and any other income sources.

- List Your Deductions and Exemptions (Old Regime): Under the old regime, meticulously list all the deductions and exemptions you are eligible for. Key areas to focus on include:

- Section 80C Investments: Calculate the total amount you invest in instruments like PPF, ELSS, ULIPs (with a minimum 10-year term), tuition fees, and home loan principal repayment.

- Section 80D: List the medical insurance premiums paid for yourself, spouse, dependent parents, and children. Additionally, factor in any medical expenses incurred for these individuals.

- House Rent Allowance (HRA): Calculate the HRA exemption you are eligible for based on your rent paid, city of residence, and your employer's contribution.

- Leave Travel Allowance (LTA): If applicable, determine the LTA exemption you can claim for travel expenses incurred during leave.

- Estimate Your Tax Liability under Both Regimes:

Utilize tax calculators or online tools available on the Income Tax Department website. These tools allow you to input your income, deductions, and investments under both regimes, providing an estimated tax liability for each.

-

Compare and Make an Informed Decision:

-

If the estimated tax liability in the old regime, after considering all deductions and exemptions, is lower than the new regime, then the old regime might be a better fit.

-

Conversely, if the new regime's estimated tax liability is lower, even without deductions, it could be the more advantageous option.

-

Beyond the Basics: Additional Considerations

This article provides a foundational understanding of the two tax regimes. Here are some additional factors to keep in mind:

-

Changes in Tax Laws: The Indian tax regime is subject to regular changes. Staying updated with the latest amendments is crucial for optimal tax planning.

-

Professional Advice: For complex situations or those with significant income, consulting a tax advisor can provide valuable guidance in choosing the right regime and maximizing tax benefits.

Real-World Scenarios

Scenario 1: Salaried Individual with Moderate Income and Investments

- Name: Priya

- Annual Salary: ₹10,00,000

- Investments:

- PPF: ₹1,00,000

- ELSS: ₹50,000

- Medical Insurance Premium (self & parents): ₹30,000

- Rent Paid: ₹2,00,000 (lives in a metro city)

Tax Calculation:

- Old Regime

- Taxable Income = ₹10,00,000 - ₹1,50,000 (80C) - ₹30,000 (80D) - HRA Exemption (approx. ₹1,50,000) = ₹6,70,000

- Tax Liability: As per old regime tax slabs, tax payable would come to around ₹85,000

- New Regime

- Taxable Income: ₹10,00,000 - ₹50,000 (Standard Deduction) = ₹9,50,000

- Tax Liability: As per new regime tax slabs, tax would be around ₹1,12,500

Conclusion: In this scenario, Priya would save approximately ₹27,500 in taxes by opting for the old tax regime due to the significant deductions available.

Scenario 2: Young Professional with High Income and Minimal Savings

- Name: Rahul

- Annual Salary: ₹18,00,000

- Investments:

- Minimal deductions under Section 80C

- Medical Insurance Premium (self): ₹15,000.

- Rent Paid: ₹3,00,000 (lives in a metro city)

Tax Calculation:

-

Old Regime:

- Taxable Income: Even with HRA and minimal deductions, Rahul's income would likely fall into a higher tax bracket.

- Tax Liability: His tax outgo could be substantial even after factoring in exemptions.

-

New Regime:

- Taxable income: ₹18,00,000 - ₹50,000 (Standard Deduction) = ₹17,50,000

- Tax Liability: Tax calculated as per lower slabs of the new regime would likely be more favorable.

Conclusion: Rahul might find the new tax regime more beneficial due to lower tax slabs and minimal reliance on deductions.

Scenario 3: Individual with Low Income and No Investments

- Name: Neha

- Annual Salary: ₹5,00,000

- Investments: None

- Rent Paid: None

Tax Calculation:

- Old Regime: Neha's taxable income likely falls under the exemption limit (up to ₹5,00,000 with deductions).

- New Regime: The new regime provides a complete rebate for income up to ₹7,00,000 under certain conditions.

Conclusion: Neha would likely pay no tax under either regime. The new regime would offer a simpler process and no need to file for deductions.

Commonly Overlooked Deductions (Old Regime)

Let's shed some light on those often-overlooked deductions under the old tax regime:

Section 80E: Interest on Education Loans

- Eligibility: This deduction is available for interest paid on loans taken for higher education (after Class 12) for yourself, your spouse, or your children. This loan must be from a recognized financial institution or an approved charitable institution.

- Deduction Amount: There's no maximum limit on the amount deducted. The entire interest paid during the financial year is eligible for deduction.

- Period of Deduction: You can claim this deduction for a maximum of 8 years starting from the year you begin repaying the loan or until the entire interest is paid off, whichever is earlier.

Section 80G: Donations to Charitable Organizations

-

Eligible Donations: Donations made to specified charitable trusts or institutions are eligible for deduction. You can find a list of approved organizations on the Income Tax Department's website.

-

Deduction Amount: Deductions can range from 50% to 100% of the donated amount, with some donations qualifying for deductions with limits and others without limits. It's crucial to verify the specific deduction limits for the organization you choose to donate to.

-

Important Note: Make sure to obtain and keep receipts for your donations to claim these deductions.

Section 80TTA/B: Interest From Savings Accounts

- Section 80TTA: This section provides a deduction of up to ₹10,000 on interest earned from a savings account held with a bank, cooperative society, or post office.

- Section 80TTB: Designed for senior citizens, this offers a higher deduction limit of up to ₹50,000 for interest earned from savings accounts.

Why These Deductions Are Often Missed

-

Lack of Awareness: Many taxpayers are unaware of such deductions, making them less popular than well-known ones like 80C and 80D.

-

Record Keeping: Taxpayers often forget to track interest earned on their savings accounts throughout the year or may not prioritize keeping receipts for smaller donations.

-

Small Amounts: Since deductions under 80TTA/B are relatively small, some taxpayers may view it as insignificant and choose to ignore them.

Switching Between Tax Regimes: Understanding the Flexibility

Indian taxpayers have the flexibility to choose between the old and new tax regimes each financial year when filing their Income Tax Return (ITR). This choice allows you to optimize your tax benefits based on your income and deductions. Here's what you need to know:

Eligibility

- Salaried Individuals and Pensioners: You have the flexibility to switch between regimes every financial year.

- Businesses and Professionals: Individuals with income from a business or profession are allowed to switch to the new regime. However, once opted in, they generally cannot switch back to the old regime in future years. There are exceptions to this rule in certain specific cases.

Conditions for Switching

- Decision Time: Choosing the tax regime is made at the time of filing your Income Tax Return.

- Form 10IE (For specific cases): In certain cases, primarily if you have business income and are choosing the new regime, you might need to submit Form 10IE before the due date of filing your ITR. This form declares your intention to opt for the new regime.

Process of Switching

-

During ITR Filing The ITR form itself provides you with the option to select your preferred tax regime for that financial year. You will need to calculate your tax liability under both regimes to make the most beneficial choice.

-

Form 10IE: As mentioned above, if certain conditions apply, you may need to submit form 10IE electronically before the due date for filing your ITR.

Important Considerations

- Notifying Your Employer: When choosing the new tax regime, inform your employer as they won't need to consider deductions like HRA while calculating your TDS.

- Professional Guidance: Consulting a tax advisor is helpful, especially if you have business income or complex tax situations.

Long-Term Vision: Tax Regimes and Retirement Planning

Choosing the right tax regime today carries important implications for your financial security in retirement. While the immediate benefit of tax deductions under the old regime can be appealing, it's crucial to understand how this decision might influence your taxable income after retirement.

-

Deductions Today, Taxes Tomorrow: Many tax-saving instruments under Section 80C, like PPF and certain ELSS schemes, have lock-in periods. Upon maturity, withdrawals from these investments are often added to your taxable income. Choosing heavy deduction reliance today could lead to a higher tax burden when your income may be lower in retirement.

-

Balancing Act: Opting for the new tax regime, with lower rates and limited deductions, could reduce your current tax outgo. However, it's essential to strategize how to build a retirement corpus without the benefit of substantial tax deductions during your earning years.

-

Beyond Tax Regimes: Your choice of tax regime is just one aspect of retirement planning. Consider factors like:

- Post-retirement expenses: Estimate your expected monthly expenses after retirement, factoring in inflation.

- Pension Income: If you are entitled to a pension, factor that in as part of your taxable retirement income.

- Alternative Investments: Explore retirement-focused investments options beyond traditional 80C instruments which may or may not be taxable upon withdrawal.

Surcharges and Health & Education Cess: An Added Layer

It's essential to remember that after you calculate your tax liability under either the old or new tax regime, it's not the final amount you pay. The Indian government levies additional charges in the form of:

-

Surcharge: This is an additional tax calculated as a percentage of your income tax liability if your income exceeds certain thresholds. The surcharge rate varies depending on your income level. For example, individuals with income between ₹50 lakhs and ₹1 crore face a 10% surcharge currently.

-

Health and Education Cess: This is an additional charge levied on the income tax payable. Currently, the Health and Education Cess stands at 4% of the tax calculated under either regime.

Illustrative Example

Let's assume an individual's final tax liability after calculations under the new tax regime is ₹1,00,000. Here's how surcharge and cess would impact the final tax payable:

-

Surcharge (if applicable): Let's say their income is above ₹50 lakhs, attracting a 10% surcharge, which amounts to ₹10,000 (10% of ₹1,00,000).

-

Health and Education Cess: The cess is calculated at 4% of the income tax, so it's an additional ₹4,000 (4% of ₹1,00,000).

-

Total Tax Payable: ₹1,00,000 (initial calculation) + ₹10,000 (surcharge) + ₹4,000 (cess) = ₹1,14,000

A Note on Alternative Minimum Tax (AMT):

While focusing on the primary tax regimes – old and new – it's important to be aware of the Alternative Minimum Tax (AMT). This is a safeguard measure implemented by the government to ensure a minimum level of tax collection, even if your regular tax liability under the old regime is low due to significant deductions.

-

Applicability: AMT applies to individuals, businesses, and trusts exceeding specific income thresholds. For individuals and trusts, the threshold for AMT currently stands at ₹5 lakhs per annum.

-

Calculation: AMT is calculated at a flat rate of 18.5% (plus applicable surcharge and cess) on your Adjusted Total Income (ATI). ATI considers your income before claiming various deductions under sections like 80C, 80D etc.

-

Impact on Old Regime: AMT can potentially negate the benefits of heavy reliance on deductions under the old regime, especially if your income before deductions exceeds the AMT threshold. If your AMT liability is higher than your regular tax liability under the old regime, you'll be required to pay the higher AMT amount.

Conclusion: Tailoring Your Tax Strategy

Choosing between the old and new tax regimes boils down to a personalized assessment of your income profile, investment habits, and risk tolerance. By carefully evaluating these factors and utilizing the tools and strategies discussed, you, the Indian taxpayer, can navigate the taxation landscape confidently and unlock significant tax savings. Remember, staying informed and consulting a tax professional when needed can help you maximize your financial well-being.

Disclaimer: This article provides a general overview of the Indian tax regimes and aims to enhance understanding. Tax laws are subject to change, and the information presented may not reflect the most recent amendments. It is essential to consult a qualified tax advisor for personalized guidance tailored to your specific financial situation and to stay updated with the latest tax regulations.

What's Your Reaction?