How to File Schedule Capital Gains (CG) in ITR: The Complete Guide for Indian Taxpayers

A comprehensive guide on understanding and reporting capital gains/losses in your Indian Income Tax Return (ITR). Learn how to gather the right documents, calculate gains/losses accurately, and fill out Schedule CG correctly. Avoid common mistakes and ensure a smooth tax filing process.

Capital gains are a significant source of income for many investors and taxpayers in India. Whether you've profited from selling stocks, mutual funds, real estate, or other assets, understanding how to correctly report these gains on your Income Tax Return (ITR) is crucial. This comprehensive guide will walk you through the process of filing Schedule Capital Gains (CG), ensuring compliance and accurate reporting.

What are Capital Gains?

Capital gains represent the financial profit realized when you sell a capital asset – an investment or property – for more than its original purchase price. In essence, it's the difference between what you paid for an asset and what you receive when you sell it.

Understanding Capital Assets

In India, capital assets are a broad category and include:

- Investments: Stocks, mutual funds, bonds, etc.

- Real Estate: Land, buildings, residential houses.

- Other Assets: Jewelry, artwork, vehicles (in some cases).

It's important to note that not all items you own are considered capital assets. For example, your everyday belongings like clothes or household appliances are not usually classified as such.

Types of Capital Gains

The Indian tax system differentiates between two primary types of capital gains based on the holding period:

- Short-Term Capital Gains (STCG): These occur when you sell an asset that you've held for 36 months or less. STCG is generally taxed at your regular income tax slab rates.

- Long-Term Capital Gains (LTCG): These apply when you sell an asset held for more than 36 months. LTCG taxation is often more favorable, with lower tax rates or even exemptions in some cases.

Key Factors Affecting Capital Gains Taxation

- Asset Type: Different assets have distinct tax rules. For instance, LTCG tax rates for real estate may differ from those for equity shares.

- Holding Period: As mentioned, the duration you hold an asset significantly impacts its tax treatment.

- Indexation (for LTCG): The government allows for indexation of the purchase price of certain long-term assets to account for inflation. This can reduce your tax liability.

Understanding Schedule CG

Schedule CG, short for Schedule Capital Gains, is a dedicated section within the Indian Income Tax Return (ITR) forms. It serves as a comprehensive record of all your capital gains and losses incurred during a financial year. In essence, it's your detailed ledger for reporting the profits or losses from your investments and property transactions.

Why Schedule CG is Crucial

- Mandatory Reporting: If you've sold any capital asset during the financial year, whether you've made a profit or a loss, filing Schedule CG is mandatory. This requirement holds even if your total income falls below the taxable limit.

- Tax Calculation: The information you provide in Schedule CG is used to calculate your tax liability on capital gains. It helps determine the correct tax rates and any applicable exemptions or deductions.

- Transparency and Compliance: Properly filing Schedule CG ensures transparency in your financial dealings and demonstrates compliance with tax regulations.

What Information Goes into Schedule CG?

Schedule CG requires detailed information about each capital transaction, including:

- Asset Details: Type of asset (stocks, mutual funds, real estate, etc.), date of purchase, date of sale, and sale proceeds.

- Cost of Acquisition: The original purchase price of the asset, along with any associated costs like brokerage fees or stamp duty.

- Fair Market Value (if applicable): This is relevant in certain situations, like gifting or transferring assets.

- Exemptions/Deductions (if claimed): Details of any exemptions or deductions you are eligible for, like reinvestment in specific assets.

Who Needs to File Schedule CG?

If you've engaged in any transactions involving capital assets during the financial year, you are required to file Schedule CG. This obligation applies regardless of the following factors:

- Profit or Loss: Even if you incurred a loss on the sale of a capital asset, you must still report it in Schedule CG.

- Taxable Income: Even if your overall income (including salary, business income, etc.) falls below the taxable limit, you are still obligated to report capital gains or losses.

- Asset Type: Whether it's stocks, mutual funds, real estate, or any other capital asset, if you've sold it, Schedule CG filing is mandatory.

Who Specifically Needs to File:

- Individuals: If you've sold any capital asset, you must file Schedule CG, typically as part of ITR-2 or ITR-3.

- Hindu Undivided Families (HUFs): Similar to individuals, HUFs must report capital gains or losses in Schedule CG.

- Firms and Companies: Companies and partnerships are also required to report capital gains and losses in their tax returns, though the specific forms and schedules may differ.

Why Filing Schedule CG is Important Even with Losses:

- Setting Off Losses: Reporting losses allows you to offset them against capital gains in the same or future years, potentially reducing your tax liability.

- Carry Forward: Unabsorbed losses can be carried forward for up to eight assessment years for future set-off against capital gains.

- Tax Compliance: Filing Schedule CG accurately demonstrates transparency and ensures compliance with tax laws, avoiding potential penalties or legal issues.

Exemptions to Consider

While the general rule is that any capital gain or loss requires reporting in Schedule CG, there are certain exemptions and deductions available under Indian tax laws. These may include:

- Exemption for LTCG on Sale of Residential House (Section 54): If you reinvest the proceeds from the sale of a residential house in another property or specific bonds, you may be eligible for an exemption.

- Deduction for Investment in Specified Bonds (Section 54EC): This deduction allows you to invest in certain bonds to reduce your tax liability on LTCG.

Types of ITR Forms for Filing Schedule CG

The Income Tax Department of India offers various ITR forms tailored to different taxpayers' income sources and situations. When it comes to filing Schedule CG (Capital Gains), the most relevant forms are:

1. ITR-2:

- Who can use it?

- Individuals and Hindu Undivided Families (HUFs) who do not have income from a business or profession.

- If your income primarily comprises salary, investments (including capital gains), and other sources like interest or rental income, ITR-2 is likely the suitable form.

- What it covers:

- Schedule CG for reporting all types of capital gains (STCG and LTCG) from various assets like stocks, mutual funds, real estate, etc.

- Other schedules for reporting income from salary, house property, and other sources.

2. ITR-3:

- Who can use it?

- Individuals and HUFs who have income from a business or profession.

- If you're a self-employed professional, a partner in a firm, or have business income, you'll need to use ITR-3.

- What it covers:

- Schedule CG for reporting capital gains, similar to ITR-2.

- Additional schedules for reporting income from business or profession, along with profit and loss details.

Important Considerations:

- Income Sources: The primary factor in deciding between ITR-2 and ITR-3 is whether you have income from a business or profession.

- Residential Status: Your residential status (resident, non-resident, etc.) also plays a role in determining the appropriate ITR form.

- Other Schedules: Both ITR-2 and ITR-3 include other schedules for reporting different income types. Make sure you fill out all the relevant schedules based on your sources of income.

Step-by-Step Guide to Filing Schedule CG

1. Gather Your Documents:

i) Purchase and Sale Deeds (for Property):

- Purpose: These establish the cost of acquisition and sale price of the property, essential for calculating capital gains/losses.

- Key Details: Dates of purchase/sale, purchase price, sale price, registration fees, stamp duty paid, brokerage (if any).

ii) Contract Notes (for Shares/Mutual Funds):

- Purpose: These confirm your buy and sell transactions, including dates, quantities, and prices.

- Key Details: Transaction dates, number of units bought/sold, purchase/sale price, brokerage (if any).

iii) Demat Account Statements:

- Purpose: Provide a consolidated summary of your holdings and transactions throughout the year.

- Key Details: Opening and closing balances, dates of transactions, details of securities bought/sold.

iv) Bank Statements:

- Purpose: May reflect proceeds from the sale of assets, dividends, interest, etc.

- Key Details: Dates and amounts of deposits related to asset sales, dividend/interest income.

v) Additional Documents for Schedule Capital Gains (ITR):

- Brokerage Statements/Transaction Slips: Provide details of brokerage and other charges related to transactions.

- Capital Gains Statements (from brokers/mutual fund houses): Summarize your capital gains/losses for the year.

- Form 26AS: This is your tax credit statement, which reflects any TDS deducted on your capital gains.

- Expense Proofs (if claiming deductions): If you incurred expenses for repairs, improvement, or transfer of assets, keep these receipts.

- Indexation Table (for long-term assets): If you're claiming indexation benefit on long-term assets, you'll need this table to adjust the purchase price for inflation.

Example Scenarios:

- Long-term Capital Gain on Property Sale: You'll need purchase and sale deeds, improvement receipts (if any), brokerage statements, and indexation table.

- Short-term Capital Gain on Share Sale: You'll need contract notes, demat statements, brokerage statements, and Form 26AS (if TDS was deducted).

Important Considerations:

- Holding Period: Determine whether your gains are short-term (assets held for 36 months or less) or long-term (assets held for more than 36 months). This affects the applicable tax rate.

- Exemptions/Deductions: Certain exemptions and deductions may be available. For example, long-term capital gains on the sale of equity shares/equity-oriented mutual funds are exempt up to Rs. 1 lakh per year.

2. Calculate Capital Gains/Losses:

i) Short-Term Capital Gains (STCG):

-

Calculate Net Sale Proceeds:

- Sale Price - Brokerage/Commission - Securities Transaction Tax (STT) - Other Expenses = Net Sale Proceeds

-

Calculate Cost of Acquisition:

- Purchase Price + Brokerage/Commission + Stamp Duty (if applicable) + Other Expenses = Cost of Acquisition

-

Calculate STCG:

- Net Sale Proceeds - Cost of Acquisition = STCG

ii) Long-Term Capital Gains (LTCG):

-

Calculate Indexed Cost of Acquisition (ICOA):

- ICOA = (Cost of Acquisition) * (Cost Inflation Index of the year of sale) / (Cost Inflation Index of the year of purchase)

-

Calculate Net Sale Proceeds: (same as STCG)

-

Calculate LTCG:

- Net Sale Proceeds - Indexed Cost of Acquisition = LTCG

Special Rules for Listed Securities/Equity-Oriented Mutual Funds:

- Long-Term Capital Gains Tax: LTCG exceeding ₹1 lakh in a financial year is taxed at a flat rate of 10% (without indexation benefit).

- Example: If your total LTCG from these instruments is ₹1.5 lakh, the first ₹1 lakh is exempt, and the remaining ₹50,000 is taxed at 10%.

- Grandfathering Clause: For shares/units purchased before 31st January 2018, gains are computed based on the higher of:

- Sale price minus actual cost of acquisition.

- Sale price minus the fair market value (FMV) as of 31st January 2018.

Key Points to Remember:

- Holding Period: Short-term gains are on assets held for 36 months or less. Long-term gains are on assets held for more than 36 months.

- Tax Rates: STCG is taxed at your applicable income tax slab rate. LTCG tax rates vary based on the asset type (e.g., 20% with indexation for real estate, 10% without indexation for listed securities exceeding ₹1 lakh exemption).

- Set-off and Carry Forward: Losses can be set off against gains in the same category (e.g., STCL against STCG, LTCL against LTCG). Unutilized losses can be carried forward for up to 8 assessment years.

Example:

Let's say you sold 100 shares of a company for ₹250 per share (total sale proceeds: ₹25,000). You had purchased these shares 4 years ago for ₹100 per share (total cost of acquisition: ₹10,000).

- Since you held the shares for more than 36 months, it's a long-term capital gain.

- Let's assume the Indexed Cost of Acquisition is ₹14,000.

- LTCG = ₹25,000 - ₹14,000 = ₹11,000

3. Fill in Schedule CG:

i) Part A: Details of STCG (Short-Term Capital Gains):

- Listed/Unlisted Shares/Securities:

- Fill in details of each transaction:

- Name of the scrip

- ISIN (International Securities Identification Number)

- Date of acquisition

- Date of sale

- Full value of consideration (sale price)

- Cost of acquisition (purchase price + expenses)

- STCG (calculated as per our previous discussion)

- Fill in details of each transaction:

- Equity/Non-Equity Oriented Mutual Funds:

- Enter similar details as above for each mutual fund scheme.

- Classify the scheme as equity-oriented (more than 65% equity allocation) or non-equity oriented.

ii) Part B: Details of LTCG (Long-Term Capital Gains):

- Listed/Unlisted Shares/Securities:

- Follow the same format as Part B, but remember to calculate indexed cost of acquisition (ICOA) for each transaction.

- Consider the special rule for LTCG exceeding ₹1 lakh from listed securities/equity-oriented mutual funds.

- Equity/Non-Equity Oriented Mutual Funds:

- Similar to listed shares/securities, but with the classification of the scheme.

iii) Details of STCG/LTCG on Other Assets:

- Immovable Property:

- Provide details like:

- Address of the property

- Date of acquisition

- Date of sale

- Sale price

- Cost of acquisition (including stamp duty, registration charges, etc.)

- Improvement costs (if any)

- Indexed cost of acquisition (for LTCG)

- If the property is sold within 2 years of purchase, section 50C comes into play, and you might need to consider the stamp duty value as the deemed sale price.

- Provide details like:

- Gold/Jewelry/Precious Metals:

- Details of sale and purchase similar to immovable property.

- Other Assets (e.g., Bonds, Debentures):

- Enter relevant details based on the type of asset.

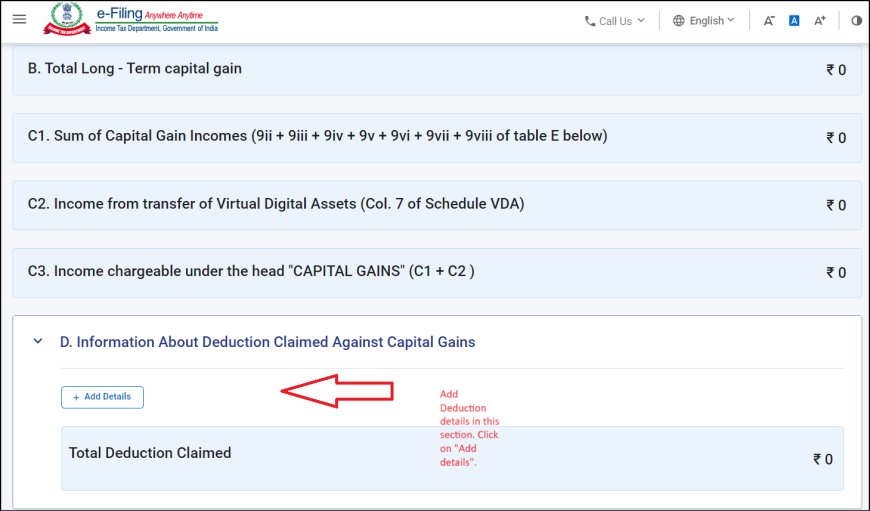

iv) Part D: Information About Deduction Claimed Against Capital Gains:

This section is where you report any deductions you are eligible to claim against your capital gains. These deductions can help reduce your tax liability. Some common deductions under this section include:

- Section 54: Deduction for investment in a new residential house property within specified time limits (for LTCG on sale of a residential house property).

- Section 54EC: Deduction for investment in specified bonds (for LTCG on sale of land or building or both).

- Section 54F: Deduction for investment in a new residential house property within specified time limits (for LTCG on sale of any asset other than a residential house property).

- Section 54GB: Deduction for investment in equity shares of eligible startups (for LTCG on sale of residential property).

How to Fill Section D:

- Claim: Indicate whether you are claiming any deduction.

- Section: Specify the relevant section of the Income Tax Act under which you are claiming the deduction.

- Amount: Enter the amount of deduction claimed.

- Details: Provide specific details related to the deduction. For example, if claiming under Section 54, you would provide details of the new house property purchased.

Example:

Let's say you sold a residential house property for a long-term capital gain of ₹10 lakhs. You invested ₹8 lakhs in a new residential house property within the specified time limits. In this case:

- Claim: Yes

- Section: 54

- Amount: ₹8,00,000

- Details: Details of the new house property purchased (address, date of purchase, etc.)

v) Table E: Computation of Tax Liability on Total Income

This table is where you calculate your total tax liability after factoring in all your income sources and applicable deductions. The "Sum of Capital Gain Incomes" section specifically deals with your capital gains and losses. (Losses to be filed in Schedule CYLA)

Here's the breakdown of the components:

- 9ii: Short-term capital gains taxable at special rates (@15%): This covers STCG on equity-oriented mutual funds and listed equity shares, which are taxed at 15% (plus surcharge and cess).

- 9iii: Short-term capital gains taxable @ 30%: This covers STCG if your total income falls within the 30% tax bracket, your short-term capital gains will also be taxed at 30%.

- 9iv: Short-term capital gains taxable at applicable rates: This includes STCG which are taxed at applicable rates based on the asset type.

- 9v: Short-term capital gains taxable at the DTAA rates: This is for STCG on foreign assets which are taxed at DTAA rates.

- 9vi: Long-term capital gains taxable at special rates: This is for LTCG on listed equity shares and equity-oriented mutual funds exceeding the exemption limit of ₹1 lakh, which are taxed at 10% (without indexation).

- 9vii: Long-term capital gains taxable @ 20%: For non-equity assets like debt mutual funds, real estate properties, and gold, the LTCG tax is 20% after indexation.

- 9viii: Long-term capital gains taxable at the DTAA rates: This is for LTCG on foreign assets which are taxed at DTAA rates

How to Calculate the Sum of Capital Gain Incomes:

- Gather Information: Refer to your filled-in Schedule CG for the details of all your capital gains and losses.

- Segregate: Classify your capital gains into the appropriate categories mentioned above (9ii, 9iii, 9iv, 9v, 9vi, 9vii, 9viii).

- Add up the Gains: Add up all the gains within each category. For example, add up all your short-term gains on listed shares to get the figure for 9ii.

- Total Sum: Finally, add up all the individual totals from each category (9ii + 9iii + 9iv + 9v + 9vi + 9vii + 9viii) to get the "Sum of Capital Gain Incomes."

4. Set-off and Carry Forward of Losses:

i) Set-off of Capital Losses:

-

Within the Same Financial Year:

- Short-term Capital Losses (STCL): Can be set off against both STCG (short-term capital gains) and LTCG (long-term capital gains).

- Long-term Capital Losses (LTCL): Can only be set off against LTCG.

-

Priority:

- STCL is usually set off first against STCG, and then the remaining STCL, if any, can be set off against LTCG.

- If STCL is not sufficient to cover STCG, then LTCL can be used to set off the remaining STCG.

- Any remaining LTCL can only be set off against LTCG.

ii) Carry Forward of Unabsorbed Losses:

-

Permissible Period: You can carry forward unabsorbed capital losses for up to 8 assessment years immediately following the assessment year in which the loss was incurred.

-

Conditions:

- You must have filed your ITR for the year in which the loss was incurred on or before the due date.

- The losses must be specifically mentioned in the ITR of the year in which they were incurred.

-

Utilization of Carried Forward Losses:

- Carried forward losses can only be set off against capital gains of the same nature in future years.

- For example, carried forward STCL can be set off against both STCG and LTCG in future years, but carried forward LTCL can only be set off against LTCG.

- The order of set-off remains the same as explained above (STCL utilized first, then LTCL).

Example:

Let's say in FY 2023-24, you have the following capital gains and losses:

- STCG: ₹50,000

- STCL: ₹30,000

- LTCG: ₹80,000

- LTCL: ₹40,000

In this case:

- STCL (₹30,000) will be set off against STCG (₹50,000), leaving a taxable STCG of ₹20,000.

- The remaining STCL is ₹0.

- LTCL (₹40,000) will be set off against LTCG (₹80,000), leaving a taxable LTCG of ₹40,000.

- The remaining LTCL is ₹0.

Key Points:

- No Intra-Head Adjustment: You cannot set off capital losses against income from other heads like salary, house property, or business income.

- Carry Forward Only for Losses: Only losses can be carried forward, not gains.

- Tax Benefit: Set-off and carry forward of losses help you reduce your overall tax liability by offsetting your capital gains with previous losses.

5. Verification and Submission:

i) Thorough Review:

- Double-Check All Information: Carefully review all the details you've entered, including personal information, income details, deductions, tax payments, and bank account details for refunds.

- Verify Calculations: Recheck all calculations related to income, deductions, tax payable, and refunds.

- Supporting Documents: Compare the information in your ITR with the supporting documents (Form 16, TDS certificates, investment proofs, etc.) to ensure consistency.

ii) Verification of ITR:

- Mandatory Step: Verification is essential for your ITR to be considered valid.

- Time Limit: You must verify your ITR within 30 days of filing it online.

- Verification Methods:

- Aadhaar OTP: Receive a one-time password (OTP) on your Aadhaar-linked mobile number and enter it on the e-filing portal.

- Net Banking: Use your net banking credentials to e-verify through your bank's website.

- Bank Account Number: Generate an Electronic Verification Code (EVC) through your pre-validated bank account.

- Demat Account: Generate EVC through your Demat account.

- Registered Mobile Number: Generate EVC and receive it on your registered mobile number (not linked to Aadhaar).

- ITR-V (Physical Verification): If you can't e-verify, download ITR-V, sign it, and mail it to the Centralized Processing Center (CPC) within 30 days of filing.

iii) Submission of ITR:

- Online Filing: Once verified, your ITR is considered filed. You'll receive an acknowledgment on your registered email ID and mobile number.

- Offline Filing: If you filed offline, send the signed ITR-V to the CPC by post.

iv) After Submission:

- Track Refund Status: If you're expecting a refund, you can track its status on the e-filing portal.

- Intimation Under Section 143(1): The Income Tax Department will process your return and send an intimation under Section 143(1), which may show a refund, demand, or no change.

- Respond to Notices: If you receive any notices from the department, respond promptly and provide any additional information or clarification required.

Common Mistakes to Avoid

1. Incorrect Computation of Gains/Losses:

- Double-Check Your Calculations: It's crucial to recheck all your calculations related to capital gains and losses. Even small errors can significantly impact your tax liability.

- Use Online Calculators or Tax Software: These tools can help you avoid manual errors and ensure accurate calculations.

- Consult a Tax Professional: If you're unsure about any calculations, seek help from a qualified tax professional.

- Common Errors:

- Incorrectly calculating indexed cost of acquisition (for LTCG)

- Overlooking brokerage, STT, or other expenses

- Applying the wrong tax rate

2. Not Reporting All Transactions:

- Report Every Transaction: Even small gains or losses must be reported in your ITR.

- Scrutinize Bank and Demat Statements: Carefully review your bank and Demat account statements to ensure you haven't missed any transactions.

- Include Dividends and Interest: Don't forget to report dividends received on shares and interest earned on bonds or debentures.

- Consequences: Non-reporting of income can lead to penalties and interest charges.

3. Incorrect ITR Form:

- Choose the Right Form: Different ITR forms are applicable based on your income sources and residential status.

- Example:

- Salaried individuals with income from other sources (like capital gains) generally use ITR-2.

- Individuals with income from business or profession use ITR-3 or ITR-4.

- Check the Latest Guidelines: Refer to the income tax website or consult a tax professional to ensure you're using the correct form for the current assessment year.

4. Missing the Deadline:

- Due Date: The usual due date for filing ITR is 31st July of the assessment year.

- Consequences of Late Filing:

- Late filing fee: ₹5,000 if filed before December 31st, ₹10,000 if filed after that.

- Interest on tax due: Interest will be charged on any unpaid tax from the due date until the date of filing.

- Loss of carry forward of losses: You may lose the ability to carry forward losses to future years.

Additional Mistakes to Avoid:

- Ignoring Form 26AS: This statement shows the tax deducted at source (TDS) on your income. Reconcile this with your Form 16 and investment statements.

- Incorrect Personal Information: Double-check your PAN, Aadhaar, bank account details, and address to avoid refund issues.

- Not Claiming Deductions: If you're eligible for deductions (like 80C, 80D, etc.), make sure to claim them.

- Not Verifying ITR: Remember, verification is mandatory for your ITR to be considered valid.

Conclusion

Understanding and accurately reporting capital gains and losses is a crucial aspect of financial planning and tax compliance. By meticulously gathering the right documents, calculating gains/losses correctly, and diligently filling out Schedule CG in your ITR, you can ensure a smooth tax filing process and potentially minimize your tax liability.

Remember, being aware of common mistakes and avoiding them can save you from unnecessary penalties and headaches. It's always advisable to consult a tax professional if you're unsure about any aspect of capital gains taxation or have complex transactions.

By staying organized, informed, and proactive, you can confidently navigate the world of capital gains and make sound financial decisions.

Disclaimer:

The information provided in this article is for general informational purposes only and should not be considered as professional financial or tax advice. While every effort has been made to ensure the accuracy and completeness of the information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this article.

Tax laws and regulations are subject to change, and individual circumstances may vary. Therefore, it's crucial to consult with a qualified tax professional or financial advisor for personalized advice tailored to your specific situation. We are not liable for any losses or damages arising from the use of this information.

What's Your Reaction?