Sovereign Gold Bonds (SGBs): A Secure Way to Shine in Your Investment Portfolio

Learn about Sovereign Gold Bonds (SGBs) – a secure, government-backed way to invest in gold. Get insights on safety, interest income, tax benefits, and how SGBs compare to physical gold.

For centuries, Indians have held a deep fascination with gold. It's more than just a beautiful ornament; it's seen as a symbol of prosperity, security, and a hedge against inflation. Traditionally, Indians have invested in physical gold – coins, bars, or jewellery. However, this comes with its own set of challenges – storage risks, purity concerns, and making charges.

Introduced in 2015, Sovereign Gold Bonds (SGBs) offered a game-changer for gold investors in India. Issued by the Reserve Bank of India (RBI) on behalf of the Government of India, SGBs are a unique investment avenue that combines the benefits of physical gold with the safety and convenience of a financial instrument.

Understanding Sovereign Gold Bonds

SGBs are essentially government securities denominated in grams of gold. Think of them as certificates representing a specific amount of gold. When you invest in SGBs, you pay the issue price in Indian rupees, and on maturity, you receive the redemption value which is linked to the prevailing market price of gold. Additionally, SGBs offer a fixed interest rate payable semi-annually, providing a regular income stream on your investment.

Key Features and Benefits of SGBs

- Safe and Secure: Unlike physical gold, SGBs are held in demat form or in the RBI's books, eliminating the risks of theft, loss, or damage associated with physical gold.

- Assured Purity: You are guaranteed the purity of the gold you invest in, as SGBs are backed by the Government of India.

- Regular Interest Income: SGBs offer a semi-annual interest of 2.50% per annum, providing a guaranteed return on your investment irrespective of the gold price movement.

- Capital Appreciation Potential: The redemption value of SGBs is linked to the prevailing market price of gold. So, if the gold price rises, you benefit from the capital appreciation along with the interest earned.

- Tax Benefits: SGBs offer attractive tax benefits. Interest earned on SGBs is taxable as income, but if you hold the bond till maturity, any capital gains are exempt from tax. This makes SGBs a tax-efficient way to invest in gold.

- Liquidity: While the lock-in period for SGBs is eight years, there's an exit option from the 5th, 6th, and 7th year on the interest payment dates. You can redeem your bonds at the prevailing market price on those dates.

- Loan Against Security: SGBs can be used as collateral to avail loans from banks, offering additional financial flexibility.

Who Should Consider Investing in SGBs?

SGBs are a suitable investment option for a wide range of investors, particularly those who:

- Seek a Secure Way to Invest in Gold: If you're hesitant about the risks associated with physical gold but still want to benefit from gold price movements, SGBs offer a secure alternative.

- Desire Regular Income: The fixed interest rate on SGBs provides a steady income stream on your gold investment.

- Are Looking for Tax-Efficient Investment Options: The tax benefits associated with SGBs make them attractive for investors seeking tax-friendly investment avenues.

- Want to Diversify their Portfolio: SGBs can be a valuable addition to a well-diversified portfolio, offering a hedge against inflation and market volatility.

Things to Consider Before Investing in SGBs

While SGBs offer numerous advantages, it's essential to consider certain factors before investing:

- Lock-in Period: SGBs have a lock-in period of eight years, with an exit option only after five years. Ensure this aligns with your investment horizon.

- Interest Rate: The fixed interest rate of 2.50% may not always keep pace with inflation or potential returns from other asset classes.

- Gold Price Fluctuation: While SGBs protect you from physical gold's storage risks, the redemption value is still linked to the market price of gold, which can fluctuate.

Investing in SGBs: A Step-by-Step Guide

The process of investing in SGBs is relatively straightforward:

- Track Issuance Dates: The RBI announces new SGB issuances periodically. Keep an eye on RBI's website or authorized banks for upcoming SGB offerings.

- Choose Your Investment Amount: The minimum investment amount is 1 gram of gold, and the maximum limit varies depending on the investor category (individual, HUF, etc.).

- KYC Compliance: Ensure your KYC (Know Your Customer) documents are in order, as they are mandatory for investing in SGBs.

- Application Process: You can apply for SGBs through authorized banks, stockbrokers, or online platforms of participating institutions. The application form will require details like your name, PAN number, investment amount, and preferred mode of holding (demat or physical certificate).

- Payment: You will need to make the payment for the SGBs at the issue price on the application date. The payment can be made through online banking, debit card, or physical challan at designated bank branches.

- Confirmation and Allotment: Once the application period closes, RBI will allot SGBs based on the subscription received. You will receive a confirmation email or SMS if your application is successful.

- Demat Account or Physical Certificate: Depending on your chosen mode of holding, the SGBs will be credited to your demat account or issued as a physical certificate.

Trading SGBs on Secondary Market

While SGBs have an eight-year lock-in period, there's an option for premature redemption after the fifth year. You can trade your SGBs on the secondary market through stock exchanges after the lock-in period. This allows you to exit your investment before maturity if needed, but the redemption price will depend on the prevailing market price of gold at that time.

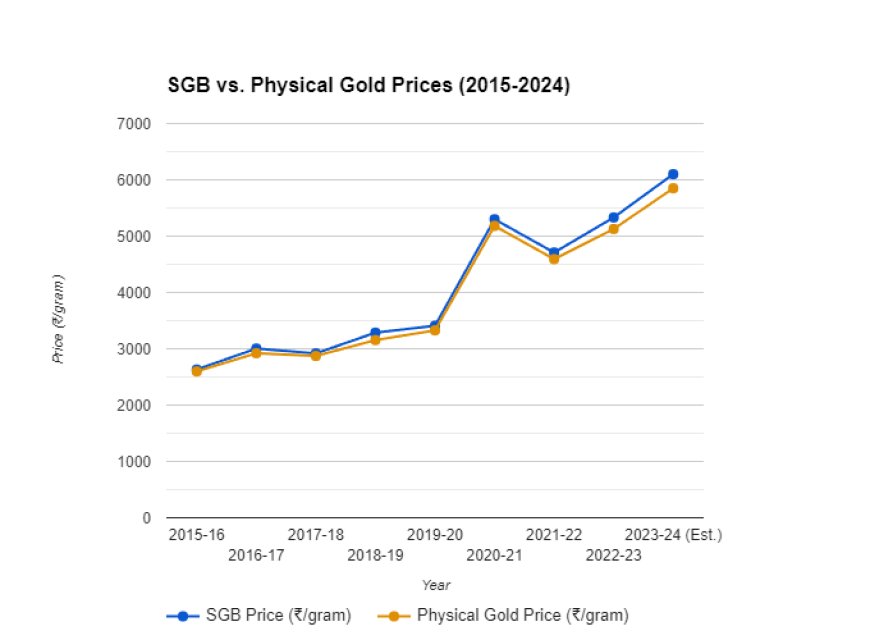

Price Trends of Sovereign Gold Bonds

The price of Sovereign Gold Bonds is linked to the prevailing market price of gold. Since their introduction in 2015, SGB prices have tracked the general trends of gold, with some variations due to the interest component and market demand for SGBs themselves. Let's examine the price history:

Price Trends of Sovereign Gold Bonds

| SGB Series | Financial Year | Issue Price per gram (INR) |

|---|---|---|

| Series I - Nov 2015 | 2015-16 | ₹2,684 |

| Series III - March 2016 | 2015-16 | ₹2,570 |

| Series I - July 2016 | 2016-17 | ₹3,119 |

| Series VI - Oct 2017 | 2017-18 | ₹2,987 |

| Series IV - Jul 2018 | 2018-19 | ₹3,214 |

| Series XII - Apr 2019 | 2019-20 | ₹3,443 |

| Series V - Aug 2020 | 2020-21 | ₹5,334 |

| Series III - Oct 2021 | 2021-22 | ₹4,765 |

| Series VIII - Jan 2023 | 2022-23 | ₹5,361 |

| Series IV - Feb 2024 | 2023-24 | ₹6,263 |

Key Observations

- Reflecting Gold Prices: The overall trend in SGB prices broadly reflects the movement of gold prices over the years.

-

- Fluctuations within Years: There can be variations in the SGB issue price even within a single financial year, depending on market conditions at the time of issuance.

Analysis and Insights

Overall Trends

SGB prices have generally risen over time since their introduction in 2015. While there have been periods of short-term fluctuations, the long-term trend mirrors the general upward trajectory of gold prices during this period. Here's a breakdown of the key factors:

-

Gold as a Safe Haven: Gold is often seen as a safe-haven asset during times of economic uncertainty or inflation. As global economic concerns have increased over the years, the demand for gold has generally risen, pushing up prices. This trend is reflected in the increasing prices of SGBs.

-

Indian Demand for Gold: India is one of the largest consumers of gold globally. The strong cultural affinity for gold and its use as a store of value contributes to sustained demand within the Indian market. This supports the price of SGBs, which are directly linked to domestic gold prices.

-

-

Periods of Fluctuation: It's important to note that gold prices can be volatile in the short term, influenced by factors like interest rates, global currency fluctuations, and geopolitical events. These short-term fluctuations can temporarily cause SGB prices to dip or rise sharply before stabilizing in alignment with the overall gold market trend.

-

Impact of Purchase Price on Returns

It's crucial to remember that the price at which you purchase Sovereign Gold Bonds significantly impacts your overall returns. Since the redemption value at maturity is linked to the prevailing gold price, let's examine the scenarios:

-

Purchasing at lower prices: If you invest in SGBs when gold prices are relatively low, you'll acquire more units (grams) of gold for the same investment amount. At maturity, if gold prices have appreciated, you stand to experience higher capital gains on each unit held.

-

Purchasing at higher prices: Conversely, if you invest in SGBs when gold prices are high, you receive fewer units of gold for the same investment. While you may still benefit from price appreciation by the time of redemption, the capital gains could be less significant compared to the scenario of purchasing at lower prices.

Key Takeaway: Timing your investment can play a role in maximizing potential returns. While it's impossible to predict future gold prices with absolute certainty, investors who purchase SGBs during periods of relatively lower gold prices could increase their opportunity for higher capital gains.

Tracking Gold Prices

Sovereign Gold Bonds are designed to closely mirror the price of physical gold. Ideally, their performance should track the domestic gold market price movements over time. However, there can be minor differences due to a few factors:

-

Interest Component: SGBs offer a fixed interest rate of 2.50% per annum paid semi-annually. This interest provides an additional return on your investment compared to pure physical gold, which doesn't generate income.

-

Market Demand for SGBs: At times, if the demand for SGBs is particularly high or low, it can cause a slight premium or discount to the prevailing physical gold price. However, these deviations are often temporary and tend to correct themselves over time.

Analysis of Historical Data

Key Takeaways:

- The price movements of SGBs closely reflect the fluctuations in physical gold prices, underscoring their ability to mirror the gold market. Investors seeking a reliable way to gain exposure to gold price movements will find Sovereign Gold Bonds (SGBs) remarkably effective.

- The fixed interest component provides a layer of income stability to your investment, reducing dependency solely on gold price fluctuations.This regular interest income compounds over time, significantly enhancing the overall return potential of SGBs.

- While SGBs are designed to closely mirror gold prices, occasional minor deviations may occur in the short term due to market-specific factors. It's important to remember that these deviations tend to be temporary. Over the long-term, SGB prices generally converge to reflect the prevailing gold price.

Tax Implications of SGBs

- Interest Income: The semi-annual interest earned on SGBs is taxable as income under the head "Income from Other Sources."

- Capital Gains: If you hold the SGBs till maturity, any capital gains arising from the difference between the purchase price and redemption price are exempt from tax.

- Early Redemption: In case of premature redemption after five years, capital gains are taxable as short-term capital gains if held for less than three years, and as long-term capital gains if held for more than three years. Long-term capital gains on SGBs attract a concessional tax rate of 20% with indexation benefit, which can significantly reduce the tax liability.

While Sovereign Gold Bonds (SGBs), Gold Mutual Funds, and Gold ETFs all offer exposure to gold prices, they have distinct characteristics that cater to different investment preferences. Let's delve into a clear comparison:

Similarities:

- Underlying Asset: All three investment options ultimately provide exposure to the price movements of gold. Their value fluctuates based on gold market trends.

- Hedging Potential: They can act as a hedge against inflation, as gold prices tend to rise during inflationary periods.

- Portfolio Diversification: Including any of these options in your portfolio can add diversification and potentially improve risk-adjusted returns.

Key Differences

| Feature | Sovereign Gold Bonds (SGBs) | Gold Mutual Funds | Gold ETFs (Exchange Traded Funds) |

|---|---|---|---|

| Investment Type | Debt instrument | Mutual fund scheme | Exchange traded fund |

| Issuer | Government of India | Asset Management Company (AMC) | Listed on stock exchanges |

| Price Movement | Linked to physical gold price | Tracks gold price index | Tracks gold price index |

| Liquidity | Lower liquidity (lock-in period with exit option after 5 years) | Can be redeemed on any trading day | High liquidity (can be traded on exchanges throughout the trading day) |

| Returns | Guaranteed interest of 2.50% p.a. + potential capital gains | Market-linked returns; depend on gold price and fund performance | Market-linked returns; depend on gold price movement and expense ratio |

| Management Fees | No management fees | Management fees charged by AMC | Expense ratio levied by ETF provider |

| Taxation | Interest income taxed, capital gains at maturity exempt | Taxed as capital gains (short-term or long-term) | Taxed as capital gains (short-term or long-term) |

Investment Style Suitability:

- Risk-Averse Investors: For those seeking guaranteed returns and lower risk, SGBs are a good option due to the fixed interest and tax benefits on maturity gains. The lock-in period might be a drawback for some investors.

- Active Investors: Gold ETFs provide high liquidity and the ability to capitalize on short-term gold price movements through intraday trading. However, they involve expense ratios and capital gains taxes.

- Long-Term Investors: Gold Mutual Funds can be suitable for long-term wealth creation through exposure to gold prices. However, investor returns depend on the fund's performance and market fluctuations. Investors need to consider the expense ratio as well.

Additional Considerations:

*Investment Horizon: Consider your investment timeline. SGBs have an 8-year lock-in period, while Gold ETFs and Mutual Funds offer more flexibility.

- Investment Objective: Are you seeking steady returns with some gold price exposure (SGBs) or aiming to potentially capture short-term gold price movements (Gold ETFs) or benefit from professional fund management (Gold Mutual Funds)?

- Investment Expertise: Gold Mutual Funds involve choosing a fund and understanding their investment strategies. ETFs and SGBs are simpler investment options.

Management Expenses: A Key Differentiator

One of the key advantages of Sovereign Gold Bonds (SGBs) is the absence of management fees. Unlike Gold Mutual Funds and Gold ETFs, which involve fees charged by Asset Management Companies (AMCs) or ETF providers, SGBs do not incur any such additional costs.

-

Gold Mutual Funds: Investors in Gold Mutual Funds pay an annual management fee, typically referred to as an expense ratio, which is a percentage of the assets under management. This fee covers the cost of professional fund management, research, and administrative expenses.

-

Gold ETFs: While Gold ETFs often have lower expense ratios compared to Gold Mutual Funds, they still charge a fee to cover the costs of operating the ETF, such as storage of gold, tracking the index, and trading costs.

The Cost Impact

These management expenses can have a significant impact on your overall returns over time. Here's why:

- Reduced Returns: The fees charged by Gold Mutual Funds and Gold ETFs directly reduce your net returns. Even a small percentage difference in fees can compound over long periods, impacting your wealth creation potential.

- SGB Advantage: Since SGBs do not have these management expenses, your returns are not subject to these reductions.

Important Note: When considering Gold Mutual Funds or Gold ETFs, carefully evaluate the expense ratios and track records of various funds. Choose options with lower fees to maximize your potential returns.

Liquidity: A Spectrum of Options

When it comes to investing in gold, SGBs, Gold Mutual Funds, and Gold ETFs offer different levels of liquidity, which refers to how easily you can convert your investment into cash when needed.

- Gold ETFs: Highest Liquidity

- Traded on Exchanges: Gold ETFs are listed on stock exchanges and can be bought or sold during trading hours, much like stocks. This provides investors with high liquidity, allowing them to enter or exit their positions quickly based on market conditions or personal needs.

- Gold Mutual Funds: Moderate Liquidity

- Redemption through the Fund House: Units of Gold Mutual Funds can be redeemed through the fund house on any business day. Processing time for redemptions might vary, but investors generally have access to their funds within a few days.

- Sovereign Gold Bonds (SGBs): Lowest Liquidity

- Lock-in Period: SGBs have a mandatory lock-in period of 8 years. However, there's an option to exit prematurely after the 5th, 6th, and 7th year on the interest payment dates.

- Secondary Market Trading: While SGBs can be traded on stock exchanges after the lock-in period, liquidity in the secondary market can be limited compared to Gold ETFs.

Investor Considerations

- Investment Horizon: If you anticipate needing to sell your gold investment in the short term, Gold ETFs offer the best liquidity. SGBs are better suited for longer-term holding periods due to their lock-in feature.

- Market Fluctuations: Gold ETFs' high liquidity allows for capitalizing on short-term price fluctuations, making them more suitable for active traders.

-

- Emergency Needs: For investors seeking an investment they can readily liquidate in case of unexpected financial needs, Gold Mutual Funds, or ETFs might be better options than SGBs.

Investment Strategies with SGBs

1. Portfolio Diversification

- Reducing Risk: Gold traditionally has a low correlation with other asset classes like stocks and bonds. Including SGBs in your portfolio can help spread your risk across different asset classes, potentially reducing overall portfolio volatility.

- Hedge Against Inflation: Gold is often seen as a hedge against inflation. When inflation rises, the price of gold tends to appreciate, offering some protection to your portfolio's purchasing power. SGBs provide this inflation hedge along with the added benefit of interest income.

2. Tactical Allocation

- Short-Term Outlook on Gold: While SGBs are primarily suited for long-term investments, they can be used for tactical allocation for investors with a short-term bullish view on gold prices.

- Taking Advantage of Price Movements: If you anticipate a significant upward movement in gold prices in the near future, you could invest in SGBs and potentially exit them before maturity to gain from the appreciation in the gold price, along with the interest earned.

- Important Note: Tactical allocation involves market timing and carries higher risk. Thoroughly analyze the gold market outlook and consider your risk tolerance before employing this strategy.

Example: Consider an investor who expects gold prices to rise sharply in the next few months due to anticipated geopolitical tensions. They could invest in SGBs, with an intention to sell them in the secondary market before maturity if their prediction of the gold price rise holds true.

Key Considerations:

- Investment Goals: SGBs are primarily designed for long-term wealth creation and portfolio diversification. If your primary goals align with these, tactical allocation should be a secondary consideration.

-

- Risk Appetite: Tactical allocation with SGBs involves a degree of speculation on gold price trends. Ensure this aligns with your overall risk tolerance.

Illustrative Example

- Mr. Singh invests Rs. 1,00,000 in Sovereign Gold Bonds (SGBs) in 2024.

- Let's assume the issue price of gold at the time is Rs. 5,000 per gram. This means Mr. Singh effectively purchases 20 grams of gold (1,00,000 / 5,000).

- Over the next 8 years, let's say the price of gold appreciates by 50% to Rs. 7,500 per gram.

- Interest Component: Additionally, Mr. Singh earns a fixed interest of 2.50% per annum on his initial investment, adding approximately Rs. 20,000 to his returns over the investment period.

Hypothetical Redemption Value:

- Gold Appreciation: The market value of his 20 grams of gold at redemption would now be Rs. 1,50,000 (20 grams * Rs. 7,500 per gram).

- Total Redemption Amount: His estimated total redemption amount would be approximately Rs. 1,70,000 (Rs. 1,50,000 + Rs. 20,000).

Important Disclaimers:

- Hypothetical Scenario: This example is purely for illustrative purposes. Actual gold price movements can be unpredictable and could be higher or lower than the assumed 50% appreciation.

- No Guaranteed Returns: Sovereign Gold Bonds are subject to market fluctuations in gold prices. The final redemption amount will depend on the prevailing gold price at maturity.

Key Takeaway

This example highlights the potential for SGBs to deliver returns through a combination of gold price appreciation and fixed interest income.

Sovereign Gold Bonds offer a compelling alternative for investors seeking to invest in gold. They provide a safe, secure, and convenient way to own gold while offering the benefit of regular interest income and potential capital appreciation. When compared to physical gold, SGBs eliminate storage hassles, purity concerns, and making charges. Additionally, the tax benefits make them an attractive investment option for long-term wealth creation.

However, it's crucial to consider your investment goals, risk tolerance, and investment horizon before investing in SGBs. The lock-in period and interest rate should be factored into your decision-making process.

By understanding the features, benefits, and risks associated with SGBs, you can make an informed decision about whether they fit your investment strategy. For investors seeking a secure and tax-efficient way to add gold to their portfolio, Sovereign Gold Bonds can be a shining addition.

Frequently Asked Questions (FAQs) on Sovereign Gold Bonds

1. Eligibility

- Who can invest in SGBs? SGBs can be purchased by individuals (including joint holders) who are resident Indians, Hindu Undivided Families (HUFs), trusts, universities, and charitable institutions.

- Are there any nationality restrictions? Yes, only resident Indians are eligible to invest in SGBs. NRIs (Non-Resident Indians) cannot purchase SGBs.

2. Minimum and Maximum Investment Limits

- What is the minimum investment amount? The minimum investment in SGBs is 1 gram of gold.

- Is there a maximum investment limit? Yes, the maximum limits are as follows:

- Individuals and HUFs: 4 kg per fiscal year (April-March)

- Trusts and similar entities: 20 kg per fiscal year

3. Nomination Facility

- Can I nominate someone for my SGBs? Yes, you can nominate a person to receive the SGB units and/or redemption proceeds in case of your demise. The nomination process is similar to other financial instruments.

4. Risk Factors

- Are SGBs risk-free? While SGBs carry significantly lower risks than physical gold, they are not entirely risk-free. Some potential risks include:

- Gold Price Fluctuation: The redemption value of SGBs is linked to gold prices. If gold prices decline, your redemption value could be lower than your purchase price.

- Interest Rate Risk: The fixed interest rate of 2.50% p.a. might become less attractive if prevailing interest rates on other fixed-income instruments rise significantly in the future.

5. Taxation

- How are SGBs taxed?

- Interest Income: Interest earned on SGBs is taxable as per your income tax slab.

- Capital Gains: If you hold SGBs till maturity, any capital gains on redemption are exempt from tax. However, if you redeem prematurely, capital gains are taxed based on your holding period (short-term or long-term).

6. Where to Buy and How to Sell SGBs

- How can I purchase SGBs? You can buy SGBs through banks (public and some private sector), Stock Holding Corporation of India Limited (SHCIL), designated post offices, and stock exchanges.

-

- How can I sell my SGBs? You can sell SGBs on stock exchanges after the lock-in period or redeem them directly with the RBI on maturity.

Disclaimer: The information provided in this article is intended for informational purposes only and should not be construed as financial or investment advice. It's important to consult a qualified financial advisor before making any investment decisions related to Sovereign Gold Bonds or other financial instruments.

What's Your Reaction?