How to File Schedule House Property in ITR: Step-by-Step Guide

Navigate the complexities of Schedule HP (Income from House Property) in your Indian Income Tax Return with this comprehensive guide tailored for Kolkata. Understand Gross Annual Value (GAV), Net Annual Value (NAV), and deductions to accurately report your income from house property. Learn about special scenarios like jointly owned properties and deemed let-out properties, and get tips for smooth filing in Kolkata.

Income Tax Return (ITR) filing can seem like a daunting task, especially when it comes to complex schedules like Schedule HP (House Property). But understanding this schedule is crucial if you own a house property, whether it's self-occupied, let-out, or deemed to be let-out. This guide will walk you through the intricacies of Schedule HP, ensuring you file your ITR correctly and maximize your tax benefits.

What is Schedule HP?

Schedule HP is a dedicated section within the Income Tax Return (ITR) form that serves as the focal point for reporting income or losses stemming from house property. This section is an essential component of your ITR if you own any form of house property, regardless of whether it's your primary residence, a rented-out property, or even a property that you haven't put to use.

Types of Income Reported in Schedule HP:

- Rental Income: If you've rented out your property, the rent you receive constitutes your income from house property.

- Deemed Rental Income: Even if you live in your own house and don't receive any rent, the tax laws consider a notional rent that your property could potentially generate. This notional rent, known as deemed rental income, is also included in Schedule HP.

Who Needs to File Schedule HP in India?

Filing Schedule HP in your Income Tax Return (ITR) is mandatory if you fall under any of the following categories:

1. Owners of House Property:

- If you have sole ownership of a house property, regardless of whether you live in it, rent it out, or leave it vacant, you are required to file Schedule HP. This applies even if you didn't earn any rental income during the financial year.

- The tax laws require you to report details about the property and calculate its potential rental income, even if it's self-occupied.

2. Co-Owners of House Property:

- In cases where you jointly own a house property with others, each co-owner must file Schedule HP individually in their respective ITRs.

- You need to report your proportionate share of the income or loss from the property based on your ownership percentage.

- This ensures that each co-owner's tax liability is calculated accurately based on their individual income from the property.

3. Individuals with Deemed Let-Out Property:

- If you own more than one house property and live in one of them, the tax laws consider the other properties as "deemed to be let-out."

- Even if you don't actually rent out these properties, you're required to calculate their potential rental income (deemed rental income) and report it in Schedule HP.

- This provision is in place to ensure that individuals don't avoid tax by leaving properties vacant while enjoying the benefits of owning multiple properties.

Key Components of Schedule HP

Schedule HP in your Income Tax Return (ITR) is where you detail the income or losses you have from house property. Understanding its key components is crucial for accurate reporting and claiming relevant deductions. Let's delve deeper into each of these components:

1. Property Details:

- Address of the property: This includes the full postal address of the property, including house/flat number, building name, street, city, state, and PIN code. This information helps the tax authorities identify the property correctly.

- Property type: Indicate whether the property is self-occupied (you reside in it), let-out (rented to a tenant), or deemed to be let-out (you own more than one property and one is self-occupied, while others are considered let-out for tax purposes).

- Share in the property: If you co-own the property with others, mention your proportionate share in the property. This share determines your portion of the income or loss to be reported.

- Date of purchase/completion of construction: This is the date when you acquired the property through purchase or completed its construction. It's relevant for calculating depreciation and other deductions.

2. Income Details:

- Gross Annual Value (GAV): This is the estimated annual rent that the property could fetch in the current market. It's usually the higher of the actual rent received or the municipal valuation of the property. For self-occupied property, the GAV is usually nil.

- Rent Received: This is the actual rent you received from the tenant during the financial year. If the property was vacant for some time, you need to adjust the rent accordingly.

- Municipal Taxes Paid: Include any property tax, house tax, or similar taxes paid to the local municipality during the year.

- Interest on Home Loan: If you've taken a home loan for the property, you can claim a deduction for the interest paid on the loan. The deduction amount varies depending on whether the property is self-occupied or let-out.

- Co-owner Details (if applicable): If the property is co-owned, provide details of each co-owner, including their name, PAN, share in the property, and their share of income or loss.

3. Deductions:

- Standard Deduction: This is a flat 30% deduction allowed on the Net Annual Value (NAV) of the property. NAV is calculated as GAV minus municipal taxes paid. This deduction covers expenses like repairs, maintenance, etc., without requiring you to provide actual bills.

- Interest on Home Loan: For self-occupied property, you can deduct up to ₹2 lakhs of interest paid on your home loan. For let-out property, there's no upper limit on this deduction. The interest amount is calculated based on your home loan statement.

Step-by-Step Guide to Filling Schedule House Property

1. Gather Your Documents:

a) Property Documents:

- Sale Deed: This is the primary document proving your ownership of the property.

- Mother Deed/Title Deed: This traces the chain of ownership of the property and establishes a clear title.

- Encumbrance Certificate (EC): This certifies that the property is free from any legal or monetary liabilities.

- Khata Certificate/Extract: This is a revenue document issued by the municipal corporation, essential for property tax payments.

- Property Tax Receipts: Keep records of paid property taxes as proof of payment.

- Building Plan Approval: If you've made any structural changes, keep the approved building plans.

- Occupancy Certificate (OC): This certifies that the building is fit for occupation (applicable for apartments and some independent houses).

- Completion Certificate (CC): This certifies that the construction is complete as per approved plans (mostly applicable for new constructions).

b) Rent Agreements (if applicable):

- Current Rent Agreement: Keep the latest agreement signed with your tenant.

- Past Rent Agreements: If available, keep previous agreements for reference.

- Rent Receipts: These serve as proof of rent payments received from the tenant.

c) Home Loan Statement (if applicable):

- Latest Loan Statement: This shows your outstanding loan amount, interest rate, and payment history.

- Loan Sanction Letter: This outlines the terms and conditions of your home loan.

- Prepayment/Part-payment Receipts: If you've made any additional payments towards the loan, keep the receipts.

d) Municipal Taxes and Other Expenses:

- Property Tax Receipts: As mentioned earlier, keep records of all property tax payments.

- Water and Sewerage Tax Receipts: These are usually paid annually or semi-annually.

- Garbage Collection/Solid Waste Management Receipts: These may be included in your property tax bill or paid separately.

- Electricity Bills: Keep records for utility payments.

- Maintenance Bills: If you live in an apartment complex or gated community, keep receipts for maintenance charges.

2. Calculate Gross Annual Value (GAV):

GAV is the estimated annual rent a property can fetch. It's a crucial figure for income tax purposes, especially when calculating income from house property.

Scenarios for Calculating GAV:

a) Let-Out Property:

- Actual Rent Received: This is the total rent you receive from your tenant(s) over a year.

- Municipal Valuation: This is the value assigned to your property by the municipal corporation for property tax purposes.

- GAV Calculation: The GAV is usually the higher of the actual rent received or the municipal valuation. However, it can't exceed the 'fair rent' (reasonable rent for a similar property in the same area).

Example:

- Actual Rent Received: ₹300,000 per year

- Municipal Valuation: ₹280,000 per year

- Fair Rent: ₹320,000 per year

In this case, the GAV would be ₹300,000 (the higher of actual rent and municipal valuation, but not exceeding the fair rent).

b) Self-Occupied Property:

- GAV: The GAV is considered nil for up to two self-occupied properties. This means no income tax is payable on these properties.

c) Deemed-to-be Let-Out Property:

- This applies when you have more than two self-occupied properties or if you have a property that is vacant but not available for rent.

- Expected Rent: The GAV is calculated based on the expected rent the property could fetch in the market. This is determined by considering factors like location, size, amenities, and prevailing rental rates in the area.

- Calculation: Similar to a let-out property, the GAV would be the higher of the expected rent or the municipal valuation, but not exceeding the fair rent.

3. Calculate Net Annual Value (NAV):

NAV is the income derived from your property after deducting municipal taxes. It's a crucial figure for determining the taxable income from your house property.

Formula for Calculating NAV:

NAV = GAV (Gross Annual Value) - Municipal Taxes Paid

Example Calculation:

Let's assume:

- GAV of your property: ₹500,000 per year

- Municipal taxes paid: ₹50,000 per year

NAV Calculation:

NAV = ₹500,000 - ₹50,000 = ₹450,000 per year

Therefore, the Net Annual Value (NAV) of your property would be ₹450,000 per year.

Further Deductions from NAV:

It's important to note that you can claim certain deductions from the NAV to arrive at the taxable income from your house property. These deductions include:

- Standard Deduction: A flat 30% of the NAV is allowed as a standard deduction for repairs and maintenance, irrespective of actual expenses.

- Interest on Home Loan: If you've taken a home loan for the property, you can deduct the interest paid on it.

4. Calculate Income from House Property:

Income from House Property is the taxable income you earn from owning a property, whether it's rented out, self-occupied, or deemed to be let-out. This income is calculated after deducting allowable expenses and deductions.

Formula for Calculating Income from House Property:

Income from House Property = NAV - Standard Deduction - Interest on Home Loan

Components Explained:

-

NAV (Net Annual Value):

- As we calculated earlier, NAV is the GAV (Gross Annual Value) minus municipal taxes paid.

-

Standard Deduction:

- A flat 30% of the NAV is allowed as a standard deduction for repairs, maintenance, and other property-related expenses. This deduction is available regardless of actual expenses incurred.

- Important: This deduction is NOT available if the NAV is nil (e.g., in the case of a self-occupied property).

-

Interest on Home Loan:

- If you have a home loan for the property, you can deduct the interest paid during the financial year. There might be a limit on this deduction depending on the type of property and loan usage.

Example Calculation:

Let's consider the previous example:

- NAV of your property: ₹450,000 per year

Now, let's assume:

- Interest paid on home loan during the year: ₹100,000

Income from House Property Calculation:

- Standard Deduction: 30% of ₹450,000 = ₹135,000

- Income from House Property = ₹450,000 - ₹135,000 - ₹100,000 = ₹215,000

Therefore, in this example, your Income from House Property would be ₹215,000 for the year. This amount would then be added to your total income for tax calculation.

Important Considerations:

- Loss from House Property: If the deductions (standard deduction and interest) exceed the NAV, it results in a loss from house property. This loss can be set off against other heads of income.

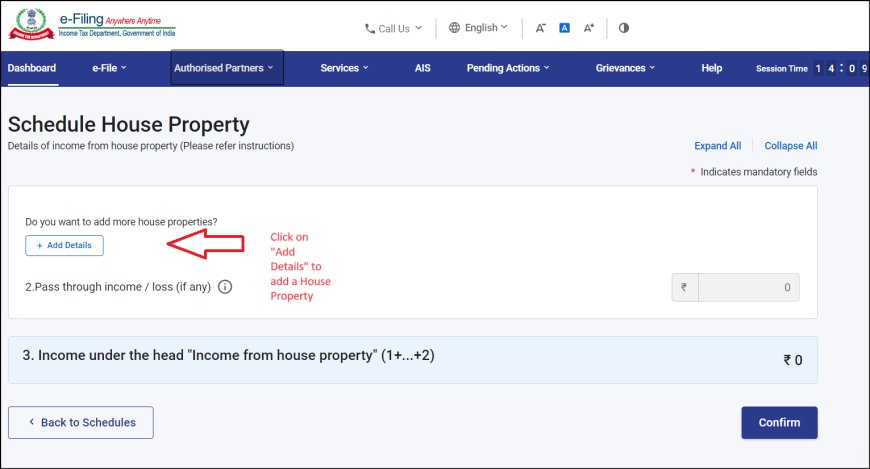

5. Fill in Schedule House Property:

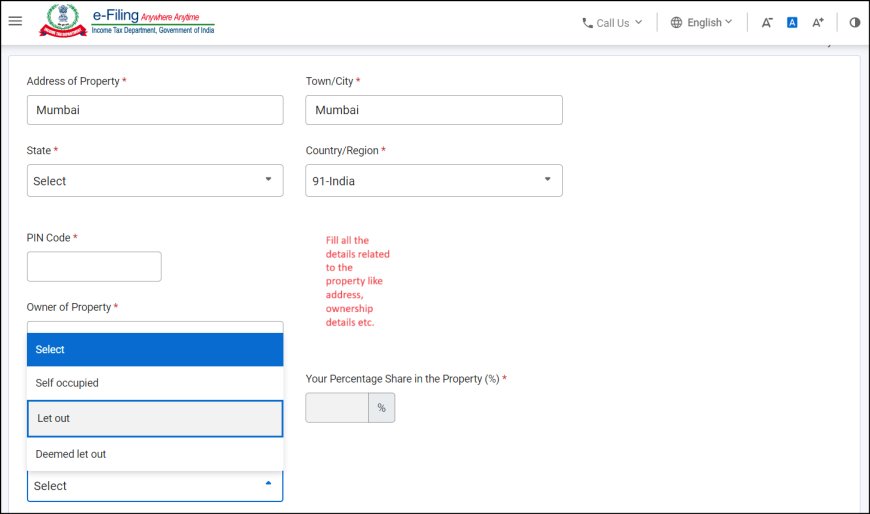

i) Details of Property:

- Address of Property: Enter the complete address of the property, including house/flat number, building name, street, locality, city, and PIN code.

- Ownership Type: Select the relevant option (Self-occupied, Let-out, or Deemed let-out).

- Share of Ownership: If you co-own the property, mention your percentage of ownership.

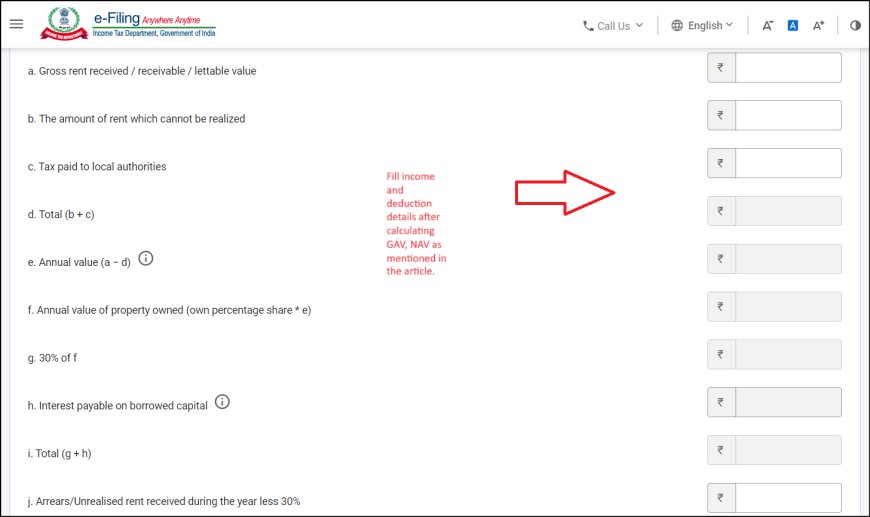

ii) Income from House Property:

- (a) Gross Annual Value (GAV):

- If let-out: Enter the actual rent received (or municipal valuation, whichever is higher, subject to fair rent).

- If deemed let-out: Enter the expected rent the property could fetch (or municipal valuation, whichever is higher, subject to fair rent).

- If self-occupied: Enter "NIL."

- (b) Less: Municipal Taxes Paid: Enter the amount of property taxes paid to the Kolkata Municipal Corporation (KMC) during the financial year.

- (c) Net Annual Value (NAV): This is automatically calculated as (a) - (b).

iii) Deductions:

- (d) Less: Standard Deduction (30% of NAV): This is automatically calculated. However, remember it's not applicable if the NAV is nil (self-occupied property).

- (e) Less: Interest on Borrowed Capital (Home Loan): Enter the amount of interest paid on the home loan during the financial year.

- (f) Income from House Property: This is automatically calculated as (c) - (d) - (e). If negative, it becomes a loss from house property.

iv) Details of Co-Owners (if applicable):

- If you co-own the property, provide the following details for each co-owner:

- Name

- PAN (Permanent Account Number)

- Percentage of Share in Property

- Share of Income/Loss from House Property (this will be auto-calculated based on their share in the property)

Special Scenarios

1. Jointly Owned Property:

- Separate Filing: If you co-own a property with others, each co-owner must file Schedule HP separately in their respective Income Tax Returns (ITR).

- Share of Income/Loss: Each co-owner should report their share of the income or loss from the house property based on their ownership percentage. This ensures accurate reporting and tax calculation for each individual.

- Example: If you and your sibling jointly own a property with a 50-50 share, you'll each report 50% of the rental income (or expected rent if deemed let-out) and 50% of the municipal taxes paid.

2. Deemed to be Let-Out Property:

- Multiple Properties: If you own more than one house property and reside in one, the others are considered "deemed to be let-out" for tax purposes.

- Expected Rent: Even if these properties are vacant, you need to estimate the rent they could fetch in the market. This expected rent is then used to calculate the GAV and NAV.

- Municipal Valuation: As always, the municipal valuation often plays a significant role. If the municipal valuation is higher than your expected rent, it will be used to calculate the GAV.

- Fair Rent: Remember that the GAV for deemed let-out properties cannot exceed the 'fair rent' (reasonable rent for a similar property in the same area).

3. Loss from House Property:

- Expenses Exceed Income: If the total deductions (standard deduction of 30% of NAV and interest on the home loan) exceed the income from the property, it results in a loss from house property.

- Carry Forward: You can carry forward this loss for up to 8 assessment years and set it off against future income from house property. This can be beneficial for tax planning, especially if you plan to acquire more properties or increase the rental income from your existing properties in the future.

Example: Filling Schedule HP for a Let-Out Property

Let's assume you own a house property in Delhi that you've rented out for ₹25,000 per month. You paid ₹10,000 as municipal taxes and ₹1,50,000 as home loan interest in the financial year. Here's how your Schedule HP might look:

| Particulars | Amount (₹) |

|---|---|

| Gross Annual Value (GAV) | 3,00,000 |

| Less: Municipal Taxes Paid | 10,000 |

| Net Annual Value (NAV) | 2,90,000 |

| Less: Standard Deduction (30%) | 87,000 |

| Income from House Property | 2,03,000 |

| Less: Interest on Home Loan | 1,50,000 |

| Taxable Income from House Property | 53,000 |

Conclusion

In conclusion, understanding and accurately completing Schedule HP is essential for every property owner in Kolkata. While the process might seem complex at first glance, this guide, coupled with meticulous record-keeping and potential professional guidance, can simplify the task.

By grasping the key concepts of Gross Annual Value (GAV), Net Annual Value (NAV), and Income from House Property, you can confidently navigate through the unique aspects of Kolkata's property tax system, such as the prominent role of municipal valuation. Additionally, knowing when and how to claim deductions, like the standard deduction and home loan interest, empowers you to optimize your tax liability.

Whether you are a seasoned landlord or a first-time homeowner, Schedule HP should not be overlooked. It's a crucial instrument for ensuring compliance with tax regulations and maximizing your financial benefits as a property owner.

Remember, accurate reporting of your income from house property is not merely a legal requirement; it's a contribution to the collective growth of our city and nation. So, take the time to understand this schedule, file diligently, and pave the way for a smoother, more transparent tax filing experience.

Disclaimer:

The information provided in this article is intended for general informational purposes only and should not be considered as professional tax or legal advice. Tax laws and regulations are subject to change, and individual circumstances may vary. It is always recommended to consult with a qualified tax professional or chartered accountant for personalized advice regarding your specific situation and to ensure compliance with the latest tax laws applicable in Kolkata, West Bengal, and India. The author and publisher of this article disclaim any liability for errors, omissions, or any losses or damages arising from the use of this information.

What's Your Reaction?