Build Your Retirement Nest Egg with NPS: Tax Savings and Steady Income

Discover NPS - India's retirement savings plan. A detailed exploration of the National Pension System (NPS) in India, including its benefits, tax advantages, investment options, and frequently asked questions.

The National Pension System (NPS) is a voluntary retirement savings scheme launched by the Government of India in 2004. It is a defined contribution pension scheme, which means that the amount of pension you receive at retirement will depend on the contributions you make during your working life. The NPS is designed to provide a regular income for subscribers after their retirement.

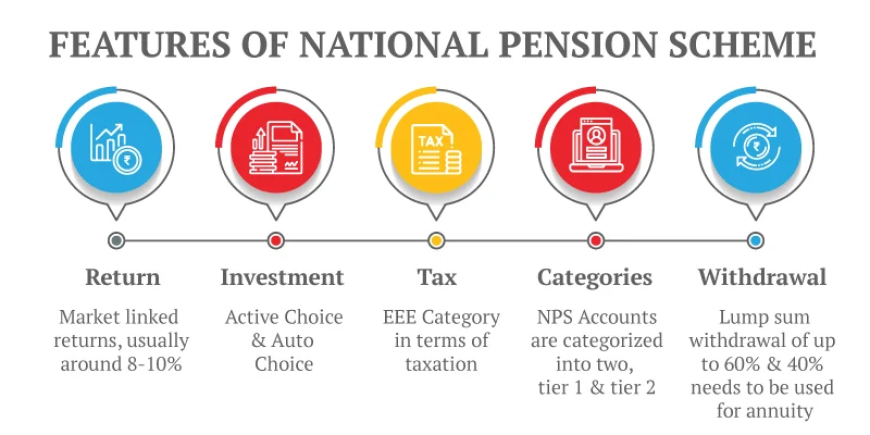

Key Features of NPS

The NPS offers several attractive features that make it a good option for retirement planning in India. Here's a table summarizing the key features of NPS in India:

| Feature | Description |

|---|---|

| Type of Scheme | Voluntary, Defined Contribution |

| Eligibility | Indian citizens (except residing outside India unless on govt deputation abroad) |

| Minimum Age | 18 years |

| Maximum Age (Entry) | 70 years |

| Maximum Age (Account) | 75 years |

| Minimum Contribution | Rs.6,000 per year |

| Government Contribution (Salaried) | Up to 14% of Basic Salary (depending on employer) |

| Tax Benefits (Section 80C) | Up to Rs.1.5 lakh deduction |

| Tax Benefits (Employer Contribution) | Additional deduction under Section 80CCD(2) |

| Investment Choice | Tier I - Asset Allocation (Equity, Corporate Debt, Government Bonds) |

| Investment Management | Pension Fund Managers (PFMs) |

| Exit Options (Partial Withdrawal) | At 60 years (up to 60%) |

| Full Withdrawal | At 60 years (up to 60% lump sum, remaining for annuity) |

There are several benefits to investing in NPS, including:

- Tax benefits: Contributions to NPS are deductible under Section 80C of the Income Tax Act. This can significantly reduce your taxable income and tax liability. Additionally, for salaried individuals, employer contributions to NPS are also exempt from tax under Section 80CCD(2).

- Regular income after retirement: NPS provides a regular income after retirement in the form of a pension. This can help you maintain your financial security in your golden years.

- Market-linked returns: NPS offers the potential for higher returns compared to traditional pension plans. This is because a portion of your NPS contributions are invested in equity instruments.

- Portability: Your NPS account is portable throughout India. This means that you can continue to contribute to your NPS account even if you change jobs.

- Professional management: NPS investments are managed by professional Pension Fund Managers (PFMs). This ensures that your retirement savings are invested in a diversified and well-managed portfolio.

Who Can Invest in NPS?

NPS is open to all Indian citizens between the ages of 18 and 70 years. There is no upper limit on the maximum age up to which one can remain invested in the NPS scheme. However, contributions can only be made up to the age of 70 years.

Types of NPS Accounts

There are two types of NPS accounts:

- Tier I Account: This is the default NPS account and is mandatory for all government employees who joined service on or after January 1, 2004. Tier I account restricts withdrawal of funds before reaching the age of 60 years except for certain exceptions.

- Tier II Account: This is a voluntary account that can be opened by any Indian citizen. Tier II account offers more flexibility in terms of withdrawal of funds. However, Tier II account does not come with the tax benefits offered by Tier I account.

How to Invest in NPS?

Investing in NPS is a simple process. You can open an NPS account online or through any Point of Presence (POP). POPs are typically banks and other financial institutions that have been authorized by the PFRDA to accept NPS subscriptions.

To open an NPS account, you will need to submit the following documents:

- Completed NPS application form

- KYC documents (proof of identity, address, and photograph)

- Bank account details

Once your NPS account is opened, you can start contributing to your account. You can contribute to your NPS account as frequently as you want, but the minimum contribution per year is Rs.6,000. There is no maximum limit on the amount you can contribute to your NPS account.

Investment Choice in NPS

NPS offers a variety of investment options to choose from. These investment options are broadly categorized into asset classes such as equity, corporate debt, and government bonds. The asset allocation mix for your NPS account will depend on your risk appetite and investment horizon. Here's a breakdown of the asset classes available in NPS:

- Equity: Equity refers to stocks of companies. Equity investments offer the potential for high returns but also carry higher risk.

- Corporate Debt: Corporate debt includes bonds issued by companies. Corporate debt investments offer lower risk than equity but also offer lower potential returns.

- Government Bonds: Government bonds are issued by the Government of India. Government bonds are considered to be the safest investment option but also offer the lowest potential returns.

NPS offers several predefined investment options called Asset Allocation Strategies (AAS). These AAS options represent a mix of equity, corporate debt, and government bonds. The following are some of the commonly available AAS options:

- Aggressive Asset Allocation Strategy: This option invests a higher proportion of your contribution in equity (up to 75%). This option is suitable for young investors with a high risk appetite and a long investment horizon.

- Moderate Asset Allocation Strategy: This option invests a moderate proportion of your contribution in equity (between 40% and 75%). This option is suitable for investors with a moderate risk appetite.

- Conservative Asset Allocation Strategy: This option invests a lower proportion of your contribution in equity (up to 40%). This option is suitable for investors with a low risk appetite nearing retirement.

You can choose the AAS option that best suits your risk profile and investment goals. You can also change your AAS option over time as your risk appetite or investment horizon changes.

Exit Options in NPS

NPS restricts the withdrawal of funds before reaching the age of 60 years. This is to ensure that the accumulated corpus is used to provide a regular income after retirement. However, there are some exceptions where partial withdrawal is allowed before reaching 60 years:

- Up to 20% for children's education (after completion of 3 years of account opening) or wedding (after completion of 10 years of account opening) expenses

- Up to 3 times the annual contribution for medical treatment of self, spouse, or dependent children

At the age of 60 years, you have two options:

- Full Withdrawal: You can withdraw up to 60% of the accumulated corpus as a lump sum. The remaining 40% will be used to purchase an annuity that will provide you with a regular income after retirement.

- Annuity Purchase: You can use the entire accumulated corpus to purchase an annuity from a life insurance company. This will provide you with a guaranteed regular income after retirement.

Tax Implications of NPS on Withdrawal

The amount you receive as a lump sum withdrawal at the age of 60 years is tax-free up to 40% of the total corpus. The remaining 60% used to purchase an annuity is taxable as per your income tax slab in the year of withdrawal.

Things to Consider before Investing in NPS

Here are some things to consider before investing in NPS:

- Lock-in Period: NPS has a long lock-in period until the age of 60 years (except for limited withdrawal options). This means that your invested funds will be relatively illiquid.

- Investment Horizon: NPS is a long-term investment option. It is best suited for individuals with a long investment horizon (at least 10-15 years).

- Risk Appetite: NPS offers a variety of investment options with varying risk profiles. Choose the investment option that best suits your risk appetite.

- Tax Benefits: NPS offers attractive tax benefits. However, these tax benefits may not be suitable for everyone. Consider your overall tax situation before investing in NPS.

Recent Changes to NPS Policy

The PFRDA periodically revises and updates the regulations governing NPS to make the scheme more attractive and accessible to investors. Here are some recent changes and their impact on investors:

-

Increased Tax Exemption Limit (FY 2023-2024): In the recent Union Budget announcement, the tax exemption limit for lump sum withdrawal on the maturity of NPS was increased from 40% to 60%. This means a larger portion of the corpus can be withdrawn tax-free, enhancing the overall benefits of the scheme.

-

Introduction of Systematic Lump-sum Withdrawal (SLW) Facility: The PFRDA introduced the SLW facility allowing subscribers to withdraw their NPS investments in a phased manner over a chosen period of up to 75 years of age. This provides more flexibility to investors in utilizing their retirement corpus.

-

Change in Asset Allocation for Central Government Employees: The PFRDA revised the asset allocation limits for Central Government employees under the NPS. The permissible equity exposure has been increased, offering the potential for higher returns for those with a longer investment horizon.

-

Digital Enhancements: Several digital initiatives have been rolled out to ease NPS onboarding and management. These include online account opening, QR-code-based contributions, and enhanced digital platforms for a more seamless user experience.

Impact on Investors

- Enhanced Tax Benefits: Recent changes in tax policy make NPS even more tax-efficient as an investment option.

- Flexibility: The SLW facility provides more flexibility in how you access your funds after retirement, allowing you to plan for your desired income stream.

- Potential for Higher Returns: Depending on your asset allocation choices, recent changes could lead to the possibility of higher returns, especially for younger investors or those with long investment time horizons.

- Ease of Access: Digital enhancements make it easier to open, manage, and contribute to your NPS account.

Important Note: NPS regulations are subject to change. Always refer to the official PFRDA website (https://www.pfrda.org.in/) or consult with a financial advisor for the most recent updates and how they affect you.

Comparing NPS with Other Retirement Saving Options in India

Choosing the right retirement savings option depends on your individual circumstances, risk tolerance, and investment goals. Here's a comparison of NPS with some other popular retirement saving options in India:

| Feature | NPS | PPF | EPF | Equity Mutual Funds | Insurance-Linked Pension Plans (ULIPs) |

|---|---|---|---|---|---|

| Type | Defined Contribution | Defined Contribution | Defined Contribution | Market-Linked | Market-Linked + Insurance Cover |

| Investment Period | Up to age 60 (with limited withdrawal options) | 15 years (extendable in blocks of 5 years) | Up to retirement (depending on employment) | Varies depending on fund | Varies depending on plan |

| Tax Benefits | Deduction under Section 80CCD(1) (up to Rs. 1.5 lakh) & additional deduction under Section 80CCD(2) for salaried (employer contribution) | Deduction under Section 80C (up to Rs. 1.5 lakh) | Employer and employee contribution exempt from tax | Capital gains tax benefits | Tax benefits on premiums paid (limited) |

| Liquidity | Limited withdrawal options before 60 years | Locked for 15 years (partial withdrawal allowed after specified lock-in) | Locked till retirement (except for specific situations) | Relatively high liquidity (depending on fund) | Limited liquidity (surrender charges apply) |

| Risk Profile | Low to High (depending on asset allocation) | Low | Low | Low to High (depending on fund) | Moderate to High |

| Returns | Market-linked (potential for higher returns) | Fixed interest rate (declared by Govt. quarterly) | Fixed interest rate (declared by Govt. every quarter) | Market-linked (potential for higher returns) | Market-linked returns + Death benefit |

| Management | Professionally managed by Pension Fund Managers (PFMs) | Government managed | Government managed | Investor managed or through a financial advisor | Insurance company manages the investment component |

- Investment Lock-in: NPS has the longest lock-in period compared to other options. PPF has a 15-year lock-in with extension options, while EPF is locked until retirement. Mutual Funds and ULIPs offer more flexibility.

- Tax Benefits: NPS offers attractive tax benefits with deductions under Section 80CCD and employer contributions being tax-exempt (salaried). PPF and EPF also offer tax deductions under Section 80C.

- Risk and Returns: NPS and Mutual Funds are market-linked, offering potentially higher returns but also carrying higher risk. PPF, EPF, and ULIPs offer guaranteed or fixed returns with lower risk profiles. ULIPs offer additional life insurance coverage.

Choosing the Right Option:

- Long-term investor with high risk tolerance: NPS or Equity Mutual Funds

- Seeking guaranteed returns and tax benefits: PPF or EPF

- Need some flexibility and market exposure: Balanced Mutual Funds

-

- Want life insurance coverage with investment: ULIPs

The Pension Fund Regulatory and Development Authority (PFRDA)

The PFRDA is the statutory authority established by the Government of India in 2003 under the PFRDA Act, 2013. It functions under the overall guidance of the Ministry of Finance. The PFRDA is the primary regulatory body responsible for the development and regulation of the National Pension System (NPS) in India.

Key Roles of the PFRDA

-

Regulation and Supervision: The PFRDA lays down regulations for the NPS governing various aspects of the scheme including registration of entities, investment guidelines, and grievance redressal mechanisms. It supervises all the intermediaries involved in the NPS, such as Pension Fund Managers (PFMs), to ensure they operate in accordance with the regulations.

-

Protecting Investors' Interests: The PFRDA places a strong focus on safeguarding the interests of NPS subscribers. It sets strict guidelines for the investment and management of pension funds. The PFRDA has also established a robust grievance redressal system to address any complaints or issues raised by subscribers.

-

Promoting NPS and Pension Awareness: The PFRDA undertakes various initiatives to raise awareness about the NPS and the importance of retirement planning in India. It conducts public campaigns, workshops, and other outreach programs to educate individuals about the benefits of the NPS.

-

Providing Resources: The PFRDA website (https://www.pfrda.org.in/) serves as a valuable resource for NPS subscribers and potential investors. It provides information on various aspects of the NPS, including rules and regulations, forms and circulars, and links to other useful resources.

In Summary, the PFRDA plays a pivotal role in ensuring the smooth functioning, transparency, and growth of the National Pension System. Its regulatory oversight and investor protection measures help create a safe and secure environment for individuals to invest in their retirement through the NPS.

Conclusion

The NPS is a valuable retirement planning tool for Indian citizens. It offers a combination of tax benefits, regular income after retirement, and professional management of your retirement savings. However, it is important to understand the features, benefits, and limitations of NPS before investing. Consider your investment goals, risk appetite, and financial situation before deciding if NPS is the right option for you.

Additional Tips for NPS Investors

- Start Investing Early: The earlier you start investing in NPS, the more time your corpus has to grow.

- Contribute Regularly: Make regular contributions to your NPS account to benefit from the power of compounding.

- Review Your Investment Strategy: Regularly review your investment strategy and asset allocation in your NPS account as your age and risk profile change.

- Choose the Right PFM: Select a Pension Fund Manager (PFM) with a good track record and that aligns with your investment goals.

By following these tips, you can maximize the benefits of NPS and secure your financial future after retirement.

FAQs on the National Pension System (NPS)

Q1: What if I need the money before I turn 60?

- NPS has a strict lock-in period until the age of 60. However, partial withdrawals are allowed under certain circumstances:

- For children's higher education

- For marriage of self, children, or dependent siblings

- For the purchase/construction of a residential property

- For critical illness treatment for self, spouse, children, or dependent parents

- In case of disability or incapacitation

Q2: What happens to my NPS corpus if I die before retirement?

- In the unfortunate event of the subscriber's death before retirement, the accumulated corpus will be distributed to the nominee/legal heir as per the following:

- If the nominee is registered: 100% of the corpus to the nominee

- If no nominee is registered: The corpus will be paid to the legal heir(s).

Q3: Can I change my Pension Fund Manager (PFM)?

- Yes, you can switch your Pension Fund Manager (PFM) once within a financial year. However, some PFMs may have additional restrictions or charges associated with switching.

Q4: How do I choose the right asset allocation strategy?

- Choosing the right asset allocation strategy depends primarily on your age and risk tolerance:

- Younger Investors: More aggressive allocation with a higher percentage of equity for potential long-term growth.

- Investors Nearing Retirement: More conservative allocation with higher debt or government securities for preserving capital.

- The PFRDA also has an 'Auto Choice' asset allocation strategy, where the proportion of equity reduces automatically as you get older.

Q5: Can I have multiple NPS accounts?

- Ideally, you should have only one Tier I account. Having multiple Tier I accounts can lead to unnecessary duplication and administrative hassles. You can, however, open a Tier II account linked to your existing Tier I account.

Q6: Is there a guaranteed return in NPS?

- NPS does not offer a guaranteed return, except for investments made in Government Securities. Equity and Corporate Bond asset classes are market-linked and their returns fluctuate with market conditions.

Q7: What are the charges associated with NPS?

- NPS has one of the lowest cost structures among investment options. Charges typically include:

- Account opening charges

- Annual maintenance charges

- Fund management charges

- Transactional charges

Q8: What is the process of withdrawing funds from NPS at maturity?

- At age 60, you have the following options:

- Lump sum Withdrawal: Withdraw up to 60% of the corpus tax-free. The remaining 40% must be used to purchase an annuity.

-

- Purchase an Annuity: Use the entire corpus to purchase an annuity plan from a life insurance company that will provide you with regular pension payments.

NPS Calculators and Projecting Your Retirement Corpus

Here are a couple of reliable NPS calculators you can use to estimate your potential retirement corpus and pension amount:

- ET Money NPS Calculator: https://www.etmoney.com/tools-and-calculators/nps-calculator

- ClearTax NPS Calculator: https://cleartax.in/s/nps-calculator

These NPS calculators are helpful tools for potential investors to get a sense of the potential outcomes based on various factors. Here's how they can be used:

1. Projecting Future Returns:

- Enter your current age, desired retirement age, and estimated monthly contribution amount.

- Choose an asset allocation strategy (Aggressive, Moderate, Conservative) that reflects your risk tolerance.

- The calculator will estimate the maturity amount based on historical average returns for the chosen asset allocation. This provides a general idea of how much your corpus might grow over the investment period.

2. Potential Pension Amounts:

- After estimating the maturity corpus, the calculator will factor in an annuity purchase rate (typically based on prevailing market rates).

- This will give you an estimate of the monthly pension you could potentially receive after retirement.

3. Scenario Analysis:

- Most NPS calculators allow you to adjust various input factors and see how they affect the projected outcome.

- For example, you can increase your monthly contribution, change the asset allocation, or adjust your retirement age.

- This "what-if" analysis helps you see how different investment strategies might impact your final retirement corpus and pension amount.

Important to Remember:

- NPS calculator results are estimates based on historical data and assumptions about future returns. Actual returns may vary depending on market conditions.

- These calculators do not account for inflation, which can erode the purchasing power of your future pension.

-

- Consider these estimates as a starting point for your retirement planning. It's always best to consult with a financial advisor to create a personalized retirement plan based on your specific financial goals and risk tolerance.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial advice. The National Pension System (NPS) offers several features and benefits, but its suitability for your individual circumstances will depend on your personal financial goals, risk tolerance, and investment horizon. Always consult with a qualified financial advisor before making investment decisions related to your retirement planning.

What's Your Reaction?