NAV Explained: Demystifying the Net Asset Value of Your Mutual Fund in India

Understand how Net Asset Value (NAV) reflects the performance of your mutual fund investments in India. Learn how NAV is calculated, its significance, and factors influencing its fluctuations. Make informed investment decisions with our in-depth guide.

The world of mutual funds can be brimming with unfamiliar terms and figures. But fret not, for understanding these concepts is key to making informed investment decisions. One such crucial concept is Net Asset Value (NAV), the cornerstone of mutual fund valuation. This article delves deep into NAV, explaining its essence, calculation, and how it reflects the performance of your chosen mutual fund scheme in the Indian context.

What is NAV?

NAV, or Net Asset Value, represents the per-unit market value of a mutual fund scheme. In simpler terms, it's the price you pay to buy a unit of the fund and the price you receive when you redeem it. Imagine a mutual fund as a large basket filled with various securities like stocks, bonds, and other assets. The NAV reflects the collective value of all these holdings within the basket, minus any liabilities like expenses incurred by the fund management.

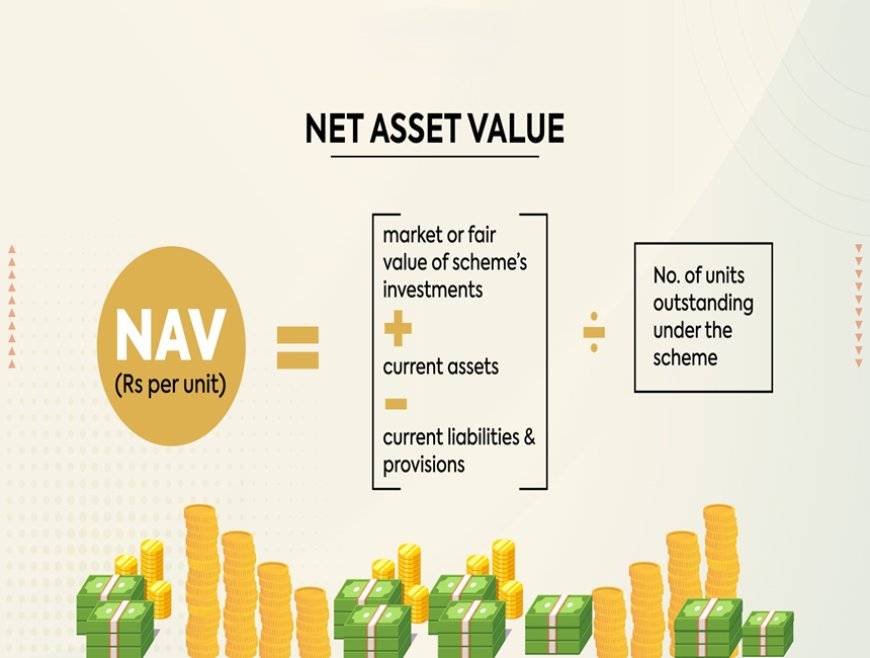

NAV Calculation: Unveiling the Formula

NAV is calculated by the Asset Management Company (AMC) daily, at the close of the market. Here's the formula that breaks down the calculation:

NAV = (Total Assets - Liabilities) / Number of Outstanding Units

Let's dissect the formula:

- Total Assets: This refers to the combined market value of all the securities held by the mutual fund scheme on a particular day.

- Liabilities: These are any expenses incurred by the fund, such as management fees, administrative costs, and operational charges.

- Number of Outstanding Units: This represents the total number of units currently outstanding in the mutual fund scheme.

Essentially, we add up the value of all the holdings, subtract any liabilities, and then divide the result by the number of outstanding units to arrive at the NAV per unit.

NAV and Performance: A Direct Correlation

NAV serves as a crucial indicator of a mutual fund scheme's performance. As the value of the underlying assets in the fund's portfolio increases, so does the NAV. Conversely, if the asset values decline, the NAV will follow suit. This direct correlation between NAV and the fund's performance allows investors to gauge the scheme's health and potential returns.

Understanding NAV Fluctuations: A Normal Market Phenomenon

Unlike fixed deposits offering a predetermined interest rate, mutual funds invest in market-linked instruments. The stock market, by its very nature, experiences fluctuations. These fluctuations in the prices of the underlying securities directly impact the NAV of the mutual fund scheme. So, it's normal to see the NAV go up and down on a daily basis.

NAV vs. Market Price: A Key Distinction for Indian Investors

It's important to understand that NAV differs from the market price of a mutual fund unit, particularly in the Indian context. Unlike Exchange Traded Funds (ETFs) that trade throughout the day on stock exchanges, open-ended mutual funds in India have purchase and redemption transactions occurring only at the NAV, calculated at the day's end.

Here's how it works:

- Purchase Price: When you invest in a mutual fund scheme, you buy units at the NAV applicable on the day you place your order. The order is typically processed after the market closes, and the NAV for that particular day is used to determine the number of units you receive for your investment amount.

- Redemption Price: Similarly, when you redeem your units, the NAV prevailing on the redemption date is used to calculate the amount you receive.

NAV and Different Types of Mutual Funds

NAV plays a vital role across various types of mutual funds available in India:

- Equity Funds: As equity funds invest in stocks, their NAV directly reflects the performance of the stock market. A rising NAV indicates potential capital appreciation for investors.

- Debt Funds: Debt funds invest in fixed-income instruments like bonds. While NAV fluctuations can occur, debt funds generally exhibit lower volatility compared to equity funds.

- Hybrid Funds: These funds combine equity and debt investments. The NAV movement depends on the weightage of each asset class within the scheme.

Benefits of Tracking NAV

Regularly monitoring your mutual fund's NAV offers several benefits:

- Performance Evaluation: Tracking NAV fluctuations helps you assess the fund's performance over time. An upward trend in NAV suggests positive returns, while a downward trend indicates potential losses.

- Investment Decisions: By comparing NAVs of different schemes within the same category, you can make informed investment decisions based on their relative performance.

- Investment Timing: While market timing is a complex endeavor, monitoring NAV movements can provide insights into potential entry or exit points, although past performance is not necessarily indicative of future results.

Importance of NAV in Systematic Investment Plans (SIPs)

Systematic Investment Plans (SIPs): A Powerful Tool for Regular Investment

Systematic Investment Plans (SIPs) are a popular and particularly beneficial investment strategy for salaried individuals in India. Let's delve into how SIPs work and why they hold immense value for regular investors.

The Essence of SIPs:

Imagine a scenario where you invest a fixed amount of money, say ₹1,000, into your chosen mutual fund scheme every month, just like a recurring deposit. That's the core principle of an SIP. You set up a standing instruction with your bank, and the designated amount gets automatically deducted and invested in the fund at regular intervals, typically monthly, quarterly, or even weekly.

Benefits for Salaried Individuals:

For salaried individuals in India, SIPs offer a unique set of advantages:

- Disciplined Investing: SIPs inculcate a habit of disciplined investing. You invest a fixed amount regularly, regardless of market fluctuations, fostering long-term wealth creation.

- Affordable Investment: SIPs allow you to start investing with small amounts, making them accessible even with a limited monthly income. This is in contrast to a lump sum investment, which might require a significant amount of money upfront.

- Rupee-Cost Averaging: Market volatility is a natural phenomenon. SIPs help you leverage this volatility through rupee-cost averaging. Here's how it works: When the NAV (Net Asset Value) of the fund is low, you purchase more units with your fixed SIP amount. Conversely, when the NAV is high, you buy fewer units. This automates a form of market timing, potentially averaging out the cost per unit over time and mitigating the impact of market highs and lows.

- Power of Compounding: When you invest regularly through SIPs, your returns get reinvested. These reinvested earnings also earn returns, leading to the powerful effect of compounding. Over the long term, compounding can significantly accelerate your wealth creation journey.

SIPs: A Stepping Stone to Financial Goals

Whether you're planning for retirement, your child's education, or a dream vacation, SIPs can be a valuable tool. By consistently investing a manageable amount, you can accumulate a substantial corpus over time. The power of discipline and compounding can work wonders for your financial future.

Rupee-Cost Averaging: Taming Volatility with SIPs

NAV, as we know, reflects the ever-changing market dynamics. While this fluctuation can be unsettling for some investors, SIPs, through a concept called rupee-cost averaging, turn this volatility into a potential advantage, especially for the long-term investor.

Understanding Rupee-Cost Averaging:

Imagine you've decided to invest ₹1,000 every month in a chosen mutual fund scheme via an SIP. Now, picture the NAV fluctuating over a year:

- Month 1: NAV is low (let's say ₹10). With your ₹1,000, you purchase 100 units (₹1,000 / ₹10 = 100).

- Month 6: Market conditions change, and the NAV rises to ₹15. Your ₹1,000 now fetches you fewer units (66.67 units, approximately).

- Month 12: The NAV dips again, say to ₹12. This time, your ₹1,000 translates to 83.33 units.

The Beauty of the Average:

By consistently investing a fixed amount (₹1,000 in this example) irrespective of the NAV, you acquire more units when the NAV is low and fewer units when it's high. This automatic "balancing act" helps you average out the cost per unit over time.

Mitigating Volatility:

Market volatility can be nerve-wracking, especially for new investors. Rupee-cost averaging through SIPs helps you avoid the emotional temptation of trying to "time the market." You invest consistently, regardless of whether the market is high or low.

Long-Term Benefits:

The true power of rupee-cost averaging unfolds over the long term. Here's why:

- Lower Average Cost: By buying more units when the NAV is low, you potentially bring down your average cost per unit over the investment horizon. This can translate into higher overall returns when you redeem your units.

- Disciplined Approach: SIPs enforce discipline. You invest regularly, avoiding the fear of investing during market downturns or the euphoria of chasing high NAVs.

- Focus on Long-Term Goals: SIPs shift your focus from short-term market fluctuations to your long-term financial goals. You stay invested for the long haul, allowing compounding to work its magic.

Rupee-cost averaging is not a guarantee of profit, but it is a powerful strategy for mitigating market volatility and potentially achieving better returns over the long term through SIPs.

The Compounding Effect: Supercharging Your SIP Returns

SIPs alone are powerful, but when you understand the compounding effect that comes into play with regular reinvestment, your appreciation for them deepens even further. Let's see how this works:

-

Reinvesting Returns for Exponential Growth: Many mutual funds offer a choice between the "growth" option and "dividend" option.

- Dividend Option: If you choose this option, any profits the fund generates, either through capital gains (selling stocks at a higher price than they were purchased) or dividend payouts from the stocks held by the fund, are regularly distributed to you.

- Growth Option: With the growth option, all earned profits are reinvested directly back into the scheme. This means you effectively buy more units of the mutual fund. These additional units then also have the potential to earn returns.

-

The Magic of Compounding: With the growth option and reinvestment in play, a beautiful cycle begins. Your initial investment generates returns. These returns, instead of being taken out, are used to buy more units that have the potential to generate further returns. This cycle repeats, creating a snowball effect where your returns start earning their own returns. Over time, this accelerates the growth of your investment.

-

NAV is Key: Remember, whenever these reinvested profits are used to buy more units, you'll be doing so at the prevailing NAV during that time. The NAV movement—sometimes high, sometimes low—influences how many additional units you receive.

-

Long-Term Potential: The true power of compounding shines through over long time horizons. Imagine an SIP running for 10, 15, or even 20 years. Every reinvested rupee has the potential to grow into a much larger sum over such a period.

Example: (These numbers are for illustrative purposes only)

Let's say you invest ₹5000 monthly through an SIP and the fund generates an average annual return of 12%.

- After 10 Years without Reinvestment: You'd have a corpus of around ₹10.5 lakhs (this includes your invested amount and the returns).

- After 10 Years with Reinvestment: Considering the compounding effect, your corpus could grow to approximately ₹12.5 lakhs.

The difference of ₹2 lakhs underscores the immense impact of reinvesting and compounding on your long-term wealth creation potential.

Key Takeaway: When you opt for the growth option in your SIP and allow your dividends and capital gains to be reinvested, you harness the true power of compounding. This, along with the NAV movement and rupee-cost averaging, can significantly amplify your returns and accelerate the journey towards your financial goals.

NAV in Different Purchase and Redemption Scenarios

Direct vs. Regular Plans: Unveiling the NAV Advantage

When you invest in a mutual fund scheme, you essentially have two options: direct plans and regular plans. Understanding the difference between these plans, particularly how they affect NAV, is crucial for making informed investment decisions.

The Commission Factor and NAV:

-

Regular Plans: These plans involve a distributor or advisor who helps you choose the fund and guides you through the investment process. For their services, distributors receive a commission from the AMC (Asset Management Company). This commission is embedded within the expense ratio of the regular plan. As a result, the NAV of a regular plan is generally slightly lower than the NAV of the same scheme's direct plan.

-

Direct Plans: Here, you invest directly with the AMC, eliminating the intermediary role of a distributor. Since there's no commission involved, the expense ratio of a direct plan is lower. Consequently, the NAV of a direct plan is typically higher compared to the regular plan of the same scheme.

NAV Advantage and Long-Term Impact:

This seemingly small difference in NAV between direct and regular plans can have a significant impact on your returns, especially over the long term. Here's why:

- Higher Starting Point: A higher NAV in direct plans translates to purchasing fewer units with your investment amount. However, these fewer units represent a larger share of the underlying assets in the fund.

- Power of Compounding: Remember, compounding amplifies returns over time. The slightly higher NAV in direct plans allows your initial investment to potentially grow at a faster rate due to the compounding effect on a larger underlying value.

Making an Informed Choice:

The decision between direct and regular plans depends on your individual circumstances. Here are some factors to consider:

- Investment Knowledge: If you're comfortable researching and managing your investments, direct plans can be a cost-effective option due to the higher NAV.

- Need for Guidance: If you're a new investor seeking professional advice, a regular plan with a distributor's guidance might be preferable. However, it's essential to choose a reputable advisor who prioritizes your financial goals over commissions.

The Long-Term Perspective:

While the initial difference in NAV between direct and regular plans might seem insignificant, it can snowball into a substantial sum over extended investment horizons. For long-term investors, the cost advantage and potential for higher returns offered by direct plans can be very attractive.

Cut-Off Times: Demystifying the NAV for Same-Day Transactions

Understanding NAV cut-off times is crucial for ensuring you get the NAV you expect when investing in mutual funds in India. Here's what you need to know:

The Cut-Off Time Mechanism:

Asset Management Companies (AMCs) establish cut-off times for processing purchase and redemption orders for mutual fund units. These cut-off times typically fall within the afternoon hours, varying slightly depending on the fund category:

- Liquid Funds: These highly liquid funds often have a later cut-off time, usually around 3:00 PM. This allows for same-day processing and reflects the NAV prevailing at the end of that business day.

- Equity Funds, Debt Funds, and Hybrid Funds: These categories generally have an earlier cut-off time, around 1:00 PM or 2:00 PM. Orders placed after the cut-off time are processed on the next business day.

Impact on Your NAV:

The cut-off time plays a vital role in determining the NAV applicable to your transaction:

- Transactions Before Cut-Off: If you place your order to buy or redeem units before the cut-off time for that specific fund category, the NAV applied will be the one prevailing at the close of business on the same day.

- Transactions After Cut-Off: However, if your order is placed after the cut-off time, it will be processed on the next business day. Consequently, the applicable NAV will be the one prevailing at the end of the next business day.

Example:

Let's say you want to invest in an equity fund with a cut-off time of 2:00 PM.

- Order Placed Before 2 PM: If you submit your purchase order by 1:00 PM, the NAV applicable to your investment will be the closing NAV of that same business day.

- Order Placed After 2 PM: If your order is submitted after 2:00 PM, it will be processed on the next business day. The NAV applicable to your purchase will then be the closing NAV of the next business day.

Why Do Cut-Off Times Exist?

These cut-off times are necessary to allow AMCs adequate time to:

- Process all buy and redemption orders received for the day.

- Calculate the final NAV for the scheme based on the closing market prices of the underlying securities held by the fund.

- Update the scheme's records with the new unit holdings for each investor.

Planning Your Transactions:

Being aware of the cut-off times for your chosen mutual fund scheme allows you to plan your investments strategically. If you aim to get the NAV of a particular business day, ensure your order is placed well before the designated cut-off time for that fund category.

Dividend Payout vs. Growth: Understanding NAV and Your Investment Needs

Mutual funds often offer investors a choice between "dividend" and "growth" options within the same scheme. These options involve differing treatments of profits generated by the fund, leading to variations in NAV and ultimately impacting your investment returns. Let's break this down:

Dividend Payout Option:

- Regular Income: When you choose the dividend option, the fund periodically distributes a portion of its profits (from either sale of stocks within the portfolio or dividends received from those stocks) as dividends to investors.

- Impact on NAV: Dividends paid out are subtracted from the fund's assets, which consequently reduces the NAV. So, after a dividend is declared, you'll see the NAV drop by the amount of the dividend per unit.

- Suitable for: Investors who prioritize a regular income stream from their investments often prefer the dividend option.

Growth Option

- No Payouts, Reinvestment: In the growth option, all profits generated are reinvested back into the fund to buy more assets. This means no cash payouts are made to investors.

- Impact on NAV: With reinvestment, the value of the fund's assets increases over time. This growth in value is reflected in a rising NAV.

- Suitable for: The growth option aligns well with investors focused on long-term wealth creation and capital appreciation.

The NAV Connection

The contrasting treatment of dividends between the two options crucially explains the NAV difference:

- Dividend Payout: Decreases NAV due to cash payouts.

- Growth: Increases NAV as profits remain invested within the fund.

Choosing Wisely: Your Needs Matter

The decision between dividend payout and growth option hinges on your individual financial goals and needs:

- Seeking Regular Income: If you need regular income for expenses, especially post-retirement, the dividend payout option might be more suitable. Keep in mind, dividends are not guaranteed and are subject to the fund making profits and declaring them.

- Prioritizing Long-term Growth: For investors with a long investment horizon who prioritize significant capital appreciation over the years, the growth option is often preferred. It harnesses the power of compounding through reinvestment, potentially maximizing investment growth for the future.

Important Note: Even though the portfolio of securities within both 'growth' and 'dividend' options is usually the same, keep in mind:

- Dividends received in the dividend option are subject to taxation.

- Long-term capital gains in the growth option are also subject to taxation when you eventually redeem your units.

Capital Gains Tax on Mutual Funds in India: A Quick Guide

Understanding capital gains taxation is essential when investing in mutual funds in India. Here's a simplified overview:

Taxation on Capital Gains:

- When you redeem your mutual fund units, any profit you earn is considered a capital gain. This gain is taxed based on the holding period and the asset class of the fund.

Types of Capital Gains:

-

Short-term Capital Gains (STCG): If you hold your mutual fund units for less than 1 year before redemption, the gains are classified as STCG. STCG on equity funds is taxed at a flat rate of 15%.

-

Long-term Capital Gains (LTCG): Gains from units held for more than 1 year are considered LTCG. Here's the breakdown for LTCG tax on different asset classes:

- Equity Funds: LTCG exceeding ₹1 lakh in a financial year is taxed at 10% without the benefit of indexation (which previously adjusted for inflation).

- Debt Funds (Investments made after April 1, 2023): LTCG from debt funds are now treated as regular income and taxed according to your income tax slab rate.

- Debt Funds (Investments made before April 1, 2023): LTCG on these investments exceeding ₹1 lakh still enjoys the benefit of indexation, with the tax rate capped at 20%.

The Tax Angle: Understanding True Investment Returns

While analyzing NAV is crucial for understanding a mutual fund's performance, it's equally important to view returns from an after-tax perspective. Taxation can significantly affect your real-world returns. Let's see how:

The Reality of Taxes: Remember, taxes eat into your profits. It's the amount left after deducting taxes that actually lands in your pocket.

-

Short-Term vs. Long-Term Impact: Taxes have a more immediate and pronounced impact on short-term capital gains (STCG), taxed at a higher rate compared to long-term capital gains (LTCG). High STCG tax can seriously erode your returns in the short run.

-

Debt Funds: Taxation on debt funds depends on your holding period and income tax slab. With the 2023 budget, LTCG on debt funds are no longer as tax-friendly, as they are taxed based on your income tax slab.

-

Dividend Distribution Tax (DDT): While DDT has been abolished, remember that dividends received were previously taxed at the fund house level. The NAV used to reflect this upfront dividend tax.

Examples:

-

Equity Mutual Fund: Let's say you made a ₹50,000 profit on an equity fund investment.

- STCG: If you redeem within a year, your entire profit is taxed at 15%, reducing your take-home amount by ₹7500.

- LTCG: If you hold for more than a year, the first ₹1 lakh is tax-free. Any profit over ₹1 lakh is taxed at 10%, which translates into a much lower tax liability compared to STCG.

-

Debt Mutual Fund: Imagine a ₹50,000 LTCG on a debt fund investment held for more than 3 years.

- Before April 1, 2023 Investments: Taxed at 20% with indexation, potentially reducing your tax liability.

- After April 1, 2023 Investments: The entire ₹50,000 is added to your taxable income and taxed as per your income tax slab, which could be higher than the previous 20%.

The Bottom Line:

Merely considering the increase in NAV doesn't depict the whole picture. To assess the actual return on your investments, factoring in taxes is crucial. This after-tax NAV perspective helps you make informed decisions based on true investment potential, beyond just the raw NAV figures.

Common Myths About NAV

Don't Be Fooled by the Glitter: Higher NAV Isn't Always Golden

When venturing into the world of mutual funds, it's easy to fall prey to the misconception that a higher NAV automatically translates to a better performing fund. Let's dispel this myth and understand why relative NAV movement is the key factor to consider for potential returns.

NAV: A Reflection, Not a Guarantee:

NAV, or Net Asset Value, simply represents the current market value of all the securities held by a mutual fund scheme divided by the number of outstanding units. A higher NAV indicates a higher collective value of the underlying assets. However, it doesn't necessarily guarantee superior future performance.

Why Higher NAV Isn't Always Best:

Here's why focusing solely on a high NAV can be misleading:

- Entry Point: A high NAV could simply mean you're buying units at a peak price. While the fund might have performed well historically, future returns are not guaranteed.

- Fund Age: Older funds naturally accumulate a higher NAV due to reinvested earnings over time. However, a younger fund with a lower NAV might have the potential for higher growth if it's invested in promising companies.

Relative Movement Matters:

Instead of getting fixated on a high NAV, what truly matters is the relative movement of the NAV over time. Here's what to consider:

- NAV Appreciation: Look for a consistent upward trend in the NAV over a reasonable period (ideally, several years). This indicates the fund's ability to generate value for investors.

- Comparison with Peers: Compare the NAV movement of your chosen fund with similar funds within the same category. Consistent outperformance relative to peers is a good sign.

Fundamental Analysis Matters More:

Beyond NAV, focus on a fund's underlying fundamentals. Consider factors like:

- Investment Strategy: Align your investment goals with the fund's strategy (growth, value, income-oriented, etc.)

- Expense Ratio: Lower expense ratios translate to higher potential returns for you.

- Fund Management: Research the fund manager's track record and investment philosophy.

The Takeaway:

A higher NAV can be attractive, but it shouldn't be the sole deciding factor when choosing a mutual fund. Look beyond the surface and focus on the NAV's upward trajectory, compare it with peers, and prioritize the fund's overall investment strategy and management. Remember, consistent and sustainable growth in NAV over time is a more reliable indicator of a potentially well-performing fund.

NAV: A Snapshot, Not a Crystal Ball

While NAV is a vital indicator of a mutual fund's health, it's essential to remember that it represents the fund's value at a specific point in time. It does not guarantee future returns. Let's understand why and explore the external factors that can influence NAV.

NAV: A Measure of Current Value

Think of NAV like a photograph. It captures the worth of a mutual fund's underlying assets at a given moment but doesn't reveal what lies ahead. Here's why considering NAV as a sole predictor of future performance can be misleading:

- Market Volatility: The stock market experiences upswings and downturns, which directly impact the value of a fund's holdings and ultimately its NAV. A high NAV today could be followed by a dip tomorrow due to market fluctuations beyond the fund's control.

- Company-Specific Changes: Even within a well-performing fund, the value of individual companies held by the fund can fluctuate due to factors like earnings reports, management changes, industry disruptions, and more. These individual changes impact the overall NAV.

External Factors Influencing Market and NAV

Several external, often unpredictable, factors can influence market conditions, which then impacts the collective value of assets held by a mutual fund and, in turn, the NAV:

- Economic Conditions: Broad economic factors like interest rates, inflation, and GDP growth directly influence business profitability and investor sentiment, shaping stock market trends.

- Geopolitical Events: Events like wars, trade disputes, and political turmoil can create uncertainty and volatility in the market, impacting stock prices.

- Sector-Specific Trends: Global and domestic developments can drive entire sectors (like technology, pharmaceuticals, or energy) up or down, significantly impacting funds with exposure to particular sectors.

- Investor Sentiment: Driven by news, economic forecasts, and other factors, investor sentiment (bullish or bearish) can impact overall market movements and, subsequently, the NAV of mutual funds.

The Importance of Perspective

NAV is a valuable metric, but it needs to be interpreted in context. Instead of viewing it as a promise of returns:

- Focus on Long-term Trends: Examine the fund's NAV movement over several years. A consistently upward trend is a more reliable indicator than a single day's high NAV.

- Analyze Alongside Other Factors: Consider the fund's investment strategy, historical performance, expense ratio, and the broader economic landscape to get a comprehensive picture of its potential.

Investing Wisely: Beyond Just NAV

While NAV is a critical metric, it shouldn't be the sole factor driving your investment decisions. Here are some additional aspects to consider:

- Investment Objective and Risk Tolerance: Clearly define your investment goals (retirement planning, child's education, etc.) and risk tolerance (how comfortable are you with potential losses?). Align your mutual fund selection with these factors.

- Fund Management: Research the fund manager's track record, investment philosophy, and experience. A skilled manager can significantly impact the fund's performance.

- Expense Ratio: This fee, charged by the AMC, covers fund management and operational costs. Opt for funds with a lower expense ratio, as it directly affects your returns.

- Diversification: Spread your investments across different asset classes and fund categories to mitigate risk. A well-diversified portfolio reduces the impact of volatility in any single asset class.

- Investment Horizon: Consider your investment timeframe. Equity funds are better suited for long-term goals, while debt funds can be appropriate for shorter horizons.

Practical Applications of NAV: Making Informed Choices

Here are some practical ways to leverage NAV for informed investment decisions:

- Compare NAVs of Similar Funds: Use online platforms or financial advisors to compare the NAVs of different mutual funds within the same category. This can help you choose a scheme with a better historical performance, keeping in mind past performance is not indicative of future results.

- Track NAV Movement Over Time: Monitor the long-term NAV trend of your chosen mutual fund. A consistent upward trajectory generally indicates a well-performing scheme.

- Calculate Potential Returns: By analyzing past NAV movements and expense ratio, you can make an educated guess about potential returns, though remember this is not a guaranteed outcome.

NAV and Investor Psychology: Avoiding Common Pitfalls

Investing in mutual funds requires a disciplined approach. Here's how NAV can influence investor behavior and how to navigate these situations:

- Panic Selling: Don't rush to redeem your units based on short-term NAV fluctuations, especially in equity funds. Remember, market volatility is inevitable. Stay focused on your long-term investment goals.

- NAV Chasing: Chasing funds with the highest recent NAV can be risky. Focus on the overall portfolio strategy and asset allocation, not just short-term performance surges.

Conclusion: NAV - A Guiding Light in Your Investment Journey

By understanding NAV and its role in mutual fund performance, you can become a more informed and confident investor. Remember, NAV is just one piece of the puzzle. Use it alongside other factors to make sound investment decisions that align with your financial goals and risk tolerance. Invest wisely, stay disciplined, and let NAV be your guiding light on the path to achieving your financial aspirations.

Additional Tips for Indian Investors:

- Utilize online resources provided by SEBI (Securities and Exchange Board of India) and AMCs to access detailed information about mutual fund schemes and their NAVs.

- Consider consulting a registered financial advisor who can personalize your investment strategy based on your unique financial situation.

- Remember, investing is a marathon, not a sprint. Stay patient, disciplined, and focus on your long-term goals.

By incorporating these insights, you can navigate the world of mutual funds with greater confidence and achieve your financial objectives in the dynamic Indian market.

Disclaimer: The information contained in this article is for general informational purposes only and should not be construed as professional financial advice. It does not take into account your specific investment objectives, financial situation, or personal needs. Before making any investment decisions based on this information, it's strongly recommended that you consult with a SEBI-registered financial advisor for personalized guidance. The author and publisher of this article disclaim any liability for losses or damages resulting from actions taken in reliance on this content.

What's Your Reaction?