Conquer Your Debts with the Debt Avalanche Method: A Comprehensive Guide for Indian Borrowers

Conquer your debt and achieve financial freedom with the Debt Avalanche Method. This comprehensive guide, tailored for Indian borrowers, explains how to prioritize high-interest debts, save money on interest payments, and accelerate your debt-free journey. Includes real-life success stories, expert insights, and practical tips for overcoming challenges.

Debt is a common part of life in India, whether it's student loans, credit card balances, or personal loans. The weight of multiple debts can be overwhelming, but there's a strategic way to tackle them head-on: the Debt Avalanche Method. In this comprehensive guide, we'll break down the method, discuss its benefits, and provide a step-by-step approach to help you achieve financial freedom.

What is the Debt Avalanche Method?

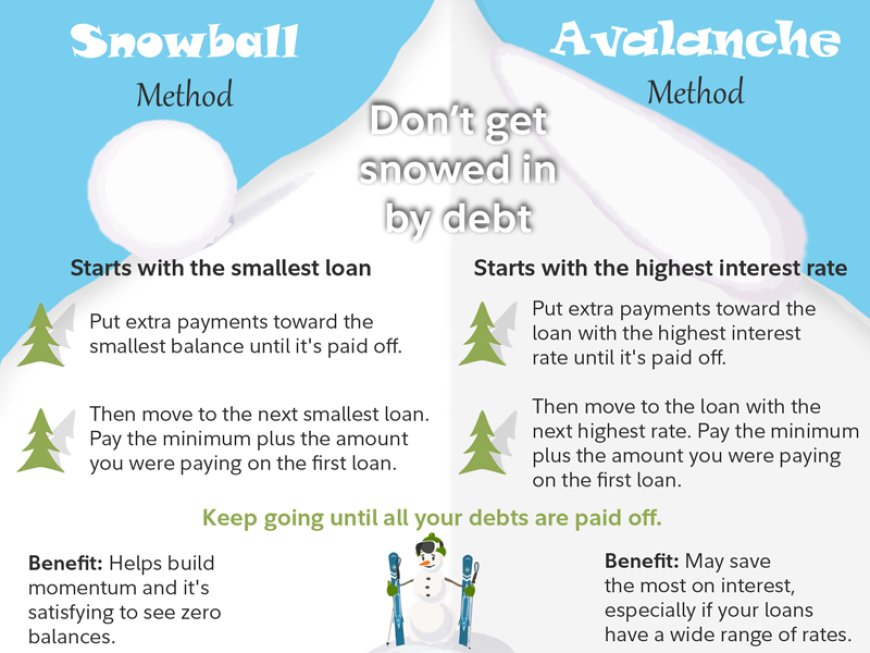

The Debt Avalanche Method is a debt repayment strategy that prioritizes paying off debts with the highest interest rates first. Unlike the Debt Snowball Method, which focuses on the smallest balances, the Debt Avalanche prioritizes minimizing the total interest you pay over time.

How Does It Work?

-

List Your Debts: Start by listing all your debts, from credit card balances to personal loans. Include the outstanding balance and interest rate for each debt.

-

Prioritize by Interest Rate: Arrange your debts in descending order based on their interest rates. The debt with the highest interest rate becomes your top priority.

-

Minimum Payments: Ensure you make at least the minimum payment on all your debts to avoid penalties and maintain good credit.

-

Extra Payments: Allocate any extra money you have towards paying off the debt with the highest interest rate. Continue making these extra payments until it's completely paid off.

-

Move Down the List: Once the highest-interest debt is cleared, move on to the next highest-interest debt. Apply the same approach: minimum payments on all debts, plus extra payments on the target debt.

-

Repeat: Continue this process until you've paid off all your debts.

Benefits of the Debt Avalanche Method

-

Save Money: By tackling high-interest debts first, you'll minimize the total interest paid over the lifetime of your debts, saving you significant money.

-

Faster Debt Reduction: Although it might seem counterintuitive, the Debt Avalanche Method can often lead to faster overall debt reduction compared to other methods.

-

Motivation: Seeing your highest-interest debts disappear can provide a sense of accomplishment and motivate you to continue your debt repayment journey.

The Debt Avalanche Method and the Indian Financial Landscape

The Debt Avalanche Method is not just a Western concept; it's highly relevant and adaptable to the specific financial challenges and cultural nuances faced by Indian borrowers.

Relevance to Indian Borrowers:

-

High-Interest Rate Environment: India's lending landscape often involves high-interest rates, especially for unsecured loans like credit cards and personal loans. The Debt Avalanche Method, with its focus on tackling high-interest debts first, can be a powerful tool for Indian borrowers seeking to minimize their interest burden and save money.

-

Multiple Debt Sources: Many Indians juggle multiple debts, from education loans to gold loans to informal borrowing from friends and family. The Debt Avalanche Method provides a structured approach to prioritize and manage these diverse debts effectively.

-

Cultural Considerations: In India, there's often a cultural expectation of financial support from family or community members. While this can be helpful, it can also lead to informal debts with unclear terms and potential strain on relationships. The Debt Avalanche Method offers a transparent and systematic way to address debts, irrespective of their source.

Comparison with Traditional Methods:

| Method | Advantages | Disadvantages |

|---|---|---|

| Debt Avalanche | Minimizes interest payments, faster debt reduction, structured approach | Requires discipline and consistent extra payments |

| Relying on Family Support | Can provide immediate financial relief, no interest payments, builds on trust | Can strain relationships, unclear terms, potential for conflict |

| Gold Loans | Easy access to funds, no credit checks, flexible repayment options | High interest rates, risk of losing valuable assets, potential for overborrowing |

| Informal Lending (Friends, Family) | Convenient, flexible terms, no paperwork | Unclear terms, potential for conflict, risk of damaging relationships, may not be sufficient for larger debts |

Advantages of a Structured, Interest-Focused Approach:

-

Financial Empowerment: The Debt Avalanche Method empowers borrowers to take control of their debts proactively, rather than relying solely on external support or informal arrangements.

-

Transparency: It provides a clear, step-by-step plan that helps borrowers understand their debt situation and track their progress towards financial freedom.

-

Interest Savings: By prioritizing high-interest debts, borrowers can significantly reduce the total interest paid over time, freeing up more money for savings or other financial goals.

-

Reduced Stress: A structured approach can alleviate the stress and anxiety associated with debt, leading to better financial decision-making and improved overall well-being.

Adapting to the Indian Context:

While the core principles of the Debt Avalanche Method remain the same, Indian borrowers can adapt it to their specific circumstances:

- Negotiate Interest Rates: Explore opportunities to negotiate lower interest rates with lenders, especially for unsecured loans.

- Consolidate High-Interest Debts: If feasible, consider consolidating high-interest debts into a single loan with a lower interest rate.

- Utilize Government Schemes: Research government-sponsored debt relief or financial assistance programs that may be available to you.

The Debt Avalanche Method offers a practical, empowering, and culturally relevant approach to debt management for Indian borrowers. By embracing this structured, interest-focused strategy, you can break free from the cycle of debt, achieve financial independence, and secure a brighter future for yourself and your loved ones.

Step-by-Step Guide: Applying the Debt Avalanche Method in India

-

Gather Your Debt Information: Collect details about all your debts, including balances, interest rates, minimum payments, and due dates. You can find this information on your loan statements or online banking portals.

-

Create a Debt List: Make a spreadsheet or list to organize your debts. Start with the debt with the highest interest rate at the top and the lowest at the bottom.

-

Calculate Minimum Payments: Determine the minimum payment due for each debt. This is the minimum amount you need to pay each month to avoid penalties.

-

Budget for Extra Payments: Analyze your income and expenses to identify how much extra money you can allocate towards debt repayment each month. Even a small amount can make a big difference over time.

-

Start Paying: Make all the minimum payments on time, and then use your extra funds to pay off the debt with the highest interest rate. Continue making these extra payments until the debt is fully paid.

-

Rollover Payments: Once the first debt is paid off, "rollover" the amount you were paying on it to the next highest-interest debt. This will accelerate the repayment of that debt.

-

Stay Consistent: Consistency is key. Stick to your plan and track your progress. Celebrate small victories along the way to stay motivated.

-

Reassess Periodically: As you pay off debts and your financial situation changes, reassess your debt list and adjust your strategy if needed.

Debt Avalanche Method in Practice

Your Debts:

- Personal Loan: ₹50,000 balance, 15% interest rate

- Credit Card 1: ₹20,000 balance, 18% interest rate

- Credit Card 2: ₹10,000 balance, 12% interest rate

Step 1: Prioritize by Interest Rate

The Debt Avalanche Method prioritizes paying off the debt with the highest interest rate first. In this case, Credit Card 1 has the highest interest rate, so you would focus your efforts on paying it off first.

Step 2: Make Minimum Payments on All Debts

Ensure you're at least making the minimum payments on all your debts to avoid late fees and penalties.

Step 3: Extra Payments on the Highest Interest Debt

Any extra money you have available each month (after making minimum payments) should go towards Credit Card 1. Let's say you can allocate an additional ₹5,000 per month.

Step 4: Snowball the Payments

Once you've paid off Credit Card 1, you'll take the ₹5,000 you were using for that payment and add it to the minimum payment for the Personal Loan. This accelerates the repayment of your next highest interest debt.

Step 5: Repeat Until Debt-Free

Continue this process of focusing on the highest interest debt and snowballing your payments until all your debts are paid off. In this example, you would then target the Personal Loan, followed by Credit Card 2.

Visual Representation:

Here's a visual representation of the Debt Avalanche Method in action for your example:

- Focus on Credit Card 1: ₹20,000 balance + ₹5,000 extra payment = ₹25,000 paid each month

- Credit Card 1 paid off: Now, ₹5,000 is added to the minimum payment of Personal Loan

- Focus on Personal Loan: ₹50,000 balance + ₹5,000 (extra from Credit Card 1) + Minimum Payment = Higher monthly payment

- Personal Loan paid off: Now, the total amount from Personal Loan and previous extra payment goes towards Credit Card 2

- Focus on Credit Card 2: ₹10,000 balance + (extra from Personal Loan + ₹5,000) = Highest monthly payment until paid off

Benefits of Debt Avalanche Method:

- Save on Interest: By focusing on high-interest debts first, you'll minimize the total interest paid over time.

- Mathematical Efficiency: This method is the most efficient way to eliminate debt from a purely financial standpoint.

Who is the Debt Avalanche Method Best For?

- Analytical Individuals: If you're motivated by numbers and want to minimize interest payments, the Debt Avalanche Method is a good choice.

- Long-Term Focus: This method requires patience, as it may take longer to see initial progress compared to the Debt Snowball Method.

Tax Implications of Debt Repayment in India

In India, debt repayment itself doesn't have direct tax implications. However, there are a few scenarios where your debt repayment strategy might indirectly impact your taxes:

-

Interest Paid on Home Loans: Interest paid on home loans can be deducted from your total income under Section 24 of the Income Tax Act, subject to certain limits. If you're using the Debt Avalanche Method, prioritizing a home loan with a high interest rate might maximize this deduction initially.

-

Prepayment Charges: Some loans might have prepayment penalties. If you're paying off debts early, factor these charges into your calculations, as they can affect your overall savings.

-

Debt Consolidation: If you consolidate debts, the interest rates on the new loan might be different, which could impact your tax deductions if a home loan is involved.

-

Capital Gains Tax (if applicable): If you sell assets to pay off debts, you might incur capital gains tax depending on the type of asset and the duration for which you held it.

It's always advisable to consult a tax professional for personalized advice regarding your specific situation.

Ethical Considerations: Debt Avalanche vs. Debt Snowball

The choice between the Debt Avalanche and Debt Snowball methods isn't just about financial efficiency – it also involves ethical considerations.

Debt Avalanche:

- Pros: Prioritizing high-interest debt saves you the most money in the long run, which could be seen as a financially responsible choice.

- Cons: Some may find it demotivating to focus on large balances with high interest rates, especially if those debts take longer to clear.

Debt Snowball:

- Pros: Offers quick wins and psychological satisfaction by eliminating smaller debts first, which can boost motivation and momentum.

- Cons: Might result in paying more interest overall compared to the Debt Avalanche Method, potentially delaying your journey to debt freedom.

Choosing the Right Path for You

Ultimately, the best method is the one that aligns with your personal values and financial goals. Consider the following:

- Financial Priority: If saving money is your top priority, the Debt Avalanche Method is the logical choice.

- Emotional Well-being: If you need quick wins and motivation to stay on track, the Debt Snowball might be more suitable.

There's no right or wrong answer – it's about finding the approach that empowers you to achieve your debt-free goals with confidence and peace of mind.

Overcoming Challenges and Staying Motivated on Your Debt-Free Journey

The path to debt freedom isn't always smooth. Life throws curveballs, and the emotional weight of debt can be a challenge in itself. But with the right strategies and mindset, you can overcome setbacks and stay motivated throughout your journey.

Dealing with Setbacks:

-

Unexpected Expenses: When faced with an unexpected expense like a medical emergency or car repair, don't panic. Reassess your budget and identify areas where you can cut back temporarily. This might mean eating out less, postponing non-essential purchases, or finding ways to save on utilities.

-

Income Fluctuations: If your income takes a hit due to a job loss or reduced hours, adjust your debt repayment plan accordingly. Prioritize minimum payments on all debts to avoid penalties, and temporarily reduce or pause extra payments until your income stabilizes.

-

Creative Solutions: Explore opportunities to boost your income, such as freelancing, part-time gigs, or selling unused items. Every extra rupee can be channeled towards your debt repayment goals.

Mental and Emotional Aspects:

-

Acknowledge the Struggle: It's perfectly normal to feel stressed, overwhelmed, or discouraged when dealing with debt. Acknowledge these feelings and be kind to yourself. Remember, progress – no matter how small – is still progress.

-

Set Achievable Goals: Break down your debt repayment into smaller, more manageable goals. Celebrate each milestone you reach, whether it's paying off a small debt or reaching a certain percentage of your total debt paid.

-

Find Support: Share your journey with a trusted friend, family member, or financial mentor who can offer encouragement and accountability. Consider joining online forums or support groups where you can connect with others facing similar challenges.

-

Practice Self-Care: Taking care of your mental and emotional well-being is crucial. Engage in activities that help you de-stress and recharge, such as exercise, meditation, spending time in nature, or pursuing hobbies.

Staying Motivated: Tips for Indian Borrowers

-

Visualize Your Goal: Create a vision board or write down your financial goals. Visualizing your debt-free future can be a powerful motivator.

-

Track Your Progress: Use a debt tracker or spreadsheet to monitor your progress visually. Seeing your debts shrink can be incredibly motivating.

-

Reward Yourself: Set up small rewards for yourself as you reach milestones. It could be a special meal, a movie night, or a small treat.

-

Remember Your "Why": Connect with your deeper reasons for wanting to be debt-free. Whether it's achieving financial independence, buying a home, or providing for your family, reminding yourself of your "why" can keep you focused and motivated.

Case Studies: Real-Life Success Stories with the Debt Avalanche Method

The Debt Avalanche Method isn't just a theoretical concept; it's a practical tool that has helped countless Indians achieve financial freedom. Let's explore some real-life success stories that showcase its effectiveness across different debt scenarios and income levels.

Priya's Triumph Over Credit Card Debt

-

Profile: Priya, a 32-year-old marketing professional in Mumbai, had accumulated ₹1.5 lakhs in credit card debt across three cards with interest rates ranging from 16% to 22%.

-

Strategy: Priya diligently listed her debts, prioritizing the card with the highest interest rate. She made minimum payments on all cards and allocated any extra funds towards the high-interest debt.

-

Timeline: It took Priya 2.5 years to become debt-free. She accelerated her progress by taking on freelance projects and cutting back on discretionary spending.

-

Lessons Learned: "The Debt Avalanche Method gave me a clear roadmap and helped me stay focused," says Priya. "Seeing my balances shrink each month motivated me to keep going."

The Sharma Family's Education Loan Journey

-

Profile: The Sharma family in Delhi had taken out multiple education loans for their two children, totaling ₹8 lakhs with interest rates between 9% and 12%.

-

Strategy: They applied the Debt Avalanche Method, focusing on the loan with the highest interest rate first. To increase their extra payments, they rented out a spare room in their house.

-

Timeline: It took the Sharmas 4 years to clear their education loans. They credit their success to meticulous budgeting and their determination to provide a debt-free future for their children.

-

Lessons Learned: "We realized the power of prioritizing high-interest debts," says Mr. Sharma. "The extra income from renting our spare room made a significant impact on our repayment timeline."

Rahul's Personal Loan Payoff

-

Profile: Rahul, a 28-year-old software engineer in Bengaluru, had a ₹3 lakh personal loan with a 14% interest rate, taken to finance a home renovation.

-

Strategy: Rahul diligently followed the Debt Avalanche Method, making extra payments whenever possible by optimizing his budget and picking up additional freelance work.

-

Timeline: Rahul cleared his personal loan in 18 months, well ahead of the original loan term.

-

Lessons Learned: "The Debt Avalanche Method helped me save a significant amount in interest," says Rahul. "I'm now more conscious of my spending habits and the importance of avoiding high-interest debt."

Different Debt Scenarios

These case studies illustrate the versatility of the Debt Avalanche Method. It can be applied to various debt types, including:

- Credit Card Debt: Ideal for those with multiple cards and varying interest rates.

- Education Loans: Helps borrowers manage multiple loans and save on interest over time.

- Personal Loans: Accelerates repayment and reduces the overall interest burden.

- Other Debts: The method can be adapted to any type of debt, simply prioritize by interest rate and make extra payments towards the highest-interest debt.

Income Levels

The Debt Avalanche Method is effective for borrowers across different income levels. While higher income earners might be able to make larger extra payments, even small contributions can make a substantial difference over time for those with lower incomes. The key is to be consistent and disciplined in your approach.

Key Takeaways:

- Success is Possible: These case studies prove that anyone can achieve debt freedom with the right strategy and determination.

- Flexibility: The Debt Avalanche Method is adaptable to various debt types and income levels.

- Motivation: Seeing real-life success stories can inspire and motivate you on your own debt-free journey.

Expert Insights: A Financial Advisor's Perspective

To gain deeper insights into the Debt Avalanche Method in the Indian context, we spoke with Priya, a certified financial planner with extensive experience in debt management.

Q: In your experience, how effective is the Debt Avalanche Method for Indian borrowers?

A: The Debt Avalanche Method is a highly effective strategy for Indian borrowers, especially in the current financial landscape. With high-interest rates prevalent on unsecured loans, prioritizing high-interest debts can lead to significant savings over time. It's a structured and logical approach that aligns well with the financial goals of many Indians, who are often keen on minimizing interest payments and achieving debt freedom faster.

Q: Are there any specific challenges or considerations that Indian borrowers should be aware of when using this method?

A: One challenge could be the cultural aspect of borrowing and lending within families and social circles. It's important to communicate openly with loved ones about your debt repayment strategy and set clear boundaries if informal debts are involved. Additionally, some borrowers might find it difficult to stay motivated when the initial debts are large. It's crucial to focus on progress, celebrate small wins, and remember the long-term benefits of becoming debt-free.

Q: What advice would you give to Indian borrowers who are considering the Debt Avalanche Method?

A: First, create a detailed list of all your debts, including interest rates and minimum payments. Then, analyze your budget and identify areas where you can cut back to increase your extra payments. Start small and gradually increase your contributions as you become more comfortable. Remember, consistency is key, and even small extra payments can make a big impact over time.

Conclusion

The Debt Avalanche Method stands as a beacon of hope for Indian borrowers seeking to break free from the chains of debt. Its structured, interest-focused approach aligns seamlessly with the financial realities of India, offering a powerful tool to navigate high-interest rates, manage multiple debts, and overcome cultural challenges.

By prioritizing high-interest debts and making consistent extra payments, you can save significant amounts of money, accelerate your journey towards financial freedom, and ultimately achieve your financial goals. While the path might not always be easy, the inspiring stories of individuals and families who have triumphed over debt using this method serve as a testament to its effectiveness.

Remember, the Debt Avalanche Method isn't just about numbers; it's about empowerment, discipline, and a brighter financial future. Embrace this strategy, stay motivated, and seek support when needed. With dedication and perseverance, you can conquer your debts, regain control of your finances, and pave the way for a more secure and prosperous life.

As you embark on your debt-free journey, remember that every rupee paid towards your highest-interest debt is a step closer to financial independence. Don't get discouraged by setbacks, celebrate your progress, and stay focused on your "why." The rewards of financial freedom are well worth the effort and sacrifice.

If you're ready to take the first step towards a debt-free future, start implementing the Debt Avalanche Method today. Remember, it's never too late to take control of your finances and build a brighter tomorrow.

Common Queries About the Debt Avalanche Method

Q: Is the Debt Avalanche Method suitable for all types of debt?

A: Yes, it can be applied to any type of debt. However, it's particularly effective for high-interest debts like credit cards and personal loans.

Q: What if I have multiple debts with similar interest rates?

A: If the interest rates are very close, you can choose to prioritize the debt with the smallest balance first for a quick win, or focus on the one you find most stressful to manage.

Q: What if I can't afford to make extra payments every month?

A: That's okay. Even small, consistent extra payments can make a difference over time. Start with whatever you can afford and gradually increase as your financial situation allows.

Q: Can I switch between the Debt Avalanche and Debt Snowball Method?

A: Yes, you can adjust your strategy as needed. If you need quick wins for motivation, start with the Debt Snowball and then switch to the Debt Avalanche once you have gained momentum.

Disclaimer:

The information provided in this article about the Debt Avalanche Method is intended for general informational purposes only and should not be considered financial or professional advice. Individual financial situations and debt circumstances can vary widely, and it is important to consult with a qualified financial advisor or debt counselor before making any decisions regarding your personal finances.

The case studies presented in this article are for illustrative purposes and may not reflect the experiences of all individuals. The success of the Debt Avalanche Method depends on various factors, including individual commitment, financial discipline, and specific debt scenarios. We encourage you to conduct thorough research and seek professional guidance to determine the most suitable debt repayment strategy for your unique needs.

This website and its authors do not assume any responsibility for any financial decisions or actions taken by readers based on the information presented in this article.

For personalized financial advice and guidance tailored to your specific situation, please consult with a qualified financial professional.

What's Your Reaction?