Top Investment Platforms in India for Beginners: Taking Your First Steps Towards Financial Freedom

Get started with investing in India! This guide covers top investment platforms like Zerodha, Upstox, Groww, Paytm Money, and more, explains fees, KYC, and helps you choose the best platform for your first steps.

Welcome to the exciting world of investing! As an Indian citizen, you have a wealth of opportunities to grow your money and achieve your financial goals. But for beginners, navigating the investment landscape can be daunting. With so many platforms and investment options available, choosing the right one can feel overwhelming.

This article is your one-stop guide to the top investment platforms in India for beginners. We'll explore the features, benefits, and considerations for each platform, helping you make an informed decision as you embark on your investment journey.

Understanding Investment Platforms:

Before diving into specific platforms, let's understand what an investment platform is and the different types available in India.

- Investment platforms are online portals or mobile applications that allow you to buy and sell various investment instruments like stocks, mutual funds, Exchange Traded Funds (ETFs), and more. These platforms connect you to the stock exchanges and provide tools for managing your portfolio.

Types of Investment Platforms in India:

-

Discount Brokers: These brokers offer a low-cost way to trade stocks and other assets. They typically charge a flat fee per trade or a commission based on the trade value. Discount brokers are ideal for beginners who plan to actively trade and have some understanding of the markets.

-

Full-Service Brokers: These traditional brokers provide personalized investment advice, research reports, and portfolio management services. They charge higher fees compared to discount brokers but offer a more hand-holding experience.

-

Robo-advisors: These are automated investment platforms that use algorithms to create and manage your portfolio based on your risk tolerance and financial goals. Robo-advisors are a good option for beginners who want a simple, hands-off investing approach.

Top Investment Platforms for Beginners in India:

Now, let's delve into some of the most popular and beginner-friendly investment platforms in India:

1. Zerodha:

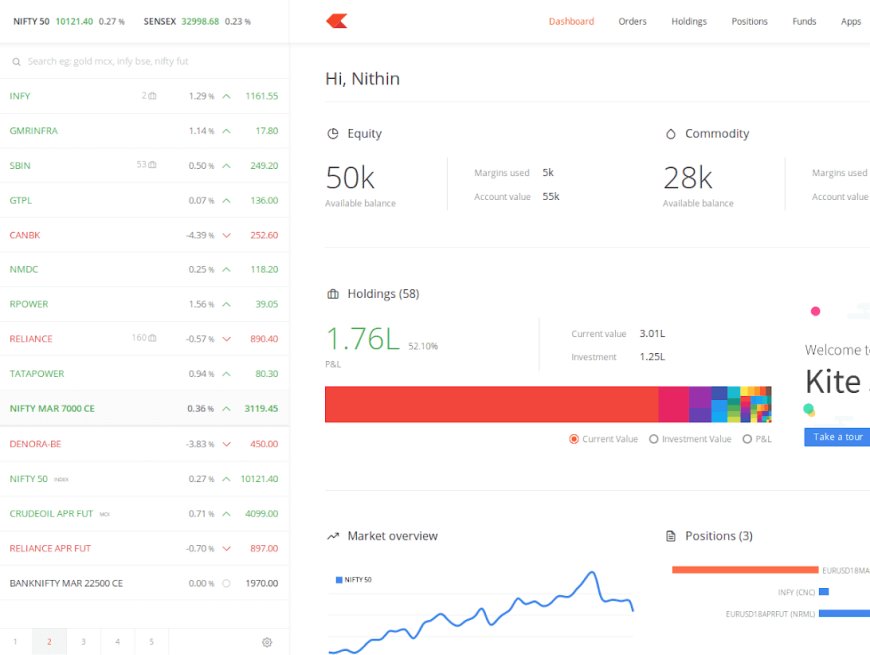

Zerodha is a leading discount broker in India, renowned for its user-friendly platform, Zerodha Kite. Kite offers a sleek interface, advanced charting tools, and in-depth market data. Zerodha charges a flat brokerage fee of Rs. 20 per trade, regardless of the trade value, making it cost-effective for beginners. They also offer educational resources and webinars to help you learn the ropes of investing.

Pros:

- User-friendly platform

- Low brokerage fees

- Educational resources

Cons:

- Limited research and advisory services

- Focuses primarily on active trading

2. Upstox:

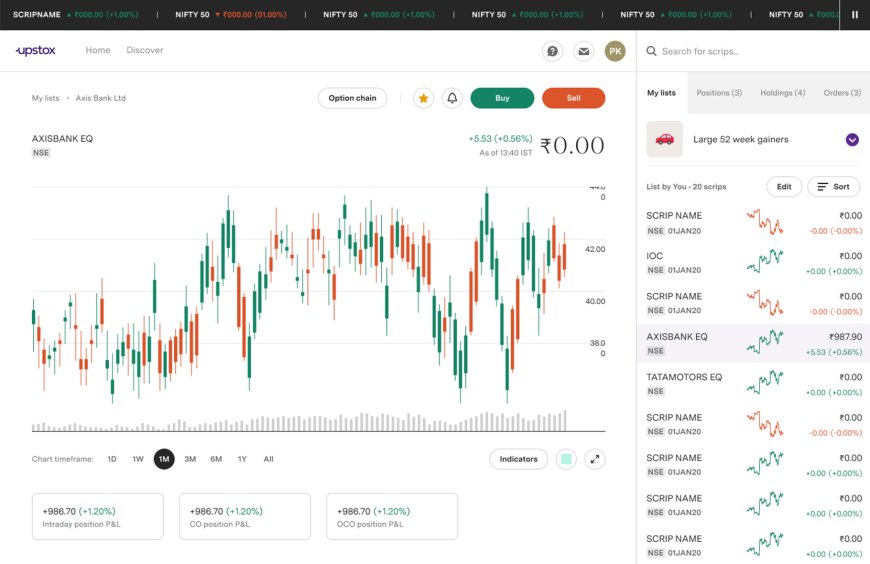

Upstox is another popular discount broker known for its intuitive mobile app and user-friendly web platform. They offer a variety of investment options, including stocks, mutual funds, and ETFs. Upstox charges a flat brokerage fee structure similar to Zerodha, making it cost-competitive for beginners. They also provide basic research reports and educational content.

Pros:

- User-friendly interface

- Low brokerage fees

- Mobile app for convenient investing

Cons:

- Limited research and advisory services

- Focuses primarily on active trading

3. Groww:

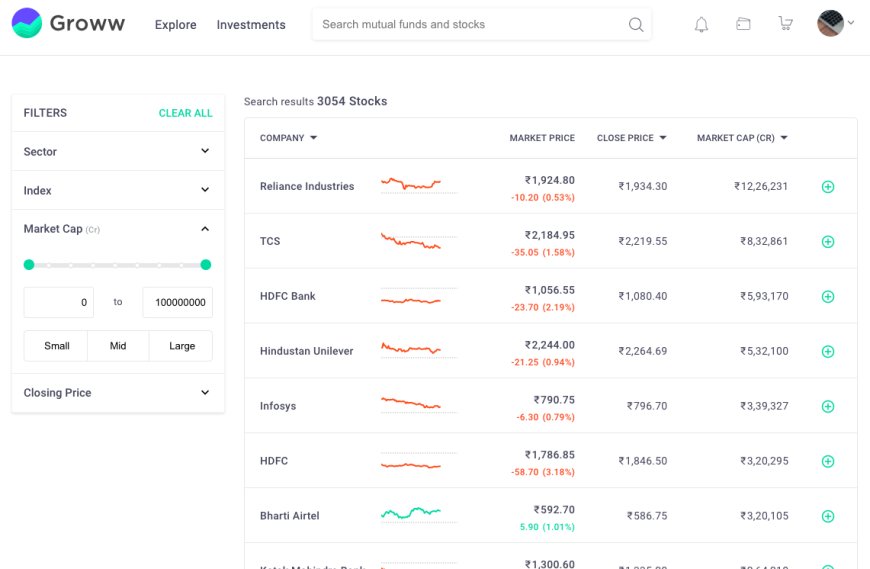

Groww is a unique platform that caters specifically to mutual fund investments. They offer a simple and intuitive interface, allowing you to invest in direct mutual funds (without any commission charges). Groww provides curated mutual fund recommendations based on your risk profile and financial goals. Their platform also offers educational resources to help you understand mutual funds better.

Pros:

- Ideal for mutual fund investing

- Zero commission charges on direct mutual funds

- Simple and user-friendly interface

Cons:

- Limited investment options (primarily mutual funds)

- Doesn't offer stock trading

4. Paytm Money:

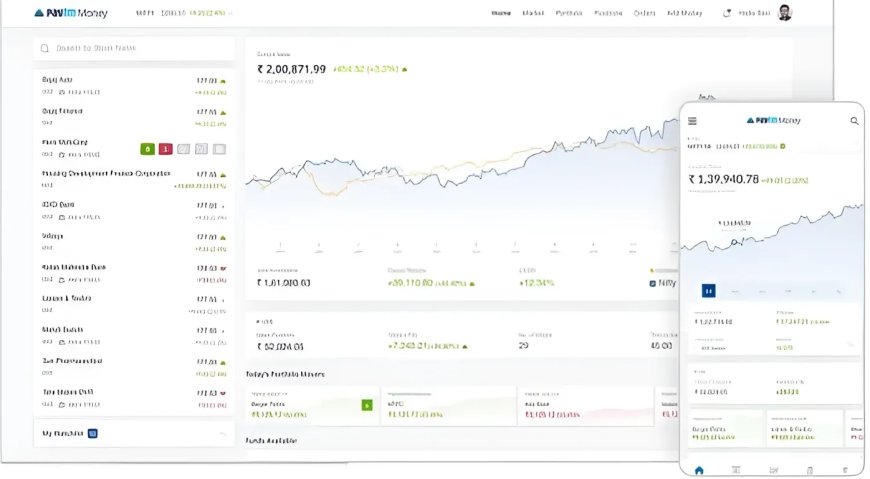

Paytm Money, a subsidiary of the popular digital payments platform Paytm, offers a convenient way to invest in stocks, mutual funds, and digital gold. Their platform is user-friendly and integrates seamlessly with the Paytm wallet, making investing accessible to a wider audience. Paytm Money charges a brokerage fee based on the trade value, which might be slightly higher than discount brokers like Zerodha or Upstox.

Pros:

- Convenient and user-friendly platform

- Integrated with Paytm wallet

- Offers a variety of investment options

Cons:

- Slightly higher brokerage fees compared to discount brokers

- Limited research and analysis tools

ETMONEY:

ETMONEY is a robo-advisor platform backed by The Economic Times. It utilizes algorithms to create personalized investment portfolios based on your risk tolerance and financial goals. ETMONEY offers a completely automated investment experience, making it ideal for beginners who want a hands-off approach. They charge a minimal management fee based on your investment amount.

Pros:

- Automated and hassle-free investing

- Personalized portfolio creation

- Suitable for beginners with limited investment knowledge

Cons:

- Limited control

- Higher fees

- Limited investment options

KYC and Account Opening Process

KYC (Know Your Customer): Your Gateway to Investing

Before diving into the world of investment platforms, you'll encounter KYC (Know Your Customer) requirements. KYC is a mandatory process regulated by SEBI (Securities and Exchange Board of India) to ensure transparency and prevent financial crimes like money laundering.

Here's a breakdown of the KYC process in India:

What Documents Do You Need?

-

Proof of Identity (POI): This verifies who you are. Documents like Aadhaar Card, PAN Card, Voter ID Card, Passport, Driving License (with photo) are typically accepted.

-

Proof of Address (POA): This confirms your residential address. The same documents used for POI can often serve as POA, Alternatively, utility bills (electricity, water), bank account statements, or ration card (with photo) can be used.

How Does KYC Verification Happen?

There are two main methods for KYC verification in India:

-

In-Person Verification (IPV): This traditional method involves visiting a branch office of the investment platform or a registered KYC Registration Agency (KRA). A representative will verify your original documents and capture your photograph and signature.

-

eKYC (electronic KYC): This paperless method leverages Aadhaar for verification. It can be done online or offline:

-

Online eKYC: This method uses OTP (One Time Password) verification or biometric authentication (fingerprint or retina scan) linked to your Aadhaar.

-

Offline eKYC: This method involves using an Aadhaar XML file or scanning the QR code on your Aadhaar card.

-

Benefits of eKYC:

- Faster and more convenient: No need to visit a physical branch.

- Paperless and eco-friendly: Reduces reliance on physical documents.

- Secure: Aadhaar-based verification ensures high security.

Things to Remember:

- Always provide genuine documents during KYC verification.

- KYC is a one-time process for most investment platforms. However, some platforms might require periodic updation of your information (e.g., address change).

-

- Never share your KYC documents or Aadhaar details with anyone you don't trust.

Types of Accounts

1. Demat Account

- Purpose: Think of your Demat account as a digital locker to hold your investments in shares, bonds, ETFs, mutual funds (held in dematerialized form), and government securities.

- How it Works: When you buy shares, they don't come as physical certificates anymore. Instead, they're held electronically within your Demat account.

- Mandate: You must have a Demat account to trade stocks or invest in other dematerialized securities in India.

- Providers: Depository Participants (DPs) such as banks, brokers, or dedicated financial institutions are authorized to offer Demat accounts.

2. Trading Account

- Purpose: Your Trading account acts as the link between your Demat account and the stock exchanges (like NSE and BSE). It's where you place buy and sell orders for stocks or other securities.

- How it Works: When you execute a 'buy' order, the shares are transferred to your Demat account. When you 'sell', the shares move out of your Demat.

- Mandate: A Trading account is needed in conjunction with a Demat account if you wish to trade in stocks.

- Providers: Stockbrokers (both full-service and discount brokers) typically offer Trading accounts.

3. 3-in-1 Account

- Convenience: Several brokers offer 3-in-1 accounts, combining a Demat account, a Trading account, and your linked bank account into one streamlined package.

- Benefit: Seamless transfer of funds for trading and smooth settlement of trades.

Additional Points to Consider

- Account Charges: Different providers have varying account opening fees and annual maintenance charges (AMC) for Demat and Trading accounts.

-

- Other Account Types: Some platforms may offer special accounts like NRI (Non-Resident Indian) Demat accounts and specific accounts for commodity trading.

Typical Account Opening Process on Investment Platforms

-

Choosing Your Platform: Research the platforms discussed earlier (Zerodha, Upstox, Groww, etc.) and choose one that best suits your needs.

-

Visit the Website or App: Go to the official website of the platform or download their mobile app.

-

Initiate Signup: Locate the "Sign Up", "Open an Account", or similar button.

-

Basic Details: Provide your name, email address, mobile number, and usually your PAN card number (for mandatory KYC linking).

-

KYC Verification:

- eKYC: If available, opt for the eKYC method for a fast and paperless process using your Aadhaar.

- In-Person: If eKYC is not supported or you prefer in-person verification, you may be directed to schedule an appointment for IPV.

-

Bank Account Linking: Provide your bank account details (account number, IFSC code) that will be linked to your investment account for funding and withdrawals.

-

Additional Information: The platform may ask for information like your occupation, annual income, and investment experience.

-

Document Upload: If you didn't use eKYC, you might be asked to upload scanned copies or photographs of KYC documents (POI, POA).

-

Review and Submission: Carefully review all the provided details before submitting your application.

-

Account Verification: The platform will review your information and documents. This process can take a few hours to a few days.

-

Account Activation: Once approved, you'll receive your account credentials (user ID and password) typically via email or SMS.

Things to Remember:

- Platform Differences: Some platforms may ask you to sign forms (digitally or physically) or may have slightly different steps in their process.

- Guidance: Most platforms offer clear walkthroughs on their websites or apps. If unsure, don't hesitate to reach out to their customer support.

-

- Account Opening Charges: Some platforms might have a one-time account opening charge.

Understanding Fees and Charges of Top Platforms

Investment Platform Fee Comparison

| Platform | Account Opening Fee | Annual Maintenance Charge (AMC) | Brokerage Fees (Equity) | Account Inactivity Fee | Demat Account AMC | Trading Account AMC | Other Potential Fees |

|---|---|---|---|---|---|---|---|

| Zerodha | ₹200 | ₹300 | ₹20 per trade or 0.03% (whichever is lower) | - | ₹0 | ₹300 | Account reactivation fee (if inactive for over a year) |

| Upstox | ₹299 (one-time) | ₹25 per month | ₹20 per trade or 0.05% (whichever is lower) | ₹50 per quarter (if inactive for over a quarter) | ₹0 | ₹0 | Account reactivation fee (if inactive for over a year) |

| Groww | Free | Free | Direct Mutual Funds: Free | - | ₹0 | ₹0 | Account closure charges (applicable if closed within a year of opening) |

| Paytm Money | Free | Free | Equity Delivery: Free | ₹100 per quarter (if inactive for over a quarter) | - | ₹0 | Account reactivation fee (if inactive for over a year) |

| ETMONEY | Free | Free (for investment amount up to ₹1 lakh) | Not applicable (robo-advisor platform) | - | - | - | Management fee (0.5% to 1% based on investment amount) |

Notes:

- This table is for informational purposes only and fees may change. Please refer to the official websites of the platforms for the latest fee structures.

- Brokerage fees are typically per executed trade. Some platforms might have different fee structures for other asset classes like derivatives or commodities.

- Account inactivity fees are charged if your account is not used for a specific period.

- Some platforms might have additional fees for services like account statement requests, margin funding, or contract notes.

Key Takeaways:

- Discount brokers (Zerodha, Upstox) generally offer the lowest brokerage fees, making them suitable for active traders.

- Groww stands out for offering free direct mutual fund investments.

- Robo-advisor platforms like ETMONEY charge a management fee instead of brokerage fees.

-

- Carefully consider all potential fees when choosing an investment platform.

Hidden Charges

-

DP Transaction Charges (Debenture Position Charges): Every time you sell shares from your Demat account, you may incur a DP transaction charge. This is levied by the Depository Participant (DP), not the broker. The charges vary between DPs and might be per transaction or on a per scrip (per stock/ETF) basis.

-

Call and Trade Charges: Some brokers charge a fee if you place orders through their telephone helpline instead of through the online platform or app. These charges can be significant, especially if you rely on this method frequently.

-

Pledge/Unpledge Charges: If you take a loan against your shares (margin funding), you may incur charges for pledging your shares as collateral and then again for un-pledging them when you repay the loan.

-

Auto-Square Off Charges: Many brokers auto-square off your trading positions at a specific time of day if you have insufficient funds to meet margin requirements. This might attract penalty charges.

-

STT (Securities Transaction Tax): While STT is not a broker-levied fee, it's a government tax on both buying and selling transactions on stock exchanges. It's important to factor this into your overall trading cost.

-

Account Modification Charges: Some platforms may charge you to change details like your address, linked bank account, or nominee information on your Demat and trading accounts.

-

Delayed Payment Charges: If you fail to pay for shares you've bought, or you don't maintain sufficient margin ratios, you may incur penalties.

How to Uncover Hidden Fees

- Scrutinize Fee Schedules: Read the platform's fee schedules carefully. These are often in fine print in the terms and conditions.

- Enquire with Customer Support: Ask directly about fees for specific scenarios (margin-related charges, pledging, etc.), instead of just focusing on the main brokerage plan advertised.

-

- Community Forums: Search online forums where users discuss their experiences with different platforms. They might expose less-publicized fees.

Research and Analysis Tools Offered by Top Platforms

Types of Research Reports

-

Company-Specific Reports

- Initiation Coverage Reports: Detailed analysis when an analyst or brokerage firm starts coverage of a particular stock.

- Earnings Updates: Reports released after quarterly or annual financial results, analyzing the company's performance and updates to outlook.

- Event-Driven Reports: Analysis centered around specific events affecting the company (e.g., mergers, product launches, regulatory changes).

- In-Depth Company Analysis: Comprehensive reports delving into the company's business model, financials, competitive landscape, future prospects, and valuation metrics.

-

Sector-Based Reports

- Industry Overviews: Broader reports on trends, challenges, and opportunities within a specific industry sector (e.g., Technology, Pharmaceuticals, Automobiles).

- Comparative Analysis: Reports comparing key players within a sector, highlighting performance metrics, strengths, and weaknesses.

-

Economic and Market Reports

- Macroeconomic Analysis: Reports focusing on macro trends like GDP growth, inflation, interest rates, and their potential impact on the markets.

- Market Outlook: Periodic reports providing insights on market trends, sector performance, and potential investment ideas.

Which Platforms Offer Research Reports?

- Full-Service Brokers: Platforms like Motilal Oswal, ICICI Direct, Sharekhan are known for robust research offerings, providing a wide array of the reports mentioned above.

- Discount Brokers: Zerodha and Upstox offer basic research resources like fundamental company data and sometimes market news, but they may not have the same depth of analyst-generated reports.

-

- Specialized Platforms: Some platforms might specialize in certain types of reports. For example, trading platforms focused on derivatives may offer technical analysis reports.

Stock Screeners

Stock screeners are powerful tools on investment platforms that help you narrow down your choices and identify potential investment opportunities based on specific criteria. Imagine them as filters you apply to a vast pool of stocks, allowing you to focus on those that meet your investment goals and risk tolerance.

Here's how beginners can leverage stock screeners effectively:

Understanding Stock Screeners:

- Customization: Most screeners provide a range of filters, allowing you to search by market capitalization (large-cap, mid-cap, small-cap), price-to-earnings ratio (P/E), debt-to-equity ratio, dividend yield, and many more.

- Fundamental vs. Technical Filters:

- Fundamental Filters: These focus on a company's financial health, profitability, and growth potential (e.g., P/E ratio, return on equity (ROE), sales growth).

- Technical Filters: These analyze historical price and volume data to identify potential trading opportunities based on technical indicators (e.g., moving averages, relative strength index (RSI)). While beginners might not be familiar with technical analysis yet, some basic technical filters can be helpful.

Getting Started with Stock Screeners:

-

Define Your Criteria: Before using a screener, determine what you're looking for in a stock. What's your investment horizon? What level of risk are you comfortable with? What sectors interest you?

-

Choose Relevant Filters: Use a combination of fundamental filters that align with your investment goals. For example, if you prioritize long-term growth, focus on filters like P/E ratio, ROE, and sales growth.

-

Refine Your Results: Don't expect the screener to give you a magic list. Start with broad filters and gradually refine them based on the number of results you get.

-

-

Don't Rely Solely on the Screener: The screener is a starting point. Always research the shortlisted companies further by reading analyst reports, company news, and financial statements.

-

Additional Tips for Beginners:

- Start Simple: Don't overwhelm yourself with too many filters at once. Begin with a few basic filters and gradually add complexity as you gain experience.

- Focus on Fundamentals: For long-term investing, fundamental analysis is more important than technical analysis for beginners.

- Look Beyond Ratios: Don't just rely on ratios blindly. Understand what each ratio signifies and interpret it in the context of the company's industry and overall market conditions.

-

- Use Multiple Screeners: Different platforms have different screener functionalities. Try screeners on various platforms to get a wider range of potential investment ideas.

Charting Tools

Technical Chart Analysis: A Brief Overview

-

Premise: Unlike fundamental analysis, which focuses on a company's financial health, technical analysis examines historical price and volume data to uncover potential trading patterns and predict future price movements.

-

Chart Types:

- Line Chart: The simplest chart, connecting closing prices over time.

- Candlestick Chart: Popular among traders, each candlestick represents the open, high, low, and close prices for a specific period.

- Bar Chart: Similar to candlestick charts, but less visually focused.

-

Technical Indicators: These are mathematical calculations derived from price and volume data. They are overlaid on charts to help identify trends, momentum, and potential buy or sell signals.

Common Types of Technical Indicators

-

Trend Indicators:

- Moving Averages (MA): Simple Moving Average (SMA) or Exponential Moving Average (EMA) smooth out price fluctuations to identify the underlying trend.

- Bollinger Bands: These bands set around the moving average show volatility levels.

-

Momentum Indicators:

- Relative Strength Index (RSI): Measures the strength of recent price changes and indicates potential overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Helps identify changes in trend direction and momentum.

-

Volume Indicators:

- On-Balance Volume (OBV): Uses volume to confirm uptrends or downtrends.

Where to Find Charting Tools

- Discount Brokers: Platforms like Zerodha (Kite) and Upstox offer advanced charting tools with various technical indicators.

- Specialized Trading Platforms: Some platforms cater specifically to technical analysis, offering a vast array of technical indicators and customizable charts.

- Third-Party Charting Tools: Websites like TradingView offer highly advanced charting possibilities, though they might involve additional costs.

How Beginners Can Use Charting Tools

- Identify Trends: Use moving averages or trend lines to recognize overall market or stock direction (uptrend, downtrend, or sideways).

- Spot Potential Reversals: Look for bullish or bearish chart patterns or divergences between price and indicators.

- Entry and Exit Points: Indicators like RSI and MACD can aid in timing your trades.

-

- Confirm Fundamental Analysis: Use technical analysis alongside your fundamental research. For example, if a stock looks strong fundamentally, check if technical indicators support an upward trend.

Quick Reference: Final Comparison of Key Features

Here's a comparison table highlighting key features of the platforms we've discussed, providing a quick overview for beginners:

| Feature | Zerodha | Upstox | Groww | Paytm Money | ETMONEY |

|---|---|---|---|---|---|

| Platform Type | Discount Broker | Discount Broker | Mutual Fund Specialist | Discount Broker | Robo-advisor |

| Brokerage - Intraday/Delivery | ₹20 or 0.03% per trade | ₹20 or 0.05% per trade | Zero (Direct MF) | Free (Delivery), ₹10 (Intraday) | - |

| AMC | ₹300 per year | ₹25 per month | Free | ₹0 | Free (up to ₹1 lakh invested) |

| Demat Account AMC | ₹0 | ₹0 | ₹0 | - | - |

| Research Tools | Limited | Basic | None | Basic | Algorithm-driven |

| User Interface | Advanced (Kite) | Modern | Simple | User-friendly | Simple |

| Investment Options | Stocks, ETFs, Derivatives | Stocks, ETFs, Derivatives | Mutual Funds | Stocks, Mutual Funds, Gold | Mutual Funds, ETFs |

Additional Considerations for Beginners:

Choosing the right investment platform is crucial, but it's just one piece of the puzzle. Here are some additional considerations for beginners venturing into the investment world:

- Investment goals: Define your investment goals clearly. Are you saving for retirement, a down payment on a house, or a child's education? Different goals require different investment strategies and time horizons.

- Risk tolerance: How comfortable are you with potential losses? Understanding your risk tolerance will help you choose the right investment mix. Beginners might want to start with low-risk options like mutual funds or ETFs before venturing into high-risk assets like individual stocks.

- Investment horizon: How long do you plan to invest your money? Long-term goals allow for more aggressive investment strategies, while short-term goals might require more conservative options.

- Diversification: Don't put all your eggs in one basket. Spread your investments across different asset classes like stocks, bonds, and real estate to minimize risk.

- Discipline and patience: Investing is a marathon, not a sprint. Develop a disciplined approach and be patient, as your investments may experience fluctuations in the short term.

Getting Started with Investing:

Once you've chosen your platform and considered your investment goals and risk tolerance, it's time to take action! Here are some steps to get you started:

- Open an investment account: This process is usually straightforward on the chosen platform's website or app.

- Fund your account: Transfer money from your bank account to your investment account.

- Explore investment options: Research different investment options available on the platform, considering your goals and risk tolerance.

- Start investing: Begin investing based on your chosen strategy. Most platforms offer tools to help you build your portfolio.

- Review and monitor: Regularly review your portfolio performance and rebalance as needed to maintain your desired asset allocation.

Remember:

Investing involves inherent risks. Always do your own research before making any investment decisions. Consider consulting with a financial advisor if you need personalized guidance.

Conclusion:

Taking the first step towards financial freedom through investing can be empowering. By choosing the right platform, understanding your investment goals and risk tolerance, and practicing discipline, you can embark on a rewarding investment journey. The platforms mentioned above provide a solid foundation for beginners in India.

Disclaimer: Investing in securities involves risks, including the potential for loss of principal. The information provided in this article is for educational purposes only and does not constitute investment advice. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher of this article are not liable for any losses or damages arising from the use of this information.

What's Your Reaction?