Decoding the Language of Charts: Mastering Stock Market Chart Patterns for Profitable Trading in India

Decode the secrets hidden in price charts! Learn how to identify bullish & bearish chart patterns like triangles, flags, wedges, head & shoulders, and more. Apply technical analysis skills to the Indian stock market and improve your trading decisions.

In the dynamic world of the Indian stock market, chart patterns are like secret messages hidden in plain sight. These visual formations on price charts can reveal valuable insights into the future direction of stock prices, potentially offering a significant edge to traders and investors alike. Understanding and interpreting these patterns can be the key to unlocking profitable trading opportunities. This comprehensive guide will delve into the world of stock market chart patterns, equipping you with the knowledge to decipher these cryptic messages and elevate your trading game.

The Power of Chart Patterns: Unveiling Market Psychology

Chart patterns are more than just pretty shapes on a graph; they are visual manifestations of human behavior and market psychology. These patterns emerge as traders and investors collectively react to news, events, and economic shifts, creating predictable price movements that can be anticipated and exploited. In essence, chart patterns offer a window into the collective mind of the market.

Why Chart Patterns Work:

-

Self-Fulfilling Prophecies: Chart patterns often become self-fulfilling prophecies. When traders recognize a familiar pattern, they may adjust their positions accordingly, reinforcing the pattern and driving prices in the expected direction.

-

Recurring Market Cycles: Markets tend to move in cycles, oscillating between periods of optimism and pessimism. Chart patterns reflect these cycles, providing clues about where the market might be in its current cycle and where it might be headed.

-

Support and Resistance: Key levels of support and resistance are often evident in chart patterns. These levels represent price points where buying or selling pressure is likely to intensify, creating potential turning points or breakouts.

-

Visual Representation of Trends: Chart patterns help traders visualize the underlying trend of a stock or index. Uptrends, downtrends, and sideways movements are often clearly defined within these patterns, aiding in decision-making.

Unlocking Profitable Opportunities:

By recognizing and understanding chart patterns, traders can:

- Anticipate Trend Reversals: Identify potential turning points where a trend is likely to change direction.

- Confirm Trend Continuations: Validate the strength of an existing trend and ride it for potential profits.

- Identify Breakout Opportunities: Spot potential breakouts from consolidation patterns, where prices are likely to move sharply in one direction.

- Set Entry and Exit Points: Determine optimal entry and exit points based on the expected movement of prices within a pattern.

Continuation Patterns: Riding the Wave of Momentum

Triangles

1. Ascending Triangle: The Bullish Harbinger of Breakouts

The ascending triangle is a classic chart pattern that often signals an impending surge in prices. It's a bullish continuation pattern, meaning it typically occurs within an existing uptrend and suggests that the upward momentum is likely to persist.

Formation and Structure:

The ascending triangle is formed by:

-

Horizontal Resistance Line: This line connects a series of swing highs, where the price has struggled to break through repeatedly. It acts as a ceiling, preventing prices from rising further.

-

Rising Support Line: This line connects a series of higher lows, demonstrating that buyers are gradually stepping in at higher prices, even as the price struggles to break the resistance level.

The two lines converge to form a triangle shape, with the price action consolidating within this narrowing range. The key characteristic of an ascending triangle is that the support line is ascending, while the resistance line remains horizontal.

Psychology Behind the Pattern:

The ascending triangle reflects a battle between buyers and sellers. The horizontal resistance line shows that sellers are reluctant to let prices rise beyond a certain level. However, the rising support line indicates that buyers are becoming increasingly aggressive, willing to buy at higher and higher prices. This suggests that buying pressure is building up, and a breakout above the resistance level is becoming more likely.

Trading the Ascending Triangle:

-

Entry: Many traders wait for a breakout above the resistance level with increased volume before entering a long position. This confirmation helps to filter out false breakouts.

-

Stop-Loss: A stop-loss order can be placed below the most recent swing low or below the support line to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the triangle (the distance between the resistance line and the support line at the widest point) and projecting it upwards from the breakout point.

Key Points to Remember:

- Volume: A breakout on high volume adds credibility to the pattern and increases the likelihood of a successful trade.

- False Breakouts: Be cautious of false breakouts, where the price briefly exceeds the resistance level but then falls back within the triangle.

- Alternative Scenarios: In rare cases, the ascending triangle can turn into a reversal pattern if the price breaks down below the support line.

Example in Indian Markets:

The ascending triangle pattern can be found in various Indian stocks and indices. For instance, you might observe this pattern forming in a stock that is consolidating after a strong uptrend. The stock may be experiencing a pause as buyers and sellers battle for control, but the ascending triangle suggests that buyers are likely to win out in the end, leading to a potential breakout to the upside.

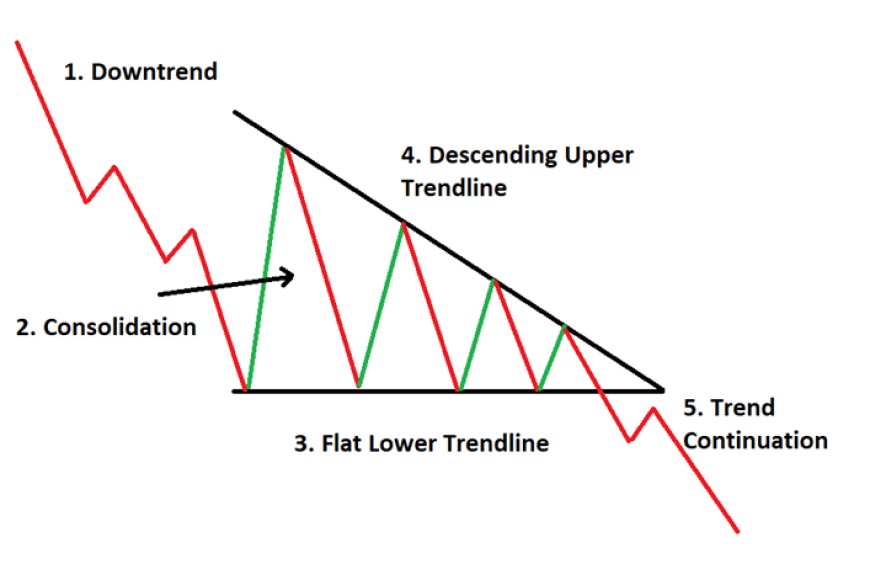

2. Descending Triangle: The Bearish Omen of Breakdowns

The descending triangle is a chart pattern that often foreshadows a decline in prices. It's a bearish continuation pattern, typically appearing during a downtrend and signaling that the downward momentum is likely to persist.

Formation and Structure:

The descending triangle is characterized by:

-

Falling Resistance Line: This line connects a series of lower highs, illustrating that sellers are increasingly dominating the market and pushing prices lower.

-

Horizontal Support Line: This line connects a series of lows at roughly the same price level, indicating that buyers are attempting to defend a certain price point but are struggling to push prices higher.

As these two lines converge, they create a triangle shape, with price action consolidating within the narrowing range. The descending nature of the resistance line, combined with the horizontal support line, creates the distinctive shape of this bearish pattern.

Psychology Behind the Pattern:

The descending triangle reflects a tug-of-war between buyers and sellers, with sellers gradually gaining the upper hand. The falling resistance line shows that sellers are becoming more aggressive, willing to sell at lower and lower prices. The horizontal support line reveals that buyers are trying to hold the line, but their efforts are waning as they struggle to lift prices above the resistance level. This dynamic suggests that selling pressure is building up, and a breakdown below the support level is increasingly probable.

Trading the Descending Triangle:

-

Entry: Traders often wait for a breakdown below the support level with increased volume to confirm the bearish signal and enter a short position.

-

Stop-Loss: A stop-loss order can be placed above the most recent swing high or above the resistance line to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the triangle (the distance between the resistance line and the support line at the widest point) and projecting it downwards from the breakdown point.

Key Points to Consider:

- Volume: A breakdown on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

- False Breakouts: Be wary of false breakdowns, where the price briefly dips below the support level but then quickly recovers.

- Alternative Scenarios: In some cases, the descending triangle can act as a reversal pattern if the price breaks out above the resistance line. However, this is less common than the bearish continuation scenario.

Example in Indian Markets:

The descending triangle can be found in various Indian stocks and indices, particularly during periods of market weakness or sector-specific downturns. For instance, you might spot this pattern in a stock that is experiencing a series of lower highs and struggling to maintain support. The descending triangle would suggest that further declines are likely, making it a potential short-selling opportunity for traders.

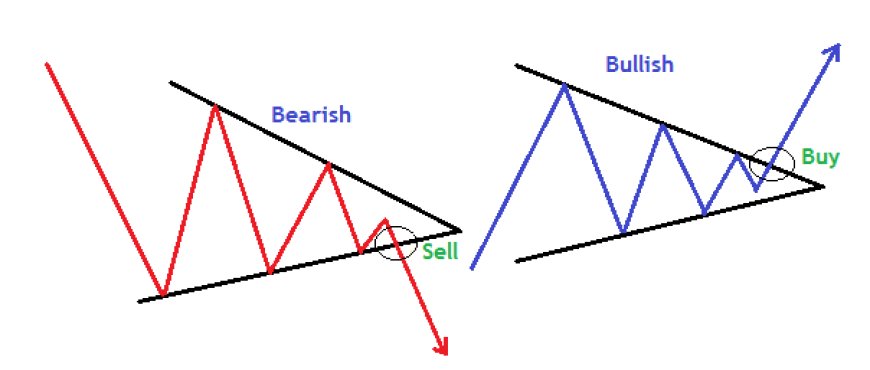

3. Symmetrical Triangle: The Coiled Spring of Market Indecision

The symmetrical triangle, also known as the coil, is a fascinating chart pattern that reflects a period of market indecision. It's a neutral pattern, meaning it doesn't inherently favor bulls or bears. Instead, it signals a period of consolidation where the forces of supply and demand are relatively balanced, creating a state of uncertainty about the future direction of prices.

Formation and Structure:

The symmetrical triangle is characterized by:

-

Converging Support and Resistance Lines: Unlike the ascending or descending triangle, both the support and resistance lines of the symmetrical triangle slope towards each other, forming a triangle shape. The support line connects a series of higher lows, while the resistance line connects a series of lower highs.

-

Decreasing Price Range: As the support and resistance lines converge, the price range within the triangle narrows. This tightening of price action suggests that a breakout is imminent, but the direction remains uncertain.

Psychology Behind the Pattern:

The symmetrical triangle reflects a state of equilibrium in the market. Buyers and sellers are engaged in a tug-of-war, with neither side able to gain a decisive advantage. This period of consolidation often occurs before a significant price move, as traders and investors assess the market's fundamental and technical factors, waiting for a catalyst to tip the balance in one direction or the other.

Trading the Symmetrical Triangle:

-

Waiting for the Breakout: The key to trading the symmetrical triangle is to wait for a breakout. This occurs when the price decisively breaks above the resistance line or below the support line.

-

Confirmation: Traders often look for confirmation of the breakout through increased volume and follow-through price action in the direction of the breakout.

-

Entry: Once the breakout is confirmed, traders can enter a long position if the price breaks above the resistance line, or a short position if the price breaks below the support line.

-

Stop-Loss: A stop-loss order can be placed on the opposite side of the breakout to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the triangle at its widest point and projecting it from the breakout point in the direction of the breakout.

Key Points to Consider:

- Breakout Direction: The direction of the breakout determines the subsequent trend. An upward breakout signals a bullish move, while a downward breakout signals a bearish move.

- False Breakouts: Be cautious of false breakouts, where the price briefly exceeds a trendline but then reverses course. Look for volume confirmation to validate the breakout.

- Volatility Expansion: Symmetrical triangles are often followed by a period of increased volatility after the breakout, as traders rush to establish positions in the new direction.

Example in Indian Markets:

Symmetrical triangles can be found across different timeframes and asset classes in the Indian market. For example, a stock might form a symmetrical triangle during a period of earnings uncertainty or ahead of a major economic announcement. Once the uncertainty is resolved, the stock could break out of the triangle, either upwards or downwards, depending on the nature of the news or event.

Flags and Pennants

1. Bullish Flags and Pennants: Rest Stops on the Road to Higher Prices

Bullish flags and pennants are two distinct yet related chart patterns that share a common theme: they represent brief pauses or consolidation periods within an ongoing uptrend. These patterns are like rest stops along a highway, where the price takes a breather before resuming its upward journey. Traders often view these patterns as opportunities to join the trend and potentially profit from the next leg up.

Bullish Flags: The Rectangular Respite

-

Formation: A bullish flag is characterized by a sharp, almost vertical price increase (the "flagpole") followed by a period of consolidation within a rectangular channel. The channel is formed by two parallel trendlines, with the upper trendline acting as resistance and the lower trendline acting as support.

-

Psychology: The flagpole represents a surge of buying pressure that propels the price higher. The subsequent consolidation period allows the market to "digest" the gains and for latecomers to join the trend.

-

Volume: Volume typically decreases during the consolidation phase and then increases again as the price breaks out of the flag, confirming the continuation of the uptrend.

Bullish Pennants: The Triangular Time-Out

-

Formation: A bullish pennant is similar to a bullish flag, but instead of a rectangular channel, the consolidation period occurs within a symmetrical triangle. The triangle is formed by converging trendlines, with the price range narrowing as the pattern matures.

-

Psychology: Like the flag, the pennant represents a pause in the uptrend as traders take profits and new buyers enter the market. The converging trendlines suggest that a breakout is imminent, but the direction remains uncertain until it occurs.

-

Volume: Volume typically contracts during the consolidation phase of a pennant and then expands as the price breaks out, validating the continuation of the uptrend.

Trading Bullish Flags and Pennants:

-

Identifying the Uptrend: Before considering a flag or pennant pattern, ensure that the underlying trend is indeed bullish. Look for a series of higher highs and higher lows leading up to the pattern's formation.

-

Entry: Wait for the price to break above the upper trendline of the flag or pennant with increased volume. This breakout confirms that the uptrend is resuming.

-

Stop-Loss: Place a stop-loss order below the low of the flagpole or the lower trendline of the pennant to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the flagpole and projecting it upwards from the breakout point.

Key Points to Consider:

-

Reliability: Flags and pennants are generally considered reliable continuation patterns, but false breakouts can occur. Always wait for confirmation before entering a trade.

-

Time Frame: These patterns can occur on various timeframes, from intraday charts to weekly or monthly charts. Adjust your stop-loss and profit target accordingly based on the timeframe you are trading.

-

Combination with Other Indicators: Use flags and pennants in conjunction with other technical indicators, such as moving averages or the Relative Strength Index (RSI), to increase the probability of a successful trade.

Example in Indian Markets:

Indian markets often witness periods of strong upward momentum followed by brief pauses as traders consolidate their positions. Bullish flags and pennants can be found in various sectors and stocks, providing opportunities for traders to capitalize on the continuation of the uptrend.

2. Bearish Flags and Pennants: Pit Stops on the Path to Lower Prices

Bearish flags and pennants are chart patterns that emerge during downtrends, signaling potential continuation of the downward movement. These patterns are characterized by brief pauses or consolidation periods within the broader bearish trend, often resembling flags or pennants on a pole.

Bearish Flags: The Rectangular Retreat

-

Formation: A bearish flag forms after a sharp decline in price (the "flagpole"), followed by a consolidation phase within a rectangular channel. This channel is defined by two parallel trendlines sloping upwards against the prevailing downtrend. The upper trendline acts as resistance, while the lower trendline acts as support.

-

Psychology: The flagpole represents a strong wave of selling pressure that drives prices lower. The subsequent consolidation phase offers a temporary reprieve as some traders take profits, and others try to buy the dip. However, this buying interest is usually not enough to reverse the downtrend.

-

Volume: Volume typically decreases during the consolidation phase and then surges again as the price breaks below the lower trendline, confirming the continuation of the downtrend.

Bearish Pennants: The Triangular Truce

-

Formation: A bearish pennant is similar to a bearish flag, but instead of a rectangular channel, the consolidation takes place within a symmetrical triangle. This triangle is formed by converging trendlines, with the price range narrowing as the pattern progresses.

-

Psychology: Like the bearish flag, the pennant indicates a brief pause in the downtrend as sellers take a breather and buyers attempt to stage a recovery. However, the narrowing price range suggests that the sellers are still in control, and a breakdown below the lower trendline is likely.

-

Volume: Volume tends to contract during the consolidation phase and then expands as the price breaches the lower trendline, validating the continuation of the downtrend.

Trading Bearish Flags and Pennants:

-

Identifying the Downtrend: Before considering a bearish flag or pennant, confirm the presence of a downtrend. Look for a series of lower lows and lower highs leading up to the pattern's formation.

-

Entry: Wait for a breakdown below the lower trendline of the flag or pennant with increased volume. This breakdown confirms that the downtrend is resuming.

-

Stop-Loss: Place a stop-loss order above the high of the flagpole or the upper trendline of the pennant to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the flagpole and projecting it downwards from the breakdown point.

Key Considerations:

- Confirmation: Always wait for confirmation of the breakdown before entering a trade. False breakdowns can occur, leading to losses.

- Time Frame: Bearish flags and pennants can form on different timeframes, from intraday charts to weekly or monthly charts. Adjust your stop-loss and profit target accordingly.

- Combined Analysis: Use these patterns in conjunction with other technical indicators and market analysis for better decision-making.

Example in Indian Markets:

Bearish flags and pennants can be found in various Indian stocks and indices, particularly during periods of market correction or sector-specific downturns. For instance, you might observe this pattern in a stock experiencing a prolonged decline, followed by a brief consolidation before resuming its downward trajectory.

Wedges

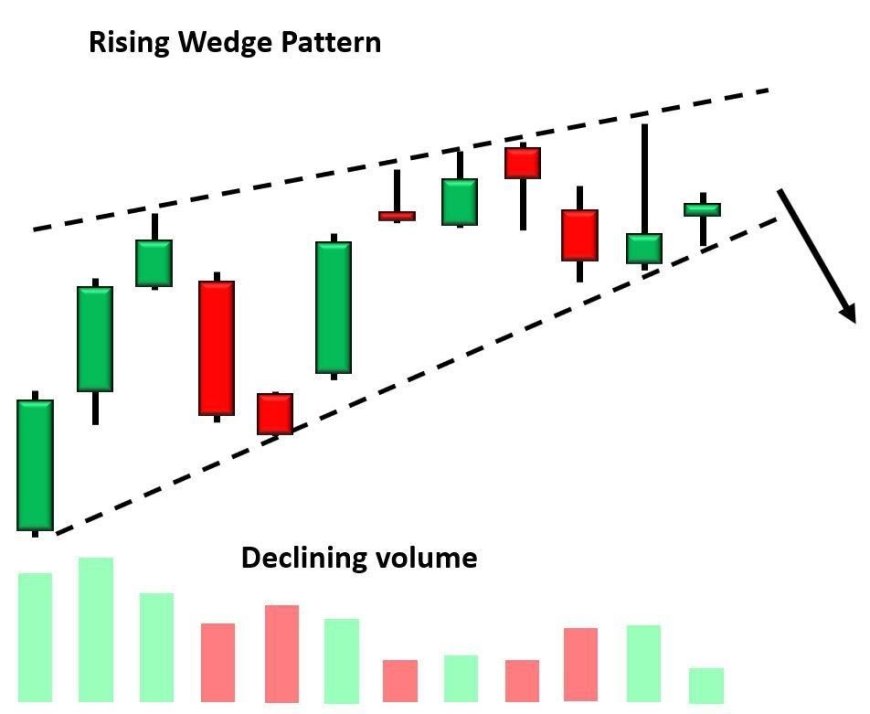

1. Rising Wedge: The Deceptive Climb Towards a Bearish Plunge

The rising wedge is a technical chart pattern that can be quite deceptive. While it appears to be forming during an uptrend, with higher highs and higher lows, it's actually a bearish reversal pattern, signaling a potential shift in momentum and a possible decline in prices.

Formation and Structure:

The rising wedge is characterized by:

-

Converging Trendlines: Two trendlines – a rising support line and a rising resistance line – converge to form a wedge shape. The crucial characteristic here is that the support line is steeper than the resistance line. This means that the price is making higher lows at a faster pace than it's making higher highs.

-

Decreasing Volume: As the wedge progresses, the trading volume typically decreases. This indicates waning buying interest and a loss of upward momentum.

Psychology Behind the Pattern:

The rising wedge reflects a battle between buyers and sellers, but with a subtle shift in power dynamics. Initially, buyers seem to be in control, pushing prices higher. However, the upward movement is becoming increasingly shallow, as indicated by the steeper support line. This suggests that buyers are gradually losing steam, while sellers are becoming more resistant at higher levels.

The decreasing volume further reinforces this notion. As buying interest dwindles, sellers are emboldened, and the likelihood of a downward breakout increases.

Trading the Rising Wedge:

-

Confirmation: Wait for the price to break below the support line with increased volume. This breakdown confirms the bearish reversal and signals a potential entry point for a short position.

-

Stop-Loss: Place a stop-loss order above the recent swing high or above the resistance line to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the wedge at its widest point and projecting it downwards from the breakdown point.

Key Points to Consider:

-

False Breakouts: Be cautious of false breakdowns, where the price briefly dips below the support line but then quickly recovers. Look for volume confirmation to validate the breakdown.

-

Continuation Pattern: In rare cases, a rising wedge can act as a continuation pattern in a downtrend. In this scenario, the price would break below the support line, continue the downtrend, and then potentially bounce back up to retest the resistance line before falling further.

-

Time Frames: Rising wedges can occur on various time frames, from intraday charts to weekly or monthly charts. The longer the timeframe, the more significant the potential reversal.

Example in Indian Markets:

Rising wedges can be found in various Indian stocks and indices, particularly during periods of market exuberance or when a stock has experienced a rapid run-up. For instance, a stock that has been rising steadily for several weeks or months might start forming a rising wedge as buyers become less enthusiastic and sellers start to exert pressure. This could signal a potential reversal, offering an opportunity for traders to enter short positions and profit from the expected decline.

2. Falling Wedge: The Bear Trap Signaling a Bullish Rebound

The falling wedge is a compelling chart pattern that often signifies a potential reversal in a downtrend. It's a bullish reversal pattern, meaning it typically occurs during a downtrend and suggests that the downward momentum is weakening, paving the way for a potential upward price movement.

Formation and Structure:

The falling wedge is characterized by:

-

Converging Trendlines: Two trendlines – a falling support line and a falling resistance line – converge to form a wedge shape. The crucial characteristic here is that the resistance line is steeper than the support line. This implies that the price is making lower highs at a faster pace than it's making lower lows.

-

Decreasing Volume: As the wedge progresses, trading volume typically decreases. This signals waning selling pressure and a loss of downward momentum.

Psychology Behind the Pattern:

The falling wedge represents a battle between buyers and sellers, but with a subtle shift in power dynamics. Initially, sellers appear to be in control, pushing prices lower. However, the downward movement is becoming increasingly shallow, as indicated by the steeper resistance line. This suggests that sellers are gradually losing steam, while buyers are becoming more resilient at lower levels.

The decreasing volume further reinforces this notion. As selling pressure diminishes, buyers are emboldened, and the likelihood of an upward breakout increases.

Trading the Falling Wedge:

-

Confirmation: Wait for the price to break above the resistance line with increased volume. This breakout confirms the bullish reversal and signals a potential entry point for a long position.

-

Stop-Loss: Place a stop-loss order below the recent swing low or below the support line to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the wedge at its widest point and projecting it upwards from the breakout point.

Key Points to Consider:

-

False Breakouts: Be cautious of false breakouts, where the price briefly exceeds the resistance line but then falls back within the wedge. Look for volume confirmation to validate the breakout.

-

Continuation Pattern: In some instances, a falling wedge can act as a continuation pattern in an uptrend. In this scenario, the price would break above the resistance line, continue the uptrend, and then potentially pull back to retest the support line before rising further.

-

Time Frames: Falling wedges can occur on various time frames, from intraday charts to weekly or monthly charts. The longer the timeframe, the more significant the potential reversal.

Example in Indian Markets:

Falling wedges can be found in various Indian stocks and indices, particularly during periods of market pessimism or when a stock has experienced a sharp decline. For instance, a stock that has been falling consistently might start forming a falling wedge as sellers become exhausted and buyers start to accumulate shares at lower prices. This could signal a potential reversal, offering an opportunity for traders to enter long positions and profit from the expected rebound.

Reversal Patterns: Spotting the Change of Tide

Head and Shoulders

1. Head and Shoulders Top: The Three Peaks of Impending Decline

The Head and Shoulders Top is a classic and widely recognized chart pattern that signals a potential reversal of an uptrend. It's a bearish pattern, suggesting that the upward momentum is waning and a potential downtrend is on the horizon.

Formation and Structure:

The Head and Shoulders Top is characterized by:

-

Left Shoulder: A peak forms during the uptrend, followed by a pullback to a level of support. This support level is often referred to as the "neckline."

-

Head: The price rallies again, breaking above the previous peak (the left shoulder) to form a higher high. This second peak is the "head" of the pattern. It's typically accompanied by higher volume than the left shoulder.

-

Right Shoulder: The price pulls back again, finding support at or near the neckline. Then, it rallies one more time, but fails to reach the height of the head, forming the "right shoulder." The right shoulder usually has lower volume than the head and left shoulder.

-

Neckline: A trendline drawn connecting the lows of the two pullbacks (the valleys between the shoulders and head) forms the neckline. The neckline can be horizontal, ascending, or descending, but a downward sloping neckline is considered the most bearish.

Psychology Behind the Pattern:

The Head and Shoulders Top pattern reveals a shift in market sentiment from bullish to bearish. The left shoulder represents the initial peak of enthusiasm, followed by a pullback as some traders take profits. The head signifies a renewed surge of buying, but it fails to reach new highs, indicating that the bullish momentum is weakening. Finally, the formation of the right shoulder confirms the waning interest from buyers, as they are unable to push prices higher than the previous rally.

The breakdown below the neckline is a crucial moment. It signifies that the sellers have taken control, and the previous support level has now become resistance. This often triggers further selling pressure, accelerating the price decline.

Trading the Head and Shoulders Top:

-

Confirmation: Wait for a breakdown below the neckline with increased volume to confirm the bearish reversal and initiate a short position.

-

Entry: Many traders enter a short position after the breakdown or on a retest of the neckline, which often acts as resistance after being broken.

-

Stop-Loss: A stop-loss order can be placed above the right shoulder or above the neckline to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the head (the distance between the head and the neckline) and projecting it downwards from the breakdown point.

Key Points to Consider:

- Volume: A breakdown on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

- False Breakdowns: Be wary of false breakdowns, where the price briefly dips below the neckline but then quickly recovers. Look for volume confirmation and sustained downward momentum.

- Alternative Scenarios: In rare cases, a Head and Shoulders Top can fail, with the price rallying back above the neckline. This is more likely to occur if the volume on the breakdown is weak or if the overall market sentiment remains bullish.

Example in Indian Markets:

The Head and Shoulders Top pattern can be found in various Indian stocks and indices, particularly at the end of extended rallies or when a particular sector or theme loses favor. For example, a stock that has been a market leader might start forming this pattern as investors take profits and new buyers become hesitant. The breakdown below the neckline would signal a potential reversal of fortune, offering an opportunity for traders to short the stock and potentially profit from its decline.

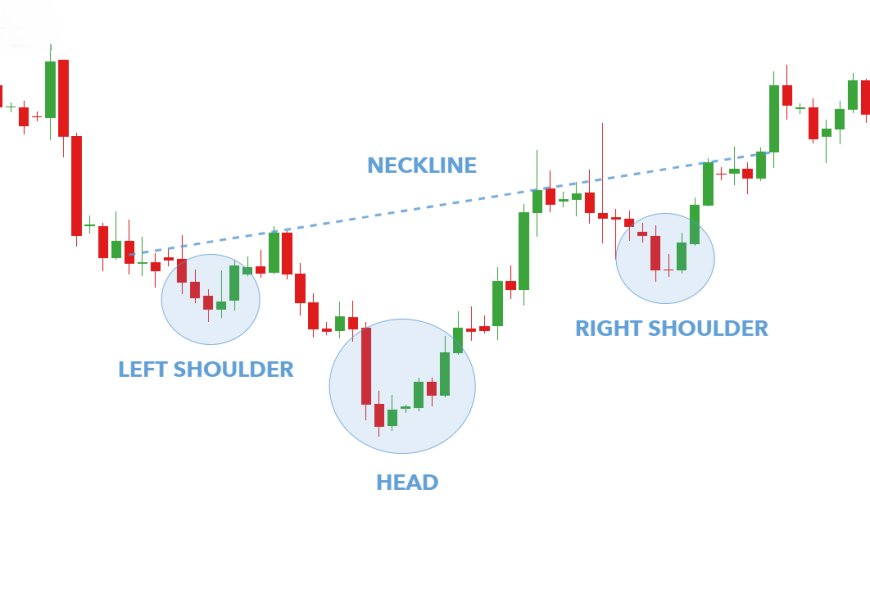

2. Inverse Head and Shoulders: The Three Valleys of Rising Optimism

The Inverse Head and Shoulders, often called the "Head and Shoulders Bottom," is a chart pattern that signals a potential reversal of a downtrend. It's a bullish pattern, suggesting that the downward momentum is weakening and a potential uptrend is on the horizon.

Formation and Structure:

The Inverse Head and Shoulders is characterized by:

-

Left Shoulder: A trough forms during the downtrend, followed by a bounce to a level of resistance. This resistance level is known as the "neckline."

-

Head: The price drops again, breaking below the previous trough (the left shoulder) to form a lower low. This second trough is the "head" of the pattern and typically has higher volume than the left shoulder.

-

Right Shoulder: The price bounces back, finding resistance at or near the neckline. Then, it drops again but doesn't reach the depth of the head, forming the "right shoulder." The right shoulder usually has lower volume than the head and left shoulder.

-

Neckline: A trendline connecting the highs of the two bounces (the peaks between the shoulders and head) forms the neckline. The neckline can be horizontal, descending, or ascending, but an upward sloping neckline is considered the most bullish.

Psychology Behind the Pattern:

The Inverse Head and Shoulders pattern reflects a shift in market sentiment from bearish to bullish. The left shoulder represents the initial trough of despair, followed by a bounce as some traders cover their short positions. The head signifies a renewed wave of selling, but it fails to reach new lows, indicating that the bearish momentum is fading. Finally, the formation of the right shoulder confirms the waning interest from sellers, as they are unable to push prices lower than the previous decline.

The breakout above the neckline is the pivotal moment. It signifies that the buyers have taken control, and the previous resistance level has now become support. This often triggers additional buying pressure, propelling the price higher.

Trading the Inverse Head and Shoulders:

-

Confirmation: Wait for a breakout above the neckline with increased volume to confirm the bullish reversal and enter a long position.

-

Entry: Many traders enter a long position after the breakout or on a retest of the neckline, which often acts as support after being broken.

-

Stop-Loss: A stop-loss order can be placed below the right shoulder or below the neckline to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the head (the distance between the head and the neckline) and projecting it upwards from the breakout point.

Key Points to Consider:

- Volume: A breakout on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

- False Breakouts: Be cautious of false breakouts, where the price briefly rises above the neckline but then falls back within the pattern. Look for volume confirmation and sustained upward momentum.

- Alternative Scenarios: In rare cases, an Inverse Head and Shoulders can fail, with the price falling back below the neckline. This is more likely if the volume on the breakout is weak or the overall market sentiment remains bearish.

Example in Indian Markets:

The Inverse Head and Shoulders pattern can be found in various Indian stocks and indices, particularly after prolonged periods of decline or when a particular sector or theme starts to regain favor. For instance, a stock that has been underperforming might start forming this pattern as short sellers cover their positions and value investors start accumulating shares. The breakout above the neckline would signal a potential reversal of fortune, offering an opportunity for traders to buy the stock and potentially profit from its rebound.

Double Tops and Bottoms

1. Double Top: The Bearish Twin Peaks Signaling Exhaustion

The Double Top is a classic and widely recognized chart pattern that indicates a potential reversal of an uptrend. It's a bearish pattern, suggesting that the upward momentum is waning and a potential downtrend is on the horizon.

Formation and Structure:

The Double Top is characterized by:

-

First Peak: After an extended uptrend, the price reaches a peak and then retraces, finding support at a lower level. This support level is called the "neckline."

-

Second Peak: The price rallies again, attempting to surpass the previous high. However, it fails to break through and forms a second peak roughly at the same level as the first. This failure to make a new high is a crucial sign of exhaustion among buyers.

-

Neckline Breakdown: The price then declines, breaking below the neckline. This breakdown is a critical confirmation of the bearish reversal and signals a potential entry point for short sellers.

Psychology Behind the Pattern:

The Double Top pattern reflects a shift in market sentiment from bullish to bearish. The first peak represents the initial peak of enthusiasm, followed by a pullback as some traders take profits. The second peak signifies a renewed attempt by buyers to push prices higher, but their failure to do so indicates a loss of momentum. The breakdown below the neckline confirms that sellers have taken control, and the previous support level has become resistance.

Trading the Double Top:

-

Confirmation: Wait for a breakdown below the neckline with increased volume to confirm the bearish reversal and initiate a short position.

-

Entry: Many traders enter a short position after the breakdown or on a retest of the neckline, which often acts as resistance after being broken.

-

Stop-Loss: A stop-loss order can be placed above the second peak to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the pattern (the distance between the peaks and the neckline) and projecting it downwards from the breakdown point.

Key Points to Consider:

- Volume: A breakdown on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

- False Breakdowns: Be wary of false breakdowns, where the price briefly dips below the neckline but then quickly recovers. Look for volume confirmation and sustained downward momentum.

- Alternative Scenarios: In rare cases, a Double Top can fail, with the price rallying back above the neckline. This is more likely to occur if the volume on the breakdown is weak or if the overall market sentiment remains bullish.

Example in Indian Markets:

The Double Top pattern can be found in various Indian stocks and indices, particularly at the end of extended rallies or when a particular sector or theme loses momentum. For example, a stock that has experienced a meteoric rise might start forming a Double Top as investors book profits and new buyers become hesitant. The breakdown below the neckline would signal a potential reversal of fortune, offering an opportunity for traders to short the stock and potentially profit from its decline.

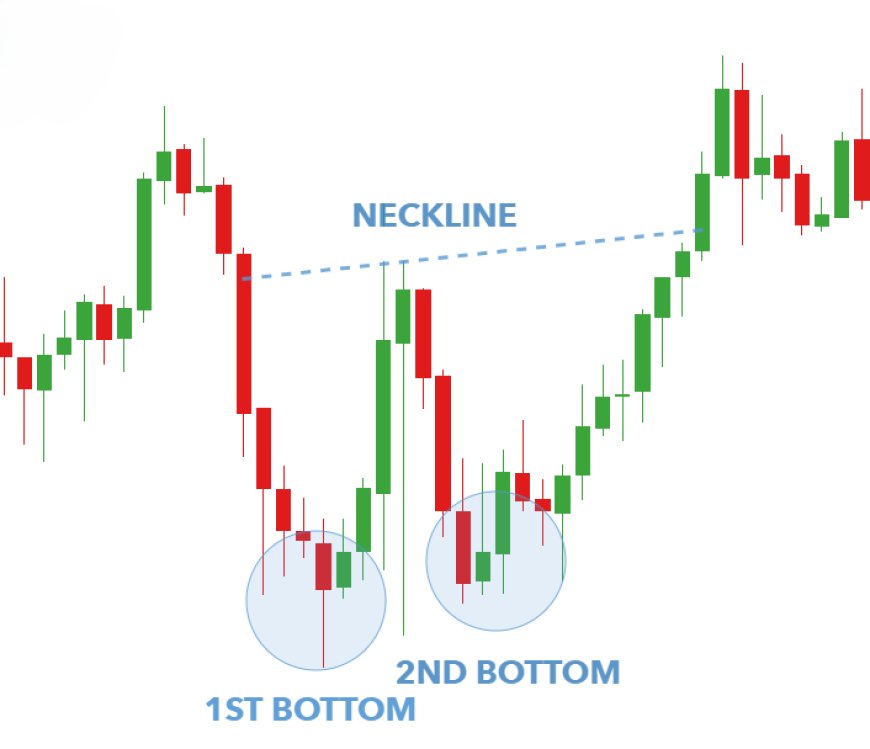

2. Double Bottom: The Bullish Twin Valleys Signaling a Rebound

The Double Bottom is a classic and widely recognized chart pattern that indicates a potential reversal of a downtrend. It's a bullish pattern, suggesting that the downward momentum is weakening and a potential uptrend is on the horizon.

Formation and Structure:

The Double Bottom is characterized by:

-

First Trough: After an extended downtrend, the price reaches a low point and then rebounds, finding resistance at a higher level. This resistance level is known as the "neckline."

-

Second Trough: The price declines again, attempting to breach the previous low. However, it fails to break through and forms a second trough roughly at the same level as the first. This failure to make a new low is a crucial sign of exhaustion among sellers.

-

Neckline Breakout: The price then rises, breaking above the neckline. This breakout is a critical confirmation of the bullish reversal and signals a potential entry point for buyers.

Psychology Behind the Pattern:

The Double Bottom pattern reflects a shift in market sentiment from bearish to bullish. The first trough represents the initial low point of pessimism, followed by a bounce as some traders cover their short positions or bargain hunters step in. The second trough signifies a renewed attempt by sellers to push prices lower, but their failure to do so indicates a loss of momentum. The breakout above the neckline confirms that buyers have taken control, and the previous resistance level has become support.

Trading the Double Bottom:

-

Confirmation: Wait for a breakout above the neckline with increased volume to confirm the bullish reversal and initiate a long position.

-

Entry: Many traders enter a long position after the breakout or on a retest of the neckline, which often acts as support after being broken.

-

Stop-Loss: A stop-loss order can be placed below the second trough to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the pattern (the distance between the troughs and the neckline) and projecting it upwards from the breakout point.

Key Points to Consider:

- Volume: A breakout on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

- False Breakouts: Be wary of false breakouts, where the price briefly rises above the neckline but then falls back within the pattern. Look for volume confirmation and sustained upward momentum.

- Variations: There are variations of the Double Bottom pattern, such as the "Adam and Eve" Double Bottom, where the second bottom is slightly higher than the first, indicating even stronger buying pressure.

Example in Indian Markets:

The Double Bottom pattern can be found in various Indian stocks and indices, particularly after extended periods of decline or when a particular sector or theme starts to recover. For instance, a stock that has been underperforming for several months might start forming a Double Bottom as sellers become exhausted and value investors start accumulating shares. The breakout above the neckline would signal a potential turnaround, offering an opportunity for traders to buy the stock and potentially profit from its rebound.

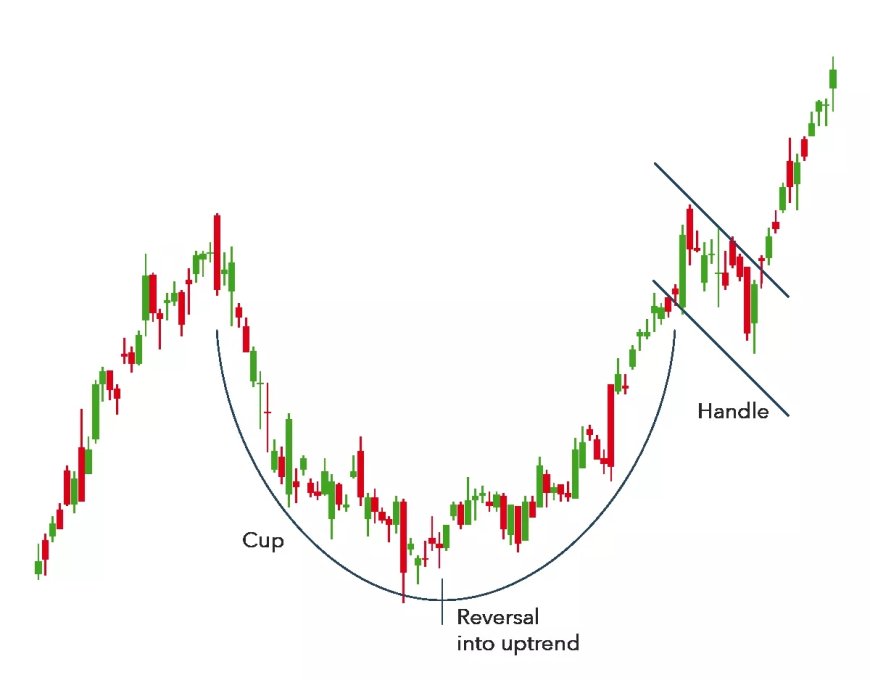

Rounding Bottom (Cup and Handle): The Bullish "U-Turn" with a Grip

The Rounding Bottom, often referred to as the "Cup and Handle" pattern, is a bullish reversal pattern that signals a potential shift from a downtrend to an uptrend. It's a pattern that is characterized by a gradual change in investor sentiment from bearish to bullish, resulting in a U-shaped price curve on a chart.

Formation and Structure:

The Rounding Bottom consists of two distinct phases:

-

The Cup: This phase forms the "U" shape of the pattern. It begins with a decline in price as the downtrend continues. However, the decline gradually slows down, and the price starts to stabilize. This forms the rounded bottom of the cup. Then, the price starts to gradually ascend, forming the right side of the cup.

-

The Handle: After the cup is formed, the price pulls back slightly, forming a short-term downward trend. This pullback is the "handle" of the pattern. The handle is usually smaller in size and shorter in duration compared to the cup. It typically forms a flag or pennant pattern.

Psychology Behind the Pattern:

The Rounding Bottom pattern reflects a gradual shift in market sentiment. Initially, sellers dominate the market, driving prices down. However, as the downtrend matures, selling pressure weakens, and buyers start to enter the market at lower prices. This leads to a gradual increase in buying pressure, which eventually overcomes the selling pressure and pushes prices higher.

The handle phase represents a brief period of consolidation where the new buyers and sellers test the market before the uptrend resumes. The breakout from the handle confirms the resumption of the uptrend and signals a potential buying opportunity.

Trading the Rounding Bottom (Cup and Handle):

-

Identify the Pattern: Look for a "U" shaped price formation followed by a handle. Ensure the handle is shorter and shallower than the cup.

-

Entry: Wait for a breakout above the upper trendline of the handle with increased volume. This breakout confirms the resumption of the uptrend.

-

Stop-Loss: Place a stop-loss order below the low of the handle or the bottom of the cup to manage risk.

-

Profit Target: The profit target can be estimated by measuring the height of the cup (the distance between the bottom of the cup and the neckline) and projecting it upwards from the breakout point.

Key Points to Consider:

-

Timeframe: The Rounding Bottom can form over weeks, months, or even years. The longer the timeframe, the more significant the potential reversal.

-

Volume: A breakout on high volume strengthens the validity of the pattern and increases the likelihood of a successful trade.

-

Confirmation: Wait for a breakout from the handle before entering a trade. A false breakout can occur if the price fails to hold above the handle's upper trendline.

Example in Indian Markets:

The Rounding Bottom pattern can be observed in various Indian stocks and indices, particularly after extended periods of decline or consolidation. For example, a stock that has been in a downtrend for several months might start forming a Rounding Bottom as investors begin to accumulate shares at lower prices. The breakout from the handle would signal a potential reversal, offering an opportunity for traders to buy the stock and potentially profit from the subsequent uptrend.

Triple Tops and Bottoms: The Trifecta of Reversal Signals

Triple Tops and Bottoms are chart patterns that signal potential reversals in market trends. They are similar to their double counterparts but feature three consecutive peaks (triple top) or troughs (triple bottom) at roughly the same price level. These patterns are relatively rare but offer a strong indication of a potential shift in market sentiment.

Triple Top: Three Strikes and You're Out

-

Formation: A triple top forms after an uptrend when the price makes three attempts to break through a resistance level but fails each time. The three peaks should be roughly at the same level, with intermediate pullbacks to a support level known as the "neckline."

-

Psychology: The first peak represents the initial enthusiasm of buyers. The second peak demonstrates a renewed effort to break the resistance, but it fails, indicating a loss of momentum. The third peak is the final attempt, and when it fails to break through, it signals exhaustion among buyers and a potential shift in sentiment towards the downside.

-

Trading: Traders typically wait for a breakdown below the neckline with increased volume to confirm the bearish reversal and initiate a short position.

Triple Bottom: Three Chances for a Rebound

-

Formation: A triple bottom forms after a downtrend when the price makes three attempts to break below a support level but bounces back each time. The three troughs should be roughly at the same level, with intermediate rallies to a resistance level known as the "neckline."

-

Psychology: The first trough represents the initial despair among sellers. The second trough indicates a renewed effort to push prices lower, but it fails, suggesting a decrease in selling pressure. The third trough is the final test of the support level, and when the price bounces back, it signals a potential shift in sentiment towards the upside.

-

Trading: Traders typically wait for a breakout above the neckline with increased volume to confirm the bullish reversal and initiate a long position.

Key Points to Consider for Both Triple Tops and Bottoms:

-

Volume: A breakout (or breakdown) on high volume adds credibility to the pattern and increases the likelihood of a successful trade.

-

False Breakouts: Be cautious of false breakouts or breakdowns. Wait for confirmation before entering a trade.

-

Neckline: The neckline is a crucial level. A break above the neckline (triple bottom) or below the neckline (triple top) often triggers further price movement in that direction.

-

Profit Targets and Stop-Losses: Profit targets and stop-loss levels can be determined based on the height of the pattern and the distance between the neckline and the peaks or troughs.

Example in Indian Markets:

Triple tops and bottoms can be found in various Indian stocks and indices, although they are less common than double tops and bottoms. For example, a stock that has been in a strong uptrend might form a triple top if it faces a strong resistance level that it is unable to break through. Conversely, a stock that has been in a prolonged downtrend might form a triple bottom if it finds support at a certain level multiple times.

Additional Considerations:

-

Timeframe: Triple tops and bottoms can occur on various timeframes, from intraday charts to weekly or monthly charts.

-

Variations: There can be variations in the pattern, such as an "ascending triple top" (where each peak is slightly higher than the previous one) or a "descending triple bottom" (where each trough is slightly lower than the previous one). These variations can provide additional clues about the strength of the reversal signal.

Other Patterns

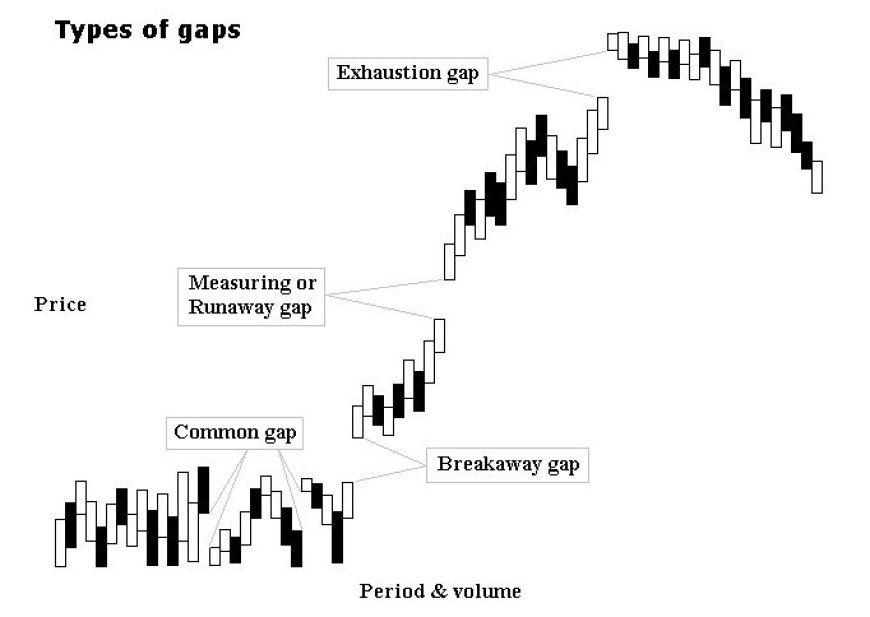

1. Gaps: The Sudden Jumps in Price Charts

Gaps are intriguing phenomena in financial markets. They occur when a stock, index, or other asset opens at a price significantly different from the previous day's closing price, with no trading activity in between. This creates a "gap" on the price chart, often signaling important market events or shifts in sentiment.

Types of Gaps and Their Significance:

-

Common Gaps:

- Characteristics: These are relatively small gaps that occur frequently, often within trading ranges or during periods of consolidation. They are usually filled within a few trading sessions, meaning the price returns to the pre-gap level.

- Implications: Common gaps generally have little predictive value. They are often caused by minor news events, low trading volume, or random market fluctuations.

-

Breakaway Gaps:

- Characteristics: Breakaway gaps occur when the price breaks out of a consolidation pattern or a trading range with a significant gap. They are often accompanied by high trading volume and signal the beginning of a new trend.

- Implications: Breakaway gaps are considered powerful signals. An upward breakaway gap often marks the start of a new uptrend, while a downward breakaway gap can indicate the start of a new downtrend.

-

Runaway Gaps (Measuring Gaps):

- Characteristics: Runaway gaps occur within a trend, usually midway through a strong price move. They are also called "measuring gaps" because the distance from the previous consolidation area to the runaway gap is often equal to the distance from the runaway gap to the next resistance or support level.

- Implications: Runaway gaps confirm the strength of the existing trend and suggest that the price could continue moving in the same direction for a significant distance.

-

Exhaustion Gaps:

- Characteristics: Exhaustion gaps occur near the end of a trend, often on high volume. They signal a climax in buying or selling pressure and can indicate that the trend is about to reverse.

- Implications: Exhaustion gaps are warning signs for traders. An exhaustion gap in an uptrend suggests that the buying pressure is exhausted, and a reversal to the downside is possible. Conversely, an exhaustion gap in a downtrend indicates that selling pressure is waning, and a reversal to the upside is possible.

Trading Gaps in the Indian Market:

While gaps can provide valuable insights, it's important to exercise caution when trading them in the Indian market. Here are some additional points to consider:

- Context is Key: Always analyze gaps in the context of the overall market trend and other technical indicators. A gap's significance can vary depending on the broader market environment.

- Confirmation: Wait for confirmation before acting on a gap. A gap doesn't guarantee a trend reversal or continuation. Look for additional evidence, such as volume patterns and other technical indicators, to confirm the signal.

- Risk Management: Use stop-loss orders to protect your capital in case the price moves against your trade.

Example in Indian Markets:

Let's say a prominent Indian technology stock has been consolidating for several weeks. Suddenly, it gaps up on high volume, breaking above the resistance level of the consolidation range. This could be a breakaway gap, signaling the start of a new uptrend. Traders who recognize this pattern might enter long positions, anticipating further gains.

On the other hand, if a stock that has been in a steep decline suddenly gaps down on high volume, it could be an exhaustion gap. This could signal that the selling pressure is exhausted, and a reversal to the upside is possible. Traders might consider closing short positions or even entering long positions in anticipation of a rebound.

2. Rectangles (Trading Ranges): The Battleground of Bulls and Bears

Rectangles, or trading ranges, are chart patterns that reflect a period of consolidation or indecision in the market. They form when prices move sideways within a defined range, bouncing between horizontal support and resistance levels. These patterns are relatively common and can occur across various timeframes, from intraday charts to weekly or monthly charts.

Formation and Structure:

Rectangles are characterized by:

-

Horizontal Support and Resistance Levels: Two parallel horizontal lines define the trading range. The upper line represents resistance, a price level where sellers tend to enter the market, preventing prices from rising further. The lower line represents support, a price level where buyers tend to step in, preventing prices from falling further.

-

Sideways Price Movement: The price oscillates within the range, touching or approaching the support and resistance levels multiple times. This sideways movement indicates a balance between buying and selling pressure.

Psychology Behind the Pattern:

Rectangles reflect a period of market uncertainty and indecision. Bulls and bears are engaged in a tug-of-war, with neither side able to gain a decisive advantage. This period of consolidation often occurs before a significant price move, as traders and investors assess the market's fundamental and technical factors, waiting for a catalyst to tip the balance in one direction or the other.

Trading Rectangles:

There are two main ways to trade rectangles:

-

Range Trading: Traders can buy near the support level and sell near the resistance level, profiting from the price oscillations within the range. This strategy requires careful timing and risk management, as false breakouts can occur.

-

Breakout Trading: Traders can wait for a breakout above the resistance level or below the support level to enter a trade. A breakout indicates a potential shift in momentum and can lead to a significant price move in the direction of the breakout.

Key Points to Consider:

-

Breakout Direction: The direction of the breakout is crucial. An upward breakout signals a potential bullish move, while a downward breakout indicates a potential bearish move.

-

Volume: A breakout on high volume adds credibility to the pattern and increases the likelihood of a successful trade.

-

False Breakouts: Be cautious of false breakouts, where the price briefly exceeds a trendline but then reverses course. Look for volume confirmation and sustained momentum to validate the breakout.

-

Rectangle Width: The width of the rectangle can provide clues about the potential magnitude of the price move after the breakout. A wider rectangle suggests a larger potential move.

Example in Indian Markets:

Rectangles can be found in various Indian stocks and indices, particularly during periods of consolidation or when a stock is undergoing a sideways correction after a strong trend. For example, a stock that has experienced a sharp rally might enter a trading range as investors take profits and new buyers assess the situation. A breakout from the range could signal the resumption of the uptrend or the beginning of a downtrend.

Additional Tips for Trading Rectangles in India:

-

Consider Volatility: TheIndian market can be volatile, so be prepared for sudden price movements even within a trading range. Use appropriate stop-loss orders to manage risk.

-

Combine with Other Indicators: Use rectangles in conjunction with other technical indicators, such as moving averages, the Relative Strength Index (RSI), or the Moving Average Convergence Divergence (MACD), to confirm the breakout or breakdown.

-

News and Events: Pay attention to news and events that could impact the stock or index you are trading. These can act as catalysts for breakouts from trading ranges.

Navigating the Indian Stock Market's Unique Terrain with Chart Patterns

India's stock markets are renowned for their dynamic nature and susceptibility to both domestic and global influences. While chart patterns can provide valuable insights into potential price movements, their interpretation in the Indian context requires a nuanced approach. Here's a deeper look at the key considerations for applying chart patterns effectively in the Indian market:

Context is King: Understanding the Bigger Picture

The Indian stock market is a complex ecosystem influenced by a myriad of factors. Economic indicators like GDP growth, inflation, and interest rates play a significant role in shaping market trends. Additionally, government policies, regulatory changes, and geopolitical events can trigger sudden shifts in investor sentiment.

Therefore, when analyzing chart patterns in Indian stocks, it's crucial to consider the broader market context. A bullish pattern forming during a period of economic downturn or political instability might not be as reliable as one emerging during a period of robust growth and stability. Understanding the underlying market forces that are driving price movements will help you gauge the reliability of a chart pattern and make more informed trading decisions.

Volume: The Voice of the Market

Volume is a crucial element in validating chart patterns. A breakout or breakdown from a pattern accompanied by high trading volume is generally considered more reliable than one with low volume. In the Indian market, where participation from retail investors can be substantial, volume spikes can often amplify price movements and reinforce the significance of chart patterns.

For instance, a breakout from a symmetrical triangle with surging volume suggests strong conviction among buyers or sellers, increasing the likelihood of a sustained price move in the direction of the breakout. Conversely, a breakout with low volume might be a false signal, potentially leading to a whipsaw or a reversal of the price movement.

Combining Forces: A Multi-Pronged Approach

Chart patterns, while valuable, should not be used in isolation. They are most effective when combined with other technical indicators and fundamental analysis. Technical indicators like moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) can provide additional confirmation of the pattern's validity and potential strength.

Fundamental analysis, which involves evaluating a company's financial health, growth prospects, and competitive landscape, can help you assess the underlying value of a stock and its potential for long-term growth. By combining chart patterns with fundamental analysis, you can make more informed decisions about which stocks to buy or sell.

Risk Management: Protecting Your Capital

The Indian market's volatility necessitates prudent risk management. While chart patterns can offer attractive trading opportunities, they are not foolproof. There's always a risk that a trade might not go as planned. Therefore, it's essential to implement appropriate risk management strategies, such as:

-

Stop-Loss Orders: Place stop-loss orders to automatically exit a trade if the price moves against you by a predetermined amount. This helps to limit your losses and protect your capital.

-

Position Sizing: Don't overcommit your capital to a single trade. Diversify your portfolio across different stocks and asset classes to spread risk.

-

Risk-Reward Ratio: Before entering a trade, calculate the potential risk and reward. Ensure that the potential reward justifies the risk you are taking.

Additional Considerations for the Indian Market:

-

Liquidity: Some Indian stocks, especially mid-cap and small-cap stocks, may have lower liquidity compared to large-cap stocks. This can lead to wider bid-ask spreads and make it more challenging to execute trades at your desired price.

-

Regulatory Changes: Be aware of regulatory changes that can impact the Indian stock market. These changes can affect trading volumes, volatility, and overall market sentiment.

-

Local News and Events: Keep track of local news and events that can influence specific stocks or sectors. These can provide valuable insights into potential trading opportunities or risks.

By incorporating these considerations into your trading strategy, you can effectively leverage the power of chart patterns to navigate the unique challenges and opportunities of the Indian stock market. Remember, successful trading is a continuous learning process. Be patient, disciplined, and adapt your approach as market conditions evolve.

Conclusion: Empowering Your Trading Journey with Chart Patterns

Chart patterns are not merely abstract shapes on a graph; they are a reflection of the collective wisdom and emotions of market participants. By mastering the art of chart pattern recognition, you are essentially learning to decipher the language of the market, gaining a profound understanding of the underlying forces that drive price movements.

This knowledge is invaluable in the Indian stock market, where volatility and rapid shifts in sentiment can create both challenges and opportunities. By recognizing patterns like the bullish engulfing, head and shoulders, or double bottoms, you can anticipate potential turning points, breakouts, and breakdowns, giving you a significant edge in your trading decisions.

Remember, chart patterns are just one piece of the puzzle. Successful trading requires a multi-faceted approach that combines technical analysis with fundamental analysis, risk management, and a disciplined mindset. By integrating chart patterns into your broader trading strategy, you can develop a comprehensive framework for analyzing the market and making informed decisions.

The journey to mastering chart patterns requires patience, dedication, and continuous learning. Spend time studying historical charts, practicing pattern identification, and backtesting your strategies on different stocks and timeframes. The more you expose yourself to real-world examples and refine your skills, the more confident you will become in applying chart patterns to your trading.

With the right knowledge and practice, you can leverage the power of chart patterns to navigate the complexities of the Indian stock market. Whether you are a seasoned trader or a novice investor, chart patterns can be a valuable tool in your arsenal, helping you achieve your financial goals and build a brighter financial future.

Embrace the challenge, embark on this exciting journey of discovery, and unlock the hidden potential of chart patterns in the Indian stock market. The rewards can be substantial, both in terms of financial gains and the satisfaction of mastering a powerful skill that can last a lifetime.

Disclaimer:

The information provided in this article is for educational and informational purposes only. It does not constitute financial advice. Trading and investing in the stock market involve substantial risk of loss. The chart patterns discussed in this article are not foolproof, and their effectiveness can vary depending on market conditions. Always conduct thorough research and consider your own risk tolerance before making any investment decisions. The author and publisher of this article are not liable for any losses or damages incurred as a result of using the information presented herein.

What's Your Reaction?